|

市场调查报告书

商品编码

1773476

混合电容器市场机会、成长动力、产业趋势分析及2025-2034年预测Hybrid Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

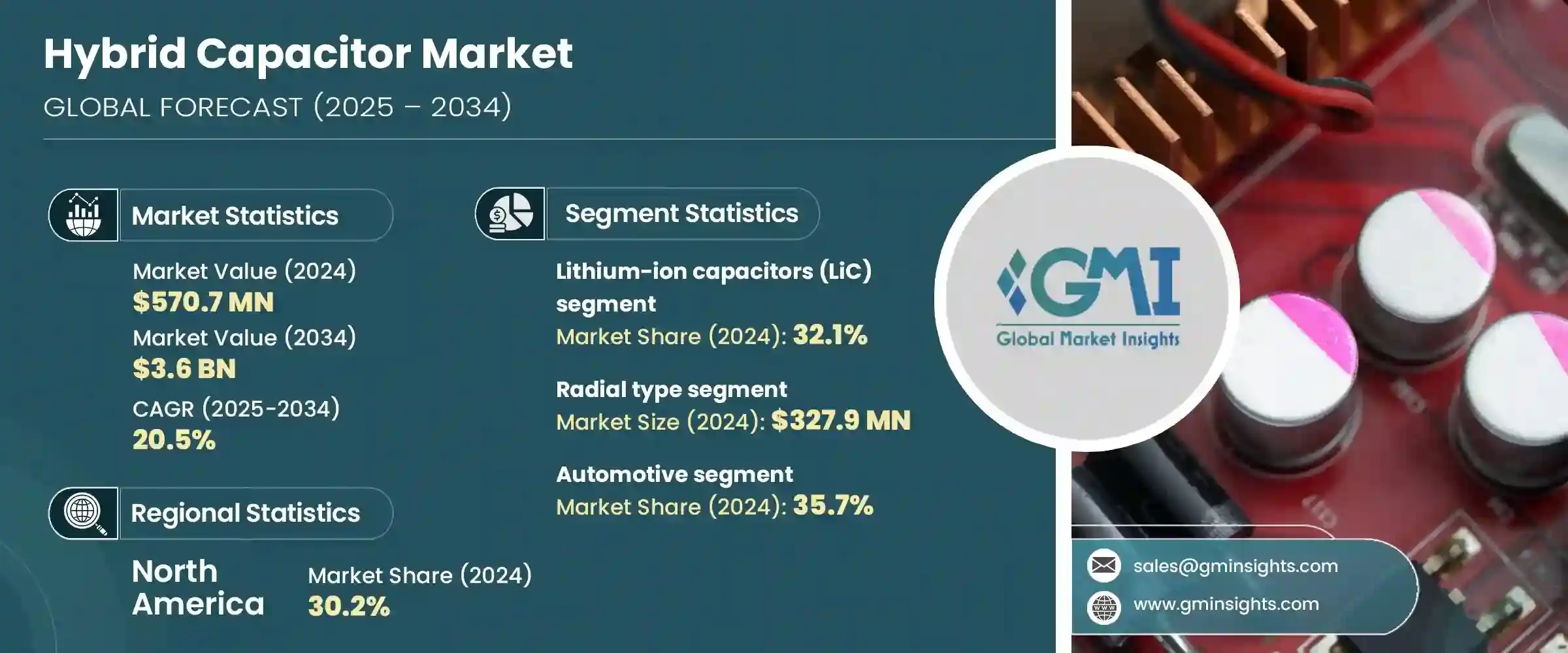

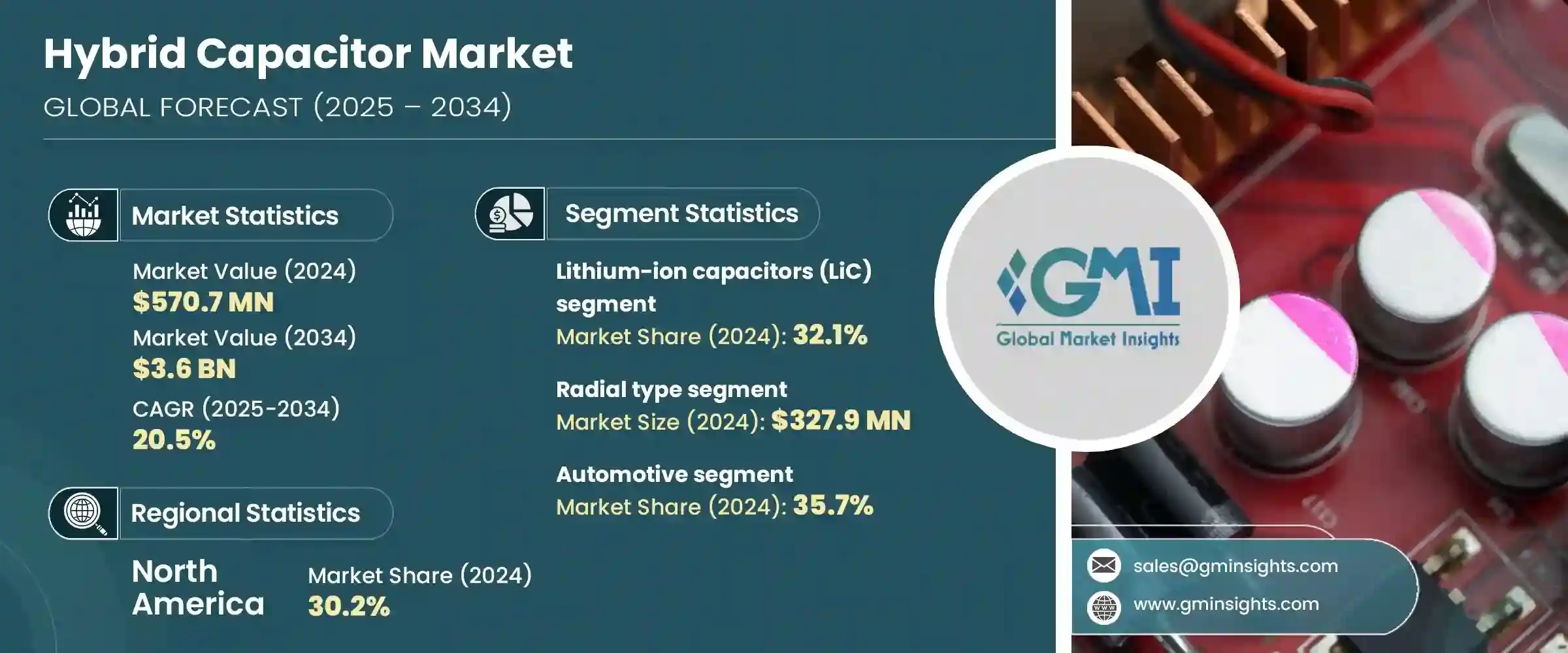

2024年,全球混合电容器市场规模达5.707亿美元,预计年复合成长率将达20.5%,2034年将达36亿美元。更严格的环境法规、企业层面的永续发展努力以及营运成本效益共同推动了这一成长。电动车和混合动力汽车需求的不断增长推动了混合电容器市场的发展,这些组件是再生煞车和功率缓衝等能源系统不可或缺的一部分。混合电容器越来越多地被用于保护电池、增强能量回收以及满足汽车级性能要求。

同时,随着有利的能源政策和经济效益的提升使节能技术更加可行,工业和电网级应用正在迅速扩张。政府旨在促进再生能源併网和电网稳定的支援措施,正在推动强大的储能技术的应用。全球电信基础设施的扩张,包括5G网路的部署,正在加速对可靠、快速响应的电源和网路系统备用能源解决方案的需求,而混合电容器在这些系统中变得至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.707亿美元 |

| 预测值 | 36亿美元 |

| 复合年增长率 | 20.5% |

径向混合电容器市场规模在2024年达到3.279亿美元,预计2034年将以19.8%的复合年增长率成长。这类电容器因其高效的节省空间设计而日益普及,尤其适用于电路板空间受限的应用。其圆柱形结构可无缝整合到紧凑型电子设备中,有效满足了市场对高性能、小型化元件日益增长的需求。

