|

市场调查报告书

商品编码

1782094

肝病治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Liver Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

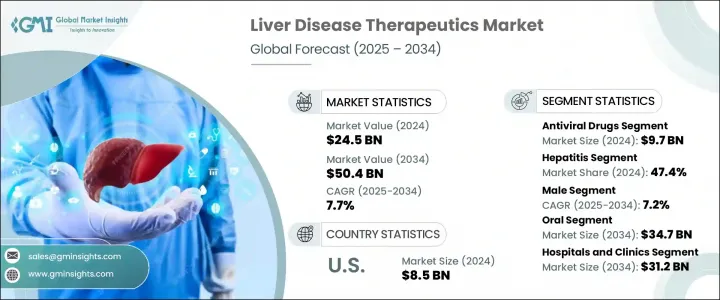

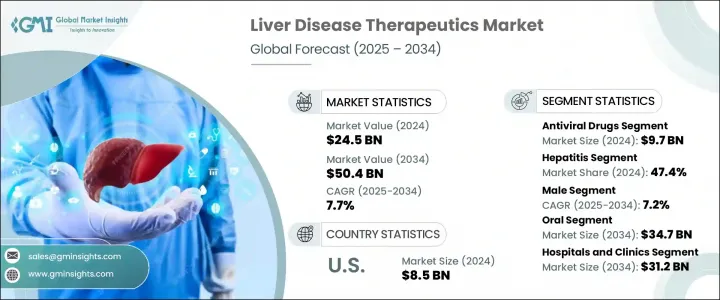

2024年,全球肝病治疗市场规模达245亿美元,预计2034年将以7.7%的复合年增长率成长,达到504亿美元。随着全球肝臟相关疾病的发生率持续上升,该市场正经历强劲成长。推动这一增长的主要动力之一是全球各年龄层肝病发病率的上升。由于遗传、环境和生活方式等多种因素的影响,慢性和急性肝病正变得越来越普遍。

人口老化是导致肝病治疗需求不断增加的另一个重要因素。随着人们寿命的延长,与年龄相关的健康问题(包括肝功能障碍)也变得越来越普遍。由于长期暴露于酒精、处方药和代谢紊乱等因素,老年人通常面临更高的慢性肝病风险。因此,医疗保健产业对专门针对老年患者肝病的治疗方案的需求日益增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 245亿美元 |

| 预测值 | 504亿美元 |

| 复合年增长率 | 7.7% |

医疗技术的创新也在支撑市场成长方面发挥了重要作用。诊断工具的进步使得早期发现和及时介入成为可能,这对于改善患者预后至关重要。能够早期识别肝臟疾病的技术正变得越来越普及和可靠,推动了对有效治疗的需求。此外,药物研发领域的持续研究正在催生出旨在更有效地治疗复杂肝臟疾病的先进治疗配方。这些改进正在促进更广泛的治疗方法的采用,并有助于扩大市场规模。

按产品划分,抗病毒药物成为表现最佳的细分市场,2024 年的市场规模达 97 亿美元。由于病毒性肝炎(尤其是乙肝和丙肝)的广泛传播,该细分市场占据主导地位,而病毒性肝炎仍然是导致慢性肝损伤及其併发症的主要原因之一。

直接抗病毒药物 (DAA) 凭藉其高治癒率和更少的副作用,显着改变了治疗模式。这些现代疗法不仅疗效较佳,而且由于疗程较短,患者较容易完成治疗。疗效和安全性较高的新一代抗病毒药物的上市加速了全球应用,尤其是在感染负担较重的地区。这些药物在改善临床疗效方面已得到证实,这使得该领域继续成为整体市场收入的主要贡献者。

就疾病类型而言,肝病治疗市场可分为肝炎、自体免疫疾病、非酒精性脂肪肝病 (NAFLD)、癌症、遗传性疾病和其他类别。其中,肝炎领域占据主导地位,2024 年的市占率高达 47.4%。这主要是由于B型肝炎和C肝感染在全球范围内持续存在,亟需有效的医疗解决方案。

持续的药物创新使治疗更加便利高效,配方改进,疗程更短、更安全。现代肝炎治疗简化了给药方案,提高了治癒率,从而提高了患者的依从性。此外,持续研发功能性疗法,确保肝炎领域在更广泛的治疗市场中保持领先地位。

