|

市场调查报告书

商品编码

1797691

泌尿科设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Urology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

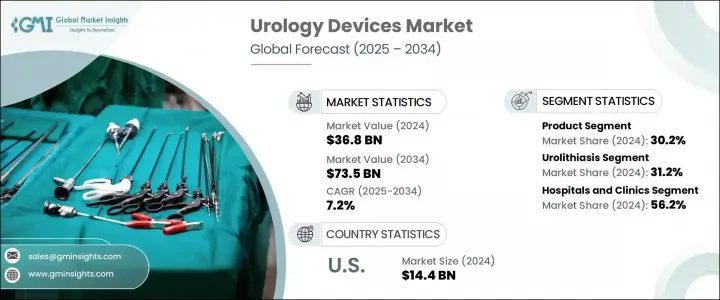

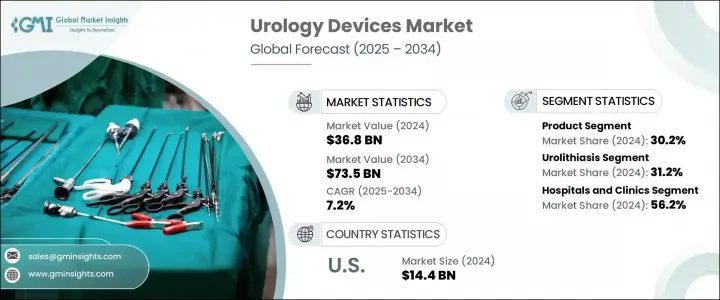

2024年,全球泌尿科设备市场规模达368亿美元,预计2034年将以7.2%的复合年增长率成长,达到735亿美元。该市场的成长轨迹主要受泌尿科疾病发病率激增的驱动,包括肾结石、良性前列腺增生 (BPH) 和尿失禁。泌尿健康意识的提升,加上全球人口老化,进一步推动了泌尿科设备需求的成长。诊断和治疗方案的技术进步,以及微创手术和居家照护的转变,是先进泌尿科设备日益普及的关键因素。

医疗保健提供者越来越依赖智慧数据驱动的工具来改善患者治疗效果并降低手术风险。公营和私营部门也正在增加对泌尿科服务的投资,以扩展泌尿科服务,并将机器人和人工智慧融入临床工作流程。随着全球医疗保健支出的不断增长以及对个人化医疗解决方案的需求不断增长,泌尿科设备市场预计将在各种医疗环境中呈现强劲增长势头。该领域的设备在支持患者更快康復、改善患者舒适度和提高诊断准确性方面发挥核心作用,以满足日益增长的患者群体的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 368亿美元 |

| 预测值 | 735亿美元 |

| 复合年增长率 | 7.2% |

泌尿科器械是用于诊断、监测及治疗泌尿道及男性生殖系统相关疾病的专用仪器。这些医疗工具广泛用于结石碎裂、膀胱功能检测、尿流监测和摄护腺治疗等手术。它们广泛部署于外科中心、医院和专科泌尿科诊所,这些地方拥有先进的基础设施,能够支援大量的手术和术后护理。

预计到2034年,雷射碎石设备市场将以8%的复合年增长率成长,这得益于市场对微创治疗方案的需求,这些方案能够提供精准的干预、更快的癒合速度和更少的併发症。这些设备用户友好且经济高效,使其成为结石管理和其他泌尿外科干预措施的首选。这些设备使医生能够接触和治疗整个泌尿道系统,包括肾臟、膀胱、尿道和输尿管,从而提供高度针对性的治疗效果。

2024年,医院和诊所细分市场占据56.2%的市场份额,这得益于其处理复杂手术、提供先进技术和提供专业护理的能力。这些机构仍然是急诊和常规泌尿外科病例的首选治疗点,因为它们能够支持大量患者,并提供全面的诊断和手术方案。它们对尖端技术的投入和对创新的承诺,使其成为市场持续扩张的核心。

