|

市场调查报告书

商品编码

1782157

结核病诊断测试市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tuberculosis Diagnostics Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

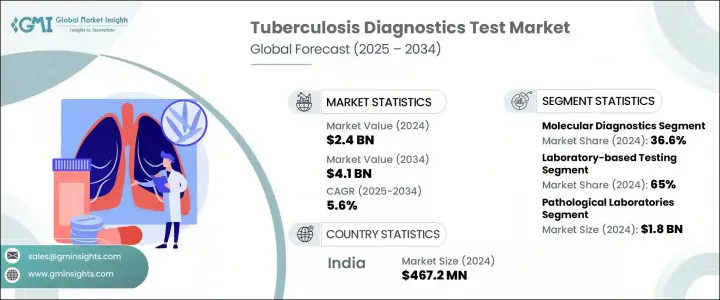

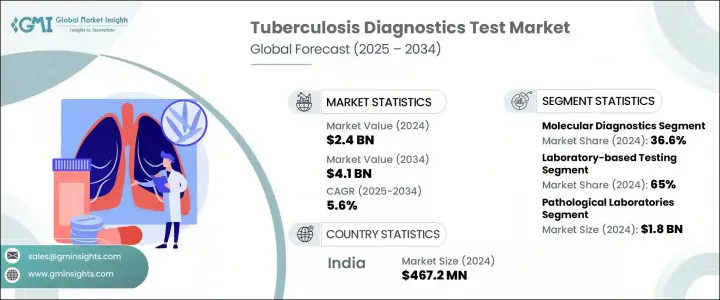

2024年,全球结核病诊断检测市场规模达24亿美元,预计到2034年将以5.6%的复合年增长率成长,达到41亿美元。全球结核病病患病率的上升,加上诊断技术的进步和公共卫生意识的急剧提升,正在推动对可靠检测工具的需求。即时检测的普及和结构化筛检计画的实施,有助于提高早期结核病的发现率。这些努力得到了公共和私营部门的支持,旨在简化及时诊断和治疗流程,这是控制结核病传播的关键步骤。

市场扩张的主要驱动力是全球加强早期筛检措施的努力。政府支持的医疗保健计画正在推出结构化策略,为高风险族群提供更便捷的诊断途径。这些措施正在透过社区检测和推广加速早期识别。结核病诊断检测用于检测结核分枝桿菌的存在,并确定个体是否感染活动性结核病或潜伏性结核病,这对于指导治疗决策至关重要。随着对准确识别的日益重视,市场对诊断平台创新和基础设施的投资持续增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.6% |

2024年,分子诊断成为领先细分市场,贡献了36.6%的市场份额,预计到2034年将以5.9%的复合年增长率成长。这些诊断技术透过快速、灵敏、准确地检测结核分枝桿菌及其抗药性,改变了产业格局。聚合酶炼式反应(PCR)作为该领域的核心技术,使医疗保健提供者能够精确地从临床样本中检测出结核菌,从而更有效地制定早期治疗决策。

2024年,实验室检测类别占最大份额,达65%。其主导地位主要归功于精准的集中检测方法,这对于诊断复杂抗药性结核病病例至关重要。这些检测通常在医院、公共卫生机构和经认证的私人实验室进行。常见的检测技术包括抹片显微镜检查、基于培养的诊断和干扰素-γ释放试验 (IGRA),所有这些技术都能深入了解疾病的严重程度和潜在的抗药性,并指导临床医生製定个人化治疗方案。

预计2025年至2034年,亚太地区结核病诊断检测市场将以5.6%的复合年增长率成长。推动这一增长的因素包括结核病病例数量的增加、公共卫生教育的不断普及、诊断实验室的普及以及旨在加强诊断基础设施的政府支持性政策。随着该地区在医疗保健领域的持续投入,对先进结核病检测解决方案的需求预计将持续成长。

该领域的领导企业包括丹纳赫集团、雅培实验室、生物梅里埃、凯杰公司、碧迪公司和罗氏公司。为了巩固市场地位,各大顶尖企业正大力投资研发,以推动分子诊断和快速诊断技术的发展。与医疗机构与研究机构的策略性併购与合作,正协助各企业拓展诊断产品组合与全球影响力。多家企业正致力于打造低成本、可携式结核病检测解决方案,以满足资源匮乏地区(尤其是高负担地区)的需求。此外,製造商正在优化检测灵敏度,缩短週转时间,并确保其平台符合国际监管标准。这些策略共同提升了检测的可近性、准确性和效率,使企业在市场中占据长期领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球结核病负担不断加重

- 结核病诊断技术进展

- 提高对结核病的认识和筛检项目

- 即时检验(POCT)激增

- 产业陷阱与挑战

- 敏感性和特异性有限

- 严格的监管情景

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 北美洲

- 欧洲

- 未来市场趋势

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按测试类型,2021 - 2034 年

- 主要趋势

- 射线照相法

- 诊断实验室方法

- 显微镜

- 基于文化的技术

- 血清学检测

- 分子诊断

- 聚合酶炼式反应(PCR)

- 核酸扩增试验(NAAT)

- GeneXpert MTB/RIF

- 检测潜伏感染

- 结核菌素皮肤试验(TST)/纯蛋白衍生物(PPD)

- 第一代基于 PPD 的 TST

- 新一代重组抗原皮肤测试

- 结核菌素皮肤试验(TST)/纯蛋白衍生物(PPD)

- 干扰素-γ释放试验(IGRA)

- 基于 ELISA 的 IGRA

- 基于 ELISPOT 的 IGRA

- 即时诊断 IGRA

- 细胞激素检测试验

- 抗药性检测(DST)

- 噬菌体试验

- 其他测试类型

第六章:市场估计与预测:按方式,2021 - 2034 年

- 主要趋势

- 即时检验(POCT)

- 实验室检测(非 POCT)

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 病理实验室

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Anhui Zhifei Longcom Biopharmaceutical Co.

