|

市场调查报告书

商品编码

1782156

肠道疾病检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Enteric Disease Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

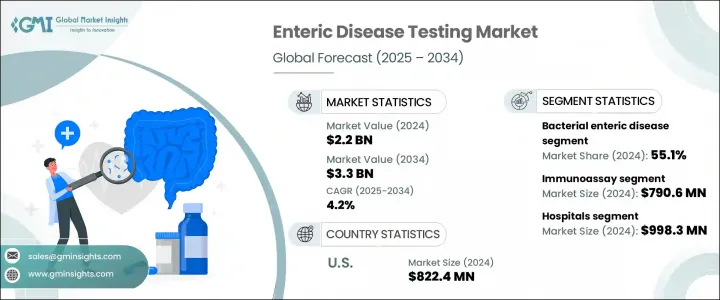

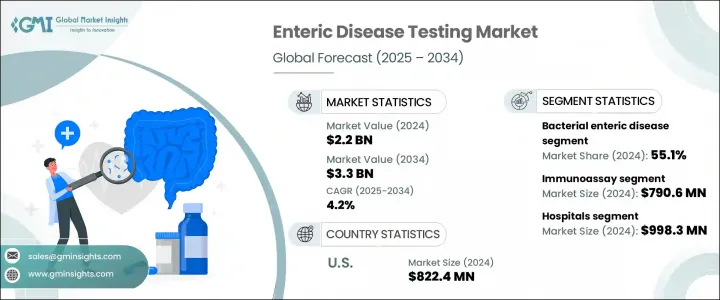

2024年,全球肠道疾病检测市场规模达22亿美元,预计2034年将以4.2%的复合年增长率成长,达到33亿美元。这一增长主要源于肠道感染盛行率的上升、公众意识的提升、监测措施的推进以及诊断检测技术的进步。肠道疾病多发于中低收入国家,通常与卫生条件不佳和水污染有关。这些感染具有復发性和地方性持续性,因此及时、准确的诊断至关重要。早期发现对于促进有效干预、改善患者预后和支持更有效的疾病控制至关重要。

此外,胶囊内视镜、可摄取感测器和药物传输系统需求的成长,也刺激了对肠道器械进行精准检测的需求。这包括评估溶解度、转运时间和胃肠道结构内的局部释放等因素,进一步推动了市场扩张。肠道疾病检测是指用于识别影响消化道的细菌、病毒或寄生虫引起的感染的诊断方法。这些检测可用于检测腹泻、霍乱、伤寒和痢疾等疾病。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 4.2% |

免疫测定领域占据市场主导地位,2024年市场规模达7.906亿美元,预计2034年复合年增长率将达4.3%。免疫测定广泛用于检测肠道病原体,尤其在资源匮乏的环境中(包括即时诊断环境)普遍使用。免疫测定是监测和应对疫情的主要方法,特别适用于细菌毒素和轮状病毒、诺罗病毒等病毒感染。

2024年,医院领域以9.983亿美元的收入引领市场,预计2025-2034年期间的复合年增长率将达到4.4%。作为急诊和紧急干预的主要中心,医院处理着许多严重的胃肠道病例,尤其是与食源性疾病相关的病例。大多数紧急病例在医院实验室处理,这反映了这些机构在肠道疾病检测中的关键作用。

2024年,美国肠道疾病检测市场规模达8.224亿美元。美国每年发生数百万例食源性疾病病例,主要由沙门氏菌、大肠桿菌和诺罗病毒等病原体引起。应对这项公共卫生挑战需要定期进行准确的肠道疾病检测。美国疾病管制与预防中心(CDC)和美国食品药物管理局(FDA)等机构的项目,例如FoodNet和PulseNet,在疫情检测和先进诊断检测方法的开发中发挥着至关重要的作用。这些机构推动着提高诊断速度和准确性所需的创新。

肠道疾病检测市场的主要参与者包括雅培实验室、碧迪公司、Biomerica、bioMerieux、Bio-Rad Laboratories、Coris BioConcept、丹纳赫、DiaSorin、默克公司、Meridian Bioscience、Techlab 和赛默飞世尔科技。为了巩固其在肠道疾病检测市场的地位,各公司正专注于持续创新和开发先进的诊断技术。这包括大力投资研发 (R&D),以提高检测试剂盒的准确性、速度和易用性,特别是对于即时诊断环境。与政府机构、研究机构和医疗保健提供者的策略合作也是扩大其市场影响力的关键。各公司也透过提供价格合理、易于使用的诊断解决方案,扩大其在肠道疾病高发新兴市场的影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肠道疾病盛行率不断上升

- 诊断技术的进步

- 预防性医疗保健服务需求不断增长

- 医疗支出和投资不断增加

- 产业陷阱与挑战

- 肠道疾病检测成本高昂

- 测试程序的复杂性

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按疾病,2021 - 2034 年

- 主要趋势

- 细菌性肠道疾病

- 沙门氏菌

- 大肠桿菌

- 弯曲桿菌

- 艰难梭菌

- 志贺氏菌症

- 李斯特菌

- 病毒性肠疾病

- 轮状病毒感染

- 诺罗病毒感染

- 肠道寄生虫病

- 贾第鞭毛虫病

- 阿米巴病

- 隐孢子虫病

第六章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 免疫测定

- 分子

- 传统的

- 色谱法和光谱法

- 其他测试类型

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 研究与学术机构

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Becton, Dickinson and Company

