|

市场调查报告书

商品编码

1782131

生成式人工智慧解决方案市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Generative AI solution Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球生成式人工智慧解决方案市场规模达186亿美元,预计到2034年将以25.2%的复合年增长率成长,达到1856亿美元。这一增长主要源于媒体、医疗保健、汽车和企业软体等行业对超个人化、自动化和创意内容生成日益增长的需求。生成模型(例如生成对抗网路 (GAN)、扩散网路和大型语言模型)曾经被限制在实验室和创意领域,如今已成为企业创新工作的核心。遵循严格规则的传统人工智慧正被能够产生类似人类的文字、图像、音讯和程式码的生成系统所取代。这种演变正在提高效率、增强设计流程并丰富产品体验。专注于应用的公司与领先的人工智慧实验室之间的合作正在加速人工智慧的普及。

因此,针对特定行业挑战而量身定制的垂直解决方案正成为常态,这标誌着人工智慧应用向产业客製化方向的转变。这一日益增长的趋势反映了行业对精准度、相关性和实际适用性的更广泛需求,而千篇一律的模型已无法满足复杂的营运需求。各组织越来越重视与其监管环境、资料类型和客户期望紧密契合的人工智慧工具。从金融、医疗保健到零售和製造业,这些针对特定领域优化的人工智慧系统正在协助加快部署速度、增强决策能力并提高投资报酬率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 186亿美元 |

| 预测值 | 1856亿美元 |

| 复合年增长率 | 25.2% |

基于Transformer的模型细分市场在2024年占据了37%的份额,预计到2034年将以26%的复合年增长率成长。这些架构支撑着几乎所有现代生成式解决方案,例如GPT、PaLM、LLaMA和Claude。它们的可扩展性、灵活性和性能使其在各行各业中广泛应用。 Transformer如今为办公室软体、程式码产生工具以及法律、金融和行销等领域的企业应用程式中的AI副驾驶提供支持,巩固了其作为生成式AI支柱的地位。

2024年,内容创作和行销占了33%的市场份额,预计2025年至2034年的复合年增长率将达到25%。企业越来越依赖产生工具来大规模製作SEO优化的部落格文章、广告活动、产品描述、电子邮件内容和促销多媒体内容。这些系统可协助行销人员实现工作流程自动化,同时保持品牌基调,并根据消费者洞察提供客製化的讯息。这种转变正在帮助品牌有效率地满足日益增长的内容需求,提升参与度,并优化行销活动的效果。

美国生成式人工智慧解决方案市场占85%的市场份额,2024年市场规模达50亿美元。这一领先地位源于其丰富的技术基础设施、先进的学术和企业研究环境以及大量的公私投资。由于主要的人工智慧创新者总部设在美国,并得到世界一流大学、新创公司和研究中心的支持,美国在生成式变压器的开发和大规模部署方面始终处于领先地位。

该市场的领先公司包括Google、英伟达、Adobe、亚马逊网路服务、微软、IBM 和 OpenAI。这些公司正在推动创新并为产业设定策略方向。为了巩固市场主导地位,生成人工智慧领域的主要参与者正在推行几项核心策略。首先,他们正积极拓展研发,开发融合文字、影像、音讯和视讯功能的下一代架构和多模式模型。其次,与行业领导者合作,提供客製化解决方案,满足从医疗诊断到汽车设计的垂直领域需求。第三,致力于使人工智慧存取更加民主化,例如提供开放 API、开发者平台和免费增值服务,这些倡议正在扩大用户参与度并加速其普及。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 电子元件供应商

- 设备製造商

- 服务提供者

- 系统整合商

- 最终用途

- 成本结构

- 利润率

- 每个阶段的增值

- 影响供应链的因素

- 破坏者

- 供应商格局

- 对部队的影响

- 成长动力

- 企业对自动化和效率的需求不断增长

- 行销和客户体验的超个人化

- 人工智慧代理和副驾驶在企业职能中的扩展

- 模型能力的进步

- 云端可用性和策略合作伙伴关係

- 产业陷阱与挑战

- 幻觉和不准确的输出

- 资料隐私和安全风险

- 市场机会

- 垂直特定大型语言模型 (LLM)

- 多模态生成式人工智慧解决方案(文字+图像+音讯+影片)

- 中小企业采用基于 SaaS 的 GenAI

- 人工智慧程式码产生和 DevOps 自动化

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 现有技术

- 基于 Transformer 的大型语言模型 (LLM)

- 生成对抗网路(GAN)

- 扩散模型

- 变分自动编码器 (VAE)

