|

市场调查报告书

商品编码

1782158

男士内衣市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Men's Underwear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

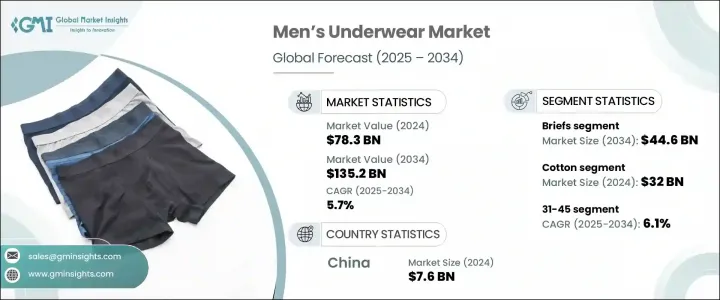

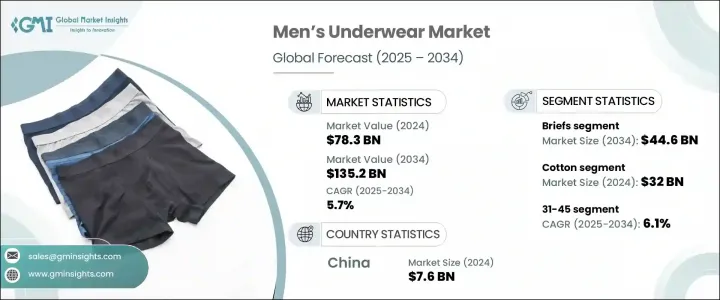

2024年,全球男士内衣市场规模达783亿美元,预计到2034年将以5.7%的复合年增长率成长,达到1352亿美元。由于人们对兼具舒适性和美感的现代时尚、功能性服装的兴趣日益浓厚,该市场正日益受到青睐。随着时尚潮流持续影响男性消费者,消费者明显转向时尚实用的内衣,其特点是剪裁俐落、运动风格和图案大胆。品牌策略和网红推广活动日益影响消费者的偏好,有助于提升品牌和系列产品的知名度和吸引力。

产品创新在推动市场成长方面发挥关键作用,尤其是在高级纺织品领域。兼具吸湿排汗、防臭和柔韧性的高性能面料正成为男士内衣的必备元素。日益增强的健康意识也推动了人们对舒适性之外,兼具抗菌和透气性等优势的布料的需求。随着男性卫生意识的增强,这些附加功能被视为至关重要。智慧布料技术和增强贴合度设计的普及,进一步拓展了市场边界,并扩大了消费者在不同价位和款式偏好上的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 783亿美元 |

| 预测值 | 1352亿美元 |

| 复合年增长率 | 5.7% |

预计到2034年,三角裤市场规模将达到446亿美元,并将继续稳步增长,这得益于其在註重支撑性和稳固贴合度的男士群体中的吸引力。对于注重实用性、无论是在工作中还是在积极的生活方式中,三角裤仍然是男士们的必备单品。该细分市场受益于材料技术的进步,例如氨纶、莫代尔和透气棉的混纺面料,这些面料有助于提升弹性、舒适度和吸湿排汗性能,从而延长穿着时间。

2024年,棉布市场价值达320亿美元,预计2025年至2034年的复合年增长率为6%。棉布的柔软透气性使其成为日常穿着的首选布料。聚酯纤维的弹性使其成为追求耐用性人士的理想之选,而莫代尔则以其丝滑的触感增添奢华感。尼龙拥有出色的弹性,非常适合高性能服装。竹子因其可持续性和对环境影响最小而广泛应用。混纺材料,尤其是与氨纶或弹性纤维混纺的混纺材料,可透过改善贴合度、运动性和保形性来增强功能性,从而满足舒适性和性能需求。

2024年,中国男士内衣市场规模达76亿美元,预计2034年将以6.5%的复合年增长率成长。该地区强劲的成长动力源自于收入水准的提高、对时尚前卫风格的兴趣增强,以及消费者对高端品牌产品的青睐。年轻消费者正引领市场,他们追求时尚、创新和舒适。随着越来越多的消费者转向线上管道,寻找和购买高端、功能性内衣,数位平台和行动商务正发挥着至关重要的作用。国内外品牌正在丰富产品种类,提供涵盖平角内裤、平角裤以及更贴合体型的款式,以满足消费者不断变化的喜好。

引领这一领域的顶尖公司包括 Hanesbrands、Saxx Underwear、阿迪达斯、乔治·阿玛尼、Hugo Boss、Tommy Hilfiger、拉尔夫·劳伦、彪马、Mack Weldon、Jockey International、安德玛、耐克、伯克希尔·哈撒韦、Bonobos 和 Calvin Klein。为了在男士内衣市场保持竞争优势,领先公司正专注于创新、永续性和品牌建立。许多公司正在投资智慧纺织品,这些纺织品具有增强的功能,例如温度调节、气味控制和符合人体工学的设计,适合全天穿着。为了吸引具有环保意识的消费者,该公司还推出了由有机棉、竹子和再生纤维製成的永续产品线。

与时尚达人和运动员的策略合作正在提升品牌知名度并促进消费者参与。电商发展和全通路零售策略帮助这些公司吸引更广泛的受众。个人化选择、尺寸包容性和订阅模式也被采用,以提高客户忠诚度并增加复购率。这些倡议共同巩固了市场领导地位和长期品牌实力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:市场洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 内裤

