|

市场调查报告书

商品编码

1773474

肋骨骨折修復系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rib Fracture Repair Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

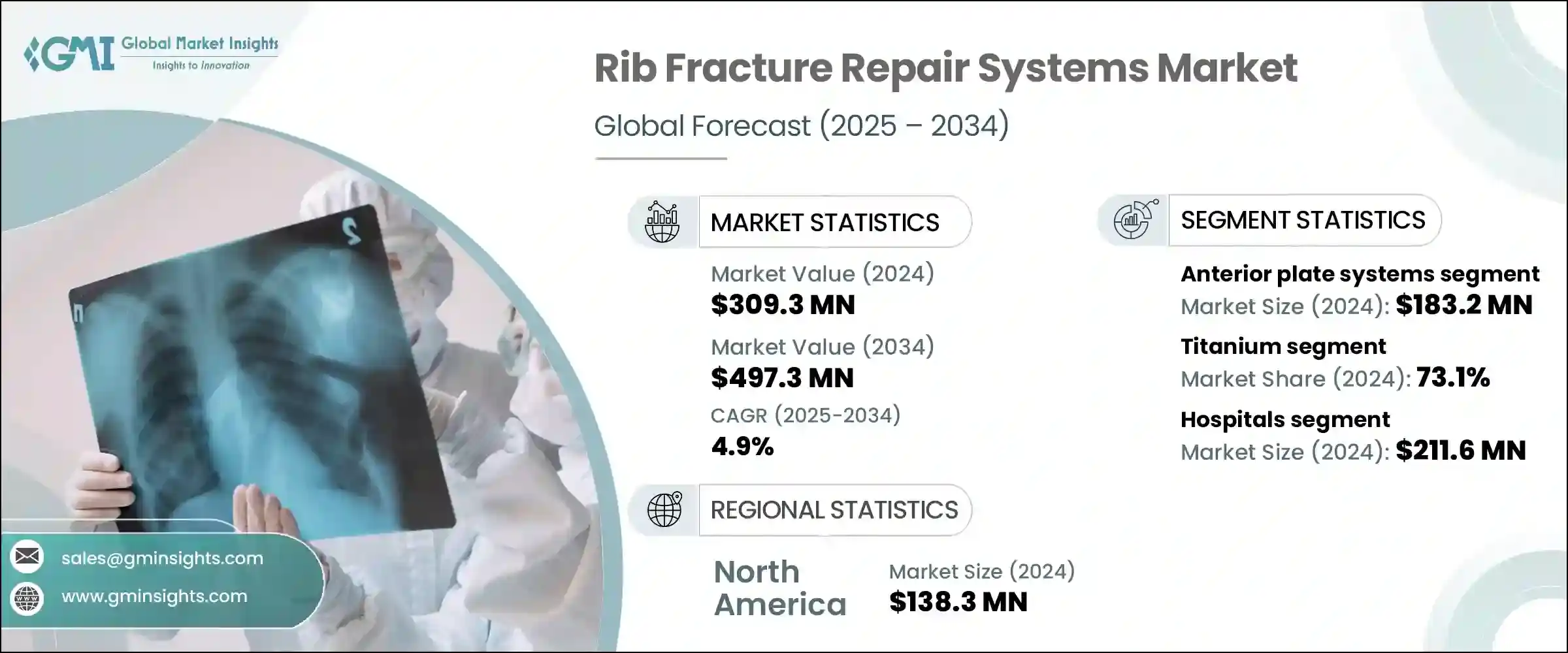

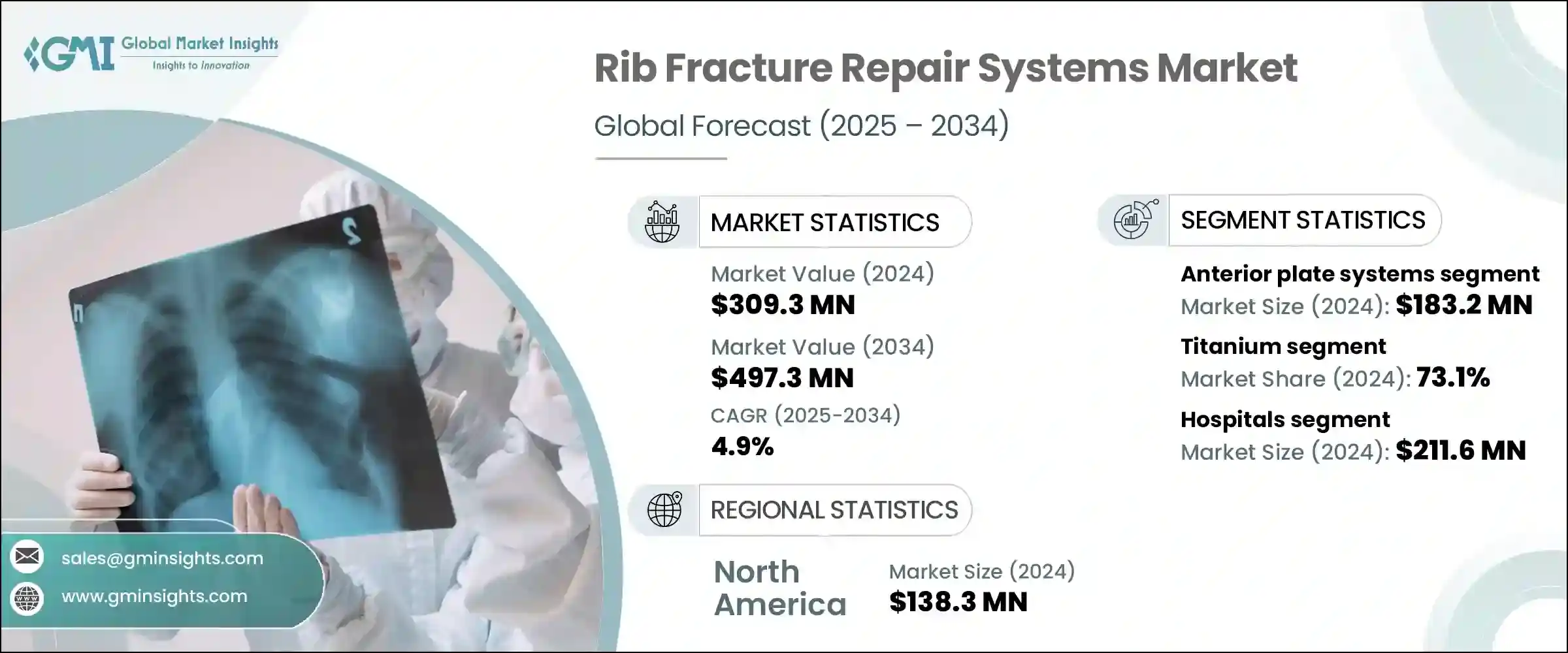

2024 年全球肋骨骨折修復系统市值为 3.093 亿美元,预计到 2034 年将以 4.9% 的复合年增长率增长至 4.973 亿美元。这些用于稳定和復位骨折肋骨的系统随着全球创伤相关损伤的持续增加而需求日益增长。车祸、运动伤害和跌倒等事故(尤其是老年人事故)增加了对可靠胸部创伤干预措施的需求。随着医疗服务提供者优先考虑更快康復和减少术后併发症,对先进肋骨固定技术的关注度日益提高。医院和创伤科正在投资微创系统,这些系统不仅可以最大限度地缩短手术时间,还可以改善病患的復原效果。增强型植入物设计,例如符合人体解剖学的骨板和低调钛系统,正在提高手术精确度,同时减少疼痛和住院时间。

