|

市场调查报告书

商品编码

1797687

地板化学品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Flooring Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

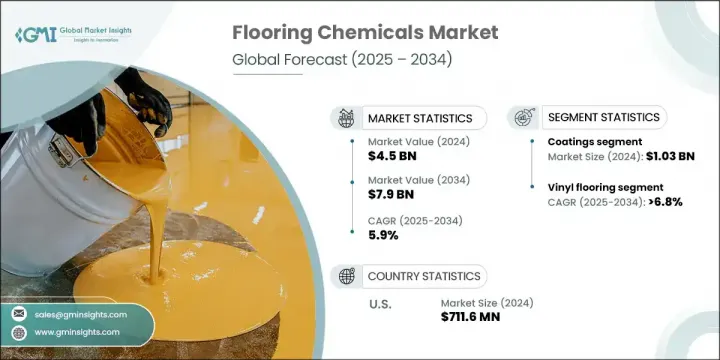

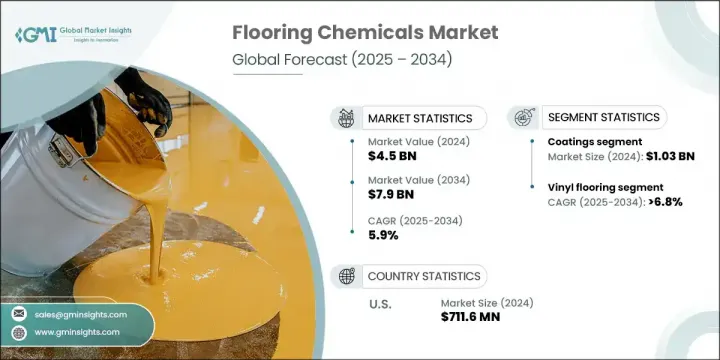

2024年,全球地板化学品市场规模达45亿美元,预计2034年将以5.9%的复合年增长率成长,达到79亿美元。由于市场转向环保材料和低排放化学配方,该市场正在快速发展。随着永续性成为核心关注点,製造商正在开发先进的地板解决方案,降低挥发性有机化合物(VOC)含量并增加生物基含量,以满足环境法规和不断变化的消费者期望。智慧製造技术和数位化工具正在整合到生产中,以确保更高的流程效率、品质控制和对需求的回应能力。

数位化的不断发展使得即时监控、供应链协调和精准定位客户需求成为可能。对高性能、耐用且永续的地板材料的追求,正推动住宅、商业和工业建筑领域的广泛需求。树脂、涂料和黏合剂等地板化学物质对于提升地板的美观度、耐磨性以及在不同环境负荷下的功能性至关重要。市场受益于强劲的创新和对兼具高弹性、易于维护和环境影响极小的地板系统的快速普及,进一步巩固了其在已开发地区和新兴地区的全球扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 79亿美元 |

| 复合年增长率 | 5.9% |

涂料产业在2024年创造了10.3亿美元的市场规模,预计到2034年将继续以7.2%的复合年增长率成长。涂料、黏合剂和密封剂对于多种材料(包括木材、瓷砖、复合地板和乙烯基)的地板安装和保护仍然至关重要。随着人们对排放的认识不断提高,企业正在创新低VOC和快速固化的黏合剂配方,从而推动住宅和商业建筑的需求。水性和生物基黏合剂的产品进步因其对环境的影响最小以及对各种地板类型的适应性而备受青睐。

预计2025年至2034年期间,乙烯基地板市场的复合年增长率将达到6.8%。这种地板解决方案因其多功能性和高回弹性而发展势头强劲,而背衬、粘合剂和表面涂层方面的化学创新则提升了其在潮湿和人流量大区域的性能。其他热门地板类型,例如地毯,在抗菌处理和低排放材料方面也取得了进展,以符合绿色建筑标准和公共卫生期望。

美国地板化学品市场占80%的市场份额,2024年市场规模达7.116亿美元。由于强劲的房屋建设、翻新趋势以及对高性能地板系统的需求,美国地板化学品产业蓬勃发展。由于气候条件多样,且各地区建筑规范各不相同,涂料、底漆和黏合剂的创新着重于气候适应型和结构专用型解决方案。这使得美国成为地板化学品技术创新的重要枢纽。

全球地板化学品市场的领导公司包括西卡股份公司、巴斯夫股份公司、陶氏化学公司、汉高股份公司和 3M 公司。地板化学品市场的主要参与者正在投资研发,以开发具有更低 VOC 排放和更高耐用性的先进配方。他们正在转向更绿色的化学品,以遵守不断变化的法规并满足消费者对永续产品日益增长的需求。正在与地板材料製造商和建筑公司建立策略合作伙伴关係,以创建针对不同安装需求的整合解决方案。公司正在透过在高成长地区开设新的製造工厂和加强分销网络来扩大其全球影响力。包括即时分析和智慧物流在内的数位转型正在提高营运效率。现在的行销策略主要集中在环保地板化学品的环境和健康效益,以吸引商业买家和有环保意识的消费者的注意。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 黏合剂