锂离子混合电容器市场规模在2024年达到1.83亿美元,目前是成长最快的市场,复合年增长率为22.1%。这些混合系统利用锂离子技术与碳化钛奈米颗粒等材料结合,实现更快的充放电循环和更灵敏的功率控制。随着人们对增强型紧凑型储能的兴趣日益浓厚,这类电容器在多个行业中得到了更广泛的应用,为其普及增添了动力。

美国混合电容器市场规模预计在2024年达到1.515亿美元,预计到2034年将以22.6%的复合年增长率成长。美国正在推动更先进的储能框架,重点在于清洁能源和电网现代化。政府支持的倡议,包括联邦机构对混合能源系统的支持,正在推动创新,并透过试点计画和商业推广促进实际应用。这些努力将混合电容器定位为工业规模能源管理和基础设施升级的关键技术。

全球混合电容器市场的主要参与者包括松下公司、TDK公司和日本贵弥功公司。领先的混合电容器製造商正优先投入研发资金,以开发更小、更快、更耐用的储能解决方案,以满足现代汽车、工业和电信应用的需求。各公司正专注于开发新的材料组合和先进的配置,以实现快速充电週期和更长的使用寿命。许多公司正在扩大其全球生产能力并建立区域供应链,以缩短交货週期并应对不断变化的需求。与电动车製造商、再生能源公司和基础设施开发人员的合作有助于增强特定应用的产品组合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电动和混合动力汽车的需求不断增长

- 消费性电子产品的扩张

- 政府推动采用清洁能源的倡议

- 电信基础设施扩张

- 智慧电网应用的进步

- 陷阱与挑战

- 生产和材料成本高

- 来自替代能源储存解决方案的激烈竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 锂离子电容器(LiC)

- 导电聚合物基混合电容器

- 铝电解电容器

- 其他的

第六章:市场估计与预测:依外形尺寸,2021 - 2034 年

- 主要趋势

- 径向型

- 覆膜型

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 能源和电力公用事业

- 电信

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Cornell Dubilier Electronics

- Eaton

- Elna Co., Ltd.

- KEMET Corporation

- Kyocera AVX

- Nichicon Corporation

- Nippon Chemi-Con Corporation

- Panasonic

- Rubycon Corporation

- TAIYO YUDEN CO., LTD.

- TDK Corporation

- VINATech Co., Ltd.

- Vishay Intertechnology, Inc.

The Global Hybrid Capacitor Market was valued at USD 570.7 million in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 3.6 billion by 2034. A combination of stricter environmental regulations, enterprise-level sustainability efforts, and operational cost benefits is propelling this growth. Rising demand for electric and hybrid vehicles fuels the hybrid capacitor market, with these components being integral to energy systems like regenerative braking and power buffering. Hybrid capacitors are increasingly being used to protect batteries, enhance energy recovery, and align with automotive-grade performance requirements.

Simultaneously, industrial and grid-level applications are expanding rapidly as favorable energy policies and improved economic performance make energy-efficient technologies more viable. Government support aimed at boosting renewable energy integration and grid stability is pushing for the adoption of robust energy storage technologies. The global expansion of telecom infrastructure, including the rollout of 5G networks, is accelerating demand for reliable, fast-responding energy backup solutions in power supplies and network systems, where hybrid capacitors are becoming essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $570.7 million |

| Forecast Value | $3.6 billion |

| CAGR | 20.5% |

The radial hybrid capacitor segment reached USD 327.9 million in 2024 and is anticipated to grow at a CAGR of 19.8% through 2034. These capacitors are gaining popularity due to their efficient space-saving design, making them particularly suitable for applications with board space limitations. Their cylindrical build allows seamless integration into compact electronics, responding well to the market's growing demand for high-performance, miniaturized components.

Lithium-ion based hybrid capacitors segment reached USD 183 million in 2024 and is currently the fastest-growing segment, with a CAGR of 22.1%. These hybrid systems leverage lithium-ion technology combined with materials such as titanium carbide nanoparticles to enable faster charge-discharge cycles and responsive power control. With rising interest in enhanced compact energy storage, these capacitors are finding broader use across multiple industries, adding momentum to their adoption.

