|

市场调查报告书

商品编码

1782117

大容量乙烯基 (MLV) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mass-loaded Vinyl (MLV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球高密度乙烯基 (MLV) 市场规模达2.903亿美元,预计到2034年将以5.5%的复合年增长率成长,达到4.883亿美元。城市化和工业活动的不断增长直接导致噪音污染加剧,进而推动了对高效隔音解决方案的需求。 MLV因其无毒特性以及在住宅和商业环境中有效降低噪音传播的能力而广受欢迎。随着人们越来越意识到环境噪音对健康的影响,基础设施和建筑项目对隔音材料的需求持续激增。此外,建筑法规对永续建筑和现代声学合规性的日益重视,进一步推动了MLV在多个领域的应用。

教育机构、医疗建筑和多单元住宅开发项目等设施的声学性能标准日益严格,也促使开发商选择基于MLV的产品。该材料的多功能性、耐用性和易于安装的特点使其成为翻新和新建建筑的首选,尤其是在空间受限的区域。随着基础设施投资的不断成长,新兴经济体对MLV的需求急剧上升。 MLV在交通枢纽和汽车製造业的应用也日益增长,因为有效的降噪对于性能和舒适度至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.903亿美元 |

| 预测值 | 4.883亿美元 |

| 复合年增长率 | 5.5% |

2024年,标准密度多层吸音板 (MLV) 市值为9,805万美元,预计到2034年将以4.2%的复合年增长率成长。由于价格实惠且供应充足,该市场将继续在基础住宅和轻型商用隔音应用中占据主导地位。然而,市场趋势正逐渐转向客製化解决方案,尤其是在医疗保健、国防和工业製造等需要精密声音控制的领域。在需要更高隔音效果或必须遵守重量限制的领域,先进的复合材料多层吸音板 (MLV) 和具有特定密度要求的定製配方更受青睐。

建筑和施工产业在2024年创造了1.203亿美元的市场规模,预计在2025-2034年期间的复合年增长率将达到5.9%。 MLV常用于天花板、隔间和地板系统,以确保符合不断发展的噪音控制法规并提升室内声音舒适度。虽然MLV的主要应用领域仍然是建筑业,但汽车製造商也越来越多地采用MLV来提高车内安静度并降低外部噪音。随着个人消费者寻求经济实惠且易于DIY的噪音管理替代方案,家庭工作室、游戏室和小型娱乐空间等面向消费者的应用正在迅速扩张。

2024年,美国高密度乙烯基 (MLV) 市场规模达7,220万美元,预计2025年至2034年的复合年增长率为2.3%。建筑规范趋严、房屋翻新需求上升以及DIY隔音材料的热情高涨,共同推动了市场扩张。同时,为满足NVH(噪音、振动和声振粗糙度)标准,汽车内装零件的使用日益增多,也推动了MLV在汽车产业的应用。建筑业的復苏以及声学品质支出的增加,共同创造了积极的长期前景。

Technicon Acoustics、Soundproof Direct、Acoustical Surfaces、All Noise Control 和 Niko Coatings 等主要参与者正积极参与全球市场竞争。为了巩固其在多层压延材料 (MLV) 行业的地位,领先公司正专注于客製化产品开发、多元化发展和策略供应链优化。核心方法包括扩展产品组合,推出多层或复合 MLV 材料,以满足特定的细分市场需求,例如工业机械、医疗空间和航太内饰。这些参与者也投资研发,以提供符合永续发展目标的轻量化环保解决方案。地理扩张、数位行销和电商管道正在帮助品牌接触 DIY 消费者,而与建筑和汽车製造商的合作则确保了在大批量市场中的回头客。卷材尺寸和应用方法的创新也在提高市场采用率和降低专案成本方面发挥关键作用。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测、产品类型,2021-2034

- 主要趋势

- 标准密度 MLV

- 1磅/平方英尺MLV产品

- 住宅应用

- 商业应用

- 工业应用

- 2磅/平方英尺MLV产品

- 高效能应用程式

- 专业工业用途

- 优质住宅项目

- 1磅/平方英尺MLV产品

- 定制密度 MLV

- 半磅MLV产品

- 高密度 MLV(>2 磅/平方英尺)

- 特定应用的客製化配方

- 复合 MLV 产品

- 泡沫背衬的 MLV

- 带有织物面的 MLV

- 多层复合系统

- 特种MLV产品

- 耐火 MLV

- 抗紫外线户外 MLV

- 抗菌MLV

- 透明装饰 MLV

第六章:市场估计与预测:依厚度,2021-2034

- 主要趋势

- 1/16吋厚度MLV

- 1/8 英吋厚度 MLV(标准)