依性别划分,市场分为男性和女性两类。 2024年,男性人口占主导地位,预期复合年增长率为7.2%。这趋势的驱动因素是男性肝病发生率高于女性。研究表明,男性更容易被诊断出患有慢性肝病,包括酒精性肝病、非酒精性脂肪肝(NAFLD)和肝炎。

这种性别差异也与生理和荷尔蒙水平的差异有关。雌激素被认为对肝臟组织具有保护作用,使停经前女性不太可能出现严重的肝损伤。另一方面,男性更容易从脂肪肝发展为更严重的疾病,例如脂肪肝和肝硬化,这增加了这一人群对医疗干预的需求。

从地区来看,美国是全球收入的最大贡献者。美国市场规模在2021年为75亿美元,2022年为78亿美元,2023年为81亿美元,2024年达85亿美元。这种持续增长反映了肝臟相关健康问题的日益增多,尤其是非酒精性脂肪性肝病(NAFLD)及其更严重的类型—非酒精性脂肪性肝炎(NASH)。造成这现象的因素包括肥胖激增、久坐不动的生活方式以及相关的代谢紊乱。

美国的医疗保健体系透过公共和私人保险计划支持早期诊断和高成本专科治疗,这有助于推动市场持续扩张。认知度的提高、广泛的筛检工作以及医疗基础设施的改善,都有助于美国保持领先地位。

在全球范围内,竞争格局由大型跨国公司、区域性公司和新兴企业组成。约45%至50%的市占率由四家领先公司占据,这些公司正积极透过合作、收购和推出创新疗法来扩大市场份额。这些公司正在大力投资研发,以满足尚未满足的临床需求并改善患者治疗效果,从而在这个快速发展的行业中占据战略优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 肝病盛行率不断上升

- 诊断技术的进步

- 久坐的生活方式、不良饮食和饮酒现象增多

- 产业陷阱与挑战

- 治疗费用高昂,尤其是生物製剂

- 某些药物的副作用和疗效有限

- 市场机会

- 非酒精性脂肪性肝炎 (NASH) 和肝癌的强大研发管道

- 新兴市场的扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 抗病毒药物

- 疫苗

- 化疗

- 标靶治疗

- 免疫抑制剂

- 免疫球蛋白

- 皮质类固醇

- 其他产品

第六章:市场估计与预测:依疾病类型,2021 - 2034 年

- 主要趋势

- 肝炎

- 自体免疫疾病

- 非酒精性脂肪肝(NAFLD)

- 癌症

- 遗传性疾病

- 其他疾病类型

第七章:市场估计与预测:依性别,2021 - 2034 年

- 主要趋势

- 男性

- 女性

第八章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 肠外

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Amgen

- AbbVie

- Bristol-Myers Squibb

- Bayer

- GSK plc

- Gilead Sciences

- Hoffmann-La Roche

- Intercept Pharmaceuticals

- Johnson & Johnson Services

- Merck & Co.

- Novartis

- Pfizer

- Sanofi

- Takeda Pharmaceutical Company Limited

- Zydus Lifesciences

The Global Liver Disease Therapeutics Market was valued at USD 24.5 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 50.4 billion by 2034. The market is witnessing robust growth as the prevalence of liver-related health conditions continues to rise worldwide. One of the primary forces fueling this growth is the increasing global incidence of liver diseases across all age groups. Liver conditions, both chronic and acute, are becoming more widespread due to a combination of genetic, environmental, and lifestyle-related factors.

An aging population is another important factor contributing to the expanding demand for liver disease treatments. As people live longer, age-related health issues, including liver dysfunction, are becoming more common. Elderly individuals often face a higher risk of chronic liver problems due to prolonged exposure to factors such as alcohol consumption, use of prescription medications, and metabolic disorders. As a result, the healthcare industry is seeing a greater need for therapeutic options that specifically address liver diseases in older patients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.5 Billion |

| Forecast Value | $50.4 Billion |

| CAGR | 7.7% |

Innovations in medical technology have also played a significant role in supporting market growth. Advancements in diagnostic tools have enabled early detection and timely intervention, which are critical for improving patient outcomes. Technologies that allow for early-stage identification of liver disorders are becoming more accessible and reliable, driving the demand for effective treatments. Furthermore, continuous research in pharmaceutical development is leading to the creation of advanced therapeutic formulations designed to treat complex liver conditions more effectively. These improvements are contributing to broader treatment adoption and helping expand the market size.

By product, antiviral drugs emerged as the top-performing segment, accounting for USD 9.7 billion in 2024. The segment dominates due to the widespread occurrence of viral hepatitis, particularly hepatitis B and C, which remain among the leading causes of chronic liver damage and associated complications.

