|

市场调查报告书

商品编码

1782097

橡胶-金属黏合製品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rubber-To-Metal Bonded Articles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

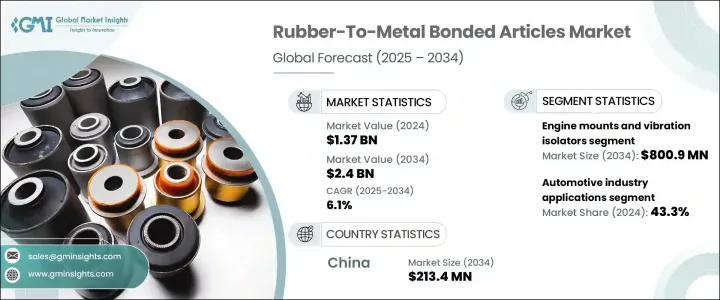

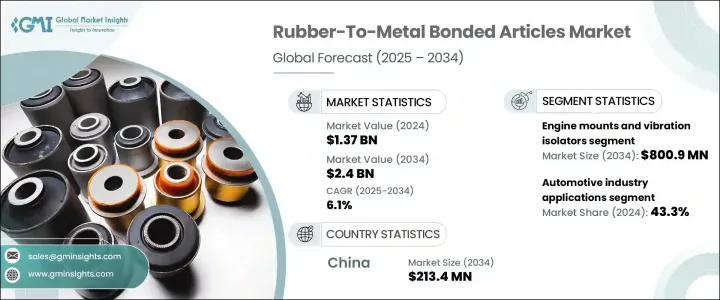

2024年,全球橡胶-金属黏合製品市场规模达13.7亿美元,预计到2034年将以6.1%的复合年增长率成长,达到24亿美元。这一强劲势头得益于一系列终端行业日益增长的需求,包括工业机械、航太和汽车行业。在这些行业中,橡胶-金属黏合製品对于降低噪音、吸收衝击和抑制振动至关重要。由于汽车产业越来越青睐高性能、轻量化且符合燃油效率和排放标准的零件,汽车产业将继续成为推动橡胶-金属黏合製品需求的主导力量。

随着法规日益严格,尤其是在排放和车辆安全方面,製造商正倾向于采用先进的黏合解决方案来满足不断变化的标准。航太业也在关键结构和功能领域扩大这些黏合部件的应用。此外,建筑、医疗保健和电子等行业正在开闢新的应用途径,预示着多元化的成长模式。黏合技术的创新,尤其是氰基丙烯酸酯黏合剂(其市场份额已超过40%),正在进一步推动产业发展。然而,原材料和能源价格的上涨带来了挑战,尤其对规模较小的市场参与者而言。这可能会加速整合进程,因为大型企业正在寻求垂直整合和稳定其供应链。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13.7亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 6.1% |

引擎支架和隔振器市场在2024年创收4.403亿美元,预计到2034年将成长至8.009亿美元,复合年增长率为6.2%。这些部件对于汽车和工业机械应用至关重要,在这些应用中,保持结构稳定性和最大限度地减少引擎相关的振动至关重要。在电动和混合动力车型中,它们的重要性更加突出,因为製造商优先考虑减轻重量和改善NVH(噪音、振动和声振粗糙度)特性。

2024年,汽车领域占据了最大的市场份额,达到43.3%,这得益于悬吊衬套、防振系统和排气支架等黏合部件的广泛使用。印度、德国、中国和美国等地区的市场扩张,带动了对高性能耐用零件的需求成长。新兴汽车技术正在重塑产品需求,促使製造商开发更整合、更有效率的零件,以符合最新的安全和排放标准。

中国橡胶-金属黏合製品市场在2024年创收1.143亿美元,预计年复合成长率为6.5%,到2034年将达到2.134亿美元。儘管进口量下降,但该地区仍然是全球最大的橡胶-金属黏合製品消费国,国内需求持续成长。有利的贸易政策和基础设施投资正在推动中国向国内生产转型,使中国在该行业更接近自给自足。与此同时,美国市场在同一时期经历了显着成长。

橡胶-金属黏合製品市场的领导者包括大陆集团、哈金森公司、特瑞堡公司、住友理工株式会社和威巴克公司。为了巩固其在橡胶-金属黏合製品市场的地位,顶尖公司正专注于几项核心策略。他们大力投资研发,以打造先进的轻量化黏合解决方案,满足电动和混合动力汽车平台不断变化的需求。他们正在进行策略性併购,以更好地控制供应链并扩大市场份额。主要参与者也在提升製造能力,并利用自动化来提高效率。此外,许多公司正在与原始设备製造商 (OEM) 签订长期合同,以确保稳定的需求并加强其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计数据(註:仅提供重点国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 引擎支架和隔振器

