|

市场调查报告书

商品编码

1782149

免疫球蛋白市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Immunoglobulin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

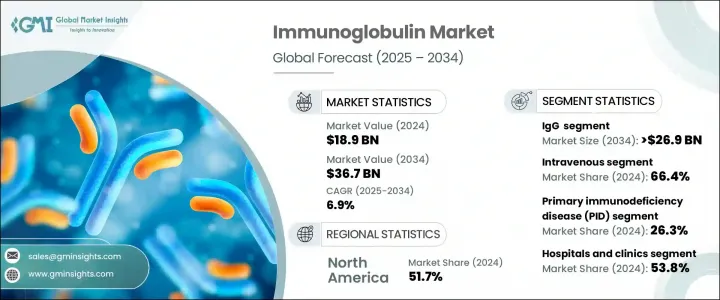

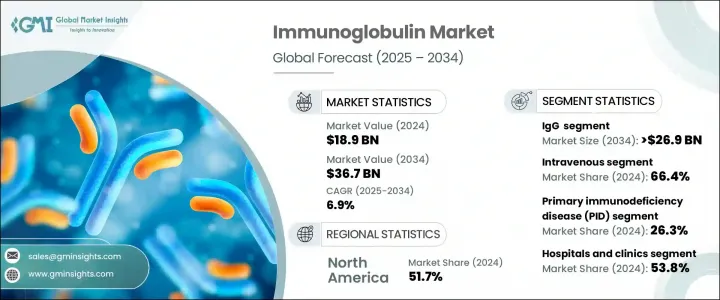

2024年,全球免疫球蛋白市场规模达189亿美元,预计到2034年将以6.9%的复合年增长率成长,达到367亿美元。这一增长主要归因于各年龄层原发性和继发性免疫缺陷疾病发生率的上升。随着诊断技术的不断进步和医护人员意识的不断提高,慢性发炎性脱髓鞘多发性神经病变和多灶性运动神经病变等复杂疾病的检出率正在稳步上升。

这些疾病通常需要终身治疗,包括免疫球蛋白疗法,免疫球蛋白疗法在控制症状和预防感染方面发挥关键作用,从而推动了持续的产品需求。免疫球蛋白是免疫系统的重要组成部分,作为抗体,能够辨识并中和病毒、细菌和毒素等有害病原体。这些糖蛋白由B细胞自然产生,可透过静脉或皮下注射的方式,用于免疫系统需要额外支持或调节的患者。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 189亿美元 |

| 预测值 | 367亿美元 |

| 复合年增长率 | 6.9% |

自体免疫和免疫缺陷病例对免疫球蛋白疗法的日益依赖,进一步增强了市场前景。这些疗法用于纠正抗体缺陷并调节免疫活性,为患者提供可行的长期解决方案。预期寿命的延长,加上全球慢性病发病率的上升,正在创造更广泛的需要免疫支持的患者群体,从而扩大需求。随着免疫学研究的进展和产品可及性的提高,免疫球蛋白疗法在神经内科、血液科和内科等众多医学学科的应用日益受到关注。持续的创新、已开发地区优惠的报销方案以及对血浆采集网路的策略性投资预计将进一步加速市场成长。

在不同类型的免疫球蛋白中,IgG 继续占据主导地位。 2024 年,IgG 占据了 74.1% 的市场份额,预计到 2034 年将超过 269 亿美元,复合年增长率为 6.8%。其主导地位源自于广泛的临床应用和在多种疾病中均已证实的疗效。 IgG 占循环抗体的比例最高,对于中和病原体、提供被动免疫以及管理免疫相关疾病至关重要。其稳定的疗效和广泛的应用范围使其成为医疗机构的首选。同时,IgA 领域正在成为成长最快的领域之一,预计到 2034 年的复合年增长率将达到 7.7%。人们对其在黏膜免疫中的作用及其潜在治疗应用的日益认识,促进了这一增长势头。

