|

市场调查报告书

商品编码

1797730

沥青添加剂市场机会、成长动力、产业趋势分析及2025-2034年预测Asphalt Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

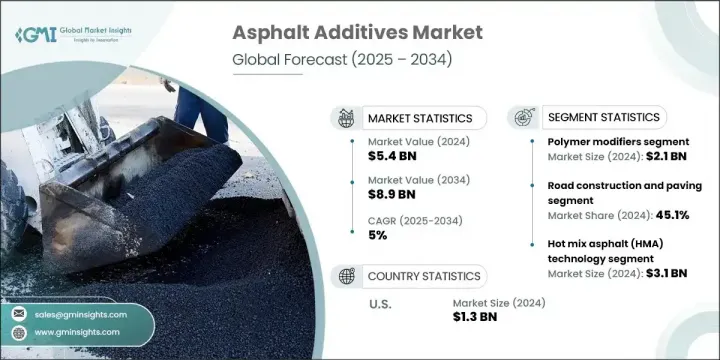

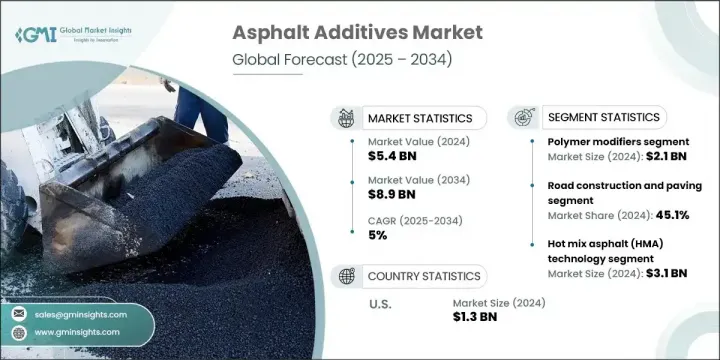

2024年,全球沥青添加剂市场规模达54亿美元,预计2034年将以5%的复合年增长率成长,达到89亿美元。随着全球大型基础设施项目的增多,对兼具耐用性、可持续性和成本效益的沥青解决方案的需求持续增长。再生剂、抗剥落剂和聚合物改质剂等添加剂越来越多地用于增强沥青混合料的抗车辙、抗开裂和抗湿气损害性能。各国政府正在转向这些材料,以期在控制长期维护预算的同时延长道路的使用寿命。

随着低温混合技术和再生材料的广泛使用成为行业标准,环保法规正在塑造该领域的创新。沥青添加剂不仅因其性能优势,还因其环境优势(包括降低排放和减少能耗)而日益受到青睐。生物基和奈米改质替代品的兴起进一步契合了全球绿色建筑实践的目标。在现代化基础设施和渐进式建筑政策的支持下,北美仍然是领先的市场。同时,欧洲在这一领域也发展迅速,因为它推行以永续性为重点的建筑标准,并强调循环经济模式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 54亿美元 |

| 预测值 | 89亿美元 |

| 复合年增长率 | 5% |

2024年,聚合物改质剂市场规模达21亿美元。它们在沥青增强领域持续占据主导地位,源自于其能够增强弹性和强度,同时在交通繁忙和恶劣天气下抵抗变形。这些添加剂可以无缝融入现有的沥青配方,帮助道路保持长期性能,最大程度地减少对路面的干扰。

2024年,道路建设和铺路产业占45.1%。该行业的成长反映了市场对耐用、高性能道路的需求成长,这些道路能够承受高交通负荷和不断变化的天气模式。在新建城市道路和高速公路基础设施项目中,使用聚合物改质和抗剥落添加剂对于提高路面耐久性和抗裂性仍然至关重要。

2024年,美国沥青添加剂市场规模达13亿美元。由于其完善的道路系统、清晰的监管方向以及公共和私营部门在交通升级方面不断增加的投资,该地区继续保持领先地位。美国的研究和创新工作重点是开发可持续的高性能材料,以降低维护要求并增强基础设施的韧性。这一趋势主要源自于对气候适应型道路网络和环保建筑材料(包括温拌技术和下一代聚合物配方)的迫切需求。

