|

市场调查报告书

商品编码

1782127

人工智慧硬体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

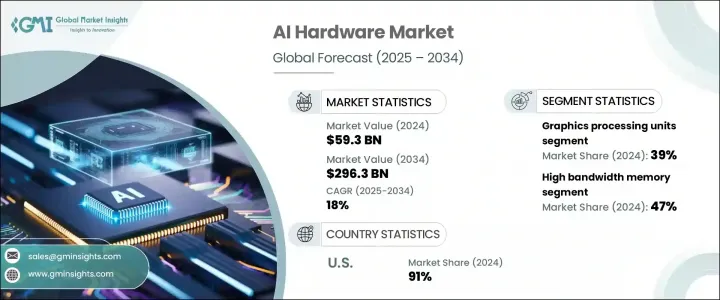

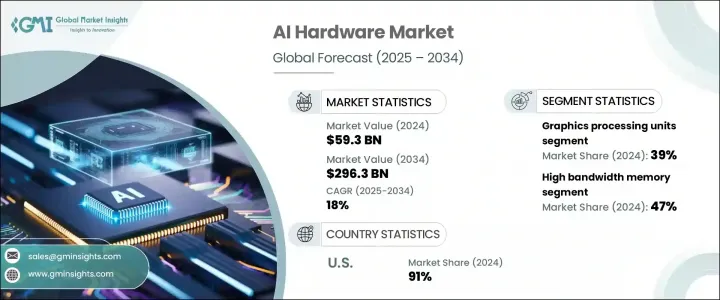

2024年,全球人工智慧硬体市场规模达593亿美元,预计到2034年将以18%的复合年增长率成长,达到2,963亿美元。这一强劲的成长势头源于人工智慧在各行各业的广泛应用,这显着增加了对高效能运算基础设施的需求。随着企业越来越多地部署具有复杂运算需求的人工智慧模型,企业对能够处理大规模处理任务的专用人工智慧硬体的依赖也日益增加。

企业正在向硬体转型,这些硬体不仅能够支援更快的资料吞吐量,还能支援更低的延迟和更高的能源效率。这种趋势不仅限于云端环境;人工智慧也正在边缘运算环境中得到应用,为工业系统、行动装置和嵌入式解决方案中的即时决策提供支援。边缘人工智慧的普及进一步推动了对能够独立运作而无需持续依赖云端服务的处理器和记忆体单元的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 593亿美元 |

| 预测值 | 2963亿美元 |

| 复合年增长率 | 18% |

综观处理器领域,AI 硬体市场细分为图形处理单元 (GPU)、中央处理单元 (CPU)、张量处理单元 (TPU)、专用积体电路 (ASIC)、现场可程式闸阵列 (FPGA) 和神经处理单元 (NPU)。其中,GPU 在 2024 年占据市场主导地位,约占总营收的 39%。从 2025 年到 2034 年,预计这一领域的复合年增长率将超过 18%。 GPU 的主导地位可归因于其在平行运算、记忆体处理以及训练和运行推理模型方面的高效能力。这些特性使得 GPU 对企业级 AI 平台和需要可扩展效能以进行复杂模型开发的研究机构都至关重要。

从记忆体和储存的角度来看,AI 硬体市场包括高频宽记忆体 (HBM)、AI 优化 DRAM、非挥发性记忆体以及新兴记忆体技术。 2024 年,高频宽记忆体领域占据最大份额,占整个市场的 47%。预计该领域在预测期内的复合年增长率将超过 19%。这种需求激增很大程度上受到 AI 系统对速度和频宽日益增长的需求的影响。随着 AI 模型变得越来越复杂且资料量越来越大,高频宽记忆体能够实现近乎即时的资料检索,这对于实现无缝效能至关重要,尤其是在即时应用中。此功能使企业能够最大限度地减少延迟、提高回应速度并更好地管理工作负载处理。

从应用角度来看,资料中心和云端运算仍然是市场收入的最大贡献者。随着对可扩展、高效能基础设施的需求日益增长,该领域持续快速扩张。大量需要进行大规模训练和推理的人工智慧模型的激增,促使企业建立专门用于支援人工智慧工作负载的资料中心。这些中心配备了尖端的加速器和专为高效执行人工智慧而量身定制的组件。企业正在优先投资专用基础设施,这些基础设施不仅能满足当前的人工智慧需求,还能预测未来模型的需求。

从区域来看,美国在北美人工智慧硬体市场占据领先地位,占据了该地区近91%的收入份额,2024年市场规模约为198亿美元。这一优势得益于美国在技术创新方面的领先地位、强大的供应链以及先进的半导体製造能力。美国仍然是全球人工智慧硬体开发的中心,并拥有由硬体公司、研究机构和云端服务供应商组成的丰富生态系统。