- Biomerica

- bioMerieux

- Bio-Rad Laboratories

- Coris BioConcept

- Danaher

- DiaSorin

- Merck KGaA

- Meridian Bioscience

- Techlab

- Thermo Fisher Scientific

The Global Enteric Disease Testing Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 3.3 billion by 2034. This growth is driven by the increasing prevalence of enteric infections, greater awareness, surveillance initiatives, and technological advancements in diagnostic testing. Enteric diseases, often occurring in low- and middle-income countries, are commonly linked to inadequate sanitation and contaminated water. These infections are recurrent, with endemic persistence, highlighting the need for timely, accurate diagnostics. Early detection is crucial in facilitating effective interventions that improve patient outcomes and support better disease control efforts.

Additionally, the rise in demand for capsule endoscopy, ingestible sensors, and drug delivery systems has spurred the need for accurate testing of enteric devices. This includes evaluating factors like dissolution, transit time, and localized release within gastrointestinal structures, further driving market expansion. Enteric disease testing refers to diagnostic methods used to identify infections caused by bacteria, viruses, or parasites that affect the digestive tract. Tests are used to detect conditions like diarrhea, cholera, typhoid, and dysentery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 4.2% |

The immunoassay segment dominated the market, generating USD 790.6 million in 2024, and is projected to grow at a CAGR of 4.3% through 2034. Immunoassays are widely used for detecting enteric pathogens and are particularly prevalent in low-resource settings, including point-of-care environments. They are the primary method for surveillance and outbreak response, especially for bacterial toxins and viral infections like rotavirus and norovirus.

The hospitals segment led the market in 2024 with a revenue of USD 998.3 million and is expected to grow at a CAGR of 4.4% during 2025-2034. As major centers for acute care and emergency interventions, hospitals handle many severe gastrointestinal cases, especially those related to foodborne diseases. Most urgent cases are processed in hospital-based labs, reflecting the crucial role of these institutions in enteric disease testing.

U.S. Enteric Disease Testing Market was valued at USD 822.4 million in 2024. The country sees millions of foodborne illness cases annually, driven by pathogens like Salmonella, E. coli, and Norovirus. Addressing this public health challenge requires regular, accurate enteric disease testing. Programs from organizations like the CDC and FDA, such as FoodNet and PulseNet, play a vital role in outbreak detection and the development of advanced diagnostic tests. These agencies drive the innovation necessary to improve diagnostic speed and accuracy.

Key players in the Enteric Disease Testing Market include Abbott Laboratories, Becton, Dickinson and Company, Biomerica, bioMerieux, Bio-Rad Laboratories, Coris BioConcept, Danaher, DiaSorin, Merck KGaA, Meridian Bioscience, Techlab, and Thermo Fisher Scientific. To strengthen their position in the enteric disease testing market, companies are focusing on continuous innovation and the development of advanced diagnostic technologies. This includes investing heavily in research and development (R&D) to improve the accuracy, speed, and ease of use of testing kits, particularly for point-of-care settings. Strategic collaborations with government agencies, research institutions, and healthcare providers are also key to expanding their market footprint. Companies are also increasing their presence in emerging markets where the incidence of enteric diseases is high by providing affordable, easy-to-use diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Disease trends

- 2.2.3 Test type trends

- 2.2.4 End use trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of enteric diseases

- 3.2.1.2 Technological advancements in diagnostic technologies

- 3.2.1.3 Growing demand for preventive healthcare services

- 3.2.1.4 Rising healthcare expenditure and investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with enteric disease testing

- 3.2.2.2 Complexity of testing procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bacterial enteric disease

- 5.2.1 Salmonella

- 5.2.2 E. coli

- 5.2.3 Campylobacter

- 5.2.4 C. difficile

- 5.2.5 Shigellosis

- 5.2.6 Listeria

- 5.3 Viral enteric disease

- 5.3.1 Rotavirus infection

- 5.3.2 Norovirus infection

- 5.4 Parasitic enteric disease

- 5.4.1 Giardiasis

- 5.4.2 Amebiasis

- 5.4.3 Cryptosporidiosis

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immunoassay

- 6.3 Molecular

- 6.4 Conventional

- 6.5 Chromatography & spectrometry

- 6.6 Other test types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Research & academic institutes

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Becton, Dickinson and Company

- 9.3 Biomerica

- 9.4 bioMerieux

- 9.5 Bio-Rad Laboratories

- 9.6 Coris BioConcept

- 9.7 Danaher

- 9.8 DiaSorin

- 9.9 Merck KGaA

- 9.10 Meridian Bioscience

- 9.11 Techlab

- 9.12 Thermo Fisher Scientific