沥青添加剂市场呈现温和整合趋势,巴斯夫欧洲公司、阿科玛集团、赢创工业股份公司、英杰维蒂公司和杜邦公司等领先公司在该领域占有重要地位。沥青添加剂领域的领先公司正在投资永续产品创新,专注于开发低挥发性有机化合物 (VOC)、生物基和温拌相容性添加剂。这些公司正积极拓展研发能力,以满足日益增长的气候适应型道路基础设施需求。许多公司正在与基础设施开发商和政府机构建立合作伙伴关係,试行符合环保准则并延长道路使用寿命的先进添加剂配方。地域扩张仍然是一项核心策略,各公司透过分销合作伙伴关係和本地生产瞄准新兴市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依材料类型

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 聚合物改质剂

- 苯乙烯-丁二烯-苯乙烯(SBS)

- 苯乙烯-丁二烯橡胶(sbr)

- 乙烯醋酸乙烯酯 (eva)

- 聚乙烯和聚丙烯

- 其他聚合物改质剂

- 抗剥落剂

- 胺类药剂

- 石灰基药剂

- 磷酸衍生物

- 有机硅烷化合物

- 乳化剂和表面活性剂

- 阴离子乳化剂

- 阳离子乳化剂

- 非离子乳化剂

- 温拌沥青添加剂

- 蜡基添加剂

- 化学添加物

- 发泡添加剂

- 再生剂和再循环剂

- 奈米材料添加剂

- 奈米二氧化硅

- 奈米黏土

- 碳奈米管

- 石墨烯和氧化石墨烯

- 生物基和可持续添加剂

- 其他特种添加剂

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 道路建设和铺设

- 公路建设

- 城市道路建设

- 农村公路基础设施

- 道路维护和修復

- 表面处理

- 覆盖应用程式

- 裂缝密封和修復

- 机场跑道建设

- 屋顶应用

- 商业屋顶

- 住宅屋顶

- 工业屋顶

- 防水密封

- 其他应用

第七章:市场估计与预测:按技术,2021-2034 年

- 主要趋势

- 热拌沥青(hma)技术

- 温拌沥青(WMA)技术

- 冷拌沥青技术

- 半温拌沥青混合料技术

- 回收技术

- 就地热回收

- 就地冷再生

- 植物基回收

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Arkema Group

- BASF SE

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- Ingevity Corporation

- Kraton Corporation

- Honeywell International Inc.

- The Dow Chemical Company

- Sasol Limited

The Global Asphalt Additives Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 8.9 billion by 2034. As large-scale infrastructure projects increase worldwide, demand continues to rise for asphalt solutions that offer durability, sustainability, and cost-effectiveness. Additives such as rejuvenators, anti-stripping agents, and polymer modifiers are increasingly used to enhance asphalt mixtures by improving resistance to rutting, cracking, and moisture-related damage. Governments are turning to these materials as they seek to extend the lifespan of roads while keeping long-term maintenance budgets under control.

Environmental mandates are shaping innovation in this sector, as lower-temperature mixing technologies and greater use of recycled materials become standard. Asphalt additives are gaining traction not only for their performance benefits but also for their environmental advantages, including lower emissions and reduced energy usage. The rise of bio-based and nano-modified alternatives further aligns with global goals for greener construction practices. North America remains the leading market, backed by modern infrastructure and progressive construction policies. Meanwhile, Europe is rapidly advancing in this space as it enforces sustainability-focused construction standards and emphasizes circular economy models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 billion |

| Forecast Value | $8.9 billion |

| CAGR | 5% |

The polymer modifiers segment generated USD 2.1 billion in 2024. Their continued dominance in asphalt enhancement stems from the ability to boost elasticity and strength while resisting deformation under intense traffic and severe weather. These additives blend seamlessly into existing asphalt formulations and help roads maintain long-term performance with minimal disruption.