数位影像技术的进步与先进的手术器械相结合,在加速肋骨修復系统的推广应用方面发挥着至关重要的作用。这些创新为外科医生提供了更高的手术精准度和更佳的手术视觉效果,从而改善了患者的预后并缩短了康復时间。因此,肋骨骨折修復不仅在创伤护理中,而且在骨科和胸腔外科领域也正成为首选解决方案。在即时成像和改进的植入物设计的支持下,人们对微创技术的信心日益增强,进一步推动了市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.093亿美元 |

| 预测值 | 4.973亿美元 |

| 复合年增长率 | 4.9% |

2024年,前路钢板系统市场规模达1.832亿美元。其日益普及的原因是其解剖学造型,有助于最大程度地减少组织刺激并降低术后併发症的风险。对于需要更高舒适度或註重美观的患者,此类植入物是首选。随着外科医生寻求兼顾功能性和舒适性的高效固定係统,前路钢板在常规和急诊手术中日益受到青睐。

2024年,钛基系统市场占了73.1%的份额,这主要归功于其无与伦比的强度重量比。钛金属具有刚性,且不会增加硬体体积,从而支持肋骨在呼吸过程中的自然运动。其对胸腔结构的适应性以及久经考验的机械一致性,有助于在整个癒合过程中有效保持肋骨的排列。钛金属卓越的生物相容性以及较低的免疫反应或发炎发生率,使其成为外科修復中安全的长期解决方案,并将继续在肋骨骨折修復领域占据主导地位。

由于胸部创伤病例高发生且医疗基础设施先进,美国肋骨骨折修復系统市场在2024年的价值达到1.248亿美元。机动车碰撞、老化相关的跌倒以及运动创伤等频繁发生的损伤,推动了医院和创伤中心对肋骨固定解决方案的需求。随着3D影像系统和微创植入物等高阶外科技术的广泛应用,美国医疗机构已成为尖端肋骨固定技术的早期采用者。这种环境支持了钛基精密工程植入物在各外科中心的持续集成,从而促进了全国市场的扩张。

该市场的主要参与者包括 Able Medical Devices、Acumed、Arthrex、Jeil Medical、强生、KLS Martin、美敦力、Neuro France Implants、Orthofix、OsteoMed、Selective Surgical、Smith & Nephew、Stryker、Waston Medical 和 Zimmer Biomet。该领域的知名公司正加紧研发创新、低调的植入物设计,以满足外科医生的偏好和患者特定的解剖学要求。

他们也强调研发产生物相容性和耐用性材料,例如钛和混合合金。与创伤中心和教学医院建立策略合作伙伴关係,有助于推动早期采用和基于回馈的产品改进。各公司正透过FDA和CE认证扩大其全球影响力,进而提升微创植入物在新兴区域市场的可及性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 胸部创伤发生率上升

- 手术固定係统的技术进步

- 门诊和流动手术的偏好日益增长

- 新兴市场医疗支出和基础建设增加

- 产业陷阱与挑战

- 手术和植入系统成本高昂

- 肋骨固定解决方案的认知度和可用性有限

- 市场机会

- 向创伤发生率高的渗透率较低的市场扩张

- 3D列印与个人化植入技术的融合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 定价分析

- 依产品类型

- 按地区

- 差距分析

- 波特的分析

- PESTLE 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 前板系统

- 碟盘系统

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 钛

- 聚醚醚酮(PEEK)

- 其他材料

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Able Medical Devices

- Acumed

- Arthrex

- Jeil Medical

- Johnson & Johnson

- KLS Martin

- Medtronic

- Neuro France Implants

- Orthofix

- OsteoMed

- Selective Surgical

- Smith & Nephew

- Stryker

- Waston Medical

- Zimmer Biomet

The Global Rib Fracture Repair Systems Market was valued at USD 309.3 million in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 497.3 million by 2034. These systems, designed to stabilize and realign fractured ribs, are seeing growing demand as trauma-related injuries continue to rise across the globe. Incidents stemming from vehicular accidents, sports-related injuries, and falls-particularly among the elderly-are increasing the need for reliable chest trauma interventions. As healthcare providers prioritize quicker recovery and reduced post-operative complications, the focus on advanced rib fixation techniques is intensifying. Hospitals and trauma units are investing in minimally invasive systems that not only minimize surgical duration but also improve patient recovery outcomes. Enhanced implant designs, such as anatomically shaped plates and low-profile titanium systems, are improving surgical precision while reducing pain and hospital stays.