从应用角度来看,市场细分为各种疾病,例如慢性发炎性脱髓鞘性多发性神经病变、多灶性运动神经病变、原发性和继发性免疫缺陷疾病、格林-巴利综合症、免疫性血小板减少性紫斑症以及其他利基疾病。原发性免疫缺陷症 (PID) 细分市场在 2024 年占据市场主导地位,市占率为 26.3%,预计复合年增长率将达到 7.1%。此细分市场的需求源自于疾病的终身性,需要持续的免疫球蛋白治疗才能维持足够的免疫功能。 PID 患者缺乏产生功能性抗体的能力,且极易受到频繁感染,因此免疫球蛋白注射成为疾病管理的重要组成部分。它在降低感染风险、减少住院率和改善患者整体预后方面发挥关键作用。

就最终用途而言,医院和诊所占据全球市场主导地位,2024 年的市占率为 53.8%。这些场所是接受免疫球蛋白治疗的患者的主要照护场所,尤其是需要医疗监督和专用设备的静脉注射治疗。医院的受控环境确保了输液操作的安全,并在出现不良反应时能够立即介入。由于需要反覆和长期给药,患者通常依赖医院和诊所进行持续、安全的给药。

从地区来看,北美成为最大的市场,2024 年占 51.7% 的份额。该地区拥有先进的医疗保健体系、健全的报销政策以及完善的血浆采集基础设施。免疫相关疾病的高发病率和持续的临床创新进一步巩固了其领先地位。老龄人口的不断增长和诊断能力的提升也是该地区市场强劲的关键因素。

市场参与者凭藉强大的供应链、持续的产品创新和策略合作伙伴关係保持领先地位。他们在血浆分离方面的专业知识以及对治疗一致性的关注赋予了他们竞争优势。各公司也在投资新兴市场,以挖掘新的需求并减少对传统製造技术的依赖,从而为更广泛的全球市场渗透铺平道路。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 免疫缺陷疾病发生率上升

- 扩大在神经系统疾病和自体免疫疾病的应用

- 全球人口老化

- 改进诊断意识和筛检计划

- 产业陷阱与挑战

- 治疗费用高昂

- 血浆供应限制

- 市场机会

- 重组免疫球蛋白的开发

- 新兴经济体需求不断成长

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 报销场景

- 未来市场趋势

- 差距分析

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 免疫球蛋白G

- 免疫球蛋白A

- 免疫球蛋白M

- 免疫球蛋白D

- 免疫球蛋白E

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 静脉注射(IVIg)

- 皮下(SCIg)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 慢性发炎性脱髓鞘多发性神经病变(CIDP)

- 多灶性运动神经病变(MMN)

- 原发性免疫缺陷症(PID)

- 继发性免疫缺陷症(SID)

- 格林-巴利综合症

- 免疫性血小板减少性紫斑症(ITP)

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 居家照护环境

- 其他最终用户

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ADMA Biologics

- Baxter international

- Bio Products Laboratory

- CSL Behring

- Emergent BioSolutions

- Grifols SA

- Johnson & Johnson (Omrix Biopharmaceuticals)

- Kedrion Biopharma

- LFB Group

- Octapharma AG

- Pfizer

- Shanghai RAAS Blood Products

- Takeda Pharmaceutical Company

The Global Immunoglobulin Market was valued at USD 18.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 36.7 billion by 2034. This expansion is largely attributed to the rising occurrence of immunodeficiency disorders, both primary and secondary, across various age groups. With continued advancements in diagnostics and greater awareness among healthcare providers, detection rates of complex conditions like chronic inflammatory demyelinating polyneuropathy and multifocal motor neuropathy are steadily increasing.

These conditions often require lifelong treatment involving immunoglobulin therapies, which play a key role in controlling symptoms and preventing infections, thereby fueling consistent product demand. Immunoglobulins are essential components of the immune system, functioning as antibodies that recognize and neutralize harmful pathogens such as viruses, bacteria, and toxins. Produced naturally by B cells, these glycoproteins are administered either intravenously or subcutaneously to patients whose immune systems require additional support or modulation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.9 Billion |

| Forecast Value | $36.7 Billion |

| CAGR | 6.9% |

The growing reliance on immunoglobulin-based therapies in autoimmune and immune deficiency cases continues to strengthen the market outlook. These therapies are used to correct antibody deficiencies and regulate immune activity, offering patients a viable long-term solution. Increasing life expectancy, coupled with a rise in chronic disease incidence globally, is creating a broader patient base that requires immune support, thereby adding to the demand pool. As immunology research progresses and product accessibility improves, the use of immunoglobulin therapy is gaining traction across numerous medical disciplines, including neurology, hematology, and internal medicine. Continuous innovation, favorable reimbursement scenarios in developed regions, and strategic investments in plasma collection networks are expected to further accelerate market growth.

