|

市场调查报告书

商品编码

1773479

炮塔系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Turret System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

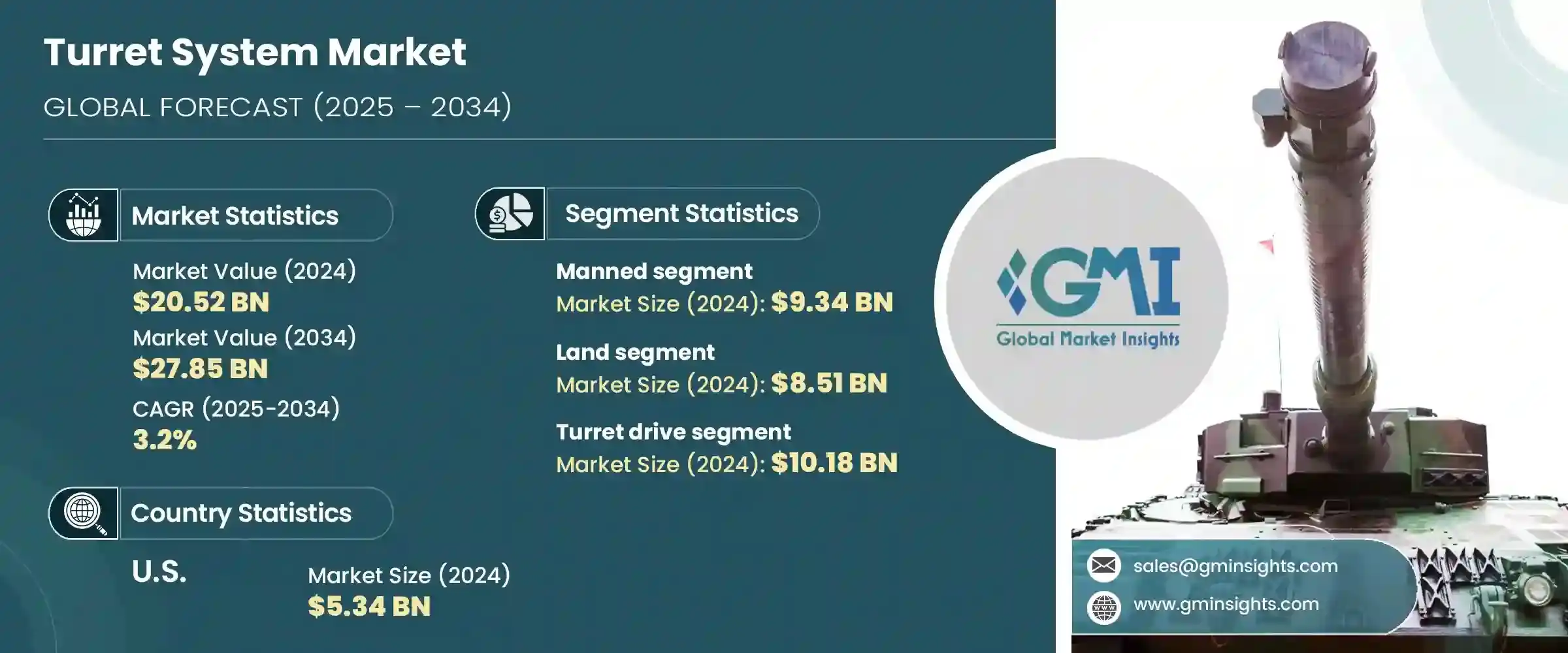

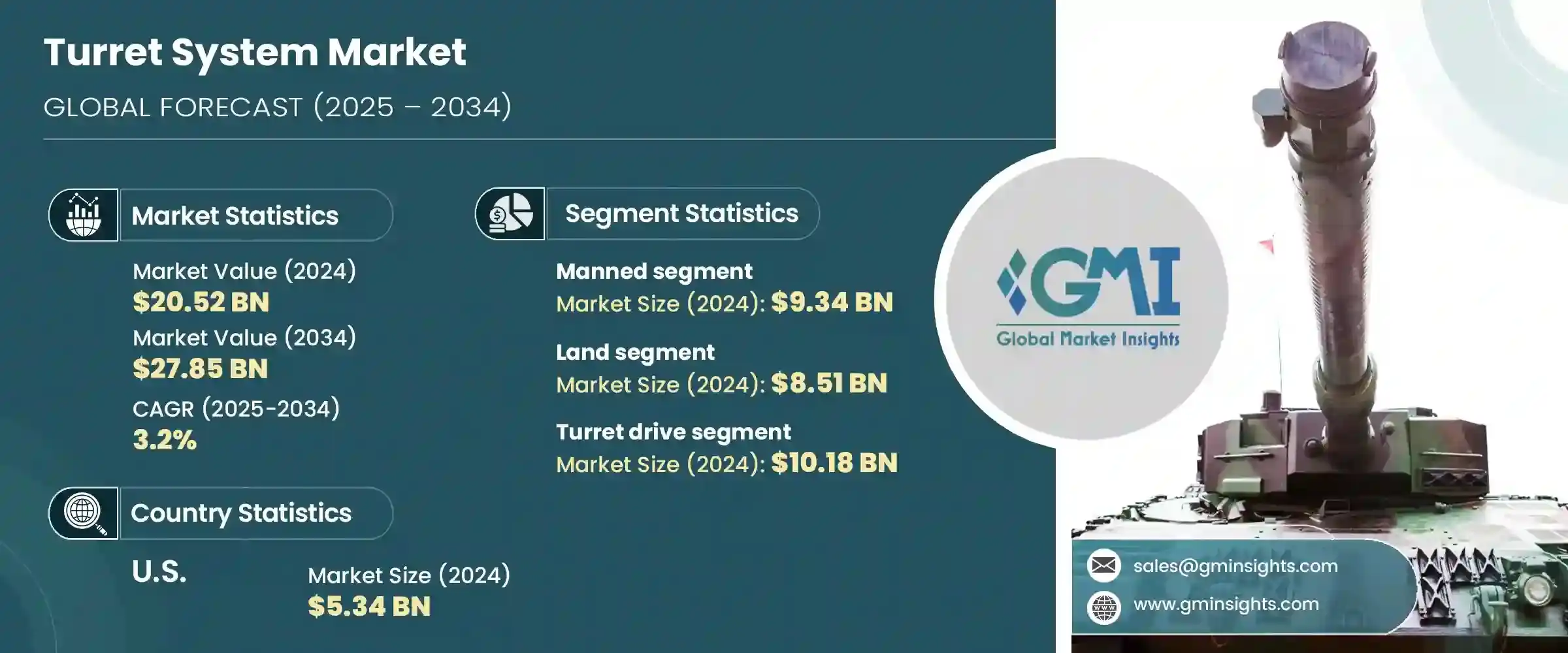

2024年,全球炮塔系统市场规模达205.2亿美元,预计2034年将以3.2%的复合年增长率成长,达到278.5亿美元。这一成长主要得益于全球军费开支的增加,其中北美、欧洲和亚太等地区的需求强劲。随着国防预算的不断增加,军事现代化和战备能力的提升成为重点。先进的炮塔系统,尤其是无人炮塔系统,因其能够提升任务执行力、降低人员风险并在动态作战环境中提高战略效率,正日益受到青睐。

政府加强对国防研发的投资,推动了炮塔系统技术的创新,尤其是在人工智慧、自动化和感测整合领域。这些进步正在突破机器人系统和车载炮塔的极限,从而加快了合约授予速度,并提高了私营国防公司的产量。自主导航和基于人工智慧的威胁识别等技术正在重塑战场格局。它们提供即时态势感知、智慧决策和自主机动——所有这些对于最大限度地减少人类参与危险任务,并最大限度地提高在不同地形和场景下的作战效能至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 205.2亿美元 |

| 预测值 | 278.5亿美元 |

| 复合年增长率 | 3.2% |

2024年,载人炮塔系统市场规模达93.4亿美元。由于其在复杂即时情境下的作战适应性,这类系统将继续占据主导地位,因为在这种情境下,人类的判断仍然至关重要。载人炮塔的可靠性已得到验证,许多武装部队并没有直接取代它们,而是选择用下一代载人解决方案升级现有的装甲部队。预计城市作战或反叛乱行动等需要增强态势感知能力的任务将继续严重依赖载人系统。