- 新兴技术

- 多模态生成式人工智慧解决方案

- 检索增强生成 (RAG) 系统

- 低程式码/无程式码 GenAI 开发平台

- 安全、校准和评估工具包

- 现有技术

- 专利分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 成本細項分析

- 可持续性分析

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 技术演进与创新路线图

- 基础模型和大型语言模型(LLM)

- 多模态人工智慧系统

- 专门的GENAI应用程式

- 新兴科技与未来发展

- 定价模型与货币化策略

- GenAI定价模型的演变

- 基于订阅的定价分析

- 免费增值和免费套餐策略

- 企业授权和客製化定价

- 收入优化和货币化趋势

- 定价竞争分析

- 未来定价模型的演变

- 企业采用和实施

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 变形金刚模型

- 文字生成

- 程式码生成

- 总结

- 问答

- 多模态转换器(文字+图像/影片)

- 生成对抗网路(GAN)

- 影像生成

- 影片生成

- 条件

- 超解析度

- 风格转换

- 扩散模型

- 影像合成

- 视讯合成

- 文字到图像的传播

- 修復/编辑工具

- 创意设计模型

- 变分自动编码器 (VAE)

- 潜在空间生成

- 语意资料建模

- 异常检测生成

- 其他的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 内容创作与行销

- 数位行销和广告

- 社群媒体内容生成

- 部落格和文章写作

- 创意设计与媒体製作

- 客户服务与支援

- 人工智慧聊天机器人和虚拟助手

- 自动响应系统

- 客户查询解决

- 多语言支援解决方案

- 软体开发和 IT

- 程式码生成和完成

- 错误检测和解决

- 文件生成

- API开发和测试

- 研究与分析

- 数据分析和洞察生成

- 科学研究援助

- 市场研究与竞争情报

- 财务分析和报告

- 教育和培训

- 评估和评价工具

- 专业技能发展

- 其他的

第七章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

- 杂交种

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医疗保健和生命科学

- 药物发现与开发

- 医学影像和诊断

- 临床文件和记录

- 病人照护和远距医疗

- 金融服务及银行业务

- 风险评估与管理

- 诈欺检测与预防

- 投资研究与分析

- 客户服务自动化

- 教育和电子学习

- 个人化学习平台

- 内容创作与课程开发

- 学生评估与评价

- 行政流程自动化

- 媒体和娱乐

- 内容创作与製作

- 游戏与互动媒体

- 音乐和音讯生成

- 视觉效果和动画

- 法律与专业服务

- 合约生成和管理

- 合规与监理支持

- 零售与电子商务

- 客户体验个人化

- 行销和广告优化

- 製造业和工业

- 品质控制和检验

- 预测性维护解决方案

- 其他的

第九章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 新加坡

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Adobe

- Amazon Web Services (AWS)

- Apple

- Anthropic

- Baidu

- DeepMind

- Genie AI

- IBM

- Intel

- Meta

- Microsoft

- MOSTLY AI

- NVIDIA

- OpenAI

- Oracle

- Salesforce

- SAP

- Synthesia

- UiPath

- Unity Technologies

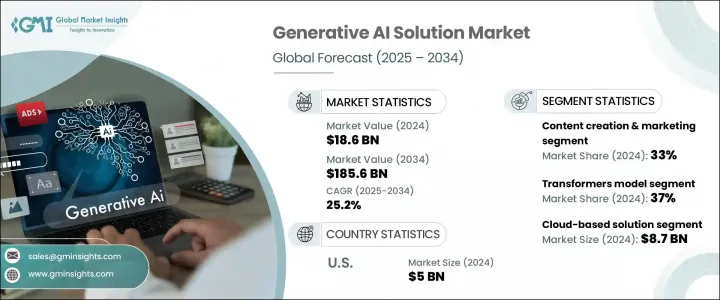

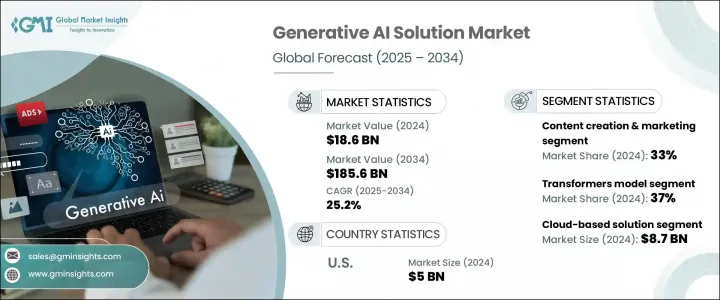

The Global Generative AI solution Market was valued at USD 18.6 billion in 2024 and is estimated to grow at a CAGR of 25.2% to reach USD 185.6 billion by 2034. The expansion is driven by increased demand for hyper-personalization, automation, and creative content generation across industries like media, healthcare, automotive, and enterprise software. Generative models, once confined to labs and creative niches-such as GANs, diffusion networks, and large language models-have become central to corporate innovation efforts. Traditional AI that followed rigid rules is being replaced by generative systems capable of producing human-like text, images, audio, and code. This evolution is driving efficiency, enhancing design processes, and enriching product experiences. Collaborations between application-focused firms and leading AI labs are accelerating adoption.

