|

市场调查报告书

商品编码

1797718

特色水果和浆果市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Specialty Fruits and Berries Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

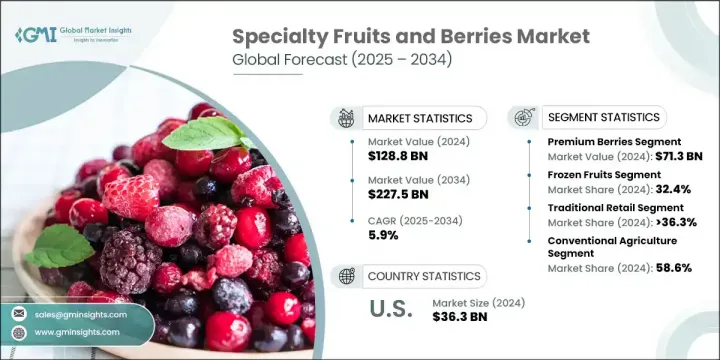

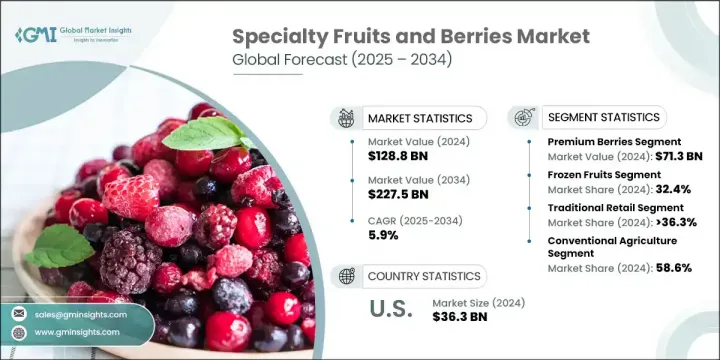

2024年,全球特色水果和莓果市场价值达1,288亿美元,预计到2034年将以5.9%的复合年增长率成长,达到2,275亿美元。市场扩张受到消费者对营养丰富食品偏好变化、种植方法进步以及分销模式转变的影响。消费者越来越青睐富含抗氧化剂、维生素和植物营养素的水果和浆果,这推动了对新鲜、加工和功能性食品领域优质和外来品种的需求。随着注重健康的饮食习惯的兴起,对超级水果的需求持续增长。分销通路不断发展,在传统零售、直销、餐饮服务和批发通路之间寻求平衡。虽然传统农业仍然占主导地位,但为了满足日益增长的城市消费需求,人们正在显着转向有机生产、保护性种植和水耕。欧洲正在加强其在有机和温室种植方面的布局,而亚太地区正迅速采用水耕系统。受消费者健康趋势和先进食品加工创新的支撑,北美仍然是最大的市场,而亚太地区正在成为成长最快的地区。

蓝莓占了37.3%的市场份额,这主要得益于需求旺盛和供应有限,尤其是在北美和欧洲。预计2034年,草莓市场规模将达342亿美元,复合年增长率为4.8%。草莓和覆盆子无论是新鲜还是加工形式,需求都持续旺盛,而接骨木果和枸杞等不太常见的浆果在营养保健品和补充剂领域也越来越受欢迎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1288亿美元 |

| 预测值 | 2275亿美元 |

| 复合年增长率 | 5.9% |

2024 年,特种水果和浆果市场的冷冻水果占最大份额,为 32.4%。冷冻水果的便利性、全年供应以及保留营养和风味的能力使其成为餐饮服务运营和注重价值的消费者家庭的必备品。

美国特色水果和莓果市场占80.1%的市场份额,2024年产值达363亿美元。美国对有机和新鲜特色水果的需求居于领先地位,零售和餐饮服务市场蓬勃发展。美国消费者对进口异国水果和功能性食品创新的兴趣日益浓厚,进一步推动了消费趋势和市场多元化。

