|

市场调查报告书

商品编码

1797706

光纤元件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fiber Optic Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

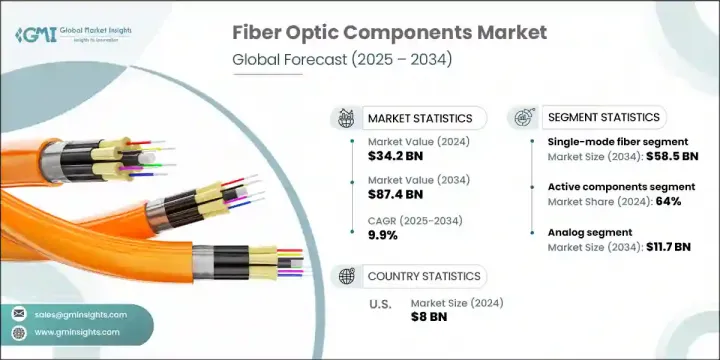

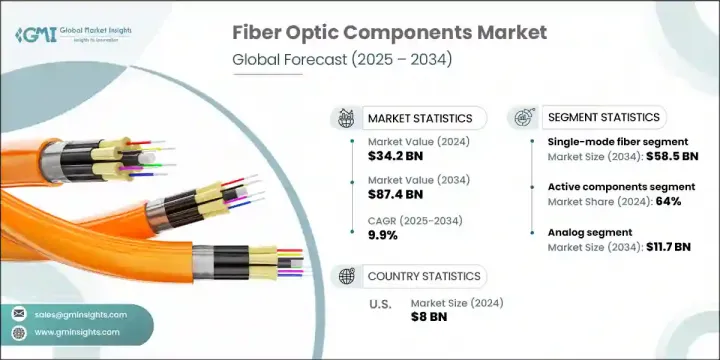

2024 年全球光纤元件市场价值为 342 亿美元,预计到 2034 年将以 9.9% 的复合年增长率增长至 874 亿美元。这一强劲成长主要得益于云端运算、边缘基础设施和超大规模资料中心扩张所带来的高速资料传输需求。物联网技术与工业和城市应用中互联生态系统的日益整合进一步增强了需求。随着各行各业实现现代化和数位转型,对快速、可靠通讯基础设施的需求正在推动多个行业采用光纤技术。各国政府(尤其是在发展中经济体)对宽频部署、智慧电网和数位服务的投资正在加速全球光纤元件市场的渗透。光纤基础设施在实现资料密集和延迟敏感型环境中的高效能连接方面发挥着至关重要的作用。

5G 的推出显着增加了对光纤组件的需求,尤其是在网路前传和回传领域。电信业者正在快速扩展其基础设施,以满足低延迟、高频宽的需求。光纤连接对于智慧城市框架、物联网、监控和数位服务平台也至关重要。这些变化推动了市场对能够提供无缝通讯和高弹性性能的组件的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 342亿美元 |

| 预测值 | 874亿美元 |

| 复合年增长率 | 9.9% |

2024年,有源元件领域占据光纤元件市场64%的领先份额。 5G网路、资料中心和城域光纤基础设施中收发器、放大器和调製器的大规模部署将继续推动该领域的发展。随着系统朝向更高的连接埠密度和更低的光学层功耗发展,对紧凑、节能设计的需求也日益增长。

预计到2034年,单模光纤市场规模将达585亿美元。其在长距离传输、低衰减以及城域网路和核心网路应用日益普及方面的优势,巩固了其重要性。海底通讯系统和5G回程基础设施的扩张显着促进了该领域的发展势头,尤其是在资料消费模式转向高吞吐量、云端原生应用的背景下。

2024年,美国光纤元件市场规模达80亿美元。人工智慧驱动的工作负载成长、业务快速迁移至云端以及下一代资料中心的扩张,正在推动对先进光纤解决方案的需求。美国国内供应商正致力于开发低延迟、高容量、热效率更高、跨平台互通性更强的光学元件,以满足不断变化的效能需求。

光纤元件市场的公司包括藤仓、Broadex Technologies、Ciena、思科系统、古河电工、光迅科技、康宁、3M、博通、安费诺和康普。为了巩固其在光纤元件市场的地位,主要参与者正在采取多管齐下的策略。领先的公司优先考虑研发投资,以提供针对人工智慧、云端运算和5G基础设施量身定制的紧凑、节能、高速的光学技术。与电信业者和超大规模企业的合作有助于将产品创新与部署需求结合。扩大製造能力并加强区域供应链可以缩短交付週期,并支持地方政府的数位化专案。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 物联网和连网设备的普及率不断提高