- 水性黏合剂

- 溶剂型黏合剂

- 聚氨酯基/湿气固化黏合剂

- 粉末黏合剂

- 热熔胶

- 密封剂

- 硅酮密封胶

- 聚氨酯密封胶

- 丙烯酸密封胶

- 丁基密封胶

- 涂料

- 环氧涂料

- 聚氨酯涂料

- 聚天门冬胺酸涂料

- 丙烯酸涂料

- 抗菌涂层

- 底漆和表面处理

- 环氧底漆

- 丙烯酸底漆

- 聚氨酯底漆

- 表面处理化学品

- 底层和平滑化合物

- 自流平化合物

- 防潮层

- 隔音垫层

- 地板饰面和抛光剂

- 水性涂料

- 溶剂型涂饰剂

- 紫外线固化涂层

- 保养抛光剂

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 硬木地板

- 强化木地板

- 乙烯基地板

- 地毯地板

- 磁砖和石材地板

- 混凝土地板

- 其他地板类型

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 独栋住宅

- 多户住宅

- 翻新和改造

- 商业的

- 办公大楼

- 零售空间

- 饭店业

- 医疗保健设施

- 教育机构

- 工业的

- 生产设施

- 仓库和配送中心

- 食品加工厂

- 製药设施

- 化学加工厂

第八章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 常规化学系统

- 传统环氧体系

- 标准聚氨酯配方

- 常规丙烯酸体系

- 先进化学技术

- 奈米科技增强配方

- 智慧功能涂料

- 自修復材料

- 抗菌技术

- 永续和生物基系统

- 生物基聚氨酯

- 植物性黏合剂

- 再生材料配方

- 低VOC和零VOC系统

- 专业和高性能係统

- 耐化学腐蚀配方

- 耐高温系统

- 防静电和导电系统

- 装饰和美学系统

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 埃及

第十章:公司简介

- BASF SE

- Sika AG

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- 3M Company

- Sherwin-Williams Company

- Mapei SpA

- HB Fuller Company

- RPM International Inc.

- Arkema Group

The Global Flooring Chemicals Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 7.9 billion by 2034. The market is rapidly evolving due to a shift toward eco-friendly materials and low-emission chemical formulations. As sustainability becomes a core focus, manufacturers are developing advanced flooring solutions with reduced VOC levels and increased bio-based content to meet both environmental regulations and changing consumer expectations. Smart manufacturing techniques and digital tools are being integrated into production to ensure greater process efficiency, quality control, and responsiveness to demand.

Increasing digitalization is enabling real-time monitoring, improved supply chain coordination, and precise targeting of customer needs. The push for high-performance, durable, and sustainable flooring materials is fueling widespread demand across residential, commercial, and industrial construction. Flooring chemicals such as resins, coatings, and adhesives are central to improving floor aesthetics, wear resistance, and functionality under varying environmental loads. The market is benefiting from strong innovation and rapid adoption of flooring systems that combine resilience, easy maintenance, and minimal environmental impact, further reinforcing its global expansion across developed and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.9% |

The coatings segment generated USD 1.03 billion in 2024 and is expected to continue growing at 7.2% CAGR through 2034. Coatings, adhesives, and sealants remain critical to floor installation and protection across multiple materials including wood, tile, laminate, and vinyl. With rising awareness around emissions, companies are innovating low-VOC and fast-curing adhesive formulations, boosting demand across both residential and commercial construction. Product advancements in water-based and bio-based adhesives have gained traction for their minimal environmental footprint and adaptability across diverse flooring types.

The vinyl flooring segment is expected to grow at a CAGR of 6.8% from 2025 to 2034. This flooring solution is gaining momentum due to its versatility and resilience, enhanced by chemical innovations in backings, adhesives, and surface coatings that boost performance in moisture-prone and high-traffic areas. Other popular flooring types, like carpet, are seeing advancements in antimicrobial treatments and low-emission materials to align with green building standards and public health expectations.

United States Flooring Chemicals Market held 80% share and generated USD 711.6 million in 2024. The U.S. flooring chemicals sector is thriving on the back of strong housing construction, renovation trends, and demand for performance-based flooring systems. With its diverse climate and varying construction codes across regions, innovation in coatings, primers, and adhesives is focused on climate-resilient and structure-specific solutions. This has positioned the U.S. as a key hub for innovation in flooring chemical technologies.