硬体市场的领先公司包括英伟达 (NVIDIA)、英特尔 (Intel)、高通 (Qualcomm Technologies)、超微半导体 (AMD)、苹果 (Apple)、Google (Google)、亚马逊网路服务 (AWS)、微软 (Microsoft)、IBM、三星电子 (Samsung Electronics) 等。这些公司持续投资开发客製化晶片、高效能处理器和下一代加速器,以满足人工智慧系统不断变化的需求。他们的努力对于塑造全球人工智慧硬体格局的下一阶段至关重要。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 生成式人工智慧应用的激增

- 边缘AI部署快速扩张

- 云端和资料中心采用

- 医疗保健和生命科学领域的人工智慧

- 政府人工智慧投资

- 产业陷阱与挑战

- 高功耗和冷却需求

- 全球晶片供应限制

- 市场机会

- 设备端 AI 需求不断成长

- 政府半导体激励措施

- AI超级运算与超大规模扩展

- 产业特定人工智慧应用的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 先进製程节点开发(3nm、2nm)

- 高频宽记忆体(HBM)的演进

- Chiplet 架构和模组化设计

- 新兴技术

- 用于人工智慧的量子运算硬体

- 光子运算和光学人工智慧硬体

- 神经形态运算架构

- 先进的记忆体技术

- 当前的技术趋势

- 案例研究

- 用例

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按处理器,2021 - 2034 年

- 主要趋势

- 图形处理单元 (GPU)

- 训练

- 推理

- 边缘

- 资料中心

- 中央处理器 (CPU)

- AI优化

- 具有 AI 加速的伺服器 CPU

- 边缘运算

- 张量处理单元 (TPU)

- 云

- 边缘

- 客製化设计

- 专用积体电路(ASIC)

- 人工智慧训练

- 人工智慧推理

- 自订人工智慧

- 现场可程式闸阵列(FPGA)

- AI优化

- 边缘人工智慧

- 可重构运算平台

- 神经处理单元(NPU)

- 智慧型手机

- 边缘人工智慧

- 物联网

第六章:市场预估与预测:按内存和存储,2021 - 2034 年

- 主要趋势

- 高频宽记忆体 (HBM)

- AI 优化的 DRAM

- 非挥发性记忆体

- 新兴记忆体技术

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 资料中心和云端运算

- 汽车和运输

- 医疗保健和生命科学

- 消费性电子产品

- 工业和製造业

- 金融服务

- 电信

第八章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 越南

- 菲律宾

- 澳新银行

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Advanced Micro Devices

- Amazon Web Services (AWS)

- Apple

- ARM

- Broadcom

- Cerebra's Systems

- Fujitsu

- Graph core

- IBM

- Intel

- Marvell Technology

- Micron Technology

- Microsoft

- NVIDIA

- Qualcomm Technologies

- Samsung Electronics

- SiPearl

- SK Hynix

- Tenstorrent

The Global AI Hardware Market was valued at USD 59.3 billion in 2024 and is estimated to grow at a CAGR of 18% to reach USD 296.3 billion by 2034. This strong growth trajectory is driven by the widespread adoption of artificial intelligence across diverse sectors, which has significantly amplified the need for high-performance computing infrastructure. As organizations increasingly deploy AI models with complex computational demands, there is a growing reliance on dedicated AI hardware capable of handling large-scale processing tasks.

Businesses are transitioning toward hardware that can support not only faster data throughput but also lower latency and greater energy efficiency. This trend is not limited to cloud environments alone; AI is also being implemented across edge computing environments, powering real-time decision-making in industrial systems, mobile devices, and embedded solutions. The proliferation of edge AI is further boosting demand for processors and memory units capable of operating independently without constant reliance on cloud services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.3 Billion |

| Forecast Value | $296.3 Billion |

| CAGR | 18% |

Across the processor landscape, the AI hardware market is segmented into graphics processing units (GPUs), central processing units (CPUs), tensor processing units (TPUs), application-specific integrated circuits (ASICs), field-programmable gate arrays (FPGAs), and neural processing units (NPUs). Among these, GPUs held the dominant share of the market in 2024, accounting for approximately 39% of total revenue. From 2025 to 2034, this segment is expected to grow at a CAGR exceeding 18%. The dominance of GPUs can be attributed to their unmatched capabilities in parallel computing, memory handling, and their efficiency in training and running inference models. These features have made GPUs essential to both enterprise-grade AI platforms and research institutions that require scalable performance for complex model development.

When viewed through the lens of memory and storage, the AI hardware market includes high bandwidth memory (HBM), AI-optimized DRAM, non-volatile memory, and emerging memory technologies. In 2024, the high bandwidth memory segment captured the largest share, contributing 47% of the total market. The segment is forecasted to expand at a CAGR of over 19% during the forecast period. This surge in demand is largely influenced by the growing need for speed and bandwidth in AI systems. As AI models become more sophisticated and data-heavy, high bandwidth memory enables near-instant data retrieval, which is critical for achieving seamless performance, particularly in real-time applications. This capability allows enterprises to minimize latency, enhance responsiveness, and better manage workload processing.