- 汽车引擎支架

- 乘用车引擎支架

- 商用车引擎支架

- 电动车专用支架

- 工业隔振器

- 机械支架和隔离器

- 暖通空调系统隔离器

- 帮浦和压缩机支架

- 航太发动机支架

- 飞机发动机支架

- 直升机振动系统

- 无人机和无人驾驶飞机应用

- 汽车引擎支架

- 衬套和悬吊部件

- 汽车衬套

- 控制臂衬套

- 稳定桿衬套

- 支柱安装衬套

- 板簧衬套

- 工业套管

- 机械衬套

- 输送系统组件

- 重型设备衬套

- 船舶和非公路用套管

- 船用引擎支架

- 建筑设备衬套

- 农业机械零件

- 汽车衬套

- 密封件和垫圈

- 汽车密封件

- 引擎密封件和垫圈

- 变速箱密封件

- 差速器密封件

- 航太密封件

- 航空发动机密封件

- 液压系统密封件

- 环境控制系统密封件

- 工业密封件

- 帮浦和阀门密封件

- 管道密封件

- 製程设备密封件

- 汽车密封件

- 联轴器和柔性连接器

- 汽车驱动联轴器

- CV 接头防尘罩

- 传动轴联轴器

- 传动联轴器

- 工业用挠性联轴器

- 马达联轴器

- 泵浦联轴器

- 发电机联轴器

- 船舶和航太联轴器

- 螺旋桨轴联轴器

- 飞机系统联轴器

- 特殊黏合部件

- 汽车驱动联轴器

- 防震垫和支架

- 减震器和阻尼器

- 柔性接头和连接器

- 客製化工程解决方案

第六章:市场估计与预测:按键结技术,2021 - 2034 年

- 主要趋势

- 化学键合技术

- 基于黏合剂的黏合系统

- 环氧基黏合剂

- 聚氨酯黏合剂

- 有机硅基体系

- 特种化学黏合剂

- 硫化黏合

- 硫磺硫化体系

- 过氧化物硫化

- 辐射硫化

- 金属氧化物硫化

- 底漆和涂料系统

- 金属表面底漆

- 橡胶相容涂料

- 多层黏合系统

- 基于黏合剂的黏合系统

- 机械键结技术

- 包覆成型工艺

- 嵌件成型应用

- 双色射出成型系统

- 多材料成型

- 封装技术

- 完整的封装系统

- 部分封装方法

- 选择性黏合区域

- 机械联锁

- 纹理表面黏合

- 机械紧固系统

- 混合键合方法

- 包覆成型工艺

- 先进的键合技术

- 等离子处理黏合

- 大气等离子系统

- 低压等离子处理

- 电晕处理应用

- 雷射辅助键合

- 雷射表面活化

- 雷射焊接应用

- 选择性雷射加工

- 奈米科技增强黏合

- 奈米粒子增强黏合剂

- 碳奈米管的应用

- 基于石墨烯的系统

- 等离子处理黏合

- 新兴黏合技术

- 自修復黏合系统

- 智慧黏合技术

- 生物基黏合系统

- 可回收黏合解决方案

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车产业应用

- 搭乘用车

- 引擎和动力总成部件

- 悬吊和底盘系统

- 车身和内装应用

- 电动车专用零件

- 商用车

- 重型卡车应用

- 公车和长途汽车系统

- 专用车辆零件

- 摩托车和两轮车应用

- 引擎悬吊系统

- 悬吊部件

- 振动控制系统

- 汽车售后市场

- 替换零件市场

- 性能升级组件

- 维护和维修应用

- 搭乘用车

- 航太和国防工业

- 商业航空

- 引擎悬吊系统

- 起落架部件

- 客舱和内装应用

- 环境控制系统

- 军用和国防飞机

- 战斗机部件

- 运输飞机系统

- 直升机应用

- 无人机和无人驾驶飞机系统

- 太空和卫星应用

- 运载火箭部件

- 卫星系统

- 太空站应用

- 航太售后市场

- 维修、维修和大修 (MRO)

