|

市场调查报告书

商品编码

1797699

Compute Express Link (CXL) 组件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Compute Express Link (CXL) Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

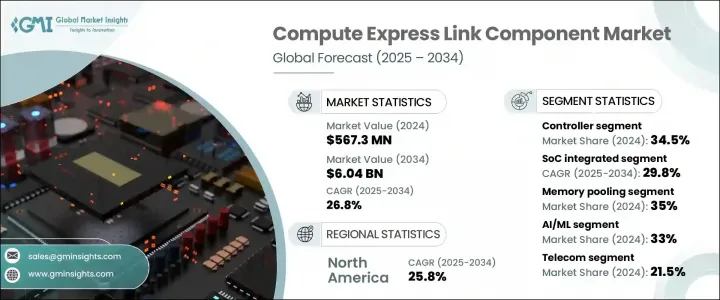

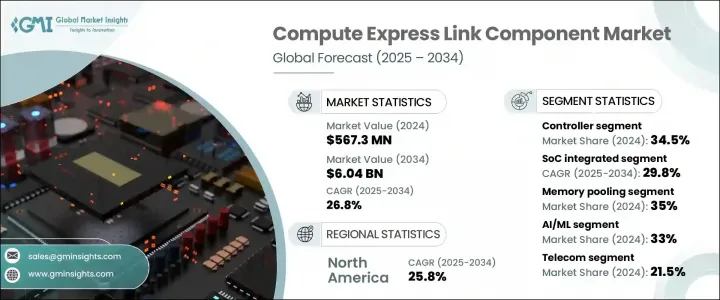

2024 年全球 Compute Express Link 组件市场价值为 5.6731 亿美元,预计到 2034 年将以 26.8% 的复合年增长率增长,达到 60.4 亿美元。这种快速扩张反映了现代资料中心对高效能运算、AI/ML 工作负载和记忆体分解的激增需求。 CXL 技术可实现灵活的记忆体架构和池化访问,使其成为下一代基础设施的关键驱动力。企业越来越多地寻求可扩展的记忆体管理,以避免冗余并降低硬体成本。 CXL 的池化记忆体模型出现在 2020 年代初,当时资料中心正在寻求更好的资源利用率。透过将计算与记忆体分离,过度配置变得不必要,从而实现了成本效益。由 CXL 支援的记忆体分层和可组合伺服器架构的创新正在重塑伺服器设计,促进跨节点动态共享记忆体和储存。

这项技术正在重塑资料中心架构,并为资源优化、效率和敏捷性树立全新标准。透过将记忆体与运算资源分离,它实现了前所未有的工作负载分配可扩展性和灵活性。这项转变支援即时资料处理、高频宽连线以及跨系统的动态资源共享,从而大幅降低延迟和基础设施成本。此外,它还透过最大限度地减少閒置资源和简化营运工作流程,打造更节能的环境。随着企业追求更快的创新週期和更智慧的资源利用,这项技术进步将成为下一代软体定义资料中心的基础要素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.6731亿美元 |

| 预测值 | 60.4亿美元 |

| 复合年增长率 | 26.8% |

2024年,网路介面控制器 (NIC) 市场规模远小于控制器,市占率为 5.9%,为 3,320 万美元,但成长非常迅速。 NIC 对于支援可组合系统中的低延迟互连至关重要。随着 CXL 的普及,NIC 在实现跨运算和记忆体层的可扩展、高吞吐量连接方面发挥着至关重要的作用,使其成为成长最快的元件类别。

预计到 2034 年,SoC 整合组件市场规模将达到 18 亿美元,成为成长最快的组件形式。基于 SoC 的 CXL 解决方案提供紧凑、节能的架构,是边缘和云端部署的理想选择。这些高密度模组可提高营运效率并节省空间,在尺寸或功率受限的领域更具吸引力,并支援精简的硬体配置,以满足现代运算需求。