Advancements in digital imaging technologies combined with state-of-the-art surgical instruments are playing a crucial role in accelerating the use of rib repair systems. These innovations provide surgeons with enhanced precision and better visualization during procedures, which leads to improved patient outcomes and shorter recovery times. As a result, rib fracture repair is becoming a preferred solution not only in trauma care but also within orthopedic and thoracic surgery units. The growing confidence in minimally invasive techniques, supported by real-time imaging and improved implant designs, is further driving market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $309.3 Million |

| Forecast Value | $497.3 Million |

| CAGR | 4.9% |

The anterior plate systems segment was valued at USD 183.2 million in 2024. Their growing popularity comes from their anatomical shaping, which helps minimize tissue irritation and reduce the chance of post-surgical complications. These implants are preferred in patients who require enhanced comfort or for those where aesthetics is a consideration. With surgeons seeking efficient fixation systems that balance functionality and comfort, anterior plates are increasingly selected for both routine and emergency procedures.

The titanium-based systems segment captured a 73.1% share in 2024, largely due to the material's unmatched strength-to-weight ratio. Titanium offers rigidity without excess hardware bulk, supporting the rib's natural motion during respiration. Its adaptability to the thoracic structure and proven mechanical consistency help maintain rib alignment effectively throughout the healing process. Titanium's exceptional biocompatibility and low likelihood of causing immune responses or inflammation make it a safe long-term solution in surgical repairs, fueling its continued dominance in rib fracture repair solutions.

United States Rib Fracture Repair Systems Market was valued at USD 124.8 million in 2024 due to its high rate of chest trauma cases and its advanced healthcare infrastructure. Frequent injuries caused by motor vehicle collisions, aging-related falls, and sports trauma are driving hospital and trauma center demand for rib fixation solutions. With the widespread adoption of high-end surgical technologies, including 3D imaging systems and minimally invasive implants, U.S. institutions are early adopters of cutting-edge rib stabilization technologies. This environment supports the continuous integration of titanium-based, precision-engineered implants throughout surgical centers, contributing to national market expansion.

Key players involved in the market include Able Medical Devices, Acumed, Arthrex, Jeil Medical, Johnson & Johnson, KLS Martin, Medtronic, Neuro France Implants, Orthofix, OsteoMed, Selective Surgical, Smith & Nephew, Stryker, Waston Medical, Zimmer Biomet. Prominent companies in this space are intensifying their focus on developing innovative, low-profile implant designs that meet both surgeon preferences and patient-specific anatomical requirements.

They are also emphasizing R&D to produce biocompatible and durable materials like titanium and hybrid alloys. Strategic partnerships with trauma centers and teaching hospitals help drive early adoption and feedback-driven product refinement. Firms are expanding their global footprint through FDA and CE approvals, enhancing access to minimally invasive implants in new regional markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Material

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chest trauma injuries

- 3.2.1.2 Technological advancements in surgical fixation systems

- 3.2.1.3 Growing preference for outpatient and ambulatory surgical procedures

- 3.2.1.4 Increased healthcare spending and infrastructure development in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of surgical procedures and implant systems

- 3.2.2.2 Limited awareness and availability of rib fixation solutions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into underpenetrated markets with high trauma incidence

- 3.2.3.2 Integration of 3D printing and personalized implant technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Anterior plate systems

- 5.3 U-plate systems

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Polyether ether ketone (PEEK)

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Able Medical Devices

- 9.2 Acumed

- 9.3 Arthrex

- 9.4 Jeil Medical

- 9.5 Johnson & Johnson

- 9.6 KLS Martin

- 9.7 Medtronic

- 9.8 Neuro France Implants

- 9.9 Orthofix

- 9.10 OsteoMed

- 9.11 Selective Surgical

- 9.12 Smith & Nephew

- 9.13 Stryker

- 9.14 Waston Medical

- 9.15 Zimmer Biomet