|

市场调查报告书

商品编码

1782092

胸腔外科器械市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Thoracic Surgery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

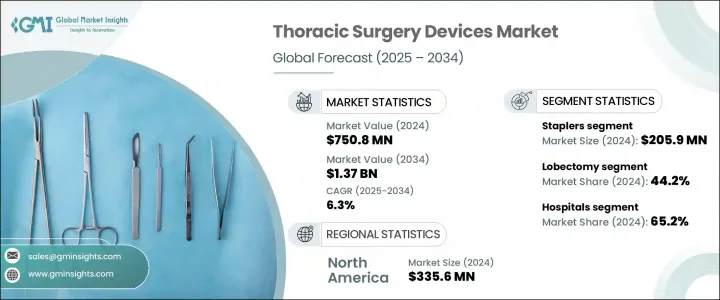

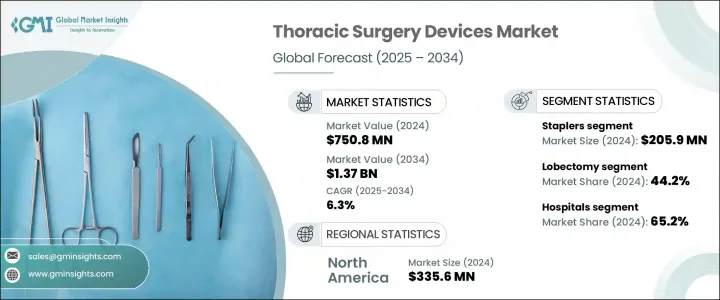

2024 年全球胸腔外科手术设备市场价值为 7.508 亿美元,预计到 2034 年将以 6.3% 的复合年增长率成长,达到 13.7 亿美元。慢性阻塞性肺病 (COPD)、肺癌等胸部疾病以及需要外科手术干预的疾病的发生率不断上升,推动了市场的发展势头。人口老化、环境污染物暴露以及持续的吸烟习惯导致这些疾病的盛行率上升。病例激增直接增加了对能够带来更好疗效的先进胸腔外科手术器械的需求。视讯辅助和机器人辅助胸腔外科手术等微创手术因具有恢復时间短、术后不适感减轻和併发症风险降低等优点,越来越受到人们的青睐。

这些先进的手术方法不仅改善了患者的康復,还显着缩短了住院时间,使得更多类型的手术能够在门诊环境中进行。这一转变促进了门诊手术中心 (ASC) 的快速发展,如今,它们被视为传统住院治疗的高效、经济且对患者友好的替代方案。 ASC 可以缩短病患週转时间,降低营运成本,并提高排班弹性,使其成为医疗服务提供者和病患日益青睐的选择。随着微创技术日益精进,设备日益紧凑和专业化,ASC 正在扩展其处理复杂胸腔外科手术的能力,而这些手术曾经只能在高危重症医院环境中进行,这进一步加速了市场对专为这些机构定制的先进手术设备的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.508亿美元 |

| 预测值 | 13.7亿美元 |

| 复合年增长率 | 6.3% |

2024年,吻合器市场成为最大贡献者,市场规模达2.059亿美元。电动吻合器、数位吻合器和关节吻合器等设计创新正在不断提升手术精准度,减少组织渗漏等併发症,并提高手术效率。这些先进功能改善了组织处理,缩短了手术时间,同时帮助外科医生更自信、更安全地处理复杂的胸腔解剖结构。

2024年,肺叶切除术占最大份额,达44.2%。此技术仍是早期非小细胞肺癌的首选治疗方法,而早期非小细胞肺癌占肺癌确诊病例的绝大部分。随着筛检技术和诊断方法的改进,越来越多的患者,尤其是老年人和高风险族群,能够更早被识别并成为手术治疗的候选对象。可手术病例的增加推动了对肺叶切除术专用工具的需求,包括血管封闭器械、解剖器械和高性能吻合器。

2024年,美国胸腔外科器械市场规模达3.028亿美元。美国肺癌和慢性阻塞性肺病(COPD)的发生率持续居高不下,这两种疾病在晚期通常都需要手术介入。由于数百万患者受这些疾病的影响,美国的医疗服务提供者正在医院和癌症中心稳步进行胸腔外科手术。持续的外科治疗需求确保了全国医疗机构对胸腔外科器械的需求仍然强劲。

塑造这一市场的关键参与者包括通用电气医疗、Biolitec、美德乐、富士胶片控股、奥林巴斯、微创医疗、库克医疗、康美医疗、贝朗、直觉外科、美敦力、康德乐、波士顿科学、卡尔史托斯和强生。为了巩固其在胸腔外科设备市场的地位,领先的公司正专注于创新驱动策略。这些措施包括推出具有增强的人体工学、精确度和即时回馈的下一代手术工具。许多参与者正在透过策略合作伙伴关係和区域分销协议扩大其全球影响力。其他公司则在投资研发,以创建与微创和机器人辅助手术相容的设备。为特定手术应用提供客製化解决方案并优化门诊环境的成本效益也是重中之重。此外,公司正在将数位技术整合到设备中,以提高手术准确性和术后效果,帮助它们吸引更广泛的医疗服务提供者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 肺癌和慢性呼吸系统疾病盛行率上升

- 微创技术的应用日益广泛

- 胸腔外科器械的技术进步

- 扩大门诊手术中心

- 产业陷阱与挑战

- 先进胸腔外科设备和机器人系统成本高昂

- 缺乏熟练的胸腔外科医生和专门培训

- 市场机会

- 增加新兴经济体的医疗保健投资

- 人工智慧和数位平台在手术规划和仪器中的整合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 定价分析

