|

市场调查报告书

商品编码

1773477

喷射混凝土喷涂机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Shotcrete Spray Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

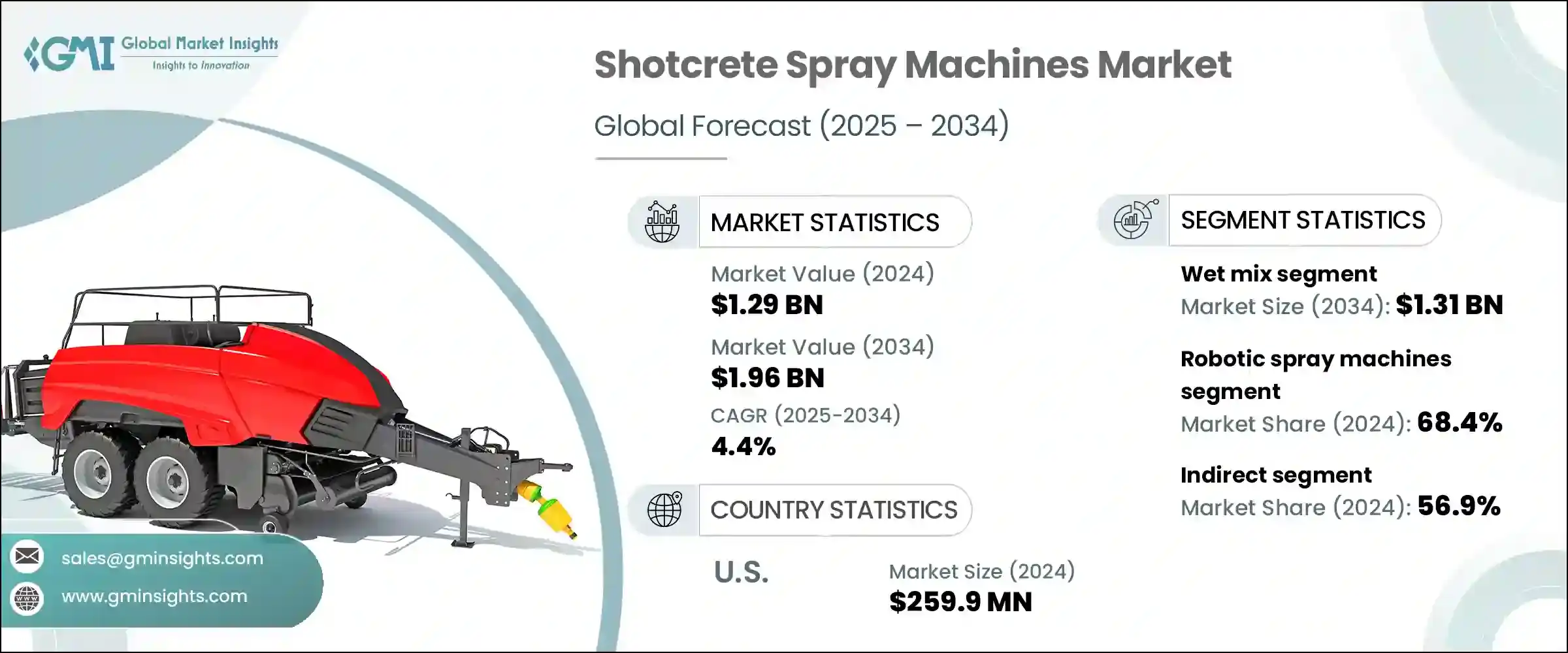

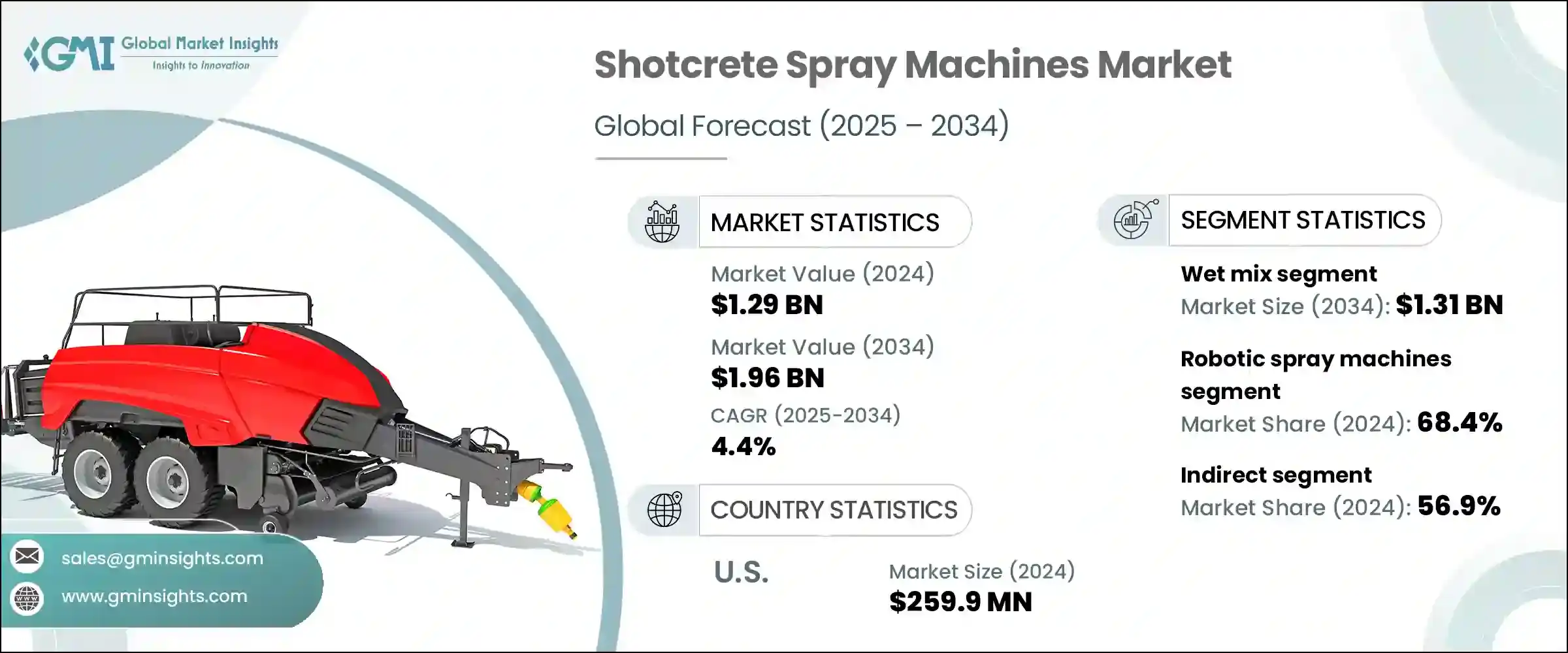

2024年,全球喷射混凝土喷涂机市场规模达12.9亿美元,预计2034年将以4.4%的复合年增长率成长,达到19.6亿美元。这一增长主要得益于城市发展的加速和基础设施投资的强劲增长。联合国预测,到2050年,全球近三分之二的人口将居住在城市地区,各国政府和建筑商正致力于高效、节省空间的施工方法。喷射混凝土喷涂机在满足这些需求方面发挥着至关重要的作用,尤其是在隧道衬砌和地下加固应用中。

亚洲和欧洲各国正大力投资兴建交通隧道、地下管线和基础设施走廊。因此,市场需求正迅速转向机器人喷射混凝土机,这类设备能够快速喷涂、提供卓越的表面附着力,并可进入狭窄区域。这些自动化解决方案可提供一致的喷涂精度,同时最大限度地减少人工需求并提高安全标准。北美和欧洲等地区的劳动力短缺和安全法规日益严格,进一步推动了机器人系统的普及。自动化和远端控制喷射混凝土设备的兴起,正在透过提高速度、精度和整体施工效率来改变施工现场的运作方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12.9亿美元 |

| 预测值 | 19.6亿美元 |

| 复合年增长率 | 4.4% |

湿拌混凝土製程领域在2024年创造了8.463亿美元的产值,预计到2034年将达到13.1亿美元。湿喷混凝土因其均匀的稠度和较高的抗压强度(通常在4,000至7,000 psi之间)已迅速成为大型专案的首选施工方法。由于所有材料在喷涂前均已预先混合,此工艺可确保施工平稳均匀,并将材料损失降至最低。回弹率远低于10%,从而实现更清洁的施工现场、更高品质的产出并减少浪费,最终有助于节省专案成本并提升环境安全。