全球特色水果和莓果市场的主要主导者包括 Driscoll's Inc.、Berry World Group、Exotic Tropical Fruits LLC、Costa Group Holdings Limited 和 Dole Food Inc.。为了扩大市场份额,特色水果和浆果行业的公司正在采取多项重点策略。这些策略包括:投资保护性和有机种植方法,以确保全年供应和永续性合规性;透过引进外来且营养丰富的品种来丰富产品组合;以及与餐饮服务和零售巨头建立策略合作伙伴关係。领先的公司也在加强其冷链物流和采后技术,以在全球分销过程中维持产品品质。此外,对品牌建立、品牌故事和可追溯性的投资——尤其是对高端和有机产品线——继续在加强跨地区市场定位和消费者信任方面发挥核心作用。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 消费者对奇异且营养丰富的水果和浆果的需求不断增加。

- 人们的健康意识日益增强,对天然、功能性食品的偏好也日益增强。

- 拓展全球高端零售和电子商务分销管道。

- 植物性饮食的日益普及促进了特色水果的消费。

- 产业陷阱与挑战

- 易腐烂性和复杂的冷链物流增加了营运成本。

- 新兴市场的认知度和可及性有限,限制了市场的成长。

- 市场机会

- 果汁、果酱和补充品等加值产品的创新。

- 随着可支配收入的增加,向尚未开发的市场扩张。

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 优质莓果

- 蓝莓

- 草莓

- 覆盆子

- 其他(枸杞、巴西莓、接骨木果)

- 异国水果和热带水果

- 火龙果

- 百香果

- 其他(猕猴桃、石榴)

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 冷冻水果

- 干燥和脱水产品

- 果汁和饮料

- 粉末和萃取物

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 生鲜消费及零售

- 食品加工和製造

- 营养保健品和补充品产业

- 化妆品和个人护理应用

- 餐饮和酒店业

- 工业和 B2B 应用

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 传统零售通路

- 直接面向消费者的管道

- 餐饮服务分销

- 批发和B2B频道

第九章:市场估计与预测:按种植管道,2021 - 2034 年

- 主要趋势

- 传统农业

- 有机栽培

- 温室及保护地栽培

- 水耕和无土系统

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Berry World Group

- Costa Group Holdings Limited

- Dole Food Inc

- Driscoll's Inc.

- Exotic Tropical Fruits LLC

- Frutos Tropicales Europe

- Hortifrut SA

- Naturipe Farms LLC

- Omer Decugis & Cie

- Planasa

- TFC Holland

- Wish Farms

The Global Specialty Fruits and Berries Market was valued at USD 128.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 227.5 billion by 2034. Market expansion is being shaped by changing consumer preferences toward nutrient-dense foods, advancements in cultivation methods, and a shift in distribution models. Consumers are increasingly drawn to fruits and berries rich in antioxidants, vitamins, and phytonutrients, driving demand for premium and exotic varieties across fresh, processed, and functional food applications. Demand for superfruits continues to rise in response to wellness-focused diets. Distribution continues to evolve, balancing between traditional retail, direct-to-consumer, foodservice, and wholesale channels. While conventional farming remains dominant, there's a notable transition toward organic production, protected cultivation, and hydroponics to meet rising urban consumption. Europe is strengthening its footprint in organic and greenhouse cultivation, whereas Asia-Pacific is rapidly adopting hydroponic systems. North America remains the largest market, supported by consumer health trends and advanced food processing innovation, while Asia-Pacific is emerging as the fastest-growing region.

The blueberries segment held 37.3% share, driven by high demand and limited supply, especially in North America and Europe. The strawberry market is projected to reach USD 34.2 billion by 2034, growing at a CAGR of 4.8%. Strawberries and raspberries continue to see high demand in both fresh and processed formats, while less common berries such as elderberry and goji are gaining popularity in nutraceutical and supplement segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.8 Billion |

| Forecast Value | $227.5 Billion |

| CAGR | 5.9% |

The frozen fruits segment from the specialty fruits and berries market represented the largest share at 32.4% in 2024. Their convenience, year-round availability, and ability to retain nutrition and flavor have made them essential in foodservice operations and value-conscious consumer households.