- 零件更换市场

- 升级和现代化计划

- 商业航空

- 工业机械设备

- 生产设备

- 工具机应用

- 自动化系统组件

- 机器人应用

- 流程工业

- 化学加工设备

- 石油和天然气工业应用

- 发电系统

- 建筑和采矿设备

- 重型机械部件

- 土方设备

- 矿山机械应用

- 海洋和近海

- 船舶引擎支架

- 海上平台部件

- 船舶推进系统

- 生产设备

- 基础设施和建筑

- 建筑和施工

- 暖通空调系统组件

- 电梯和自动扶梯系统

- 结构振动控制

- 交通基础设施

- 铁路系统部件

- 桥樑和隧道应用

- 机场基础设施

- 公用事业和能源

- 发电厂部件

- 再生能源系统

- 输配电

- 建筑和施工

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- 3M Company

- BASF SE

- Bridgestone Corporation

- Continental AG

- Cooper Standard

- ElringKlinger AG

- Freudenberg Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hutchinson SA

- Parker Hannifin Corporation

- Sumitomo Riko Company Limited

- Trelleborg AB

- Vibracoustic

- ZF Friedrichshafen AG

The Global Rubber-To-Metal Bonded Articles Market was valued at USD 1.37 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 2.4 billion by 2034. This strong momentum is attributed to the growing demand across a range of end-use industries, including industrial machinery, aerospace, and automotive, where these components are essential in minimizing noise, absorbing shocks, and dampening vibrations. The automotive sector continues to be a dominant force in driving demand, owing to the increasing preference for high-performance, weight-saving components that support fuel efficiency and emissions compliance.

As regulations tighten, especially around emissions and vehicle safety, manufacturers are leaning into advanced bonding solutions to meet evolving standards. The aerospace industry is also expanding its use of these bonded parts in critical structural and functional areas. Additionally, sectors such as construction, healthcare, and electronics are creating new pathways for application, signaling a diversified growth pattern. Innovations in bonding technologies, especially with cyanoacrylate adhesives-which already command over 40% of the market-are providing a further lift. However, rising raw material and energy prices pose challenges, particularly for smaller market players. This may accelerate consolidation efforts, as larger firms look to integrate and stabilize their supply chains vertically.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.37 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 6.1% |

The engine mounts and vibration isolators segment generated USD 440.3 million in 2024 and is projected to grow to USD 800.9 million by 2034, growing at a CAGR of 6.2%. These components are critical across automotive and industrial machinery applications, where maintaining structural stability and minimizing engine-related vibrations are essential. Their relevance is heightened in both electric and hybrid models, where manufacturers prioritize reduced weight and improved NVH (Noise, Vibration, and Harshness) characteristics.

In 2024, the automotive segment held the largest market share at 43.3%, owing to the extensive usage of bonded components like suspension bushings, anti-vibration systems, and exhaust brackets. Market expansion in regions such as India, Germany, China, and the United States has led to increased demand for high-performance, durable components. Emerging vehicle technologies are reshaping product requirements, pushing manufacturers to develop more integrated, efficient parts that align with updated safety and emissions standards.

China Rubber-To-Metal Bonded Articles Market generated USD 114.3 million in 2024 and is forecasted to grow at a CAGR of 6.5%, to reach USD 213.4 million by 2034. Despite a dip in imports, the region remains the largest global consumer, with local demand continuing to rise. Favorable trade policies and infrastructure investment are driving a shift toward domestic production, allowing China to move closer to self-reliance in this industry. Meanwhile, the United States experienced significant market growth during the same period.

Leading players in the Rubber-To-Metal Bonded Articles Market include Continental AG, Hutchinson SA, Trelleborg AB, Sumitomo Riko Co., Ltd., and Vibracoustic GmbH. To strengthen their position in the rubber-to-metal bonded articles market, top companies are focusing on several core strategies. They are heavily investing in research and development to create advanced, lightweight bonding solutions that cater to the evolving needs of electric and hybrid vehicle platforms. Strategic mergers and acquisitions are being pursued to gain better control of supply chains and expand market share. Key players are also enhancing their manufacturing capabilities and leveraging automation to improve efficiency. Furthermore, many are entering long-term contracts with OEMs to ensure consistent demand and strengthen their global presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics( Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.7 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Engine mounts and vibration isolators