Direct-acting antiviral agents (DAAs) have significantly changed the treatment landscape by offering high cure rates and fewer side effects. These modern therapies are not only more effective but also easier for patients to complete, thanks to their shorter treatment durations. The launch of next-generation antivirals with better efficacy and safety profiles has accelerated global adoption, especially in regions with high infection burdens. Their proven ability to improve clinical outcomes continues to position this segment as a major contributor to overall market revenues.

In terms of disease type, the liver disease therapeutics market is classified into hepatitis, autoimmune disorders, non-alcoholic fatty liver disease (NAFLD), cancer, genetic conditions, and other categories. The hepatitis segment dominated the landscape with a substantial 47.4% share in 2024. This is largely due to the persistent global burden of hepatitis B and C infections, which continue to demand effective medical solutions.

Ongoing drug innovations have made treatment more accessible and efficient, with improved formulations offering shorter and safer therapeutic regimens. Modern treatments for hepatitis feature simplified dosing schedules and increased cure rates, resulting in improved patient adherence. In addition, continuous research to develop functional cures ensures that the hepatitis segment maintains its lead within the broader therapeutics market.

By gender, the market is divided into male and female groups. In 2024, the male population represented the dominant share and is expected to grow at a CAGR of 7.2%. This trend is driven by a higher incidence of liver conditions among men compared to women. Studies show that men are more frequently diagnosed with chronic liver diseases, including alcoholic liver disease, NAFLD, and hepatitis.

This gender disparity is also linked to biological and hormonal differences. Estrogen is thought to have a protective effect on liver tissue, making premenopausal women less likely to experience severe liver damage. Men, on the other hand, are more prone to disease progression from fatty liver to more serious conditions such as steatohepatitis and cirrhosis, which increases the demand for medical intervention in this demographic.

Regionally, the United States is the largest contributor to global revenues. The U.S. market was valued at USD 7.5 billion in 2021, USD 7.8 billion in 2022, USD 8.1 billion in 2023, and reached USD 8.5 billion in 2024. This consistent growth reflects a rising number of liver-related health issues, particularly non-alcoholic fatty liver disease (NAFLD) and its more severe form, non-alcoholic steatohepatitis (NASH). Contributing factors include a surge in obesity, sedentary lifestyles, and associated metabolic disorders.

The healthcare system in the U.S. supports early diagnosis and access to high-cost specialty treatments through public and private insurance programs, which helps fuel continued market expansion. Increasing awareness, widespread screening efforts, and improved healthcare infrastructure all contribute to the country's leading position.

Globally, the competitive landscape features a mix of large multinational firms, regional companies, and emerging players. Approximately 45% to 50% of the market share is held by four leading companies that are actively engaged in expanding their market presence through collaborations, acquisitions, and the launch of innovative therapies. These companies are investing heavily in research and development to address unmet clinical needs and improve patient outcomes, giving them a strategic advantage in a rapidly growing industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Disease type

- 2.2.4 Gender

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of liver diseases

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Rise in sedentary lifestyles, poor diet, and alcohol use

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment, especially for biologics

- 3.2.2.2 Side effects and limited efficacy of certain drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Strong R&D pipeline for nonalcoholic steatohepatitis (NASH) and liver cancer

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antiviral drugs

- 5.3 Vaccines

- 5.4 Chemotherapy

- 5.5 Targeted therapy

- 5.6 Immunosuppressants

- 5.7 Immunoglobulins

- 5.8 Corticosteroids

- 5.9 Other products

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hepatitis

- 6.3 Autoimmune diseases

- 6.4 Non-alcoholic fatty liver disease (NAFLD)

- 6.5 Cancer

- 6.6 Genetic disorders

- 6.7 Other disease types

Chapter 7 Market Estimates and Forecast, By Gender, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Male

- 7.3 Female

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amgen

- 11.2 AbbVie

- 11.3 Bristol-Myers Squibb

- 11.4 Bayer

- 11.5 GSK plc

- 11.6 Gilead Sciences

- 11.7 Hoffmann-La Roche

- 11.8 Intercept Pharmaceuticals

- 11.9 Johnson & Johnson Services

- 11.10 Merck & Co.

- 11.11 Novartis

- 11.12 Pfizer

- 11.13 Sanofi

- 11.14 Takeda Pharmaceutical Company Limited

- 11.15 Zydus Lifesciences