|

市场调查报告书

商品编码

1782122

人工智慧生成内容 (AIGC) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Artificial Intelligence Generated Content (AIGC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

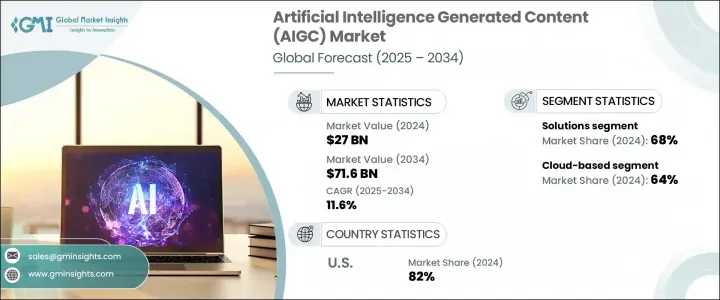

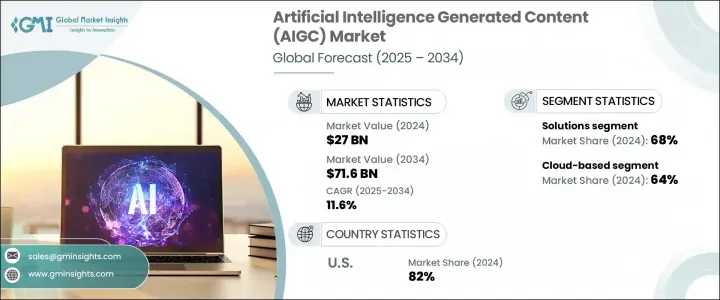

2024年,全球人工智慧生成内容市场规模达270亿美元,预计到2034年将以11.6%的复合年增长率成长,达到716亿美元。传统内容创作曾经是一项劳力密集任务,如今正由先进的人工智慧技术驱动,转变为精简的自动化流程。随着人工智慧模型日益复杂,内容製作不再局限于小众创意团队,而是正在成为一项核心企业职能。各行各业的组织都优先考虑培养精通人工智慧的团队,以便有效地引导快速工程、合乎道德的内容使用和工作流程优化。这一趋势正在将人工智慧生成内容的技能提升转化为数位转型策略的关键要素。

透过公共机构与私部门创新者之间的合作,人们日益重视技能开发,这进一步推动了市场扩张。各机构正携手合作,创造结构化的学习框架和认证体系,帮助劳动力做好准备,并应对人工智慧驱动的内容创作需求。同时,AIGC 解决方案提供者正在将培训模组整合到其平台中,确保从创意人员到企业专业人士等用户都能获得可扩展的教育资源。这些努力正在加速从行销、娱乐到教育和电子商务等各行业的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 270亿美元 |

| 预测值 | 716亿美元 |

| 复合年增长率 | 11.6% |

市场按组件细分为解决方案和服务。 2024年,解决方案占据最大份额,占总收入的近68%。预计2025年至2034年期间,该细分市场的复合年增长率将超过12%。 AIGC解决方案包括基于人工智慧的平台,可产生文字、图像、视讯、音讯甚至程式码,为企业提供动态内容开发工具。这些技术支援自动化、即时个人化和创意敏捷性,这对于依赖频繁内容更新和品牌互动的行业至关重要。企业越来越依赖这些平台来简化行销活动,增强客户沟通,并打造沉浸式数位体验。

根据部署方式,AIGC 市场可分为云端和本地部署两种模式。云端解决方案在 2024 年占据 64% 的市场份额,占据市场主导地位,预计预测期内复合年增长率将超过 13%。云端工具的受欢迎程度源自于其可扩展性、易于整合和即时存取性。云端基础架构允许使用者透过 API 和软体即服务 (SaaS) 模式产生内容,从而促进更快的迭代和持续的工作流程改进。这些工具消除了基础设施的限制,使企业能够在多个平台上扩展创意输出,因此在数位行销、教育和电子商务等充满活力的行业中尤其受欢迎。

根据技术,市场细分为几个关键创新领域,包括自然语言处理 (NLP)、生成对抗网路 (GAN)、Transformer 模型、文字转图像模型、文字转视讯/3D 模型以及语音转文字或文字转语音系统。其中,Transformer 模型在 2024 年占据主导地位。这些模型以其大规模处理能力而闻名,是许多领先的 AIGC 应用的基础。它们能够理解上下文、产生类似人类的反应并跨格式合成讯息,这使得它们对于支援多模态 AI 平台至关重要。随着 Transformer 架构的不断发展,它们正在赋能日益精细化和适应性更强的内容创作系统。

从地区来看,美国已成为北美领先的市场,占据该地区约 82% 的份额,并在 2024 年创造了约 76 亿美元的收入。美国占据主导地位的动力源于其强大的创新生态系统、对人工智慧研究的强劲投入以及企业对人工智慧技术的早期应用。成熟的数位经济和密集的人工智慧技术提供者持续推动着成长。 AIGC 工具与企业软体堆迭的集成,正在推动媒体、教育、广告和商业服务等领域的广泛采用。

