|

市场调查报告书

商品编码

1782129

冠状动脉切割球囊市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Coronary Cutting Balloon Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

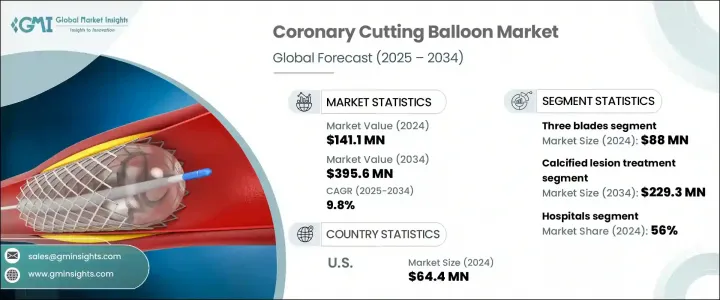

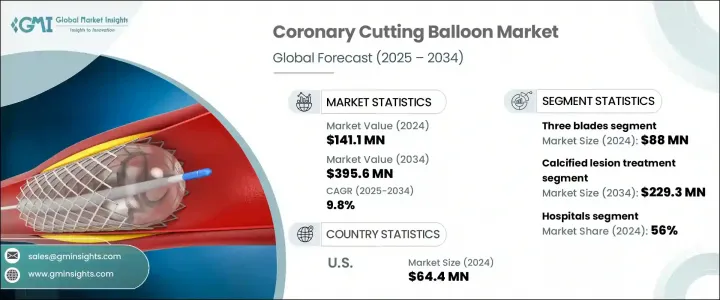

2024年,全球冠状动脉切割球囊市场规模达1.411亿美元,预计2034年将以9.8%的复合年增长率成长,达到3.956亿美元。这一成长加速的主要原因是全球心血管疾病负担的加重,以及医疗技术的不断进步和微创心臟手术的日益普及。营养不良、缺乏运动、高血压以及糖尿病患者人数的增加等因素,是导致冠状动脉粥状硬化斑块形成的重要因素。

随着越来越多的患者出现复杂病变,尤其是那些对传统治疗无效的患者,冠状动脉切割球囊因其在斑块修復方面的准确性和安全性而得到越来越广泛的应用。血管内影像和冠状动脉造影等先进诊断工具的日益普及,使得更早发现复杂的动脉阻塞成为可能,从而提高了切割球囊的及时治疗效果。这些专用设备将传统的球囊导管与微型刀片结合,可在充气过程中形成精确的切口,从而实现更安全、更有效的病变扩张。随着冠状动脉疾病 (CAD) 在新兴和已开发医疗市场的发病率不断上升,全球对这些工具的临床依赖度持续提升。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.411亿美元 |

| 预测值 | 3.956亿美元 |

| 复合年增长率 | 9.8% |

钙化病变治疗领域预计在2034年将产生2.293亿美元的市场规模。重度钙化冠状动脉疾病的盛行率日益上升,尤其是在老年族群和糖尿病患者中,这使得该治疗领域成为关注的焦点。切割球囊能够精确评估斑块,进而增强介入性心臟病专家的控制力,进而提高手术过程中支架的输送和扩张能力。随着复杂经皮冠状动脉介入治疗 (PCI) 的手术量不断增加,临床对切割球囊等可靠的病变准备设备的需求也日益增长。切割球囊在提高手术成功率和疗效方面发挥重要作用,加速了其在全球心血管护理机构的应用。

2024年,医院领域占最大份额,预计在2025-2024年期间将继续成长。医院配备了先进的导管室和多学科心臟团队,使其成为实施复杂PCI的主要中心。医院能够处理高风险冠状动脉疾病(包括严重阻塞和支架内再狭窄),这使得医院在有效利用冠状动脉切割球囊方面具有领先优势。三级医院和城市医院不断增长的医疗投资和基础设施建设,以及全天候心臟服务的提供,进一步支持了该领域的强劲需求。

2024年,美国冠状动脉切割球囊市场规模达6,440万美元。美国凭藉其庞大的冠状动脉疾病(CAD)患者群体、先进的心臟设备普及率以及高容量的冠状动脉介入(PCI)手术,在切割球囊的应用方面仍处于领先地位。创新医疗器材的早期采用和优惠的报销政策继续支撑着市场的成长。此外,血管内影像技术的日益普及,进一步支持了切割球囊在临床上用于识别和治疗复杂病变的应用。主要参与者的持续创新确保了稳定的供应和性能提升,从而促进了市场扩张。

该市场的领先公司包括乐普医疗、神奇医疗和波士顿科学。为了巩固市场地位,冠状动脉切割球囊领域的公司正在部署多项针对性策略。他们正在大力投资研发,以创新下一代设备,从而提供更高的精度和安全性。透过区域合作伙伴关係和在高成长国家获得监管部门的批准,进行地理扩张,有助于公司进入尚未开发的市场。该公司还专注于医生培训项目,以提高公众意识,并鼓励在复杂手术中更广泛地采用切割球囊。加强供应链、优化定价模式和扩大适用范围是他们为保持竞争优势和扩大全球影响力而采取的其他措施。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 心血管疾病盛行率不断上升

