|

市场调查报告书

商品编码

1797740

近场通讯 (NFC) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Near Field Communication (NFC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

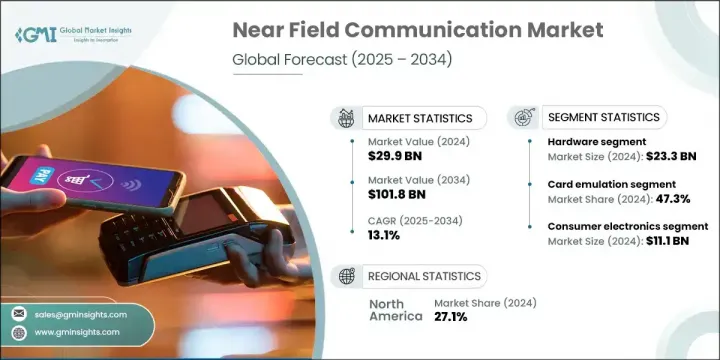

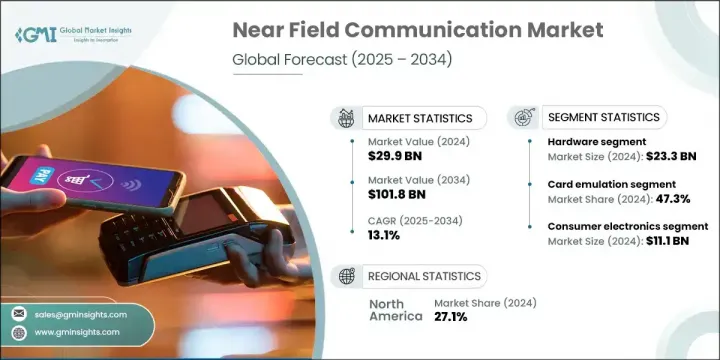

2024年,全球近场通讯市场规模达299亿美元,预计到2034年将以13.1%的复合年增长率成长,达到1,018亿美元。市场成长的动力源自于NFC技术在各类消费性电子产品中的日益普及。从穿戴式装置、平板电脑到笔记型电脑和智慧电视,这项技术正成为安全身份验证、无缝内容共享和快速设备配对的核心推动力。截至2024年,全球已有超过40亿台NFC设备被广泛使用,这充分证明了其在消费科技领域的稳固地位。

这种普及程度进一步巩固了NFC作为非接触式互动和快速无线通讯首选方式的地位。随着製造商不断提升其设备的连接性和用户便利性,NFC整合在塑造用户体验和提升产品价值方面发挥着至关重要的作用。激增的需求也推动了晶片设计领域的投资,各大公司致力于提供针对不同用例的紧凑、高效、安全的解决方案。数位转型的不断发展以及非接触式技术在个人和企业环境中的快速普及,进一步巩固了产业发展动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 299亿美元 |

| 预测值 | 1018亿美元 |

| 复合年增长率 | 13.1% |

2024年,硬体市场规模达233亿美元。这一领先地位得益于NFC读写器、晶片和标籤快速整合到越来越多的平台中,包括销售点终端、车载控制台和消费性设备。随着工业自动化和互联物联网生态系统寻求快速、低功耗的无线资料交换工具,该市场正日益受到关注。为了保持竞争力,企业正在将资源投入到下一代硬体研发中,尤其是在晶片小型化和低能耗等领域。这项发展也为与电子产品製造商建立策略合作伙伴关係创造了途径,进一步支援NFC的广泛部署,并使设备製造商能够将先进的NFC功能嵌入到紧凑的设计中。

受数位支付和交通门禁系统广泛应用的推动,卡片模拟领域在2024年占据了47.3%的市场份额。利用此功能的设备可以模拟非接触式卡,为消费者提供便利安全的日常交易介面。零售、行动旅游和金融服务等行业正在采用基于NFC的类比系统,以减少摩擦并提升客户体验。供应商目前正致力于透过在其平台中整合先进的标记化技术、嵌入式安全元件和简化的身份验证来增强其产品服务。

2024年,美国近场通讯 (NFC) 市场规模达71亿美元。该地区市场的成长主要得益于行动装置普及率的上升以及各行业POS基础设施的现代化。除零售业外,NFC在汽车技术、医疗保健、交通通道和安全门禁系统等领域的应用也正在开闢新的成长路径。 NFC在美国的广泛应用证明了其在消费者和商业环境中的灵活性和长期价值。企业正在将这项技术融入更多日常体验中,协助其在支付领域以外的应用规模化发展。