- 全球5G基础设施扩张

- 资料中心和云端运算服务的成长

- 智慧城市和智慧电网的普及

- 军事和航太应用的需求不断增长

- 产业陷阱与挑战

- 初始部署和安装成本高

- 网路基础设施管理的复杂性

- 市场机会

- 发展中经济体的新兴需求

- 光纤在5G及更高技术中的集成

- 高频宽应用(AR/VR、串流媒体、AI)的需求不断增长

- 光纤在国防和航太领域的应用

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按组件类型,2021 - 2034 年

- 主要趋势

- 主动元件

- 发射器

- 接收器

- 光放大器

- 被动元件

- 光纤电缆

- 连接器和适配器

- 耦合器和分离器

- 光开关

- 其他的

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 单模光纤

- 多模光纤

第七章:市场估计与预测:按资料传输速率,2021 - 2034 年

- 主要趋势

- 低于 10 GBPS

- 10 至 40 GBPS

- 40 至 100 GBPS

- 超过 100 GBPS

第八章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 类比光纤元件

- 数位光纤装置

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 电信和资料通信

- 长途传输网络

- 城域网路/核心网

- 接网路

- 移动回传/前传

- 企业网路(LAN/WAN)

- 其他的

- 资料中心和云端基础设施

- 资料中心内部连接

- 跨资料中心

- 高速收发器

- 储存区域网路 (SAN)

- 其他的

- 军事与国防

- 安全的战术通讯网络

- 雷达和感测器系统

- 指挥和控制系统

- 航空电子和海军通讯系统

- 其他的

- 医疗保健

- 医学影像系统

- 雷射传输系统

- 生物医学感测器和仪器

- 医院网路基础设施

- 其他的

- 工业自动化

- 工厂自动化和製程控製网络

- 机器人和机器视觉系统

- 遥感和监测

- 工业乙太网路

- 其他的

- 广播和视讯传输

- 现场活动广播基础设施

- 演播室到发射机链路 (STL)

- 有线电视和 IPTV 发行网络

- 室外转播车和移动製作

- 其他的

- 石油和天然气

- 井下光纤感

- 海底通讯链路

- 管道监测和洩漏检测系统

- 远端站点连线

- 其他的

- 航太

- 航空电子资料网络

- 卫星地面站连接

- 机上娱乐 (IFE) 系统

- 航天器光通讯系统

- 其他的

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Global Key Players

- Regional Key Players

- 利基市场参与者/颠覆者

- 3M

- 光迅科技

- 博德科技

- 立讯精密

- 奥普特森科技

- 先光

The Global Fiber Optic Components Market was valued at USD 34.2 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 87.4 billion by 2034. This robust growth is primarily driven by the increasing need for high-speed data transmission, fueled by the expansion of cloud computing, edge infrastructure, and hyperscale data centers. The rising integration of IoT technologies and connected ecosystems across industrial and urban applications is further strengthening demand. As industries modernize and shift towards digitalization, the need for fast, reliable communication infrastructure is driving the adoption of fiber optics across several sectors. Government investments in broadband rollout, smart grids, and digital services-especially in developing economies-are accelerating market penetration of fiber optic components globally. The role of fiber infrastructure has become essential in enabling high-performance connectivity across data-intensive and latency-sensitive environments.

The rollout of 5G is significantly increasing the need for fiber optic components, particularly in network fronthaul and backhaul segments. Telecom providers are rapidly scaling their infrastructure to meet low-latency, high-bandwidth requirements. Fiber-based connectivity is also critical for smart city frameworks, powering IoT, surveillance, and digital service platforms. These changes are pushing the market for components capable of delivering seamless communication and resilient performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.2 Billion |

| Forecast Value | $87.4 Billion |

| CAGR | 9.9% |

In 2024, the active components segment held the leading share of 64% in the fiber optic components market. High-volume deployment of transceivers, amplifiers, and modulators in 5G networks, data centers, and metro optical infrastructure continues to propel this segment. The demand for compact, energy-efficient designs is increasing as systems move toward higher port densities and reduced power consumption across optical layers.

The single-mode fiber optics segment is anticipated to generate USD 58.5 billion by 2034. Their advantage in long-range transmission, lower attenuation, and increasing use in metro and core network applications solidifies their relevance. The expansion of submarine communication systems and 5G backhaul infrastructure has significantly contributed to this segment's momentum, particularly as data consumption patterns shift toward high-throughput, cloud-native applications.

U.S. Fiber Optic Components Market was valued at USD 8 billion in 2024. Growth in AI-driven workloads, rapid migration to the cloud, and expansion of next-gen data centers are fueling demand for advanced fiber solutions. Domestic suppliers are focusing on developing low-latency, high-capacity optical components with better thermal efficiency and cross-platform interoperability to meet evolving performance requirements.