AIGC 的格局受竞争环境的影响,一些关键公司正在开发支援可扩展内容生成的工具。这些公司专注于提昇平台效能、增强用户体验,并支援企业级应用程序,以满足日益增长的市场需求。随着科技的成熟,AIGC 有望成为全球数位经济的基础要素,影响内容的构思、创作和消费方式。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 数位内容需求爆炸性成长

- AIGC 与商业应用程式的集成

- 基础模型的进步

- 需要在地化和个性化

- 创作者经济的崛起

- 基于云端的交付模式

- 产业陷阱与挑战

- 智慧财产权和版权风险

- 非技术专业人士的认知度有限

- 高运算资源需求

- 缺乏内容真实性检测

- 市场机会

- 产业特定的 AIGC 工具

- 合成资料生成

- 多语言和低资源模型开发

- 人工智慧与人类协作的工作流程

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 软体开发和授权成本

- 部署和整合成本

- 维护和支援成本

- 网路安全与合规成本

- 培训和变更管理成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 文字产生工具

- 影像生成平台

- 影片和动画生成器

- 音讯和语音合成工具

- 程式码生成平台

- 服务

- 咨询与策略

- 整合与部署

- 支援与维护

- 客製化内容开发服务

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 自然语言处理(NLP)

- 生成对抗网路(GAN)

- 变压器模型

- 文字到图像模型

- 文字转影片/3D

- 文字转语音 (TTS)

- 语音转文字 (STT)

第八章:市场估计与预测:依内容,2021 - 2034 年

- 主要趋势

- 文字内容

- 部落格和文章

- 行销文案(广告、电子邮件)

- 剧本和对话

- 产品描述

- 图像内容

- 数位艺术和插图

- 产品视觉效果

- 行销和社群媒体图形

- 影片内容

- 解释影片

- 虚拟主持人

- 合成演员/化身

- 音讯内容

- 画外音

- podcast

- 有声书

- 程式码内容

- Web 开发脚本

- 游戏开发程式码

- 自动化脚本

第九章:市场估计与预测:依企业规模,2021-2034

- 主要趋势

- 小型企业

- 中型企业

- 大型企业

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 行销与广告

- 媒体和娱乐

- 电子商务与零售

- 教育与培训

- 客户服务和虚拟协助

- 软体和游戏开发

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 菲律宾

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Adobe

- Alibaba Cloud

- Amazon Web Services (AWS)

- Anthropic

- Baidu

- Canva

- Copy.ai

- Descript

- Google DeepMind

- IBM

- Jasper AI

- Meta (Facebook AI)

- Microsoft

- NVIDIA

- OpenAI

- Pika Labs

- Rephrase.ai

- Runway

- Stability AI

- Synthesia

The Global Artificial Intelligence Generated Content Market was valued at USD 27 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 71.6 billion by 2034. Traditional content creation, once a labor-intensive task, is now transforming into a streamlined, automated process powered by advanced AI technologies. As AI models become more sophisticated, content production is no longer confined to niche creative teams-it is becoming a core enterprise function. Organizations across sectors are prioritizing the development of AI-literate teams that can effectively navigate prompt engineering, ethical content use, and workflow optimization. This trend is turning AIGC upskilling into a critical element of digital transformation strategies.

Market expansion is being further fueled by a growing focus on skill development through collaborations between public agencies and private sector innovators. Various institutions are working together to create structured learning frameworks and credentialing systems to prepare the workforce for the demands of AI-driven content creation. Simultaneously, AIGC solution providers are integrating training modules into their platforms, ensuring users-from creatives to enterprise professionals-have access to scalable education resources. These efforts are accelerating adoption across industries ranging from marketing and entertainment to education and e-commerce.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $71.6 Billion |

| CAGR | 11.6% |

The market is segmented by components into solutions and services. In 2024, solutions represented the largest share, accounting for nearly 68% of total revenue. This segment is expected to grow at a CAGR of over 12% between 2025 and 2034. AIGC solutions include AI-based platforms that generate text, images, videos, audio, and even code, providing businesses with tools for dynamic content development. These technologies support automation, real-time personalization, and creative agility, which are crucial in industries that rely on frequent content updates and brand engagement. Businesses are increasingly relying on these platforms to streamline marketing campaigns, enhance customer communication, and build immersive digital experiences.

By deployment, the AIGC market is categorized into cloud-based and on-premises models. Cloud-based solutions led the market with a 64% share in 2024 and are anticipated to register a CAGR of more than 13% through the forecast period. The preference for cloud-based tools is driven by their scalability, ease of integration, and real-time accessibility. Cloud infrastructure allows users to generate content via APIs and software-as-a-service (SaaS) models, promoting faster iterations and continuous workflow improvements. These tools eliminate infrastructure constraints and allow businesses to expand creative output across multiple platforms, making them especially popular in dynamic sectors like digital marketing, education, and e-commerce.

