|

市场调查报告书

商品编码

1797719

永续造纸化学品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sustainable Paper Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

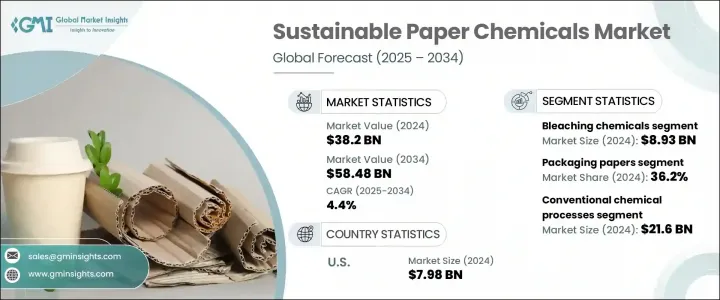

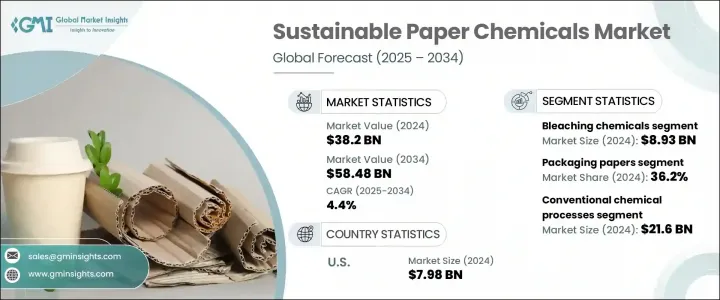

2024年,全球永续造纸化学品市场规模达382亿美元,预计到2034年将以4.4%的复合年增长率成长,达到584.8亿美元。全球对环保解决方案的日益青睐,持续提升了造纸业对永续替代方案的需求。源自再生资源、有助于降低用水量和提高能源效率的化学品,与全球清洁生产的努力相契合。人们对生态挑战的认识不断提高,环保法规日益严格,以及循环经济模式的日益推进,正在推动人们转向永续配方。

随着製造商逐渐放弃使用传统的造纸添加剂,转而使用可生物降解、可回收且无毒的替代品,预计造纸市场将持续扩张。这些进步不仅改善了造纸生产的生态影响,也提升了纸製品在耐用性、印刷品质和可回收性方面的功能。世界各国政府也加大对绿色化学替代品和功能性添加剂研究的投资,进一步强化了造纸产业对永续转型的承诺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 382亿美元 |

| 预测值 | 584.8亿美元 |

| 复合年增长率 | 4.4% |

2024年,包装纸市场占36.2%。随着对环保涂料、阻隔剂和强度增强剂的需求加速成长,该市场经历了快速成长。这些材料既能保持包装性能,又能支持可回收性和可堆肥性。线上零售和外送服务的兴起,进一步加剧了对兼具功能性和永续发展目标的纸包装的需求。品牌越来越倾向于使用生物基化学原料,以减少对环境的影响,同时满足防潮性、耐用性和适印性等性能要求。

传统化学加工领域在2024年创造了216亿美元的产值。这些成熟的方法凭藉其可扩展性、成本优势以及易于融入现有造纸厂营运的优势,依然占据主导地位。虽然这些系统根植于传统,但它们正在受到监管改革的影响而不断发展,监管改革要求采用更清洁、更有资源的生产方式。生物技术、奈米技术和人工智慧驱动的生产监控等创新技术正被用于进一步优化製造週期中化学品的使用。因此,传统方法正逐渐适应永续性指标,同时又不影响营运的连续性。

2024年,美国永续造纸化学品市场产值达79.8亿美元,主要得益于永续造纸化学品市场的推动。美国的地位源于其发达的生产基础设施、对法规合规性的重视以及消费者对环保纸张和包装产品日益增长的偏好。印刷、包装和出版领域大规模采用绿色化学技术,进一步推动了市场需求。同时,加拿大正在稳步发展,其区域计画正在推广清洁技术和循环经济实践,鼓励当地造纸生产商转向更安全、可再生的化学投入。

塑造永续造纸化学品市场竞争格局的关键公司包括陶氏、索理思有限责任公司、SNF集团、巴克曼国际实验室公司、凯米拉公司、亚什兰全球控股公司、诺力昂、艺康公司、科莱恩股份公司和巴斯夫欧洲公司。永续造纸化学品市场的领导企业正在采取多管齐下的策略,以创造强大的全球影响力。这些公司正在大力投资研发,以开发符合不断变化的监管标准和可持续发展基准的先进生物基和可生物降解化学品。扩大生产能力并建立区域合作伙伴关係,使他们能够完善分销网络并进入新兴市场。策略性收购和合资企业也被用于将绿色化学解决方案整合到更广泛的产品组合中。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依材料类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 漂白化学品