On the basis of application, data center and cloud computing remain the largest contributors to market revenue. The segment continues to expand rapidly as the need for scalable, high-performance infrastructure intensifies. The proliferation of AI models with massive training and inference requirements is driving companies to build data centers specifically designed to support AI workloads. These centers are equipped with cutting-edge accelerators and components tailored for efficient AI execution. Organizations are prioritizing investment in purpose-built infrastructure that not only meets current AI needs but also anticipates the demands of future models.

In regional terms, the United States led the AI hardware market in North America, accounting for nearly 91% of the regional revenue share and generating around USD 19.8 billion in 2024. This stronghold is driven by the country's leadership in technology innovation, a robust supply chain, and access to advanced semiconductor manufacturing capabilities. The U.S. remains a global hub for AI hardware development, supported by a rich ecosystem of hardware companies, research institutions, and cloud service providers.

Leading companies in the AI hardware market include NVIDIA, Intel, Qualcomm Technologies, Advanced Micro Devices (AMD), Apple, Google, Amazon Web Services (AWS), Microsoft, IBM, Samsung Electronics, and others. These firms are consistently investing in the development of custom chips, high-performance processors, and next-generation accelerators to support the evolving needs of AI-powered systems. Their efforts are crucial in shaping the next phase of the global AI hardware landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processor

- 2.2.3 Memory and storage

- 2.2.4 Application

- 2.2.5 Deployment

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of generative AI applications

- 3.2.1.2 Rapid expansion of edge AI deployment

- 3.2.1.3 Cloud & data center adoption

- 3.2.1.4 AI in healthcare & life sciences

- 3.2.1.5 Government AI investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High power consumption & cooling needs

- 3.2.2.2 Global chip supply constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for on-device AI

- 3.2.3.2 Government semiconductor incentives

- 3.2.3.3 AI supercomputing & hyperscale expansion

- 3.2.3.4 Growth of industry-specific AI applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Advanced process node development (3nm, 2nm)

- 3.7.1.2 High bandwidth memory (HBM) evolution

- 3.7.1.3 Chiplet architecture and modular design

- 3.7.2 Emerging technologies

- 3.7.2.1 Quantum computing hardware for AI

- 3.7.2.2 Photonic computing and optical AI hardware

- 3.7.2.3 Neuromorphic computing architectures

- 3.7.2.4 Advanced memory technologies

- 3.7.1 Current technological trends

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Processor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Graphics processing unit (GPU)

- 5.2.1 Training

- 5.2.2 Inference

- 5.2.3 Edge

- 5.2.4 Data center

- 5.3 Central processing unit (CPU)

- 5.3.1 AI-optimized

- 5.3.2 Server CPU with AI acceleration

- 5.3.3 Edge computing

- 5.4 Tensor processing unit (TPU)

- 5.4.1 Cloud

- 5.4.2 Edge

- 5.4.3 Custom designs

- 5.5 Application-specific integrated circuit (ASIC)

- 5.5.1 AI training

- 5.5.2 AI inference

- 5.5.3 Custom AI

- 5.6 Field-programmable gate arrays (FPGA)

- 5.6.1 AI-optimized

- 5.6.2 Edge AI

- 5.6.3 Reconfigurable computing platforms

- 5.7 Neural processing units (NPU)

- 5.7.1 Smartphone

- 5.7.2 Edge AI

- 5.7.3 IoT

Chapter 6 Market Estimates & Forecast, By Memory & Storage, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 High bandwidth memory (HBM)

- 6.3 AI-optimized DRAM

- 6.4 Non-volatile memory

- 6.5 Emerging memory technologies

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Data center and cloud computing

- 7.3 Automotive and transportation

- 7.4 Healthcare and life sciences

- 7.5 Consumer electronics

- 7.6 Industrial and manufacturing

- 7.7 Financial services

- 7.8 Telecommunications

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Cloud-Based

- 8.3 On-Premises

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Vietnam

- 9.4.6 Philippines

- 9.4.7 ANZ

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices

- 10.2 Amazon Web Services (AWS)

- 10.3 Apple

- 10.4 ARM

- 10.5 Broadcom

- 10.6 Cerebra’s Systems

- 10.7 Fujitsu

- 10.8 Google

- 10.9 Graph core

- 10.10 IBM

- 10.11 Intel

- 10.12 Marvell Technology

- 10.13 Micron Technology

- 10.14 Microsoft

- 10.15 NVIDIA

- 10.16 Qualcomm Technologies

- 10.17 Samsung Electronics

- 10.18 SiPearl

- 10.19 SK Hynix

- 10.20 Tenstorrent