- 按产品

- 按地区

- 差距分析

- 波特的分析

- PESTLE 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 夹具

- 钳子

- 抓取器

- 订书机

- 剪刀

- 传播者

- 持针器

- 其他产品

第六章:市场估计与预测:依手术类型,2021 - 2034 年

- 主要趋势

- 肺叶切除术

- 楔形切除术

- 肺切除术

- 其他手术类型

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- B. Braun

- Biolitec

- Boston Scientific

- Cardinal Health

- ConMed

- Cook Medical

- Fujifilm Holdings

- GE Healthcare

- Intuitive Surgical

- Johnson & Johnson

- Karl Storz

- Medela

- Medtronic

- MicroPort

- Olympus

The Global Thoracic Surgery Devices Market was valued at USD 750.8 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.37 billion by 2034. The market's momentum is being fueled by the rising incidence of thoracic conditions such as chronic obstructive pulmonary disease (COPD), lung cancer, and other diseases requiring surgical intervention. A growing aging population, exposure to environmental pollutants, and persistent smoking habits are contributing to the increased prevalence of these conditions. This surge in cases is directly raising the demand for advanced thoracic surgical instruments that can deliver better outcomes. Minimally invasive procedures such as video-assisted and robot-assisted thoracic surgeries are gaining ground due to benefits like reduced recovery time, minimized postoperative discomfort, and lower risks of complications.

These advanced surgical approaches have not only improved patient recovery but also significantly reduced hospitalization time, enabling a broader range of procedures to be performed in outpatient environments. This shift has spurred the rapid growth of ambulatory surgical centers (ASCs), which are now seen as efficient, cost-effective, and patient-friendly alternatives to conventional inpatient hospital care. ASCs allow for quicker patient turnaround, lower overhead costs, and improved scheduling flexibility, making them an increasingly attractive option for both healthcare providers and patients. As minimally invasive techniques become more refined and equipment more compact and specialized, ASCs are expanding their capabilities to handle complex thoracic surgeries that were once only possible in high-acuity hospital settings, further accelerating market demand for advanced surgical devices tailored to these facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $750.8 Million |

| Forecast Value | $1.37 Billion |

| CAGR | 6.3% |

In 2024, the staplers segment emerged as the top contributor, generating USD 205.9 million. Ongoing innovations in design, such as powered, digital, and articulating staplers, are enhancing precision, reducing complications like tissue leaks, and increasing surgical efficiency. These advanced features improve tissue handling and reduce operative time while assisting surgeons in managing complex thoracic anatomy with greater confidence and safety.

The lobectomy procedures segment held the largest share at 44.2% in 2024. This technique remains the preferred treatment for early-stage non-small cell lung cancer, which accounts for a significant majority of lung cancer diagnoses. As screening technologies and diagnostic methods improve, more patients, particularly older individuals and those with higher risk factors-are being identified earlier and becoming candidates for surgical treatment. This rise in operable cases is driving demand for specialized tools used in lobectomies, including vessel sealing instruments, dissection devices, and high-performance staplers.

United States Thoracic Surgery Devices Market was valued at USD 302.8 million in 2024. The country continues to see high rates of lung cancer and COPD, both of which frequently require surgical intervention during advanced stages. With millions affected by these conditions, healthcare providers in the U.S. are steadily performing thoracic surgeries in hospitals and cancer center settings. The consistent demand for surgical treatment ensures that the need for thoracic devices remains strong across healthcare institutions nationwide.

Key players shaping this market include GE Healthcare, Biolitec, Medela, Fujifilm Holdings, Olympus, MicroPort, Cook Medical, ConMed, B. Braun, Intuitive Surgical, Medtronic, Cardinal Health, Boston Scientific, Karl Storz, and Johnson & Johnson. To solidify their position in the thoracic surgery devices market, leading companies are focusing on innovation-driven strategies. These include launching next-generation surgical tools with enhanced ergonomics, precision, and real-time feedback. Many players are expanding their global footprint through strategic partnerships and regional distribution agreements. Others are investing in R&D to create devices compatible with minimally invasive and robotic-assisted procedures. Offering customized solutions for specific surgical applications and optimizing cost-effectiveness for outpatient settings are also top priorities. Additionally, companies are integrating digital technology into devices to improve surgical accuracy and postoperative outcomes, helping them attract a broader range of healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Surgery type

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of lung cancer and chronic respiratory diseases

- 3.2.1.2 Growing adoption of minimally invasive techniques

- 3.2.1.3 Technological advancements in thoracic surgical instruments

- 3.2.1.4 Expansion of ambulatory surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced thoracic surgical devices and robotic systems

- 3.2.2.2 Shortage of skilled thoracic surgeons and specialized training

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing healthcare investments in emerging economies

- 3.2.3.2 Integration of AI and digital platforms in surgical planning and instrumentation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter’s analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clamps

- 5.3 Forceps

- 5.4 Graspers

- 5.5 Staplers

- 5.6 Scissors

- 5.7 Spreaders

- 5.8 Needle holders

- 5.9 Other products

Chapter 6 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lobectomy

- 6.3 Wedge resection

- 6.4 Pneumonectomy

- 6.5 Other surgery types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 B. Braun

- 9.2 Biolitec

- 9.3 Boston Scientific

- 9.4 Cardinal Health

- 9.5 ConMed

- 9.6 Cook Medical

- 9.7 Fujifilm Holdings

- 9.8 GE Healthcare

- 9.9 Intuitive Surgical

- 9.10 Johnson & Johnson

- 9.11 Karl Storz

- 9.12 Medela

- 9.13 Medtronic

- 9.14 MicroPort

- 9.15 Olympus