2024年,欧洲泌尿科设备市场规模达到99亿美元,这得益于泌尿科疾病发生率的上升,尤其是在老年人群中。欧盟医疗器材法规 (MDR) 框架下的强有力监管政策强化了产品安全性和有效性的重要性,进一步增强了医疗专业人士的信心。政府旨在扩大机器人辅助手术可及性并支持微创技术创新的倡议,也推动了整个地区的市场需求。

全球泌尿科设备市场的一些主要参与者包括 Intuitive Surgical、Richard Wolf、Dornier MedTech、Olympus Corporation、Cook Medical、Ambu、Siemens Healthineers、BESDATA、NIPRO、Coloplast、Laborie Medical Technologies、Teleflex、B. Braun、Boston Scientific Corporation 和 HugeMed。泌尿科设备市场的领先公司非常注重持续创新,推出根据患者特定需求量身定制的更智慧、更安全、更有效率的设备。许多公司正在透过整合数位诊断和机器人系统来增强其产品线,以提供具有更好结果的微创解决方案。与医院、研究机构和技术开发商的策略合作伙伴关係正在帮助他们扩大产品范围并支持产品开发管道。这些参与者也透过本地化製造、分销网络和法规遵从措施在新兴市场扩张。研发投资加上泌尿科设备的即时资料整合对于提高手术成功率和营运效率至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 泌尿系统疾病盛行率上升

- 提高认识和早期诊断

- 治疗设备的技术进步

- 居家透析和门诊手术的需求不断增长

- 产业陷阱与挑战

- 严格的监管障碍

- 农村地区交通受限

- 市场机会

- 扩大门诊及微创手术

- 诊断工具需求增加

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 产品

- 内视镜

- 膀胱镜

- 一次性的

- 可重复使用的

- 输尿管镜

- 一次性的

- 可重复使用的

- 膀胱镜

- 雷射和碎石设备

- 透析设备

- 其他产品

- 内视镜

- 配件

- 导管

- 支架

- 润滑剂和凝胶

- 其他配件

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 泌尿系统结石

- 尿道恶性肿瘤

- 膀胱疾病

- 肾臟疾病

- 性功能障碍

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 透析中心

- 居家照护环境

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Ambu

- B. Braun

- BESDATA

- Boston Scientific Corporation

- Coloplast

- Cook Medical

- Dornier MedTech

- HugeMed

- Intuitive Surgical

- Laborie Medical Technologies

- NIPRO

- Olympus Corporation

- Richard Wolf

- Siemens Healthineers

- Teleflex

The Global Urology Devices Market was valued at USD 36.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 73.5 billion by 2034. The growth trajectory of this market is being driven by a surge in urological conditions, including kidney stones, benign prostatic hyperplasia (BPH), and urinary incontinence. Rising awareness of urinary health, coupled with an aging global population, is further driving demand. Technological progress in diagnostics and treatment options, along with a shift toward minimally invasive procedures and home-based care, are key contributors to the rising adoption of advanced urology devices.

Healthcare providers are increasingly relying on smart, data-enabled tools to support patient outcomes and reduce surgical risks. The market is also seeing greater investment from both public and private sectors to expand urological services and integrate robotics and AI in clinical workflows. With increasing global healthcare spending and a demand for personalized medical solutions, the urology device market is expected to experience strong momentum across diverse care settings. Devices in this space are playing a central role in supporting faster recovery, improved patient comfort, and enhanced diagnostic accuracy for a growing patient base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.8 Billion |

| Forecast Value | $73.5 Billion |

| CAGR | 7.2% |

Urology devices are specialized instruments used to diagnose, monitor, and treat conditions related to the urinary tract and the male reproductive system. These medical tools are used extensively for procedures such as stone fragmentation, bladder function testing, urinary flow monitoring, and prostate treatments. They are widely deployed in surgical centers, hospitals, and specialty urology clinics where advanced infrastructure supports high procedure volumes and post-operative care.