The road construction and paving segment represented a 45.1% share in 2024. The sector's growth reflects increased demand for long-lasting, high-performance roads that can withstand both heavy traffic loads and shifting weather patterns. Use of polymer-modified and anti-stripping additives remains essential for delivering surface durability and crack resistance in new urban roadways and highway infrastructure projects.

United States Asphalt Additives Market generated USD 1.3 billion in 2024. The region continues to lead thanks to its robust road systems, clear regulatory direction, and rising public and private sector investment in transportation upgrades. Research and innovation efforts in the country are focused on developing sustainable, high-performance materials that lower maintenance requirements while enhancing infrastructure resilience. This trend is largely driven by the urgent need for climate-adapted road networks and environmentally conscious construction materials, including warm mix technologies and next-generation polymer formulations.

The Asphalt Additives Market shows moderate consolidation, with leading companies such as BASF SE, Arkema Group, Evonik Industries AG, Ingevity Corporation, and DuPont de Nemours, Inc. playing a major role in the sector. Leading firms in the asphalt additives space are investing in sustainable product innovation, focusing on the development of low-VOC, bio-based, and warm mix-compatible additives. These companies are actively expanding R&D capabilities to address the growing demand for climate-resilient road infrastructure. Many are forming partnerships with infrastructure developers and government agencies to pilot advanced additive formulations that meet environmental guidelines and improve road longevity. Geographic expansion remains a core strategy, with companies targeting emerging markets through distribution partnerships and local production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo tons)

- 5.1 Key trends

- 5.2 Polymer modifiers

- 5.2.1 Styrene-butadiene-styrene (sbs)

- 5.2.2 Styrene-butadiene rubber (sbr)

- 5.2.3 Ethylene vinyl acetate (eva)

- 5.2.4 Polyethylene and polypropylene

- 5.2.5 Other polymer modifiers

- 5.3 Anti-stripping agents

- 5.3.1 Amine-based agents

- 5.3.2 Lime-based agents

- 5.3.3 Phosphoric acid derivatives

- 5.3.4 Organosilane compounds

- 5.4 Emulsifiers and surfactants

- 5.4.1 Anionic emulsifiers

- 5.4.2 Cationic emulsifiers

- 5.4.3 Non-ionic emulsifiers

- 5.5 Warm mix asphalt additives

- 5.5.1 Wax-based additives

- 5.5.2 Chemical-based additives

- 5.5.3 Foaming additives

- 5.6 Rejuvenators and recycling agents

- 5.7 Nanomaterial additives

- 5.7.1 Nanosilica

- 5.7.2 Nanoclay

- 5.7.3 Carbon nanotubes

- 5.7.4 Graphene and graphene oxide

- 5.8 Bio-based and sustainable additives

- 5.9 Other specialty additives

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo tons)

- 6.1 Key trends

- 6.2 Road construction and paving

- 6.2.1 Highway construction

- 6.2.2 Urban road development

- 6.2.3 Rural road infrastructure

- 6.3 Road maintenance and rehabilitation

- 6.3.1 Surface treatments

- 6.3.2 Overlay applications

- 6.3.3 Crack sealing and repair

- 6.4 Airport runway construction

- 6.5 Roofing applications

- 6.5.1 Commercial roofing

- 6.5.2 Residential roofing

- 6.5.3 Industrial roofing

- 6.6 Waterproofing and sealing

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo tons)

- 7.1 Key trends

- 7.2 Hot mix asphalt (hma) technology

- 7.3 Warm mix asphalt (wma) technology

- 7.4 Cold mix asphalt technology

- 7.5 Half-warm mix asphalt technology

- 7.6 Recycling technologies

- 7.6.1 Hot in-place recycling

- 7.6.2 Cold in-place recycling

- 7.6.3 Plant-based recycling

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 United Kingdom

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema Group

- 9.2 BASF SE

- 9.3 DuPont de Nemours, Inc.

- 9.4 Evonik Industries AG

- 9.5 Nouryon (formerly AkzoNobel Specialty Chemicals)

- 9.6 Ingevity Corporation

- 9.7 Kraton Corporation

- 9.8 Honeywell International Inc.

- 9.9 The Dow Chemical Company

- 9.10 Sasol Limited