Companies operating in the Fiber Optic Components Market include Fujikura, Broadex Technologies, Ciena, Cisco Systems, Furukawa Electric, Accelink Technologies, Corning, 3M, Broadcom, Amphenol, and CommScope. To strengthen their presence in the Fiber Optic Components Market, key players are embracing a multi-pronged strategy. Leading companies are prioritizing R&D investments to deliver compact, energy-efficient, and high-speed optical technologies tailored for AI, cloud, and 5G infrastructure. Partnerships with telecom operators and hyperscalers help align product innovation with deployment needs. Expanding manufacturing capabilities and strengthening regional supply chains enable faster delivery cycles and support local government digitalization programs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component type trends

- 2.2.2 Type trends

- 2.2.3 Data transfer rate trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing penetration of IoT and connected devices

- 3.2.1.2 Expansion of 5G infrastructure globally

- 3.2.1.3 Growth in data centers and cloud computing services

- 3.2.1.4 Proliferation of smart cities and smart grids

- 3.2.1.5 Growing demand from military and aerospace applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial deployment and installation costs

- 3.2.2.2 Complexity in network infrastructure management

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging demand in developing economies

- 3.2.3.2 Integration of fiber optics in 5g and beyond technologies

- 3.2.3.3 Growing need for high-bandwidth applications (AR/VR, streaming, AI)

- 3.2.3.4 Adoption of fiber optics in defense and aerospace sectors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Active components

- 5.2.1 Transmitters

- 5.2.2 Receivers

- 5.2.3 Optical amplifiers

- 5.3 Passive components

- 5.3.1 Fiber optic cables

- 5.3.2 Connectors & adapters

- 5.3.3 Couplers & splitters

- 5.3.4 Optical switches

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Single-mode fiber

- 6.3 Multi-mode fiber

Chapter 7 Market Estimates and Forecast, By Data Transfer Rate, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Less than 10 GBPS

- 7.3 10 to 40 GBPS

- 7.4 40 to 100 GBPS

- 7.5 More than 100 GBPS

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Analog fiber optic components

- 8.3 Digital fiber optic components

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 Telecommunications & data communication

- 9.2.1 Long-haul transmission networks

- 9.2.2 Metro/core networks

- 9.2.3 Access networks

- 9.2.4 Mobile backhaul / fronthaul

- 9.2.5 Enterprise networks (LAN/WAN)

- 9.2.6 Others

- 9.3 Data centers & cloud infrastructure

- 9.3.1 Intra-data center connectivity

- 9.3.2 Inter-data center

- 9.3.3 High-speed transceivers

- 9.3.4 Storage area networks (SAN)

- 9.3.5 Others

- 9.4 Military & defense

- 9.4.1 Secure tactical communication networks

- 9.4.2 Radar & sensor systems

- 9.4.3 Command and control systems

- 9.4.4 Avionics and naval communication systems

- 9.4.5 Others

- 9.5 Medical & healthcare

- 9.5.1 Medical imaging systems

- 9.5.2 Laser delivery systems

- 9.5.3 Biomedical sensors & instrumentation

- 9.5.4 Hospital network infrastructure

- 9.5.5 Others

- 9.6 Industrial automation

- 9.6.1 Factory automation and process control networks

- 9.6.2 Robotics & machine vision systems

- 9.6.3 Remote sensing and monitoring

- 9.6.4 Industrial Ethernet

- 9.6.5 Others

- 9.7 Broadcasting & video transmission

- 9.7.1 Live event broadcasting infrastructure

- 9.7.2 Studio-to-transmitter links (STL)

- 9.7.3 Cable TV & IPTV distribution networks

- 9.7.4 Outside broadcast (OB) vans & mobile production

- 9.7.5 Others

- 9.8 Oil & gas

- 9.8.1 Downhole fiber optic sensing

- 9.8.2 Subsea communication links

- 9.8.3 Pipeline monitoring & leak detection systems

- 9.8.4 Remote site connectivity

- 9.8.5 Others

- 9.9 Aerospace

- 9.9.1 Avionics data networks

- 9.9.2 Satellite ground station connectivity

- 9.9.3 In-flight entertainment (IFE) systems

- 9.9.4 Spacecraft optical communication systems

- 9.9.5 Others

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Broadcom

- 11.1.2 Cisco Systems

- 11.1.3 Corning

- 11.1.4 Fujikura

- 11.1.5 Huawei Technologies

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Ciena

- 11.2.1.2 CommScope

- 11.2.1.3 Lumentum Holdings

- 11.2.1.4 Viavi Solutions

- 11.2.1.5 TE Connectivity

- 11.2.2 Europe

- 11.2.2.1 Amphenol

- 11.2.2.2 Molex

- 11.2.2.3 Prysmian Group

- 11.2.3 APAC

- 11.2.3.1 Furukawa Electric

- 11.2.3.2 Sumitomo Electric

- 11.2.3.3 ZTE

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 3Ms

- 11.3.2 Accelink Technologies

- 11.3.3 Broadex Technologies

- 11.3.4 Luxshare-ICT

- 11.3.5 Optosun Technology

- 11.3.6 Senko