|

市场调查报告书

商品编码

1782101

摩擦奈米发电机 (TENG) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Triboelectric nanogenerators (TENGs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

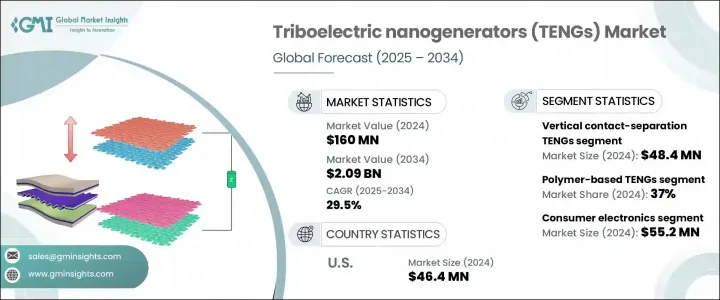

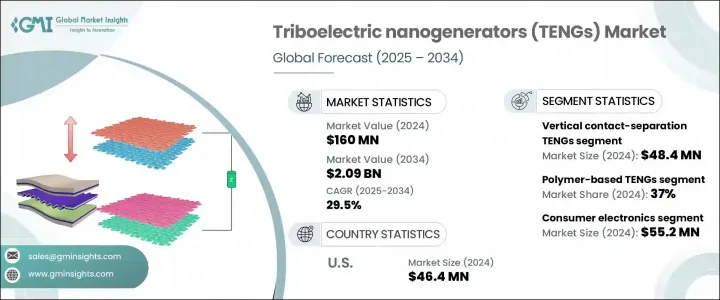

2024 年全球摩擦奈米发电机市场价值为 1.6 亿美元,预计到 2034 年将以 29.5% 的复合年增长率成长,达到 20.9 亿美元。这一显着增长得益于人们对自供电电子技术日益增长的兴趣以及对紧凑、低维护电源的迫切需求。随着从个人电子设备到工业系统等各行各业的设备变得更加便携和轻巧,对无需定期更换电池的能量收集解决方案的需求正在迅速增长。 TENG 从日常物理运动中获取能量,使其成为可持续、无电池应用的理想选择。随着物联网在智慧家庭、连网产业和城市基础设施的普及,对分散式、自主式发电系统的需求日益增长。这些奈米发电机不仅可以提供再生能源,还有助于减少电子垃圾,并支持永续发展目标。

随着各组织和政府纷纷寻求下一代绿色技术,公共和私人对替代能源创新的投资持续推动TENG进入主流应用。这些投资不仅资助了摩擦电材料和可扩展製造技术的先进研究,还支持了从智慧城市到生物医学设备等多个领域的试点计画。 TENG越来越被视为分散式能源生态系统的关键组成部分,在这种生态系统中,本地发电可以减少对电网基础设施的依赖。随着全球永续发展目标的不断加强,机构和企业资金都在加速其商业化进程,使TENG能够整合到穿戴式装置、工业感测器和自主监控系统中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.6亿美元 |

| 预测值 | 20.9亿美元 |

| 复合年增长率 | 29.5% |

垂直接触分离型TENG占据了相当大的市场份额,2024年市值达到4840万美元,预计2025年至2034年的复合年增长率将达到27%。这类TENG凭藉其简单的架构和高能量转换效率占据市场主导地位。它们适用于重复运动场景,使其成为消费级穿戴式装置和工业应用的理想选择。持续的资金投入与研究正助力TENG商业应用的拓展。

2024年,以聚合物为基础的摩擦奈米发电机(TENG)市场价值为5,930万美元,占37%的市场份额,预计2025-2034年复合年增长率为28.4%。其灵活轻巧的特性以及易于製造的特性使其成为整合到可穿戴技术中的理想选择。 PVDF和PTFE等材料因其强大的摩擦电效应而广受青睐。这些聚合物具有经济高效的製造和易于扩展的优势,促进了其在消费和医疗电子产品领域的广泛应用。

2024年,美国摩擦奈米发电机 (TENG) 市场规模达4,640万美元,预计到2034年将以28.9%的复合年增长率成长。美国在研发和创新领域的领先地位,尤其是在能量收集和先进电子技术方面,为TENG应用的发展做出了重要贡献。成熟科技公司和新兴新创企业的积极参与,正在推动其在消费产品和医疗保健解决方案中的应用。政府推动永续能源和清洁技术的倡议,进一步支持了北美TENG的崛起。先进的基础设施和智慧技术的快速部署,使该地区在全球格局中占据主导地位。

全球摩擦电奈米发电机市场的主要参与者包括德州仪器公司、三星电子有限公司、TENGTech 有限公司、小米公司和 ADI 公司。这些公司正在积极开展各种竞争,以抢占更大的市场份额。在策略方面,领先的 TENG 製造商正大力发展可扩展的原型,并与研究机构合作,以改善摩擦电性能。对下一代穿戴式和植入式装置的研发投资仍然是重中之重,因为各家公司都希望透过创新实现差异化。与物联网设备製造商和智慧型设备 OEM 建立策略合作伙伴关係正变得越来越普遍,这使得 TENG 供应商能够将其技术整合到高需求的最终应用中。此外,各家公司正在扩大製造能力併申请专利以保护专有设计,同时瞄准尚未开发的地区以实现未来成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按设备类型,2021 - 2034 年