- 1/4吋厚度MLV

- 客製化厚度产品

第七章:市场估计与预测:依格式与包装,2021-2034

- 主要趋势

- 捲筒格式产品

- 表格式产品

- 预切和定制形状

- 背胶产品

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 建筑和施工

- 住宅建筑

- 独栋住宅

- 多户住宅

- 翻新和改造项目

- 商业建筑

- 办公大楼

- 医疗保健设施

- 教育机构

- 饭店和娱乐

- 工业建筑

- 生产设施

- 资料中心

- 实验室及无尘室

- 住宅建筑

- 汽车和运输

- 搭乘用车

- 豪华和高檔车辆

- 中檔和经济型车辆

- 电动和混合动力车

- 商用车

- 卡车和重型车辆

- 公车和公共交通

- 特种车辆和紧急车辆

- 海洋和航太

- 船舶和小船

- 航空航太应用

- 轨道交通

- 搭乘用车

- 工业和设备

- HVAC 系统和管道系统

- 发电机和压缩机外壳

- 生产设备噪音控制

- 发电和公用事业应用

- 消费品和专业应用

- 家庭剧院及音响室

- 录音室及音乐场所

- 家电和电子产品噪音控制

- 临时和便携式屏障

第九章:市场估计与预测:依最终用途产业,2021-2034 年

- 主要趋势

- 建筑业

- 住宅建筑市场

- 商业建筑市场

- 基础设施和公共工程

- 翻新改造市场

- 汽车产业

- OEM应用

- 售后市场应用

- 电动车领域

- 商用车领域

- 工业製造

- 重型机械和设备

- 流程工业

- 发电

- 石油和天然气产业

- 娱乐和媒体

- 录音与广播工作室

- 剧院和表演场所

- 家庭娱乐系统

- 游戏和虚拟实境应用

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- MLV Insulation

- Trademark Soundproofing

- Acoustic Barrier Factory

- Mass Loaded Vinyl Australia

- Niko Coatings

- Commercial Acoustics

- Soundproof Direct

- TotalMass MLV Barrier Store

- Acoustical Surfaces

- RPR Products

- All Noise Control

- Technicon Acoustics

- Acoustiguard

- Sound Acoustics Solutions

- MMT Acoustix

- Soundproofing Company

- Second Skin Audio

- ResoNix Sound Solutions

- Soundproofing MLV

- Buy Insulation Product Store

- 3M Company

- BASF SE

- The Dow Chemical Company

- Autoneum Holding AG

- Sumitomo Riko Company Limited

- Zhuzhou Times New Material Technology

- Huntsman Corporation

- Exxon Mobil Corporation

- Covestro AG

- Sika AG

- Owens Corning

- Saint-Gobain

- Knauf Insulation

- Rockwool International

- Johns Manville

- Armacell GmbH

- National Gypsum Company

- USG Corporation

- CertainTeed Corporation

- Guardian Building Products

- Venator Materials Corporation

- Sachtleben Chemie GmbH

- Huntsman Pigments and Additives

- Cimbar Performance Minerals

- Bausano & Figli SpA

- LANXESS AG

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics Corporation

- Westlake Chemical Corporation

- INEOS Group Holdings SA

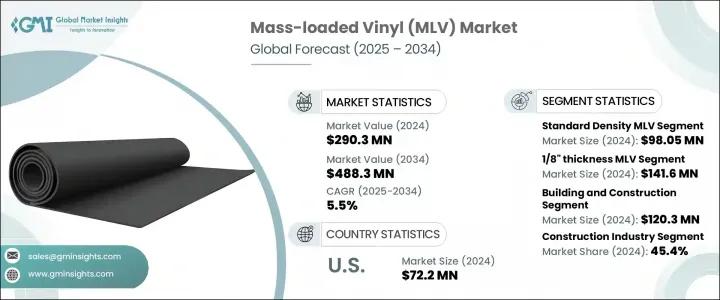

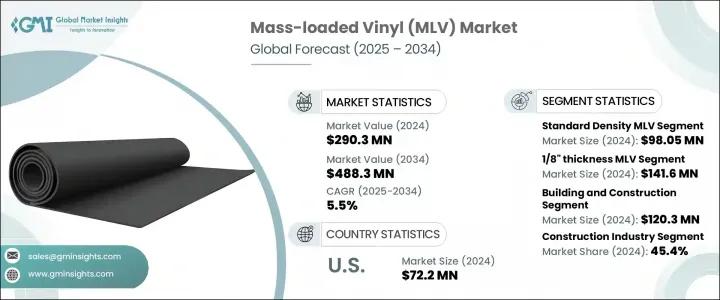

The Global Mass-loaded Vinyl (MLV) Market was valued at USD 290.3 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 488.3 million by 2034. Rising levels of urbanization and industrial activity are directly contributing to increased noise pollution, which in turn drives the need for efficient acoustic insulation solutions. MLV has gained popularity due to its non-toxic nature and its proven effectiveness in reducing sound transmission in both residential and commercial settings. As awareness grows around the impact of environmental noise on health and wellness, the demand for soundproofing materials continues to surge across infrastructure and architectural projects. In addition, a stronger emphasis on sustainable construction and modern acoustic compliance in building regulations further boosts MLV adoption across multiple sectors.