- Becton, Dickinson and Company

- bioMerieux

- Danaher Corporation (Cepheid)

- F. Hoffmann-La Roche

- Generium Pharmaceuticals

- Hain Lifescience

- Hologic

- Japan BCG Laboratory

- NIPRO

- Oxford Immunotec

- Qiagen NV

- Sanofi

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Tuberculosis Diagnostics Test Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 4.1 billion by 2034. Increasing TB prevalence worldwide, coupled with advancements in diagnostic technologies and a sharp rise in public health awareness, are fueling demand for reliable testing tools. The rising adoption of point-of-care testing and the implementation of structured screening programs are helping improve early detection rates. These efforts, supported by both public and private sectors, aim to streamline timely diagnosis and treatment, crucial steps in controlling the spread of tuberculosis.

A major driver behind the market's expansion is the global effort to strengthen early screening initiatives. Government-backed healthcare programs are rolling out structured strategies to support high-risk populations with better diagnostic access. These initiatives are accelerating early identification through community-based testing and outreach. Tuberculosis diagnostic tests are used to detect the presence of the mycobacterium tuberculosis bacteria and to determine if an individual has active TB or a latent TB infection, which is essential for guiding treatment decisions. With more emphasis on accurate identification, the market continues to witness greater investment in innovation and infrastructure across diagnostic platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.6% |

In 2024, molecular diagnostics emerged as the leading segment, contributing 36.6% share and projected to grow at a CAGR of 5.9% through 2034. These diagnostics have changed the game by offering fast, sensitive, and accurate detection of Mycobacterium tuberculosis and its drug resistance traits. The use of polymerase chain reaction (PCR) as a central technique in this space enables healthcare providers to detect TB bacteria from clinical samples with precision, making early treatment decisions more effective.

The laboratory-based testing category held the largest share 65% in 2024. Its dominance is primarily attributed to the use of accurate, centralized testing methods critical for diagnosing complex and drug-resistant TB cases. These tests are typically performed in hospitals, public health institutions, and private certified laboratories. Common testing techniques include smear microscopy, culture-based diagnostics, and interferon-gamma release assays (IGRAs), all of which offer in-depth insight into disease severity and potential resistance, guiding clinicians in creating tailored treatment plans.

Asia Pacific Tuberculosis Diagnostics Test Market is expected to grow at a CAGR of 5.6% from 2025 to 2034. Factors contributing to this growth include the increasing number of TB cases, expanding public health education, greater access to diagnostic labs, and supportive governmental policies aimed at strengthening diagnostic infrastructure. As the region continues to invest in healthcare, the demand for advanced TB testing solutions is forecasted to rise.

Prominent players leading this space include Danaher Corporation, Abbott Laboratories, bioMerieux, Qiagen N.V., Becton, Dickinson and Company, and F. Hoffmann-La Roche. To strengthen their market presence, top firms are heavily investing in R&D to advance molecular and rapid diagnostic technologies. Strategic mergers and collaborations with healthcare providers and research institutions are helping companies expand their diagnostic portfolios and global footprint. Several players are focusing on creating low-cost, portable TB testing solutions tailored for low-resource settings, particularly in high-burden regions. Additionally, manufacturers are optimizing test sensitivity, reducing turnaround time, and ensuring their platforms meet international regulatory standards. These strategies collectively enhance accessibility, accuracy, and efficiency, positioning companies for long-term market leadership.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Test type

- 2.2.3 Modality

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of tuberculosis globally

- 3.2.1.2 Advancement in tuberculosis diagnostics techniques

- 3.2.1.3 Increasing awareness and screening programs regarding tuberculosis

- 3.2.1.4 Surge in point-of-care testing (POCT)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited sensitivity and specificity

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook matrix

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Radiographic method

- 5.3 Diagnostic laboratory methods

- 5.3.1 Microscopy

- 5.3.2 Culture-based techniques

- 5.3.3 Serological tests

- 5.4 Molecular diagnostics

- 5.4.1 Polymerase chain reaction (PCR)

- 5.4.2 Nucleic acid amplification tests (NAAT)

- 5.4.3 GeneXpert MTB/RIF

- 5.5 Detection of latent infection

- 5.5.1 Tuberculin skin test (TST)/ Purified protein derivative (PPD)

- 5.5.1.1 First-generation PPD-based TSTs

- 5.5.1.2 New-generation skin tests with recombinant antigens

- 5.5.1 Tuberculin skin test (TST)/ Purified protein derivative (PPD)

- 5.6 Interferon-gamma release assays (IGRAs)

- 5.6.1.1 ELISA-based IGRAs

- 5.6.1.2 ELISPOT-based IGRAs

- 5.6.1.3 Point-of-care IGRAs

- 5.7 Cytokine detection assays

- 5.8 Detection of drug resistance (DST)

- 5.9 Phage assay

- 5.10 Other test types

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Point of care testing (POCT)

- 6.3 Laboratory-based testing (Non-POCT)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pathological laboratories

- 7.3 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Anhui Zhifei Longcom Biopharmaceutical Co.

- 9.3 Becton, Dickinson and Company

- 9.4 bioMerieux

- 9.5 Danaher Corporation (Cepheid)

- 9.6 F. Hoffmann-La Roche

- 9.7 Generium Pharmaceuticals

- 9.8 Hain Lifescience

- 9.9 Hologic

- 9.10 Japan BCG Laboratory

- 9.11 NIPRO

- 9.12 Oxford Immunotec

- 9.13 Qiagen N.V.

- 9.14 Sanofi

- 9.15 Siemens Healthineers

- 9.16 Thermo Fisher Scientific