2024年,陆基炮塔市场产值达85.1亿美元。随着全球国防开支的不断增长以及快速应对不断演变的威胁的需求日益增长,陆地车辆正在为载人和无人平台配备先进的炮塔系统。无人地面车辆(UGV)部署的增加,也加剧了对能够远端操作的炮塔系统的需求。自动化、精密感测器和人工智慧控制系统的创新,正在使陆地炮塔平台更具杀伤力、更精准、更具成本效益。

2024年,德国炮塔系统市场产值达9.5亿美元。国家大力推动工业4.0和数位主权,带动了对自主和半自主军事系统的投资成长。这包括增加用于陆地车辆和防空平台的先进炮塔系统的采购。作为全球最大的武器出口国之一,德国持续推动创新,以保持全球竞争力。在监视和边境防御等任务中,对人工智慧机器人的依赖日益增加,凸显了德国已做好充分准备,以应对不断变化的安全需求和作战复杂性。

影响炮塔系统市场格局的关键参与者包括 BAE 系统公司、Elbit 系统公司和通用动力陆地系统公司。炮塔系统市场的领先公司正在大力投资研发,以推动无人和人工智慧整合炮塔技术的创新。与国防部门和政府机构的战略合作有助于确保长期采购合约。为了增强竞争地位,製造商正在扩大生产能力,优化模组化炮塔架构,并采用尖端材料以减轻重量同时保持性能。合併、收购和合作也使参与者能够开拓新的区域市场并实现产品组合多元化。此外,该公司专注于使用下一代功能升级传统平台,而不是完全替换,这有助于他们维护与现有国防客户的关係,并透过生命週期支援和系统改造确保经常性收入。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 国防预算增加和军事现代化

- 技术创新与自动化

- 地缘政治紧张局势与安全威胁

- 扩大安全和国防基础设施

- 应用多样化

- 产业陷阱与挑战

- 开发和采购成本高

- 技术快速淘汰

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 载人

- 无人

第六章:市场估计与预测:按组成部分,2021 - 2034 年

- 主要趋势

- 炮塔驱动

- 炮塔控制

- 稳定装置

第七章:市场估计与预测:按平台,2021 - 2034 年

- 主要趋势

- 土地

- 移动/车载

- 固定/静止

- 空降

- 攻击直升机

- 战斗机

- 特殊任务飞机

- 无人驾驶飞行器(UAV)

- 海军

- 驱逐舰

- 护卫舰

- 近海支援船(Oosts)

- 轻巡洋舰

- 巡逻和扫雷舰

- 两栖舰艇

- 潜水艇

- 无人水面艇(美国)

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Moog Inc.

- Northrop Grumman

- RAFAEL Advanced Defense Systems Ltd.

- Rheinmetall AG

- Thales

The Global Turret System Market was valued at USD 20.52 billion in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 27.85 billion by 2034. This growth is largely fueled by increasing global military expenditures, with significant demand coming from regions like North America, Europe, and Asia-Pacific. As defense budgets continue to expand, the focus shifts toward military modernization and enhanced combat readiness. Advanced turret systems, especially unmanned ones, are gaining traction due to their ability to enhance mission performance, reduce risks to personnel, and enable strategic efficiency in dynamic operational environments.