United States Hybrid Capacitor Market valued at USD 151.5 million in 2024 growing at a CAGR of 22.6% through 2034. The country is advancing toward more advanced energy storage frameworks, with a strong focus on clean energy and grid modernization. Government-backed initiatives, including support from federal agencies for hybrid energy systems, are driving innovation and facilitating real-world application through pilot programs and commercial rollouts. These efforts are positioning hybrid capacitors as a key technology in industrial-scale energy management and infrastructure upgrades.

Key players in the Global Hybrid Capacitor Market include Panasonic Corporation, TDK Corporation, and Nippon Chemi-Con Corporation. Leading hybrid capacitor manufacturers are prioritizing R&D investments to develop smaller, faster, and more durable energy storage solutions tailored to modern automotive, industrial, and telecom applications. Companies are focusing on new material combinations and advanced configurations that enable rapid charge cycles and long life. Many are expanding their global production capabilities and building regional supply chains to reduce lead times and address fluctuating demand. Collaborations with EV makers, renewable energy firms, and infrastructure developers are helping strengthen application-specific product portfolios.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and Definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 executive summary

- 2.1 Industry ecosystem analysis

- 2.2 Trump administration tariffs analysis

- 2.2.1 Impact on trade

- 2.2.1.1 Trade volume disruptions

- 2.2.1.2 Retaliatory measures

- 2.2.2 Impact on the industry

- 2.2.2.1 Supply-side impact (key components)

- 2.2.2.1.1 Price volatility in key materials

- 2.2.2.1.2 Supply chain restructuring

- 2.2.2.1.3 Production cost implications

- 2.2.2.2 Demand-side impact (selling price)

- 2.2.2.2.1 Price transmission to end markets

- 2.2.2.2.2 Market share dynamics

- 2.2.2.2.3 Consumer response patterns

- 2.2.2.1 Supply-side impact (key components)

- 2.2.3 Key companies impacted

- 2.2.4 Strategic industry responses

- 2.2.4.1 Supply chain reconfiguration

- 2.2.4.2 Pricing and product strategies

- 2.2.4.3 Policy engagement

- 2.2.5 Outlook and future considerations

- 2.2.1 Impact on trade

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for electric and hybrid vehicles

- 3.2.1.2 Expansion of consumer electronics

- 3.2.1.3 Government initiatives for clean energy adoption

- 3.2.1.4 Expansion in telecommunication infrastructure

- 3.2.1.5 Advancements in smart grid applications

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High production and material costs

- 3.2.2.2 Intense competition from alternative energy storage solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market estimates and forecast, by Product Type, 2021 - 2034 (USD million & million units)

- 5.1 Key trends

- 5.2 Lithium-ion capacitors (LiC)

- 5.3 Conductive polymer-based hybrid capacitors

- 5.4 Aluminum electrolytic capacitors

- 5.5 Others

Chapter 6 Market estimates and forecast, by Form Factor, 2021 - 2034 (USD million & million units)

- 6.1 Key trends

- 6.2 Radial type

- 6.3 Laminating type

Chapter 7 Market estimates and forecast, by End Use Industry, 2021 - 2034 (USD million & million units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Consumer electronics

- 7.4 Energy & power utilities

- 7.5 Telecommunications

- 7.6 Others

Chapter 8 Market estimates and forecast, by Region, 2021 - 2034 (USD million & million units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Uk

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company profiles

- 9.1 Cornell Dubilier Electronics

- 9.2 Eaton

- 9.3 Elna Co., Ltd.

- 9.4 KEMET Corporation

- 9.5 Kyocera AVX

- 9.6 Nichicon Corporation

- 9.7 Nippon Chemi-Con Corporation

- 9.8 Panasonic

- 9.9 Rubycon Corporation

- 9.10 TAIYO YUDEN CO., LTD.

- 9.11 TDK Corporation

- 9.12 VINATech Co., Ltd.

- 9.13 Vishay Intertechnology, Inc.