近场通讯 (NFC) 市场的知名企业包括英飞凌科技、博通公司、高通科技和恩智浦半导体。主要的 NFC 解决方案供应商正在大力投资先进的晶片设计,以支援超低功耗和更小尺寸,确保其能够顺利整合到紧凑型设备中。各公司正与金融科技公司和消费性电子产品製造商建立策略联盟,以开发针对行动支付、门禁控制和汽车应用的客製化解决方案。多协定 NFC 平台的开发也日益受到重视,以应对全球市场的各种通讯标准和安全要求。供应商正在扩大生产能力,并增强在亚太和欧洲等高成长地区的分销网络。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 衝击力

- 成长动力

- 非接触式支付解决方案的采用率不断上升

- NFC技术在消费性电子产品中的扩展

- NFC 在零售和电子商务中的应用日益增多

- NFC在医疗保健领域的应用扩展

- NFC 在交通运输的应用日益增多

- 产业陷阱与挑战

- 实施和整合成本高

- 来自替代无线通讯技术的竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 市场集中度分析

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依供应量,2021-2034

- 主要趋势

- 硬体

- NFC晶片/IC

- NFC标籤

- NFC读取器

- 天线和收发器

- 其他的

- 软体

- 服务

- 系统整合与部署

- 咨询与顾问服务

- 託管服务和支持

- 其他的

第六章:市场估计与预测:依营运模式,2021-2034 年

- 主要趋势

- 阅读器模拟

- 点对点

- 卡模拟

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 付款

- 存取控制

- 配对和调试

- 身份和身份验证

- 智慧海报和行销

- 物联网配置和管理

- 其他

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 消费性电子产品

- 智慧型手机

- 穿戴式装置

- 个人电脑和笔记型电脑

- 智慧电视和媒体设备

- 其他的

- 零售与电子商务

- 非接触式POS终端

- 智慧货架和互动式资讯亭

- 产品认证和防伪标籤

- 点击提货和最后一英里物流

- 大众运输票务系统

- 其他的

- 运输和物流

- 停车和收费系统

- 车辆出入和车队管理

- 资产追踪

- 乘客资讯和智慧标牌

- 冷链监控

- 其他的

- 银行和金融服务

- 行动钱包平台

- 安全身分证与门禁卡

- 支援 NFC 的 ATM 和分行自助服务终端

- 标记化服务

- 其他的

- 卫生保健

- 支援NFC的医疗设备

- 医药包装

- 患者参与工具

- 其他的

- 汽车

- 车载设备配对

- 设备维护和服务标籤

- 远端资讯处理解决方案

- 其他的

- 工业和製造业

- 工具和资产追踪系统

- 安全设施存取和员工身份识别

- 产品配置

- 仓库和库存自动化

- 其他的

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Global Key Players

- Regional Key Players

- 利基市场参与者/颠覆者

- 身分

- 麦格泰克

- 塔吉奥斯

- 务实半导体

The Global Near Field Communication Market was valued at USD 29.9 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 101.8 billion by 2034. Market growth is being fueled by the increasing incorporation of NFC across a diverse range of consumer electronic products. From wearables and tablets to laptops and smart televisions, the technology is becoming a core enabler for secure authentication, seamless content sharing, and fast device pairing. The widespread use of over 4 billion NFC-enabled devices worldwide as of 2024 illustrates its strong foothold in consumer technology.

This level of adoption continues to reinforce NFC's position as the preferred method for touchless interaction and quick wireless communication. As manufacturers continue to enhance the connectivity and user convenience of their devices, NFC integration plays a critical role in shaping user experience and driving product value. The demand surge is also motivating investments in chip design, with companies working to deliver compact, efficient, and secure solutions tailored to different use cases. Industry momentum is further sustained by growing digital transformation and the rapid proliferation of contactless technologies in both personal and enterprise environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $101.8 Billion |

| CAGR | 13.1% |

The hardware segment generated USD 23.3 billion in 2024. This leadership is tied to the rapid integration of NFC readers, chips, and tags into a growing spectrum of platforms, including point-of-sale terminals, automotive consoles, and consumer devices. The segment is gaining traction as industrial automation and connected IoT ecosystems seek fast, low-power, wireless data exchange tools. To stay competitive, businesses are channeling resources into next-gen hardware R&D, particularly in areas like chip miniaturization and low energy consumption. This evolution also creates avenues for strategic partnerships with electronics makers, further supporting widespread deployment and enabling device manufacturers to embed advanced NFC features into compact designs.

The card emulation segment held a 47.3% share in 2024, fueled by widespread use of digital payments and transit access systems. Devices leveraging this functionality mimic contactless cards, offering a convenient and secure interface for consumers to carry out everyday transactions. Industries across retail, mobility, and financial services are adopting NFC-based emulation systems to reduce friction and improve customer experience. Vendors are now focusing on strengthening their offerings by integrating advanced tokenization, embedded secure elements, and simplified identity verification into their platforms.