Among the different immunoglobulin classes, IgG continues to hold the dominant position. In 2024, the IgG segment captured a market share of 74.1% and is anticipated to surpass USD 26.9 billion by 2034, with a CAGR of 6.8%. Its dominance stems from broad clinical usage and well-established efficacy in a wide range of conditions. IgG represents the highest proportion of circulating antibodies and is essential for neutralizing pathogens, offering passive immunity, and managing immune-related conditions. Its consistent therapeutic performance and wide application range make it the preferred choice across healthcare settings. Meanwhile, the IgA segment is emerging as one of the fastest-growing, projected to grow at a CAGR of 7.7% through 2034. Growing recognition of its role in mucosal immunity and its potential therapeutic applications is contributing to this increased momentum.

From an application perspective, the market is segmented into various conditions such as chronic inflammatory demyelinating polyneuropathy, multifocal motor neuropathy, primary and secondary immunodeficiency diseases, Guillain-Barre syndrome, immune thrombocytopenic purpura, and other niche disorders. The primary immunodeficiency disease (PID) segment led the market in 2024 with a share of 26.3% and is forecasted to expand at a CAGR of 7.1%. The demand in this segment is driven by the lifelong nature of the condition, which requires consistent immunoglobulin therapy to maintain adequate immune function. Patients with PID lack the ability to produce functional antibodies and are highly vulnerable to frequent infections, making immunoglobulin administration a vital component of disease management. It plays a critical role in reducing infection risks, limiting hospital admissions, and enhancing overall patient outcomes.

In terms of end use, the hospital and clinic segment dominated the global market with a market share of 53.8% in 2024. These settings serve as the primary point of care for patients receiving immunoglobulin therapy, particularly intravenous forms that demand medical supervision and specialized equipment. The controlled environment of hospitals ensures safe infusion practices and allows immediate intervention in case of adverse reactions. Given the requirement for repeated and long-term dosing, patients often rely on hospitals and clinics for consistent and secure administration.

Regionally, North America emerged as the largest market, commanding a share of 51.7% in 2024. The region benefits from advanced healthcare systems, robust reimbursement policies, and a well-established infrastructure for plasma collection. The high prevalence of immune-related disorders and ongoing clinical innovation further contribute to its leading position. The expanding elderly population and improved diagnostic capabilities are also key contributors to the region's market strength.

Market players are maintaining their leadership through strong supply chains, continuous product innovation, and strategic partnerships. Their expertise in plasma fractionation and focus on therapeutic consistency give them a competitive edge. Companies are also investing in emerging markets to tap into new demand and reduce dependence on traditional manufacturing techniques, paving the way for broader global market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Route of administration trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of immunodeficiency disorders

- 3.2.1.2 Expanding applications in neurological and autoimmune diseases

- 3.2.1.3 Global aging population

- 3.2.1.4 Improved diagnostic awareness and screening programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapy

- 3.2.2.2 Plasma supply constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Development of recombinant immunoglobulins

- 3.2.3.2 Rising demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Pipeline analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 IgG

- 5.3 IgA

- 5.4 IgM

- 5.5 IgD

- 5.6 IgE

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Intravenous (IVIg)

- 6.3 Subcutaneous (SCIg)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chronic inflammatory demyelinating polyneuropathy (CIDP)

- 7.3 Multifocal motor neuropathy (MMN)

- 7.4 Primary immunodeficiency disease (PID)

- 7.5 Secondary immunodeficiency disease (SID)

- 7.6 Guillain-Barre syndrome

- 7.7 Immune thrombocytopenic purpura (ITP)

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centers

- 8.4 Homecare settings

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ADMA Biologics

- 10.2 Baxter international

- 10.3 Bio Products Laboratory

- 10.4 CSL Behring

- 10.5 Emergent BioSolutions

- 10.6 Grifols SA

- 10.7 Johnson & Johnson (Omrix Biopharmaceuticals)

- 10.8 Kedrion Biopharma

- 10.9 LFB Group

- 10.10 Octapharma AG

- 10.11 Pfizer

- 10.12 Shanghai RAAS Blood Products

- 10.13 Takeda Pharmaceutical Company