机器人喷涂机市场在2024年占据了68.4%的市场份额,预计2025年至2034年的复合年增长率将达到4.7%。这些先进的系统透过提供高度均匀的喷涂层并减少操作员暴露在危险的顶部区域,正在为该行业树立新的标竿。许多系统的定位精度在±5毫米以内,确保一致的品质。机器人喷涂机每小时的喷涂量高达20立方公尺,可将工程工期缩短近四分之一,同时降低人力成本。 Normet和Aliva等供应商正在整合智慧功能,实现喷嘴自动移动并提供即时资料回馈,以优化效能和表面光洁度。

2024年,美国喷射混凝土喷涂机市场规模达2.599亿美元,预计到2034年将以4.4%的复合年增长率成长。基础设施老化以及对维修和修復的重视,持续推动交通运输和公共工程领域的需求。同时,住宅和商业开发的稳定发展也推动了对高效喷涂系统的额外需求。由于对生产力和工作场所安全的日益重视,市场对大型建筑专案中的机器人湿拌设备表现出明显的偏好。在北美,由于对地下城市开发和资源开采计画的投资不断增加,加拿大也正获得发展。

影响喷射混凝土喷涂机产业的知名公司包括 YG Machinery、Normet、Filamos、Sika、Reed、JUHE Group、Putzmeister、Gunite Supply & Equipment、CIFA、Epiroc Deutschland、Tunelmak、Gengli、Leadcrete、Blastcrete 和 MacLean。喷射混凝土喷涂机市场的领先製造商正致力于透过自动化驱动模型来扩展其产品组合,以提高安全性和效率。与基础设施承包商的策略合作使他们能够提供满足不断发展的监管标准的特定应用解决方案。公司还在研发方面进行投资,以整合基于人工智慧的控制系统,提高喷涂精度,并减少对操作员的依赖。全球参与者正在透过经销商合作伙伴关係和服务网络加强其在高成长地区的供应链,以确保更快的交付和售后支援。一些公司提供模组化设备设计和远端诊断,以优化维护和使用寿命。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 湿混料

- 干混料

第六章:市场估计与预测:按机制,2021-2034 年

- 主要趋势

- 手动喷雾机

- 机器人喷涂机

第七章:市场估计与预测:依移动性,2021-2034

- 主要趋势

- 固定式

- 移动的

- 拖车式

- 卡车安装

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 矿业

- 隧道

- 建筑施工

- 挡水结构

- 修復工程

- 其他(边坡稳定、军事设施等)

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 建筑和采矿公司

- 政府机构

- 其他(租赁机构、承包商等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿联酋

- 沙乌地阿拉伯

第十二章:公司简介

- Blastcrete

- CIFA

- Epiroc Deutschland

- Filamos

- Gengli

- Gunite Supply & Equipment

- JUHE Group

- Leadcrete

- MacLean Engineering

- Normet

- Putzmeister

- Reed

- Sika

- Tunelmak

- YG Machinery

The Global Shotcrete Spray Machines Market was valued at USD 1.29 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 1.96 billion by 2034. This growth is fueled by accelerating urban development and robust infrastructure investments. With the United Nations projecting that nearly two-thirds of the global population will live in urban settings by 2050, governments and builders are focusing on efficient, space-saving construction methods. Shotcrete spray machines have become critical in meeting these demands, especially in tunnel lining and underground stabilization applications.