美国计算快速连结 (CXL) 组件市场在 2024 年的产值达到 1.908 亿美元,预计到 2034 年将以 25.1% 的复合年增长率成长。云端服务的扩展以及对高阶运算和资料处理的需求正在推动这一成长。此外,美国资料中心的持续建置和升级也推动了对 CXL 等高速互连技术的需求,以满足不断变化的效能和可扩展性需求。

全球运算高速连结 (CXL) 组件市场的主要产业参与者包括英特尔公司、超微半导体公司 (AMD)、三星电子有限公司、美光科技公司、SK 海力士公司、Rambus 公司、Cadence 设计系统公司、澜起科技股份有限公司、Astera Labs、Mobiveil 公司、Marvell 科技公司和新思科技公司。 CXL 组件市场的领先公司优先考虑在开放产业标准、策略合作伙伴关係和产品创新方面的合作,以深化其市场占有率。许多公司正在与超大规模资料中心营运商和云端供应商结盟,以验证 CXL 设计并确保互通性。研发投资专注于提高速度、功率效率和整合能力,尤其是在 SoC 嵌入式 CXL 解决方案中。公司也利用併购来拓宽其产品组合和技术通路。扩大全球製造能力并与资料中心基础设施的部署保持一致,使提供者能够根据需求扩展规模。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 记忆体分解需求不断成长

- 加速人工智慧和机器学习工作负载

- 采用与 CXL 相容的伺服器平台

- CXL 2.0 和 3.0 标准的出现

- 超大规模和 HPC 基础设施的成长

- 产业陷阱与挑战

- 高成本和供应链复杂性

- 软体和生态系统准备滞后

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- CXL 开关

- 记忆体扩充器

- 控制器

- 重定时器

- 网路介面卡

- 其他的

第六章:市场估计与预测:依外形尺寸,2021 - 2034 年

- 主要趋势

- 附加卡

- 企业和资料中心标准外形尺寸

- SoC集成

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 记忆体池

- 加速器

- 分层记忆体架构

- 可组合基础设施

- 高速互连

- 其他的

第八章:市场估计与预测:按工作量,2021 - 2034 年

- 主要趋势

- 人工智慧/机器学习

- 高效能运算

- 数据分析

- 云端运算

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 电信

- 金融

- 卫生保健

- 石油和天然气

- 航太

- 其他的

第十章:市场估计与预测:按基础设施,2021 - 2034 年

- 主要趋势

- CSP/超大规模企业

- Neoclouds

- 企业资料中心

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- Advanced Micro Devices, Inc. (AMD)

- Astera Labs

- Cadence Design Systems, Inc.

- Intel Corporation

- Marvell Technology, Inc.

- Micron Technology, Inc.

- Microchip Technology Inc.

- Mobiveil, Inc.

- Montage Technology Co., Ltd.

- Rambus Inc.

- Samsung Electronics Co., Ltd

- SK hynix Inc.

- Synopsys, Inc.

The Global Compute Express Link Component Market was valued at USD 567.31 million in 2024 and is estimated to grow at a CAGR of 26.8% to reach USD 6.04 billion by 2034. This rapid expansion reflects surging demand for high-performance computing, AI/ML workloads, and memory disaggregation in modern data centers. CXL technology enables flexible memory architectures and pooled access, making it a key driver for next-generation infrastructure. Organizations are increasingly seeking scalable memory management to avoid redundancy and reduce hardware costs. CXL's pooled memory models emerged in the early 2020s as data centers sought better resource utilization. By decoupling compute from memory, overprovisioning becomes unnecessary, enabling cost efficiencies. Innovations in memory tiering and composable server architectures powered by CXL are reshaping server design, facilitating dynamic sharing of memory and storage across nodes.

The technology is reshaping data center architecture and setting new standards for resource optimization, efficiency, and agility. By decoupling memory from compute resources, it enables unprecedented scalability and flexibility in workload allocation. This shift supports real-time data processing, high-bandwidth connectivity, and dynamic resource sharing across systems-drastically reducing latency and infrastructure costs. It also fosters more energy-efficient environments by minimizing idle resources and streamlining operational workflows. As organizations strive for faster innovation cycles and smarter resource utilization, this advancement becomes a foundational element of next-generation, software-defined data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $567.31 Million |

| Forecast Value | $6.04 Billion |

| CAGR | 26.8% |

The network interface controller (NIC) segment was significantly smaller than controllers in 2024, capturing a 5.9% share with USD 33.2 million, but it is expanding very rapidly. NICs are essential to support low-latency interconnects in composable systems. As CXL becomes widespread, NICs play a vital role in enabling scalable, high-throughput connections across compute and memory tiers, positioning them as the fastest-growing component category.