Increased investments in defense R&D from government sources are propelling innovation in turret system technologies, particularly in AI, automation, and sensory integration. These advancements are pushing the boundaries of what robotic systems and vehicle-mounted turrets can achieve, resulting in faster contract awards and increased production from private defense firms. Technologies like autonomous navigation and AI-based threat recognition are reshaping the battlefield. They provide real-time situational awareness, intelligent decision-making, and autonomous maneuvering-all critical for minimizing human involvement in dangerous missions and maximizing operational effectiveness across varied terrains and scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.52 Billion |

| Forecast Value | $27.85 Billion |

| CAGR | 3.2% |

The manned turret system segment generated USD 9.34 billion in 2024. These systems continue to dominate due to their operational adaptability in complex, real-time situations where human judgment remains crucial. Manned turrets offer proven reliability, and instead of replacing them outright, many armed forces are opting to upgrade existing armored fleets with next-gen manned solutions. Missions requiring heightened situational awareness-such as urban combat or counterinsurgency operations-are expected to continue relying heavily on manned systems.

The land-based turret segment generated USD 8.51 billion in 2024. With global defense spending on the rise and the growing need for rapid response to evolving threats, land vehicles are being equipped with advanced turret systems for both manned and unmanned platforms. The rise in deployment of Unmanned Ground Vehicles (UGVs) has amplified the need for turret systems capable of remote operation. Innovations in automation, precision sensors, and AI-driven control systems are making land turret platforms more lethal, accurate, and cost-effective.

Germany Turret System Market generated USD 950 million in 2024. A national push toward Industry 4.0 and digital sovereignty has led to expanded investment in autonomous and semi-autonomous military systems. This includes increased procurement of advanced turret systems for use in both land vehicles and aerial defense platforms. As one of the top arms-exporting countries, Germany continues to boost innovation to remain competitive globally. A growing reliance on AI-powered robotics for tasks like surveillance and border defense underlines the nation's readiness to adapt to shifting security demands and operational complexity.

Key players shaping the Turret System Market landscape include BAE Systems, Elbit Systems, and General Dynamics Land Systems. Leading companies in the turret system market are investing heavily in R&D to drive innovation in unmanned and AI-integrated turret technologies. Strategic collaborations with defense ministries and government agencies help secure long-term procurement contracts. To strengthen their competitive position, manufacturers are expanding production capabilities, optimizing modular turret architectures, and incorporating cutting-edge materials to reduce weight while maintaining performance. Mergers, acquisitions, and partnerships also allow players to tap into new regional markets and diversify their product portfolios. Furthermore, companies are focusing on upgrading legacy platforms with next-gen capabilities rather than full replacements, helping them maintain relationships with established defense clients and ensure recurring revenue through lifecycle support and system retrofitting.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising defense budgets and military modernization

- 3.3.1.2 Technological innovations and automation

- 3.3.1.3 Geopolitical tensions and security threats

- 3.3.1.4 Expansion of security and defense infrastructure

- 3.3.1.5 Diversification of applications

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and procurement costs

- 3.3.2.2 Rapid technological obsolescence

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Manned

- 5.3 Unmanned

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Turret drive

- 6.3 Turret control

- 6.4 Stabilization unit

Chapter 7 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Land

- 7.2.1 Mobile/vehicular

- 7.2.2 Fixed/stationary

- 7.3 Airborne

- 7.3.1 Attack helicopters

- 7.3.2 Fighter aircrafts

- 7.3.3 Special mission aircrafts

- 7.3.4 Unmanned aerial vehicles (UAVs)

- 7.4 Naval

- 7.4.1 Destroyer

- 7.4.2 Frigates

- 7.4.3 Offshore support vessels (Oosts)

- 7.4.4 Corvettes

- 7.4.5 Patrol & mine countermeasure vessels

- 7.4.6 Amphibious vessels

- 7.4.7 Submarines

- 7.4.8 Unmanned surface vehicles (USAs)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BAE Systems

- 9.2 Elbit Systems Ltd.

- 9.3 General Dynamics Corporation

- 9.4 Leonardo S.p.A.

- 9.5 Lockheed Martin Corporation

- 9.6 Moog Inc.

- 9.7 Northrop Grumman

- 9.8 RAFAEL Advanced Defense Systems Ltd.

- 9.9 Rheinmetall AG

- 9.10 Thales