Tighter acoustic performance standards in facilities like educational institutions, medical buildings, and multi-unit housing developments are also prompting developers to choose MLV-based products. The material's versatility, durability, and ease of installation make it a preferred choice for renovations and new builds alike, particularly in space-restricted areas. Emerging economies with growing investments in infrastructure have shown a sharp rise in demand. MLV use is also gaining momentum in transportation hubs and automotive manufacturing, where effective noise reduction is critical to performance and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $290.3 Million |

| Forecast Value | $488.3 Million |

| CAGR | 5.5% |

In 2024, the standard density MLV segment was valued at USD 98.05 million and is projected to grow at a CAGR of 4.2% through 2034. This segment continues to dominate basic residential and light commercial soundproofing applications due to affordability and availability. However, market trends are shifting gradually toward customized solutions, particularly in sectors requiring precision-engineered sound control, such as healthcare, defense, and industrial manufacturing. Advanced composite MLVs and tailored formulations with specific density requirements are being preferred where higher sound isolation is essential or where weight limitations must be observed.

The building and construction segment generated USD 120.3 million in 2024 and is forecasted to grow at a CAGR of 5.9% during 2025-2034. MLV is frequently used in ceilings, partitions, and flooring systems to ensure compliance with evolving noise control regulations and to enhance indoor sound comfort. While its primary application remains in construction, automotive manufacturers are also increasingly adopting MLVs to elevate cabin quietness and reduce external noise. Consumer-facing applications like home studios, gaming rooms, and small entertainment spaces are expanding rapidly as individuals seek affordable and DIY-friendly noise management alternatives.

United States Mass-loaded Vinyl (MLV) Market was valued at USD 72.2 million in 2024 and is projected to grow at a CAGR of 2.3% from 2025 to 2034. A combination of stricter building codes, rising home renovations, and growing enthusiasm for do-it-yourself soundproofing is supporting market expansion. Simultaneously, the rising use of vehicle interior components to meet NVH (Noise, Vibration, and Harshness) standards is propelling MLV usage in the automotive sector. The combination of construction sector rebound and increased spending on acoustic quality creates a positive long-term outlook.

Major players such as Technicon Acoustics, Soundproof Direct, Acoustical Surfaces, All Noise Control, and Niko Coatings are actively competing across global markets. To strengthen their presence in the MLV industry, leading companies are focusing on tailored product development, diversification, and strategic supply chain optimization. A core approach includes expanding portfolios with multi-layered or composite MLV materials that address specific market niches such as industrial machinery, medical spaces, and aerospace interiors. These players are also investing in R&D to offer lightweight and eco-friendly solutions that align with sustainability goals. Geographic expansion, digital marketing, and e-commerce channels are helping brands reach DIY consumers, while partnerships with construction and automotive manufacturers ensure repeat business in high-volume segments. Innovation in roll sizes and application methods also plays a key role in improving market adoption and reducing project costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Thickness

- 2.2.4 Format and Packaging

- 2.2.5 Application

- 2.2.6 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Standard density MLV

- 5.2.1 1 lb/sq ft MLV products

- 5.2.1.1 Residential applications

- 5.2.1.2 Commercial applications

- 5.2.1.3 Industrial applications

- 5.2.2 2 lb/sq ft MLV products

- 5.2.2.1 High-performance applications

- 5.2.2.2 Specialized industrial uses

- 5.2.2.3 Premium residential projects

- 5.2.1 1 lb/sq ft MLV products

- 5.3 Custom density MLV

- 5.3.1 Half-pound MLV products

- 5.3.2 High-density MLV (>2 lb/sq ft)

- 5.3.3 Application-specific custom formulations

- 5.4 Composite MLV Products

- 5.4.1 MLV with foam backing

- 5.4.2 MLV with fabric facing

- 5.4.3 Multi-layer composite systems

- 5.5 Specialty MLV products

- 5.5.1 Fire-resistant MLV

- 5.5.2 UV-resistant outdoor MLV

- 5.5.3 Antimicrobial MLV

- 5.5.4 Transparent and decorative MLV

Chapter 6 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 1/16" thickness MLV

- 6.3 1/8" thickness MLV (Standard)

- 6.4 1/4" thickness MLV

- 6.5 Custom thickness products

Chapter 7 Market Estimates & Forecast, By Format and Packaging, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Roll format products