- 拳击手

- 平角内裤

- 行李箱

- 潮人

- 丁字裤

- 其他的

第六章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 棉布

- 聚酯纤维

- 莫代尔

- 尼龙

- 竹子

- 其他的

第七章:市场估计与预测:依年龄组,2021-2034

- 主要趋势

- 15 - 30

- 31 - 45

- 46 - 60

- 60岁以上

第八章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他(个体店、百货公司等)

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Adidas

- Berkshire Hathaway

- Bonobos

- Calvin Klein

- Giorgio Armani

- Hanesbrands

- Hugo Boss

- Jockey International

- Mack Weldon

- Nike

- Puma

- Ralph Lauren

- Saxx Underwear

- Tommy Hilfiger

- Under Armour

The Global Men's Underwear Market was valued at USD 78.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 135.2 billion by 2034. This market is gaining traction due to growing interest in modern, stylish, and performance-driven apparel that delivers both comfort and aesthetic appeal. As fashion trends continue to influence male consumers, there's a noticeable shift toward trendy, functional underwear featuring sleek cuts, athletic styling, and bold patterns. Consumer preference is increasingly shaped by branding strategies and influencer-backed promotions, which help elevate the visibility and appeal of labels and collections.

Product innovation is playing a key role in boosting market growth, especially in the realm of advanced textiles. High-performance fabrics that offer moisture management, odor resistance, and flexibility are becoming essential elements in men's underwear. Rising health awareness is also prompting demand for materials that offer benefits beyond comfort, including antimicrobial protection and breathability. As men become more hygiene-conscious, these added features are seen as vital. The popularity of smart fabric technologies and enhanced fit designs is further pushing market boundaries and expanding consumer choice across all price segments and style preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.3 Billion |

| Forecast Value | $135.2 Billion |

| CAGR | 5.7% |

The briefs segment is expected to generate USD 44.6 billion by 2034, growing steadily due to its appeal among men who value support and secure fit. Briefs continue to serve as a staple for those who prioritize practicality in both work and active lifestyles. This segment benefits from advances in material technology, such as blends featuring spandex, modal, and breathable cotton, which help improve stretch, comfort, and moisture regulation for extended wear.

The cotton segment was valued at USD 32 billion in 2024 and is projected to grow at a CAGR of 6% from 2025 to 2034. Cotton's softness and breathability keep it a preferred fabric for everyday use. Polyester's resilience makes it ideal for those seeking durability, while modal adds luxury through its silky feel. Nylon offers excellent stretch retention, making it great for high-performance wear. Bamboo, recognized for its sustainability and minimal environmental impact, is seeing wider adoption. Blended materials, especially those with spandex or elastane, enhance functionality by improving fit, movement, and shape retention, meeting both comfort and performance needs.

China Men's Underwear Market was valued at USD 7.6 billion in 2024 and is expected to grow at a CAGR of 6.5% through 2034. The region's robust expansion is driven by rising income levels, greater interest in fashion-forward styles, and a shift toward higher-end and branded products. Younger consumers are steering the market by embracing style, innovation, and elevated comfort. Digital platforms and mobile commerce are playing a crucial role, as more shoppers turn to online outlets to discover and purchase premium and performance-based underwear. Domestic and international labels are enhancing product variety, offering designs that span boxer briefs, trunks, and more tailored fits to cater to changing preferences.

Top companies shaping this space include Hanesbrands, Saxx Underwear, Adidas, Giorgio Armani, Hugo Boss, Tommy Hilfiger, Ralph Lauren, Puma, Mack Weldon, Jockey International, Under Armour, Nike, Berkshire Hathaway, Bonobos, and Calvin Klein. To maintain a competitive edge in the men's underwear market, leading companies are focusing on innovation, sustainability, and branding. Many are investing in smart textiles with enhanced features such as temperature regulation, odor control, and ergonomic design for all-day wear. Firms are also launching sustainable lines made from organic cotton, bamboo, and recycled fibers to attract environmentally aware consumers.

Strategic collaborations with fashion influencers and athletes are boosting brand recognition and driving consumer engagement. E-commerce development and omnichannel retail strategies help these companies capture wider audiences. Personalization options, size inclusivity, and subscription-based models are also being adopted to improve customer loyalty and increase repeat purchases. These efforts together help reinforce market leadership and long-term brand strength.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Age group

- 2.2.5 Price range

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Market Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Briefs

- 5.3 Boxers

- 5.4 Boxer briefs

- 5.5 Trunks

- 5.6 Hipsters

- 5.7 Thongs

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Polyester

- 6.4 Modal

- 6.5 Nylon

- 6.6 Bamboo

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 15 - 30

- 7.3 31 - 45

- 7.4 46 - 60

- 7.5 Above 60

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (individual stores, departmental stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adidas

- 11.2 Berkshire Hathaway

- 11.3 Bonobos

- 11.4 Calvin Klein

- 11.5 Giorgio Armani

- 11.6 Hanesbrands

- 11.7 Hugo Boss

- 11.8 Jockey International

- 11.9 Mack Weldon

- 11.10 Nike

- 11.11 Puma

- 11.12 Ralph Lauren

- 11.13 Saxx Underwear

- 11.14 Tommy Hilfiger

- 11.15 Under Armour