- 二氧化氯

- 过氧化氢

- 氧基漂白剂

- 酶基漂白系统

- 涂料化学品

- 淀粉基涂料

- 乳胶涂料

- 阻隔涂层

- 生物基涂层解决方案

- 製程化学品

- 製浆化学品

- 脱墨化学品

- 浮选化学品

- 清洁化学品

- 功能化学品

- 湿强剂

- 干强剂

- 助留助滤剂

- 施胶剂

- 特种添加物

- 消泡剂

- 杀菌剂

- 腐蚀抑制剂

- pH 控製剂

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 包装纸

- 瓦楞包装

- 折迭纸盒

- 食品包装

- 工业包装

- 纸巾和卫生用品

- 面纸

- 卫生纸

- 纸巾

- 餐巾

- 印刷和书写用纸

- 涂布纸

- 无涂布纸

- 新闻纸

- 书籍论文

- 特种纸

- 安全文件

- 滤纸

- 装饰纸

- 技术论文

第七章:市场估计与预测:按技术,2021-2034 年

- 主要趋势

- 传统化学工艺

- 牛皮纸製浆

- 亚硫酸盐製浆

- 机械製浆

- 永续化学工艺

- 酶促过程

- 生物基化学工艺

- 绿色化学应用

- 闭环系统

- 新兴技术

- 奈米科技应用

- 生物技术解决方案

- 数位过程控制

- 人工智慧集成

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料业

- 食品包装

- 饮料包装

- 速食店

- 医疗保健和製药

- 医疗包装

- 医药包装

- 医疗保健卫生产品

- 消费品

- 个人护理产品

- 家居用品

- 电子商务包装

- 工业应用

- 汽车产业

- 电子业

- 建筑业

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Kemira Oyj

- BASF SE

- Solenis LLC

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- Ecolab Inc.

- SNF Group

- Ashland Global Holdings Inc.

- Clariant AG

- Dow Inc.

- Buckman Laboratories International, Inc.

The Global Sustainable Paper Chemicals Market was valued at USD 38.2 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 58.48 billion by 2034. The increasing global preference for environmentally responsible solutions continues to elevate demand for sustainable alternatives in paper manufacturing. Chemicals derived from renewable sources that support lower water consumption and energy efficiency are aligning well with global efforts toward cleaner production. Rising awareness of ecological challenges, stricter environmental mandates, and a growing push toward circular economy models are reinforcing the switch to sustainable formulations.

The market is expected to experience continuous expansion as manufacturers shift away from conventional paper-making additives in favor of biodegradable, recyclable, and non-toxic substitutes. These advancements are not only improving the ecological impact of paper production but are also boosting the functional capabilities of paper products in terms of durability, print quality, and recyclability. Governments around the world are also channeling investments into research for green chemical alternatives and functional additives, further strengthening the paper sector's commitment to sustainable transformation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.2 Billion |

| Forecast Value | $58.48 Billion |

| CAGR | 4.4% |

In 2024, the packaging paper segment represented a 36.2% share. This segment has witnessed rapid growth as demand accelerates for eco-friendly coatings, barrier agents, and strength enhancers that maintain package performance while supporting recyclability and compostability. The rise of online retail and food delivery services has only intensified the need for paper packaging that is both functional and compliant with sustainability goals. Brands are increasingly leaning toward bio-based chemical inputs that reduce their environmental footprint while still meeting performance expectations for moisture resistance, durability, and printability.

The conventional chemical processing segment generated USD 21.6 billion in 2024. These well-established methods remain dominant due to their scalability, cost advantages, and ease of integration into existing paper mill operations. While rooted in tradition, these systems are evolving under the influence of regulatory reforms that demand cleaner, more resource-efficient practices. Innovations-such as biotechnology, nanotechnology, and AI-driven production monitoring-are being applied to further optimize the use of chemicals in the manufacturing cycle. As a result, conventional methods are gradually adapted to meet sustainability metrics without disrupting operational continuity.