- 主要趋势

- 垂直接触分离TENG

- 横向滑动TENG

- 单电极TENG

- 独立式摩擦电层TENG

- 混合和多模TENG

- 其他的

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 聚合物基TENG

- 含氟聚合物(PTFE、FEP、PVDF)

- 聚酰亚胺

- 有机硅

- 其他聚合物

- 金属基TENG

- 铝

- 铜

- 其他金属

- 基于奈米结构材料的TENG

- 金属氧化物

- 碳基材料

- 其他奈米结构材料

- 基于复合材料的TENG

- 聚合物金属复合材料

- 聚合物奈米颗粒复合材料

- 其他复合材料

- 基于纺织品和纤维的TENG

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 消费性电子产品

- 穿戴式装置

- 智慧纺织品和服装

- 便携式电子产品

- 其他消费应用

- 医疗保健和医疗器械

- 植入式医疗器材

- 健康监测系统

- 治疗设备

- 其他医疗保健应用

- 物联网 (IoT)

- 无线感测器网路

- 智慧家庭设备

- 工业物联网应用

- 其他物联网应用

- 汽车和运输

- 胎压监测

- 车辆健康监测

- 利用车辆振动收集能量

- 其他汽车应用

- 环境监测

- 天气监测系统

- 水质监测

- 空气品质监测

- 其他环境应用

- 智慧基础设施

- 智慧建筑

- 智慧道路和桥樑

- 智慧电网

- 其他基础设施应用

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Georgia Institute of Technology (Prof. Zhong Lin Wang's Group)

- Samsung Electronics Co., Ltd.

- Xiaomi Corporation

- TENGTech Co., Ltd.

- Beijing Institute of Nanoenergy and Nanosystems, Chinese Academy of Sciences

- Tsinghua University (Prof. Haixia Zhang's Group)

- Soochow University (Prof. Baoquan Sun's Group)

- Nanyang Technological University (Prof. Pooi See Lee's Group)

- Korea Advanced Institute of Science and Technology (KAIST)

- University of California, Berkeley (Prof. Liwei Lin's Group)

- Analog Devices, Inc.

- Texas Instruments Incorporated

- STMicroelectronics NV

- Powercast Corporation

- EnOcean GmbH

- e-peas SA

- Pavegen Systems Ltd.

- Omron Corporation

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

The Global Triboelectric nanogenerators Market was valued at USD 160 million in 2024 and is estimated to grow at a CAGR of 29.5% to reach USD 2.09 billion by 2034. This remarkable expansion is being fueled by rising interest in self-powered electronic technologies and the urgent need for compact, low-maintenance power sources. As devices across industries-from personal gadgets to industrial systems-become more portable and lightweight, the demand for energy harvesting solutions that eliminate the need for regular battery replacement is growing rapidly. TENGs harness energy from everyday physical motions, making them ideal for sustainable, battery-free applications. With the proliferation of IoT across smart homes, connected industries, and urban infrastructure, there is a growing call for decentralized, autonomous energy generation systems. These nanogenerators not only deliver renewable power but also help reduce electronic waste, supporting sustainability goals.

Public and private investments in alternative energy innovations continue to push TENGs into mainstream adoption as organizations and governments seek next-generation green technologies. These investments are not only funding advanced research into triboelectric materials and scalable manufacturing techniques but also supporting pilot projects across multiple sectors-from smart cities to biomedical devices. TENGs are increasingly viewed as a critical component in decentralized energy ecosystems, where localized power generation can reduce dependence on grid infrastructure. As sustainability goals tighten globally, both institutional and corporate funding are accelerating commercialization, enabling the integration of TENGs into wearables, industrial sensors, and autonomous monitoring systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $160 Million |

| Forecast Value | $2.09 Billion |

| CAGR | 29.5% |

The vertical contact-separation type segment captured a significant portion of the market with a value of USD 48.4 million in 2024 and is forecasted to grow at a CAGR of 27% from 2025 to 2034. These TENGs dominate the market due to their simple architecture and high energy conversion efficiency. Their suitability for repetitive-motion scenarios makes them ideal for use in both consumer wearables and industrial settings. Continued funding and research around this configuration are helping expand its commercial applications.

The polymer-based TENGs segment was valued at USD 59.3 million in 2024 and held 37% of the share, with an expected CAGR of 28.4% during 2025-2034. Their flexible and lightweight characteristics, along with ease of fabrication, make them ideal for integration into wearable technologies. Materials like PVDF and PTFE are widely favored for their strong triboelectric effects. These polymers allow cost-effective manufacturing and easy scalability, which has encouraged broader adoption across consumer and medical electronics.