As a result, vertical-specific solutions tailored to distinct industry challenges are becoming the norm, signaling a shift towards sector-tailored AI implementations. This growing trend reflects a broader industry demand for precision, relevance, and real-world applicability, where one-size-fits-all models no longer meet complex operational needs. Organizations are increasingly prioritizing AI tools that align closely with their regulatory environments, data types, and customer expectations. From finance and healthcare to retail and manufacturing, these domain-optimized AI systems are enabling faster deployment, enhanced decision-making, and better return on investment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.6 Billion |

| Forecast Value | $185.6 Billion |

| CAGR | 25.2% |

The transformer-based models segment held a 37% share in 2024 and is expected to grow at a CAGR of 26% through 2034. These architectures underpin nearly all modern generative solutions, such as GPT, PaLM, LLaMA, and Claude. Their scalability, flexibility, and performance have enabled widespread adoption across industries. Transformers now power AI copilots in office software, code generation tools, and enterprise applications in sectors such as legal, finance, and marketing, cementing their position as the backbone of generative AI.

Content creation and marketing held a 33% share in 2024 and is forecast to grow at a CAGR of 25% from 2025 to 2034. Businesses increasingly rely on generative tools to produce SEO-optimized blog posts, ad campaigns, product descriptions, email content, and promotional multimedia at scale. These systems help marketers automate workflows while maintaining brand tone and delivering tailored messaging based on consumer insights. This shift is helping brands efficiently meet growing content demands, improve engagement, and optimize campaign performance.

U.S. Generative AI Solution Market held 85% share and generated USD 5 billion in 2024. This leadership stems from a rich tech infrastructure, advanced academic and corporate research environments, and substantial public-private investment. With major AI innovators headquartered in the U.S., supported by world-class universities, startups, and research hubs, the country remains at the forefront of generative transformer development and deployment at scale.

Leading firms in this market include Google, NVIDIA, Adobe, Amazon Web Services, Microsoft, IBM, and OpenAI. These companies are driving innovation and setting strategic direction for the industry. To solidify their market dominance, major players in the generative AI space are pursuing several core strategies. First, they are aggressively expanding R&D into next-generation architectures and multimodal models that fuse text, image, audio, and video capabilities. Second, partnerships with industry-specific leaders enable tailored solutions that meet vertical needs, from healthcare diagnostics to automotive design. Third, efforts to democratize AI access, such as offering open APIs, developer platforms, and freemium services, are widening user engagement and accelerating adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 Deployment

- 2.2.5 End use industry

- 2.2.6 Organization size

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Electronic component suppliers

- 3.1.1.2 Equipment manufacturers

- 3.1.1.3 Service providers

- 3.1.1.4 System integrators

- 3.1.1.5 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising enterprise demand for automation and efficiency

- 3.2.1.2 Hyper personalization in marketing and customer experience

- 3.2.1.3 Expansion of AI agents and Copilots across enterprise functions

- 3.2.1.4 Advancements in model capabilities

- 3.2.1.5 Cloud availability and strategic partnerships

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Hallucinations and inaccurate output

- 3.2.2.2 Data privacy and security risks

- 3.2.3 Market Opportunities

- 3.2.3.1 Vertical-specific large language models (LLMs)

- 3.2.3.2 Multimodal Generative AI solution (Text + Image + Audio + Video)

- 3.2.3.3 SaaS-based GenAI adoption among SMEs

- 3.2.3.4 AI-powered code generation & DevOps automation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.1.1 Transformer-based large language models (LLMs)

- 3.6.1.2 Generative adversarial networks (GANs)

- 3.6.1.3 Diffusion models

- 3.6.1.4 Variational autoencoders (VAEs)

- 3.6.2 Emerging technologies

- 3.6.2.1 Multimodal Generative AI solution

- 3.6.2.2 Retrieval-Augmented Generation (RAG) Systems

- 3.6.2.3 Low-Code/No-Code GenAI Development Platforms

- 3.6.2.4 Safety, Alignment & Evaluation Toolkits

- 3.6.1 Current technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Cost breakdown analysis