- 7.3 Sheet format products

- 7.4 Pre-cut and custom shapes

- 7.5 Adhesive-backed products

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Building and construction

- 8.2.1 Residential construction

- 8.2.1.1 Single-family homes

- 8.2.1.2 Multi-family housing

- 8.2.1.3 Renovation and retrofit projects

- 8.2.2 Commercial construction

- 8.2.2.1 Office buildings

- 8.2.2.2 Healthcare facilities

- 8.2.2.3 Educational institutions

- 8.2.2.4 Hospitality and entertainment

- 8.2.3 Industrial construction

- 8.2.3.1 Manufacturing facilities

- 8.2.3.2 Data centers

- 8.2.3.3 Laboratories and clean rooms

- 8.2.1 Residential construction

- 8.3 Automotive and transportation

- 8.3.1 Passenger vehicles

- 8.3.1.1 Luxury and premium vehicles

- 8.3.1.2 Mid-range and economy vehicles

- 8.3.1.3 Electric and hybrid vehicles

- 8.3.2 Commercial vehicles

- 8.3.2.1 Trucks and heavy-duty vehicles

- 8.3.2.2 Buses and public transportation

- 8.3.2.3 Specialty and emergency vehicles

- 8.3.3 Marine and aerospace

- 8.3.3.1 Marine vessels and boats

- 8.3.3.2 Aircraft and aerospace applications

- 8.3.3.3 Rail transportation

- 8.3.1 Passenger vehicles

- 8.4 Industrial and equipment

- 8.4.1 HVAC systems and ductwork

- 8.4.2 Generator and compressor enclosures

- 8.4.3 Manufacturing equipment noise control

- 8.4.4 Power generation and utility applications

- 8.5 Consumer and specialty applications

- 8.5.1 Home theater and audio rooms

- 8.5.2 Recording studios and music venues

- 8.5.3 Appliance and electronics noise control

- 8.5.4 Temporary and portable barriers

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Construction industry

- 9.2.1 Residential construction market

- 9.2.2 Commercial construction market

- 9.2.3 Infrastructure and public works

- 9.2.4 Renovation and retrofit market

- 9.3 Automotive industry

- 9.3.1 OEM applications

- 9.3.2 Aftermarket applications

- 9.3.3 Electric vehicle segment

- 9.3.4 Commercial vehicle segment

- 9.4 Industrial manufacturing

- 9.4.1 Heavy machinery and equipment

- 9.4.2 Process industries

- 9.4.3 Power generation

- 9.4.4 Oil and gas industry

- 9.5 Entertainment and media

- 9.5.1 Recording and broadcasting studios

- 9.5.2 Theaters and performance venues

- 9.5.3 Home entertainment systems

- 9.5.4 Gaming and virtual reality applications

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 MLV Insulation

- 11.2 Trademark Soundproofing

- 11.3 Acoustic Barrier Factory

- 11.4 Mass Loaded Vinyl Australia

- 11.5 Niko Coatings

- 11.6 Commercial Acoustics

- 11.7 Soundproof Direct

- 11.8 TotalMass MLV Barrier Store

- 11.9 Acoustical Surfaces

- 11.10 RPR Products

- 11.11 All Noise Control

- 11.12 Technicon Acoustics

- 11.13 Acoustiguard

- 11.14 Sound Acoustics Solutions

- 11.15 MMT Acoustix

- 11.16 Soundproofing Company

- 11.17 Second Skin Audio

- 11.18 ResoNix Sound Solutions

- 11.19 Soundproofing MLV

- 11.20 Buy Insulation Product Store

- 11.21 3M Company

- 11.22 BASF SE

- 11.23 The Dow Chemical Company

- 11.24 Autoneum Holding AG

- 11.25 Sumitomo Riko Company Limited

- 11.26 Zhuzhou Times New Material Technology

- 11.27 Huntsman Corporation

- 11.28 Exxon Mobil Corporation

- 11.29 Covestro AG

- 11.30 Sika AG

- 11.31 Owens Corning

- 11.32 Saint-Gobain

- 11.33 Knauf Insulation

- 11.34 Rockwool International

- 11.35 Johns Manville

- 11.36 Armacell GmbH

- 11.37 National Gypsum Company

- 11.38 USG Corporation

- 11.39 CertainTeed Corporation

- 11.40 Guardian Building Products

- 11.41 Venator Materials Corporation

- 11.42 Sachtleben Chemie GmbH

- 11.43 Huntsman Pigments and Additives

- 11.44 Cimbar Performance Minerals

- 11.45 Bausano & Figli S.p.A.

- 11.46 LANXESS AG

- 11.47 Shin-Etsu Chemical Co., Ltd.

- 11.48 Formosa Plastics Corporation

- 11.49 Westlake Chemical Corporation

- 11.50 INEOS Group Holdings S.A.