U.S. Specialty Fruits and Berries Market held 80.1% share and generated USD 36.3 billion in 2024. The country leads in demand for organic and fresh specialty fruits, with a robust retail and foodservice market. U.S. consumers have shown growing interest in exotic imports and functional food innovations, further pushing consumption trends and market diversity.

Key players dominating the Global Specialty Fruits and Berries Market include Driscoll's Inc., Berry World Group, Exotic Tropical Fruits LLC, Costa Group Holdings Limited, and Dole Food Inc. To expand their market presence, companies operating in the specialty fruits and berries sector are adopting several focused strategies. These include investing in protected and organic farming methods to ensure year-round supply and sustainability compliance, diversifying their product portfolios with exotic and nutrient-dense varieties, and forming strategic partnerships with foodservice and retail giants. Leading firms are also enhancing their cold chain logistics and post-harvest technologies to preserve quality during global distribution. Furthermore, investment in branding, storytelling, and traceability-especially for premium and organic lines-continues to play a central role in reinforcing market positioning and consumer trust across geographies.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Form type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.2.5 Cultivation channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for exotic and nutrient-rich fruits and berries.

- 3.2.1.2 Growing health awareness and preference for natural, functional foods.

- 3.2.1.3 Expansion of premium retail and e-commerce distribution channels globally.

- 3.2.1.4 Increasing popularity of plant-based diets boosting specialty fruit consumption.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High perishability and complex cold chain logistics increase operational costs.

- 3.2.2.2 Limited awareness and accessibility in emerging markets restrict market growth.

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in value-added products like juices, jams, and supplements.

- 3.2.3.2 Expansion into untapped markets with rising disposable incomes.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion, Tons)

- 5.1 Key trends

- 5.2 Premium berries

- 5.2.1 Blueberries

- 5.2.2 Strawberries

- 5.2.3 Raspberries

- 5.2.4 Others (goji, acai, elderberry)

- 5.3 Exotic & tropical fruits

- 5.3.1 Dragon fruit

- 5.3.2 Passion fruit

- 5.3.3 Others (kiwi, pomegranate)

Chapter 6 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Billion, Tons)

- 6.1 Key trends

- 6.2 Frozen fruits

- 6.3 Dried and dehydrated products

- 6.4 Juice and beverage

- 6.5 Powder and extract

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Tons)

- 7.1 Key trends

- 7.2 Fresh consumption and retail

- 7.3 Food processing and manufacturing

- 7.4 Nutraceutical and supplement industry

- 7.5 Cosmetic and personal care applications

- 7.6 Foodservice and hospitality

- 7.7 Industrial and B2B applications

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Tons)

- 8.1 Key trends

- 8.2 Traditional retail channels

- 8.3 Direct-to-consumer channels

- 8.4 Foodservice distribution

- 8.5 Wholesale and B2B channels

Chapter 9 Market Estimates & Forecast, By Cultivation Channel, 2021 - 2034 (USD Billion, Tons)

- 9.1 Key trends

- 9.2 Conventional agriculture

- 9.3 Organic cultivation

- 9.4 Greenhouse and protected cultivation

- 9.5 Hydroponic and soilless systems

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Berry World Group

- 11.2 Costa Group Holdings Limited

- 11.3 Dole Food Inc

- 11.4 Driscoll's Inc.

- 11.5 Exotic Tropical Fruits LLC

- 11.6 Frutos Tropicales Europe

- 11.7 Hortifrut S.A.

- 11.8 Naturipe Farms LLC

- 11.9 Omer Decugis & Cie

- 11.10 Planasa

- 11.11 TFC Holland

- 11.12 Wish Farms