Based on technology, the market is segmented into several key innovations, including natural language processing (NLP), generative adversarial networks (GANs), transformer models, text-to-image models, text-to-video/3D, and speech-to-text or text-to-speech systems. Among these, transformer models held the dominant position in 2024. These models, known for their large-scale processing capabilities, are the foundation of many leading AIGC applications. Their ability to understand context, generate human-like responses, and synthesize information across formats makes them essential to powering multi-modal AI platforms. As transformer architectures continue to advance, they are enabling increasingly nuanced and adaptable content creation systems.

Regionally, the United States emerged as the leading market within North America, commanding around 82% of the regional share and generating approximately USD 7.6 billion in revenue in 2024. The country's dominance is driven by its strong innovation ecosystem, robust investment in AI research, and early enterprise adoption of AI technologies. A well-established digital economy and a dense concentration of AI technology providers continue to propel growth. The integration of AIGC tools into enterprise software stacks is driving high adoption across sectors such as media, education, advertising, and business services.

The AIGC landscape is shaped by a competitive environment, with key companies developing tools that support scalable content generation. These companies are focused on improving platform performance, enhancing user experiences, and supporting enterprise-grade applications to meet growing market demand. As the technology matures, AIGC is expected to become a foundational element of the global digital economy, influencing how content is imagined, created, and consumed.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Technology

- 2.2.5 Content

- 2.2.6 Enterprise Size

- 2.2.7 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Explosive growth in digital content demand

- 3.2.1.2 Integration of AIGC into business apps

- 3.2.1.3 Advancements in foundation models

- 3.2.1.4 Need for localization & personalization

- 3.2.1.5 Rise of the creator economy

- 3.2.1.6 Cloud-based delivery models

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Intellectual property & copyright risks

- 3.2.2.2 Limited awareness among non-tech professionals

- 3.2.2.3 High computing resource requirements

- 3.2.2.4 Lack of content authenticity detection

- 3.2.3 Market opportunities

- 3.2.3.1 Industry-specific AIGC tools

- 3.2.3.2 Synthetic data generation

- 3.2.3.3 Multilingual and low-resource model development

- 3.2.3.4 Collaborative AI-human workflows

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Text generation tools

- 5.2.2 Image generation platforms

- 5.2.3 Video and animation generators

- 5.2.4 Audio and speech synthesis tools

- 5.2.5 Code generation platforms

- 5.3 Services

- 5.3.1 Consulting & strategy

- 5.3.2 Integration & deployment

- 5.3.3 Support & maintenance

- 5.3.4 Custom content development services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Natural Language Processing (NLP)

- 7.3 Generative Adversarial Networks (GAN)

- 7.4 Transformer models

- 7.5 Text-to-image models

- 7.6 Text-to-video/3D

- 7.7 Text-to-Speech (TTS)

- 7.8 Speech-to-Text (STT)

Chapter 8 Market Estimates & Forecast, By Content, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Text content

- 8.2.1 Blogs and articles

- 8.2.2 Marketing copy (ads, emails)

- 8.2.3 Scripts and dialogues

- 8.2.4 Product descriptions

- 8.3 Image Content

- 8.3.1 Digital art & illustrations

- 8.3.2 Product visuals

- 8.3.3 Marketing & social media graphics

- 8.4 Video Content

- 8.4.1 Explainer videos

- 8.4.2 Virtual presenters

- 8.4.3 Synthetic actors/avatars

- 8.5 Audio Content

- 8.5.1 Voiceovers

- 8.5.2 Podcasts

- 8.5.3 Audiobooks

- 8.6 Code Content

- 8.6.1 Web development scripts

- 8.6.2 Game development code

- 8.6.3 Automation scripts

Chapter 9 Market Estimates & Forecast, By Enterprise Size, 2021- 2034 ($Bn)

- 9.1 Key trends

- 9.2 Small enterprises

- 9.3 Medium enterprises

- 9.4 Large enterprises

Chapter 10 Market Estimates & Forecast, By Application, 2021- 2034 ($Bn)

- 10.1 Key trends

- 10.2 Marketing & advertising

- 10.3 Media & entertainment

- 10.4 E-commerce & retail

- 10.5 Education & training

- 10.6 Customer service & virtual assistance

- 10.7 Software & game development

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Indonesia

- 11.4.7 Philippines

- 11.4.8 Singapore

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Adobe

- 12.2 Alibaba Cloud

- 12.3 Amazon Web Services (AWS)

- 12.4 Anthropic

- 12.5 Baidu

- 12.6 Canva

- 12.7 Copy.ai

- 12.8 Descript

- 12.9 Google DeepMind

- 12.10 IBM

- 12.11 Jasper AI

- 12.12 Meta (Facebook AI)

- 12.13 Microsoft

- 12.14 NVIDIA

- 12.15 OpenAI

- 12.16 Pika Labs

- 12.17 Rephrase.ai

- 12.18 Runway

- 12.19 Stability AI

- 12.20 Synthesia