Leading companies in the Global Flooring Chemicals Market include Sika AG, BASF SE, The Dow Chemical Company, Henkel AG & Co. KGaA, and 3M Company. Major players in the flooring chemicals market are investing in R&D to develop advanced formulations with lower VOC emissions and improved durability. They are shifting toward greener chemistries to comply with evolving regulations and to meet rising consumer demand for sustainable products. Strategic partnerships with flooring material manufacturers and construction firms are being formed to create integrated solutions tailored to diverse installation needs. Companies are expanding their global footprints by opening new manufacturing facilities in high-growth regions and strengthening distribution networks. Digital transformation, including real-time analytics and smart logistics, is enhancing operational efficiency. Marketing strategies now focus heavily on the environmental and health benefits of eco-conscious flooring chemicals to capture the attention of both commercial buyers and environmentally aware consumers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Applications

- 2.2.4 End use

- 2.2.5 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Kilo tons)

- 5.1 Key trends

- 5.2 Adhesives

- 5.2.1 Water-based adhesives

- 5.2.2 Solvent-based adhesives

- 5.2.3 Urethane-based/moisture-cure adhesives

- 5.2.4 Powder adhesives

- 5.2.5 Hot-melt adhesives

- 5.3 Sealants

- 5.3.1 Silicone sealants

- 5.3.2 Polyurethane sealants

- 5.3.3 Acrylic sealants

- 5.3.4 Butyl sealants

- 5.4 Coatings

- 5.4.1 Epoxy coatings

- 5.4.2 Polyurethane coatings

- 5.4.3 Polyaspartic coatings

- 5.4.4 Acrylic coatings

- 5.4.5 Antimicrobial coatings

- 5.5 Primers and surface preparation

- 5.5.1 Epoxy primers

- 5.5.2 Acrylic primers

- 5.5.3 Polyurethane primers

- 5.5.4 Surface preparation chemicals

- 5.6 Underlayments and smoothing compounds

- 5.6.1 Self-leveling compounds

- 5.6.2 Moisture barriers

- 5.6.3 Sound dampening underlayments

- 5.7 Floor finishes and polishes

- 5.7.1 Water-based finishes

- 5.7.2 Solvent-based finishes

- 5.7.3 UV-cured finishes

- 5.7.4 Maintenance polishes

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Kilo tons)

- 6.1 Key trends

- 6.2 Hardwood flooring

- 6.3 Laminate flooring

- 6.4 Vinyl flooring

- 6.5 Carpet flooring

- 6.6 Tile and stone flooring

- 6.7 Concrete flooring

- 6.8 Other flooring types

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Kilo tons)

- 7.1 Key trends

- 7.2 Residential

- 7.2.1 Single-family homes

- 7.2.2 Multi-family residential

- 7.2.3 Renovation and remodeling

- 7.3 Commercial

- 7.3.1 Office buildings

- 7.3.2 Retail spaces

- 7.3.3 Hospitality

- 7.3.4 Healthcare facilities

- 7.3.5 Educational institutions

- 7.4 Industrial

- 7.4.1 Manufacturing facilities

- 7.4.2 Warehouses and distribution centers

- 7.4.3 Food processing plants

- 7.4.4 Pharmaceutical facilities

- 7.4.5 Chemical processing plants

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Kilo tons)

- 8.1 Key trends

- 8.2 Conventional chemical systems

- 8.2.1 Traditional epoxy systems

- 8.2.2 Standard polyurethane formulations

- 8.2.3 Conventional acrylic systems

- 8.3 Advanced chemical technologies

- 8.3.1 Nanotechnology-enhanced formulations

- 8.3.2 Smart and functional coatings

- 8.3.3 Self-healing materials

- 8.3.4 Antimicrobial technologies

- 8.4 Sustainable and bio-based systems

- 8.4.1 Bio-based polyurethanes

- 8.4.2 Plant-based adhesives

- 8.4.3 Recycled content formulations

- 8.4.4 Low-voc and zero-voc systems

- 8.5 Specialty and high-performance systems

- 8.5.1 Chemical-resistant formulations

- 8.5.2 High-temperature resistant systems

- 8.5.3 Anti-static and conductive systems

- 8.5.4 Decorative and aesthetic systems

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Kilo tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 Russia

- 9.3.6 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Philippines

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Sika AG

- 10.3 Henkel AG & Co. KGaA

- 10.4 The Dow Chemical Company

- 10.5 3M Company

- 10.6 Sherwin-Williams Company

- 10.7 Mapei S.p.A.

- 10.8 H.B. Fuller Company

- 10.9 RPM International Inc.

- 10.10 Arkema Group