Countries across Asia and Europe are significantly funding transit tunnels, underground utilities, and infrastructure corridors. As a result, demand is rapidly shifting toward robotic shotcrete sprayers that deliver fast application, superior surface adhesion, and access to confined zones. These automated solutions offer consistent spraying accuracy while minimizing manual labor requirements and improving safety standards. Labor shortages and stricter safety regulations in regions like North America and Europe are further driving the adoption of robotic systems. The rise of automated and remote-controlled shotcrete equipment is transforming worksite operations by boosting speed, precision, and overall job site efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.29 Billion |

| Forecast Value | $1.96 Billion |

| CAGR | 4.4% |

The wet-mix process segment generated USD 846.3 million in 2024 and is expected to reach USD 1.31 billion by 2034. Wet-mix shotcrete has rapidly become the preferred application method across large-scale projects due to its uniform consistency and enhanced compressive strength, which typically ranges between 4,000 to 7,000 psi. Since all materials are pre-mixed before spraying, this process ensures a smooth and even application with minimal material loss. Rebound rates stay well below 10%, resulting in cleaner job sites, better quality output, and reduced waste, which together contribute to project cost savings and safer environments.

The robotic spray machines segment held a 68.4% share in 2024 and is projected to grow at a CAGR of 4.7% from 2025 through 2034. These advanced systems are setting new benchmarks in the industry by delivering highly uniform layers and reducing operator exposure to hazardous overhead zones. Many systems offer positioning precision within +-5 mm, ensuring consistent quality. Capable of spraying up to 20 cubic meters per hour, robotic sprayers can shorten project timelines by nearly a quarter while lowering labor costs. Suppliers like Normet and Aliva are integrating smart features that automate nozzle movement and provide live data feedback to optimize performance and surface finish.

U.S. Shotcrete Spray Machines Market was valued at USD 259.9 million in 2024 and is forecast to grow at a CAGR of 4.4% through 2034. Aging infrastructure and a focus on repair and rehabilitation continue to drive demand across transportation and public works sectors. In parallel, steady activity in housing and commercial development has supported additional demand for efficient spraying systems. The market shows a clear preference for robotic wet-mix equipment in large-scale construction projects, underpinned by an increasing focus on productivity and workplace safety. Within North America, Canada is also gaining traction due to growing investments in underground urban development and resource mining projects.

Prominent companies shaping the Shotcrete Spray Machines Industry include YG Machinery, Normet, Filamos, Sika, Reed, JUHE Group, Putzmeister, Gunite Supply & Equipment, CIFA, Epiroc Deutschland, Tunelmak, Gengli, Leadcrete, Blastcrete, and MacLean Engineering. Leading manufacturers in the shotcrete spray machines market are focusing on expanding their product portfolios with automation-driven models that enhance safety and efficiency. Strategic collaborations with infrastructure contractors allow them to deliver application-specific solutions that meet evolving regulatory standards. Companies are also investing in R&D to integrate AI-based control systems, improve precision spraying, and reduce operator dependency. Global players are strengthening their supply chains in high-growth regions through distributor partnerships and service networks to ensure quicker delivery and post-sale support. Some firms are offering modular equipment designs and remote diagnostics to optimize maintenance and lifespan.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mechanism

- 2.2.4 Mobility

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Wet mix

- 5.3 Dry mix

Chapter 6 Market Estimates & Forecast, By Mechanism, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual spray machines

- 6.3 Robotic spray machines

Chapter 7 Market Estimates & Forecast, By Mobility, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Stationary

- 7.3 Mobile

- 7.3.1 Trailer mounted

- 7.3.2 Truck mounted

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Mining

- 8.3 Tunneling

- 8.4 Building construction

- 8.5 Water retaining structures

- 8.6 Repair works

- 8.7 Others (slope stabilization, military installation, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction & mining companies

- 9.3 Government agencies

- 9.4 Others (rental agencies, contractors, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Blastcrete

- 12.2 CIFA

- 12.3 Epiroc Deutschland

- 12.4 Filamos

- 12.5 Gengli

- 12.6 Gunite Supply & Equipment

- 12.7 JUHE Group

- 12.8 Leadcrete

- 12.9 MacLean Engineering

- 12.10 Normet

- 12.11 Putzmeister

- 12.12 Reed

- 12.13 Sika

- 12.14 Tunelmak

- 12.15 YG Machinery