- 5.2.1 Automotive engine mounts

- 5.2.1.1 Passenger vehicle engine mounts

- 5.2.1.2 Commercial vehicle engine mounts

- 5.2.1.3 Electric vehicle specialized mounts

- 5.2.2 Industrial vibration isolators

- 5.2.2.1 Machinery mounts and isolators

- 5.2.2.2 Hvac system isolators

- 5.2.2.3 Pump and compressor mounts

- 5.2.3 Aerospace engine mounts

- 5.2.3.1 Aircraft engine mounts

- 5.2.3.2 Helicopter vibration systems

- 5.2.3.3 Uav and drone applications

- 5.2.1 Automotive engine mounts

- 5.3 Bushings and suspension components

- 5.3.1 Automotive bushings

- 5.3.1.1 Control arm bushings

- 5.3.1.2 Sway bar bushings

- 5.3.1.3 Strut mount bushings

- 5.3.1.4 Leaf spring bushings

- 5.3.2 Industrial bushings

- 5.3.2.1 Machinery bushings

- 5.3.2.2 Conveyor system components

- 5.3.2.3 Heavy equipment bushings

- 5.3.3 Marine and off-highway bushings

- 5.3.3.1 Marine engine mounts

- 5.3.3.2 Construction equipment bushings

- 5.3.3.3 Agricultural machinery components

- 5.3.1 Automotive bushings

- 5.4 Seals and gaskets

- 5.4.1 Automotive seals

- 5.4.1.1 Engine seals and gaskets

- 5.4.1.2 Transmission seals

- 5.4.1.3 Differential seals

- 5.4.2 Aerospace seals

- 5.4.2.1 Aircraft engine seals

- 5.4.2.2 Hydraulic system seals

- 5.4.2.3 Environmental control system seals

- 5.4.3 Industrial seals

- 5.4.3.1 Pump and valve seals

- 5.4.3.2 Pipeline seals

- 5.4.3.3 Process equipment seals

- 5.4.1 Automotive seals

- 5.5 Couplings and flexible connectors

- 5.5.1 Automotive drive couplings

- 5.5.1.1 Cv joint boots

- 5.5.1.2 Driveshaft couplings

- 5.5.1.3 Transmission couplings

- 5.5.2 Industrial flexible couplings

- 5.5.2.1 Motor couplings

- 5.5.2.2 Pump couplings

- 5.5.2.3 Generator couplings

- 5.5.3 Marine and aerospace couplings

- 5.5.3.1 Propeller shaft couplings

- 5.5.3.2 Aircraft system couplings

- 5.5.3.3 Specialty bonded components

- 5.5.1 Automotive drive couplings

- 5.6 Anti-vibration pads and mounts

- 5.6.1 Shock absorbers and dampers

- 5.6.2 Flexible joints and connectors

- 5.6.3 Custom engineered solutions

Chapter 6 Market Estimates and Forecast, By Bonding Technology, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Chemical bonding technologies

- 6.2.1 Adhesive-based bonding systems

- 6.2.1.1 Epoxy-based adhesives

- 6.2.1.2 Polyurethane adhesives

- 6.2.1.3 Silicone-based systems

- 6.2.1.4 Specialty chemical adhesives

- 6.2.2 Vulcanization bonding

- 6.2.2.1 Sulfur vulcanization systems

- 6.2.2.2 Peroxide vulcanization

- 6.2.2.3 Radiation vulcanization

- 6.2.2.4 Metal oxide vulcanization

- 6.2.3 Primer and coating systems

- 6.2.3.1 Metal surface primers

- 6.2.3.2 Rubber-compatible coatings

- 6.2.3.3 Multi-layer bonding systems

- 6.2.1 Adhesive-based bonding systems

- 6.3 Mechanical bonding technologies

- 6.3.1 Overmolding processes

- 6.3.1.1 Insert molding applications

- 6.3.1.2 Two-shot molding systems

- 6.3.1.3 Multi-material molding

- 6.3.2 Encapsulation technologies

- 6.3.2.1 Complete encapsulation systems

- 6.3.2.2 Partial encapsulation methods

- 6.3.2.3 Selective bonding areas

- 6.3.3 Mechanical interlocking

- 6.3.3.1 Textured surface bonding

- 6.3.3.2 Mechanical fastening systems

- 6.3.3.3 Hybrid bonding approaches

- 6.3.1 Overmolding processes

- 6.4 Advanced bonding technologies

- 6.4.1 Plasma treatment bonding

- 6.4.1.1 Atmospheric plasma systems

- 6.4.1.2 Low-pressure plasma treatment

- 6.4.1.3 Corona treatment applications

- 6.4.2 Laser-assisted bonding

- 6.4.2.1 Laser surface activation

- 6.4.2.2 Laser welding applications

- 6.4.2.3 Selective laser processing

- 6.4.3 Nanotechnology-enhanced bonding

- 6.4.3.1 Nanoparticle-enhanced adhesives

- 6.4.3.2 Carbon nanotube applications

- 6.4.3.3 Graphene-based systems

- 6.4.1 Plasma treatment bonding

- 6.5 Emerging bonding technologies

- 6.5.1 Self-healing bonding systems

- 6.5.2 Smart adhesive technologies

- 6.5.3 Bio-based bonding systems

- 6.5.4 Recyclable bonding solutions

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Automotive industry applications