United States Sustainable Paper Chemicals Market generated USD 7.98 billion in 2024, driven by the sustainable paper chemicals market. The country's position stems from its well-developed production infrastructure, emphasis on regulatory compliance, and growing consumer preference for environmentally safe paper and packaging products. Demand is being further driven by large-scale adoption of green chemistry across printing, packaging, and publishing segments. Meanwhile, Canada is experiencing steady progress as regional programs promote cleaner technologies and circular practices, encouraging local paper producers to transition toward safer, renewable chemical inputs.

Key companies shaping the competitive landscape of the Sustainable Paper Chemicals Market include Dow Inc., Solenis LLC, SNF Group, Buckman Laboratories International, Inc., Kemira Oyj, Ashland Global Holdings Inc., Nouryon, Ecolab Inc., Clariant AG, and BASF SE. Leading players in the sustainable paper chemicals market are adopting multi-pronged strategies to build a strong global presence. These companies are heavily investing in R&D to develop advanced bio-based and biodegradable chemicals that align with evolving regulatory standards and sustainability benchmarks. Expanding production capacities and forming regional partnerships allow them to improve distribution networks and access emerging markets. Strategic acquisitions and joint ventures are also being used to integrate green chemistry solutions into broader portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 End use industry trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Bleaching chemicals

- 5.2.1 Chlorine dioxide

- 5.2.2 Hydrogen peroxide

- 5.2.3 Oxygen-based bleaching agents

- 5.2.4 Enzyme-based bleaching systems

- 5.3 Coating chemicals

- 5.3.1 Starch-based coatings

- 5.3.2 Latex coatings

- 5.3.3 Barrier coatings

- 5.3.4 Bio-based coating solutions

- 5.4 Process chemicals

- 5.4.1 Pulping chemicals

- 5.4.2 Deinking chemicals

- 5.4.3 Flotation chemicals

- 5.4.4 Cleaning chemicals

- 5.5 Functional chemicals

- 5.5.1 Wet strength agents

- 5.5.2 Dry strength agents

- 5.5.3 Retention and drainage aids

- 5.5.4 Sizing agents

- 5.6 Specialty additives

- 5.6.1 Defoamers

- 5.6.2 Biocides

- 5.6.3 Corrosion inhibitors

- 5.6.4 Ph control agents

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Packaging papers

- 6.2.1 Corrugated packaging

- 6.2.2 Folding cartons

- 6.2.3 Food packaging

- 6.2.4 Industrial packaging

- 6.3 Tissue and hygiene products

- 6.3.1 Facial tissue

- 6.3.2 Toilet paper

- 6.3.3 Paper towels

- 6.3.4 Napkins

- 6.4 Printing and writing papers

- 6.4.1 Coated papers

- 6.4.2 Uncoated papers

- 6.4.3 Newsprint

- 6.4.4 Book papers

- 6.5 Specialty papers

- 6.5.1 Security papers

- 6.5.2 Filter papers

- 6.5.3 Decorative papers

- 6.5.4 Technical papers

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Conventional chemical processes

- 7.2.1 Kraft pulping

- 7.2.2 Sulfite pulping

- 7.2.3 Mechanical pulping

- 7.3 Sustainable chemical processes

- 7.3.1 Enzymatic processes

- 7.3.2 Bio-based chemical processes

- 7.3.3 Green Chemistry applications

- 7.3.4 Closed-loop systems

- 7.4 Emerging technologies

- 7.4.1 Nanotechnology applications

- 7.4.2 Biotechnology solutions

- 7.4.3 Digital process control

- 7.4.4 Artificial intelligence integration

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Food and beverage industry

- 8.2.1 Food packaging

- 8.2.2 Beverage packaging

- 8.2.3 Quick service restaurants

- 8.3 Healthcare and pharmaceuticals

- 8.3.1 Medical packaging

- 8.3.2 Pharmaceutical packaging

- 8.3.3 Healthcare hygiene products

- 8.4 Consumer Goods

- 8.4.1 Personal care products

- 8.4.2 Household products

- 8.4.3 E-commerce packaging

- 8.5 Industrial applications

- 8.5.1 Automotive industry

- 8.5.2 Electronics industry

- 8.5.3 Construction industry

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Kemira Oyj

- 10.2 BASF SE

- 10.3 Solenis LLC

- 10.4 Nouryon (formerly AkzoNobel Specialty Chemicals)

- 10.5 Ecolab Inc.

- 10.6 SNF Group

- 10.7 Ashland Global Holdings Inc.

- 10.8 Clariant AG

- 10.9 Dow Inc.

- 10.10 Buckman Laboratories International, Inc.