The SoC-integrated component segment is projected to reach USD 1.8 billion by 2034, making it the fastest-growing form factor. SoC-based CXL solutions offer compact, energy-efficient architectures ideal for edge and cloud deployments. These high-density modules deliver operational efficiency and space savings, making them increasingly attractive where size or power constraints are critical, and enabling streamlined hardware configurations that support modern compute needs.

United States Compute Express Link (CXL) Component Market generated USD 190.8 million in 2024 and is forecast to grow at a CAGR of 25.1% through 2034. Expansion of cloud services and demand for advanced computing and data processing are driving growth. In addition, continued data center buildouts and upgrades in the U.S. are fueling demand for high-speed interconnect technologies like CXL to support evolving performance and scalability needs.

Key industry players in the Global Compute Express Link (CXL) Component Market include Intel Corporation, Advanced Micro Devices, Inc. (AMD), Samsung Electronics Co., Ltd, Micron Technology, Inc., SK hynix Inc., Rambus Inc., Cadence Design Systems, Inc., Montage Technology Co., Ltd., Astera Labs, Mobiveil, Inc., Marvell Technology, Inc., and Synopsys, Inc. Leading companies in the CXL component market are prioritizing collaboration on open industry standards, strategic partnerships, and product innovation to deepen their market presence. Many are forging alliances with hyperscale data center operators and cloud providers to validate CXL designs and ensure interoperability. R&D investments are focused on enhancing speed, power efficiency, and integration capabilities, especially in SoC-embedded CXL solutions. Firms are also leveraging mergers and acquisitions to broaden their portfolio and technological access. Expanding global manufacturing capabilities and aligning with data center infrastructure roll-outs allow providers to scale with demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising Demand for Memory Disaggregation

- 3.3.1.2 Acceleration of AI and Machine Learning Workloads

- 3.3.1.3 Adoption of CXL-Compatible Server Platforms

- 3.3.1.4 Emergence of CXL 2.0 and 3.0 Standards

- 3.3.1.5 Growth in Hyperscale and HPC Infrastructure

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Cost and Supply Chain Complexity

- 3.3.2.2 Software and Ecosystem Readiness Lag

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 CXL switches

- 5.3 Memory expanders

- 5.4 Controllers

- 5.5 Retimers

- 5.6 Network interface card

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form Factor, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Add-in card

- 6.3 Enterprise and datacenter standard form factor

- 6.4 SoC integrated

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Memory-pooling

- 7.3 Accelerators

- 7.4 Tiered memory architecture

- 7.5 Composable infrastructure

- 7.6 High-speed interconnect

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Workload, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 AI/ML

- 8.3 High performance computing

- 8.4 Data analytics

- 8.5 Cloud computing

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Telecom

- 9.3 Finance

- 9.4 Healthcare

- 9.5 Oil & Gas

- 9.6 Aerospace

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Infrastructure, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 CSP/Hyperscalers

- 10.3 Neoclouds

- 10.4 Enterprise datacenters

- 10.5 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Advanced Micro Devices, Inc. (AMD)

- 12.2 Astera Labs

- 12.3 Cadence Design Systems, Inc.

- 12.4 Intel Corporation

- 12.5 Marvell Technology, Inc.

- 12.6 Micron Technology, Inc.

- 12.7 Microchip Technology Inc.

- 12.8 Mobiveil, Inc.

- 12.9 Montage Technology Co., Ltd.

- 12.10 Rambus Inc.

- 12.11 Samsung Electronics Co., Ltd

- 12.12 SK hynix Inc.

- 12.13 Synopsys, Inc.