- 不断进步的技术

- 对精确且更安全的牙菌斑修復工具的需求

- 提高认识和改进诊断方法

- 产业陷阱与挑战

- 产品成本高,加上替代技术的竞争

- 机会

- 微创心血管手术的采用日益增多

- 新兴市场和未开发市场的需求

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 高压冠状动脉切割球囊

- 按产品分類的价格趋势

- 未来市场趋势

- 报销场景

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按刀片数量,2021 - 2034

- 主要趋势

- 三片刀片

- 四刀片

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 钙化病变治疗

- 支架内再狭窄

- 病变准备

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 导管室

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 世界其他地区 (RoW)

第九章:公司简介

- Boston Scientific

- LEPU MEDICAL

- SHENQI MEDICAL

The Global Coronary Cutting Balloon Market was valued at USD 141.1 million in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 395.6 million by 2034. This acceleration is largely driven by the increasing global burden of cardiovascular conditions, along with growing advancements in medical technology and rising adoption of minimally invasive cardiac procedures. Factors such as poor nutrition, physical inactivity, hypertension, and the rising diabetic population contribute heavily to the development of atherosclerotic plaque in coronary arteries.

As more patients present with complex lesions, particularly those resistant to traditional treatment, coronary cutting balloons are being increasingly utilized for their accuracy and safety in plaque modification. The growing use of advanced diagnostic tools like intravascular imaging and coronary angiography has allowed for earlier detection of complex arterial blockages, enhancing timely treatment using cutting balloons. These specialized devices combine a conventional balloon catheter with microblades that create precise incisions during inflation, facilitating safer and more effective lesion dilation. With coronary artery disease (CAD) rising across both emerging and developed healthcare markets, clinical reliance on these tools continues to gain traction worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $141.1 Million |

| Forecast Value | $395.6 Million |

| CAGR | 9.8% |

The calcified lesion treatment segment is projected to generate USD 229.3 million in 2034. The increasing prevalence of heavily calcified coronary artery disease, especially among elderly populations and diabetic individuals, has made this treatment area a key focus. Cutting balloons provide interventional cardiologists with greater control by enabling refined plaque scoring, which enhances stent delivery and expansion during procedures. With procedural volumes rising for complex percutaneous coronary interventions (PCIs), the clinical need for reliable lesion preparation devices like cutting balloons continues to increase. Their role in improving procedural success rates and outcomes has accelerated their adoption across cardiovascular care settings globally.

In 2024, the hospitals segment, captured the largest share and projected to continue expanding during 2025-2024. Hospitals are equipped with advanced catheterization labs and multidisciplinary cardiac teams, making them the primary centers for performing complex PCIs. The ability to handle high-risk CAD cases, including severe blockages and in-stent restenosis, gives hospitals a leading edge in utilizing coronary cutting balloons effectively. Growing healthcare investments and infrastructure development in tertiary and urban hospitals, along with 24/7 availability of cardiac services, further support the strong demand from this segment.

United States Coronary Cutting Balloon Market generated USD 64.4 million in 2024. The U.S. remains at the forefront of cutting balloon adoption due to its large CAD patient pool, widespread availability of advanced cardiac facilities, and high volume of PCI procedures. Early adoption of innovative medical devices and favorable reimbursement policies continue to support the market's growth. In addition, the rising use of technologies for imaging inside blood vessels further supports the clinical use of cutting balloons in identifying and treating complex lesions. Ongoing innovation from key players ensures consistent supply and performance enhancements that contribute to market expansion.

Leading companies in this market include LEPU MEDICAL, SHENQI MEDICAL, and Boston Scientific. To strengthen their market position, companies in the coronary cutting balloon space are deploying several targeted strategies. They are investing heavily in R&D to innovate next-generation devices that offer greater precision and safety. Geographic expansion through regional partnerships and regulatory approvals in high-growth countries is helping firms enter untapped markets. Companies are also focusing on physician training programs to boost awareness and encourage broader adoption of cutting balloons in complex procedures. Strengthening supply chains, optimizing pricing models, and expanding indications for use are other approaches being adopted to maintain competitive advantage and increase global footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates & calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Number of blades

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Growing technological advancements

- 3.2.1.3 Demand for precise and safer plaque-modification tools

- 3.2.1.4 Rising awareness and improved diagnostic methods

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High product cost coupled with competition from alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Growing adoption of minimally invasive cardiovascular procedures

- 3.2.3.2 Demand in emerging and untapped markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.5.2.1 High-pressure coronary cutting balloon

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Number of Blades, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Three blades

- 5.3 Four blades

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Calcified lesion treatment

- 6.3 In-stent restenosis

- 6.4 Lesion preparation

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Catheterization laboratories

- 7.4 Ambulatory surgery centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the world (RoW)

Chapter 9 Company Profiles

- 9.1 Boston Scientific

- 9.2 LEPU MEDICAL

- 9.3 SHENQI MEDICAL