- 3.10 Sustainability analysis

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Technology evolution and innovation roadmap

- 3.11.1 Foundation models and large language models (LLMs)

- 3.11.2 Multimodal AI systems

- 3.11.3 Specialized GENAI applications

- 3.11.4 Emerging technologies and future developments

- 3.12 Pricing models and monetization strategies

- 3.12.1 GenAI pricing model evolution

- 3.12.2 Subscription-based pricing analysis

- 3.12.3 Freemium and free tier strategies

- 3.12.4 Enterprise licensing and custom pricing

- 3.12.5 Revenue optimization and monetization trends

- 3.12.6 Pricing competitive analysis

- 3.12.7 Future pricing model evolution

- 3.13 Enterprise adoption and implementation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Transformers model

- 5.2.1 Text generation

- 5.2.2 Code generation

- 5.2.3 Summarization

- 5.2.4 Question answering (Q&A)

- 5.2.5 Multimodal transformers (text+ image/video)

- 5.3 Generative adversarial networks (GAN)

- 5.3.1 Image generation

- 5.3.2 Video generation

- 5.3.3 Conditional

- 5.3.4 Super resolution

- 5.3.5 Style transfer

- 5.4 Diffusion models

- 5.4.1 Image synthesis

- 5.4.2 Video synthesis

- 5.4.3 Text-to-image diffusion

- 5.4.4 Inpainting/ editing tools

- 5.4.5 Creative design models

- 5.5 Variational autoencoders (VAEs)

- 5.5.1 Latent space generation

- 5.5.2 Semantic data modelling

- 5.5.3 Anomaly detection generation

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Content creation and marketing

- 6.2.1 Digital marketing and advertising

- 6.2.2 Social media content generation

- 6.2.3 Blog and article writing

- 6.2.4 Creative design and media production

- 6.3 Customer service and support

- 6.3.1 AI chatbots and virtual assistants

- 6.3.2 Automated response systems

- 6.3.3 Customer query resolution

- 6.3.4 Multilingual support solutions

- 6.4 Software development and IT

- 6.4.1 Code Generation and Completion

- 6.4.2 Bug Detection and Resolution

- 6.4.3 Documentation Generation

- 6.4.4 API development and testing

- 6.5 Research and analytics

- 6.5.1 Data analytics and insights generation

- 6.5.2 Scientific research assistance

- 6.5.3 Market research and competitive intelligence

- 6.5.4 Financial analysis and reporting

- 6.6 Education and training

- 6.6.1 Assessment and evaluation tools

- 6.6.2 Professional skills development

- 6.6.3 Others

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Healthcare and life sciences

- 8.2.1 Drug discovery and development

- 8.2.2 Medical imaging and diagnostics

- 8.2.3 Clinical documentation and records

- 8.2.4 Patient care and telemedicine

- 8.3 Financial services and banking

- 8.3.1 Risk assessment and management

- 8.3.2 Fraud detection and prevention

- 8.3.3 Investment research and analysis

- 8.3.4 Customer service automation

- 8.4 Education and E-learning

- 8.4.1 Personalized learning platforms

- 8.4.2 Content creation and curriculum development

- 8.4.3 Student assessment and evaluation

- 8.4.4 Administrative process automation

- 8.5 Media and entertainment

- 8.5.1 Content creation and production

- 8.5.2 Gaming and interactive media

- 8.5.3 Music and audio generation

- 8.5.4 Visual effects and animation

- 8.6 Legal and professional services

- 8.6.1 Contract generation and management

- 8.6.2 Compliance and regulatory support

- 8.7 Retail and E-commerce

- 8.7.1 Customer experience personalization

- 8.7.2 Marketing and advertising optimization

- 8.8 Manufacturing and Industrial

- 8.8.1 Quality control and inspection

- 8.8.2 Predictive maintenance solutions

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large Enterprises

- 9.3 Small and Medium Enterprises (SMEs)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 Australia

- 10.3.6 Singapore

- 10.3.7 Malaysia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Adobe

- 11.2 Amazon Web Services (AWS)

- 11.3 Apple

- 11.4 Anthropic

- 11.5 Baidu

- 11.6 DeepMind

- 11.7 Genie AI

- 11.8 Google

- 11.9 IBM

- 11.10 Intel

- 11.11 Meta

- 11.12 Microsoft

- 11.13 MOSTLY AI

- 11.14 NVIDIA

- 11.15 OpenAI

- 11.16 Oracle

- 11.17 Salesforce

- 11.18 SAP

- 11.19 Synthesia

- 11.20 UiPath

- 11.21 Unity Technologies