- 7.2.1 Passenger vehicles

- 7.2.1.1 Engine and powertrain components

- 7.2.1.2 Suspension and chassis systems

- 7.2.1.3 Body and interior applications

- 7.2.1.4 Electric vehicle specific components

- 7.2.2 Commercial vehicles

- 7.2.2.1 Heavy-duty truck applications

- 7.2.2.2 Bus and coach systems

- 7.2.2.3 Specialty vehicle components

- 7.2.3 Motorcycle and two-wheeler applications

- 7.2.3.1 Engine mount systems

- 7.2.3.2 Suspension components

- 7.2.3.3 Vibration control systems

- 7.2.4 Automotive aftermarket

- 7.2.4.1 Replacement parts market

- 7.2.4.2 Performance upgrade components

- 7.2.4.3 Maintenance and repair applications

- 7.2.1 Passenger vehicles

- 7.3 Aerospace and defense industry

- 7.3.1 Commercial aviation

- 7.3.1.1 Engine mount systems

- 7.3.1.2 Landing gear components

- 7.3.1.3 Cabin and interior applications

- 7.3.1.4 Environmental control systems

- 7.3.2 Military and defense aircraft

- 7.3.2.1 Fighter aircraft components

- 7.3.2.2 Transport aircraft systems

- 7.3.2.3 Helicopter applications

- 7.3.2.4 Uav and drone systems

- 7.3.3 Space and satellite applications

- 7.3.3.1 Launch vehicle components

- 7.3.3.2 Satellite systems

- 7.3.3.3 Space station applications

- 7.3.4 Aerospace aftermarket

- 7.3.4.1 Maintenance, repair, and overhaul (MRO)

- 7.3.4.2 Component replacement market

- 7.3.4.3 Upgrade and modernization programs

- 7.3.1 Commercial aviation

- 7.4 Industrial machinery and equipment

- 7.4.1 Manufacturing equipment

- 7.4.1.1 Machine tool applications

- 7.4.1.2 Automation system components

- 7.4.1.3 Robotics applications

- 7.4.2 Process industries

- 7.4.2.1 Chemical processing equipment

- 7.4.2.2 Oil and gas industry applications

- 7.4.2.3 Power generation systems

- 7.4.3 Construction and mining equipment

- 7.4.3.1 Heavy machinery components

- 7.4.3.2 Earth moving equipment

- 7.4.3.3 Mining machinery applications

- 7.4.4 Marine and offshore

- 7.4.4.1 Ship engine mounts

- 7.4.4.2 Offshore platform components

- 7.4.4.3 Marine propulsion systems

- 7.4.1 Manufacturing equipment

- 7.5 Infrastructure and construction

- 7.5.1 Building and construction

- 7.5.1.1 Hvac system components

- 7.5.1.2 Elevator and escalator systems

- 7.5.1.3 Structural vibration control

- 7.5.2 Transportation infrastructure

- 7.5.2.1 Railway system components

- 7.5.2.2 Bridge and tunnel applications

- 7.5.2.3 Airport infrastructure

- 7.5.3 Utilities and energy

- 7.5.3.1 Power plant components

- 7.5.3.2 Renewable energy systems

- 7.5.3.3 Transmission and distribution

- 7.5.1 Building and construction

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 BASF SE

- 9.3 Bridgestone Corporation

- 9.4 Continental AG

- 9.5 Cooper Standard

- 9.6 ElringKlinger AG

- 9.7 Freudenberg Group

- 9.8 H.B. Fuller Company

- 9.9 Henkel AG & Co. KGaA

- 9.10 Hutchinson SA

- 9.11 Parker Hannifin Corporation

- 9.12 Sumitomo Riko Company Limited

- 9.13 Trelleborg AB

- 9.14 Vibracoustic

- 9.15 ZF Friedrichshafen AG