United States Triboelectric nanogenerators (TENGs) Market was valued at USD 46.4 million in 2024 and is expected to grow at a 28.9% CAGR through 2034. The country's leadership in R&D and innovation, especially in energy harvesting and advanced electronics, significantly contributes to the development of TENG applications. Strong participation from both established tech firms and emerging startups is driving adoption in consumer products and healthcare solutions. Government initiatives promoting sustainable energy and clean technologies further support the rise of TENGs in North America. Advanced infrastructure and rapid deployment of smart technologies give the region a dominant position in the global landscape.

Key players in the Global Triboelectric Nanogenerators Market include Texas Instruments Incorporated, Samsung Electronics Co., Ltd., TENGTech Co., Ltd., Xiaomi Corporation, and Analog Devices, Inc. These companies are actively competing across various dimensions to capture greater market share. In terms of strategy, leading TENG manufacturers are focusing heavily on developing scalable prototypes and collaborating with research institutions to refine triboelectric performance. Investment in R&D for next-gen wearable and implantable devices remains a major priority, as companies look to differentiate through innovation. Strategic partnerships with IoT device makers and smart device OEMs are becoming increasingly common, allowing TENG providers to integrate their technologies into high-demand end-use applications. In addition, companies are expanding manufacturing capabilities and filing patents to protect proprietary designs, while targeting untapped regions for future growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.2 Research scope & assumptions

- 1.3 List of data sources

- 1.4 Market estimation technique

- 1.5 Market size calculation models

- 1.6 Market breakdown and data triangulation

- 1.7 Primary research validation methods

- 1.8 Secondary research verification process

- 1.9 Research limitations and challenges

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vertical contact-separation TENGs

- 5.3 Lateral sliding TENGs

- 5.4 Single-electrode TENGs

- 5.5 Freestanding triboelectric-layer TENGs

- 5.6 Hybrid and multi-mode TENGs

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Polymer-based TENGs

- 6.2.1 Fluoropolymers (PTFE, FEP, PVDF)

- 6.2.2 Polyimides

- 6.2.3 Silicones

- 6.2.4 Other polymers

- 6.3 Metal-based TENGs

- 6.3.1 Aluminum

- 6.3.2 Copper

- 6.3.3 Other metals

- 6.4 Nanostructured material-based TENGs

- 6.4.1 Metal oxides

- 6.4.2 Carbon-based materials

- 6.4.3 Other nanostructured materials

- 6.5 Composite material-based TENGs

- 6.5.1 Polymer-metal composites

- 6.5.2 Polymer-nanoparticle composites

- 6.5.3 Other composite materials

- 6.6 Textile and fiber-based TENGs

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.2.1 Wearable devices

- 7.2.2 Smart textiles and clothing

- 7.2.3 Portable electronics

- 7.2.4 Other consumer applications

- 7.3 Healthcare and medical devices

- 7.3.1 Implantable medical devices

- 7.3.2 Health monitoring systems

- 7.3.3 Therapeutic devices

- 7.3.4 Other healthcare applications

- 7.4 Internet of Things (IoT)

- 7.4.1 Wireless sensor networks

- 7.4.2 Smart home devices

- 7.4.3 Industrial IoT applications

- 7.4.4 Other IoT applications

- 7.5 Automotive and transportation

- 7.5.1 Tire pressure monitoring

- 7.5.2 Vehicle health monitoring

- 7.5.3 Energy harvesting from vehicle vibrations

- 7.5.4 Other automotive applications

- 7.6 Environmental monitoring

- 7.6.1 Weather monitoring systems

- 7.6.2 Water quality monitoring

- 7.6.3 Air quality monitoring

- 7.6.4 Other environmental applications

- 7.7 Smart infrastructure

- 7.7.1 Smart buildings

- 7.7.2 Smart roads and bridges

- 7.7.3 Smart grids

- 7.7.4 Other infrastructure applications

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Georgia Institute of Technology (Prof. Zhong Lin Wang's Group)

- 9.2 Samsung Electronics Co., Ltd.

- 9.3 Xiaomi Corporation

- 9.4 TENGTech Co., Ltd.

- 9.5 Beijing Institute of Nanoenergy and Nanosystems, Chinese Academy of Sciences

- 9.6 Tsinghua University (Prof. Haixia Zhang's Group)

- 9.7 Soochow University (Prof. Baoquan Sun's Group)

- 9.8 Nanyang Technological University (Prof. Pooi See Lee's Group)

- 9.9 Korea Advanced Institute of Science and Technology (KAIST)

- 9.10 University of California, Berkeley (Prof. Liwei Lin's Group)

- 9.11 Analog Devices, Inc.

- 9.12 Texas Instruments Incorporated

- 9.13 STMicroelectronics N.V.

- 9.14 Powercast Corporation

- 9.15 EnOcean GmbH

- 9.16 e-peas S.A.

- 9.17 Pavegen Systems Ltd.

- 9.18 Omron Corporation

- 9.19 Fujitsu Limited

- 9.20 Huawei Technologies Co., Ltd.