The laser and lithotripsy devices segment is forecasted to grow at a CAGR of 8% through 2034, propelled by the demand for minimally invasive treatment options that provide precise intervention, faster healing, and fewer complications. Their user-friendly design and cost-efficiency have made them highly preferred for stone management and other urologic interventions. These devices allow physicians to access and treat conditions across the entire urinary tract, including the kidneys, bladder, urethra, and ureters, offering highly targeted therapeutic outcomes.

In 2024, the hospitals and clinics segment accounted for a 56.2% share, fueled by their ability to handle complex procedures, offer advanced technology, and deliver specialized care. These facilities remain the first point of treatment for both emergency and routine urological cases, given their ability to support a high number of patients and provide comprehensive diagnostic and surgical options. Their investment in cutting-edge technologies and commitment to innovation make them central to the market's continued expansion.

Europe Urology Devices Market reached USD 9.9 billion in 2024, driven by a rising incidence of urologic disorders, particularly among elderly populations. Strong regulatory policies under the EU Medical Device Regulation (MDR) framework have reinforced the importance of product safety and efficacy, further boosting confidence among healthcare professionals. Government initiatives aimed at expanding access to robotic-assisted surgeries and supporting innovations in minimally invasive technologies are also propelling market demand across the region.

Some of the key players in the Global Urology Devices Market include Intuitive Surgical, Richard Wolf, Dornier MedTech, Olympus Corporation, Cook Medical, Ambu, Siemens Healthineers, BESDATA, NIPRO, Coloplast, Laborie Medical Technologies, Teleflex, B. Braun, Boston Scientific Corporation, and HugeMed. Leading companies in the urology devices market are heavily focused on continuous innovation, introducing smarter, safer, and more efficient devices tailored to patient-specific needs. Many firms are enhancing their product lines by integrating digital diagnostics and robotic systems to offer minimally invasive solutions with improved outcomes. Strategic partnerships with hospitals, research institutes, and technology developers are helping them expand their product reach and support product development pipelines. These players are also expanding in emerging markets through localized manufacturing, distribution networks, and regulatory compliance initiatives. Investment in R&D, coupled with real-time data integration in urology devices, has been pivotal in improving procedural success and operational efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of urological disorders

- 3.2.1.2 Increasing awareness and early diagnosis

- 3.2.1.3 Technological advancements in therapeutic devices

- 3.2.1.4 Growing demand for home dialysis and outpatient procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory hurdles

- 3.2.2.2 Limited access in rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and minimally invasive procedures

- 3.2.3.2 Increased demand for diagnostic tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Endoscopes

- 5.2.1.1 Cystoscopes

- 5.2.1.1.1 Disposable

- 5.2.1.1.2 Reusable

- 5.2.1.2 Ureteroscopes

- 5.2.1.2.1 Disposable

- 5.2.1.2.2 Reusable

- 5.2.1.1 Cystoscopes

- 5.2.2 Laser and lithotripsy devices

- 5.2.3 Dialysis devices

- 5.2.4 Other products

- 5.2.1 Endoscopes

- 5.3 Accessories

- 5.3.1 Catheters

- 5.3.2 Stents

- 5.3.3 Lubricants and gels

- 5.3.4 Other accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urolithiasis

- 6.3 Urethral malignancies

- 6.4 Bladder disorders

- 6.5 Kidney diseases

- 6.6 Erectile dysfunction

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Dialysis centers

- 7.4 Home care settings

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ambu

- 9.2 B. Braun

- 9.3 BESDATA

- 9.4 Boston Scientific Corporation

- 9.5 Coloplast

- 9.6 Cook Medical

- 9.7 Dornier MedTech

- 9.8 HugeMed

- 9.9 Intuitive Surgical

- 9.10 Laborie Medical Technologies

- 9.11 NIPRO

- 9.12 Olympus Corporation

- 9.13 Richard Wolf

- 9.14 Siemens Healthineers

- 9.15 Teleflex