United States Near Field Communication (NFC) Market was valued at USD 7.1 billion in 2024. Market growth in the region is largely propelled by the uptick in mobile device adoption and the modernization of POS infrastructure across industries. Beyond retail, NFC applications in automotive technology, healthcare, transit access, and secure entry systems are creating new growth paths. The diverse application of NFC in the U.S. proves its flexibility and long-term value across consumer and commercial settings. Businesses are integrating this technology into more everyday experiences, helping scale adoption beyond payments.

Prominent players in the Near Field Communication (NFC) Market include Infineon Technologies, Broadcom Inc., Qualcomm Technologies, and NXP Semiconductors. Major NFC solution providers are heavily investing in advanced chip design that supports ultra-low power consumption and smaller form factors, ensuring smooth integration into compact devices. Companies are forming strategic alliances with fintech firms and consumer electronics manufacturers to develop tailor-made solutions for mobile payments, access control, and automotive use. A growing focus is also on developing multi-protocol NFC platforms to handle various communication standards and security requirements across global markets. Vendors are expanding production capabilities and enhancing distribution networks in high-growth regions like Asia Pacific and Europe.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Operating mode trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of contactless payment solutions

- 3.2.1.2 Expansion of NFC technology in consumer electronics

- 3.2.1.3 Increasing use of NFC in retail and e-commerce

- 3.2.1.4 Expansion of NFC applications in healthcare

- 3.2.1.5 Increasing use of NFC in transportation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and integration costs

- 3.2.2.2 Competition from alternative wireless communication technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Offering, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 NFC chips / ICs

- 5.2.2 NFC tags

- 5.2.3 NFC readers

- 5.2.4 Antennas & transceivers

- 5.2.5 Others

- 5.3 Software

- 5.4 Services

- 5.4.1 System integration & deployment

- 5.4.2 Consulting & advisory services

- 5.4.3 Managed services & support

- 5.4.4 Others

Chapter 6 Market Estimates & Forecast, By Operating Mode, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Reader emulation

- 6.3 Peer-to-peer

- 6.4 Card emulation

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Payments

- 7.3 Access control

- 7.4 Pairing and commissioning

- 7.5 Identity and authentication

- 7.6 Smart posters and marketing

- 7.7 IoT provisioning and management

- 7.8 Other

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphones

- 8.2.2 Wearables

- 8.2.3 PCs and laptops

- 8.2.4 Smart TVs and media devices

- 8.2.5 Others

- 8.3 Retail and e-commerce

- 8.3.1 Contactless POS terminals

- 8.3.2 Smart shelves and interactive kiosks

- 8.3.3 Product authentication and anti-counterfeit tags

- 8.3.4 Click and collect and last-mile logistics

- 8.3.5 Public transit ticketing systems

- 8.3.6 Others

- 8.4 Transportation and logistics

- 8.4.1 Parking and toll collection systems

- 8.4.2 Vehicle access and fleet management

- 8.4.3 Asset tracking

- 8.4.4 Passenger information and smart signage

- 8.4.5 Cold chain monitoring

- 8.4.6 Others

- 8.5 Banking and financial services

- 8.5.1 Mobile wallet platforms

- 8.5.2 Secure ID and access cards

- 8.5.3 NFC-enabled ATMs and branch kiosks

- 8.5.4 Tokenization services

- 8.5.5 Others

- 8.6 Healthcare

- 8.6.1 NFC-enabled medical devices

- 8.6.2 Pharmaceutical packaging

- 8.6.3 Patient engagement tools

- 8.6.4 Others

- 8.7 Automotive

- 8.7.1 In-vehicle device pairing

- 8.7.2 Equipment maintenance and service tags

- 8.7.3 Telematics solutions

- 8.7.4 Others

- 8.8 Industrial and manufacturing

- 8.8.1 Tool and asset tracking systems

- 8.8.2 Secure facility access and employee IDs

- 8.8.3 Product configuration

- 8.8.4 Warehouse and inventory automation

- 8.8.5 Others

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 NXP Semiconductors

- 10.1.2 Broadcom Inc.

- 10.1.3 Infineon Technologies

- 10.1.4 STMicroelectronics

- 10.1.5 Qualcomm Technologies

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Texas Instruments

- 10.2.1.2 Apple Inc.

- 10.2.1.3 Google LLC

- 10.2.1.4 Zebra Technologies Inc.

- 10.2.1.5 Avery Dennison

- 10.2.1.6 HID Global

- 10.2.2 Europe

- 10.2.2.1 Thales Group

- 10.2.2.2 ams-OSRAM

- 10.2.2.3 smart-TEC GmbH & Co. KG

- 10.2.3 Asia Pacific

- 10.2.3.1 Samsung Electronics

- 10.2.3.2 Sony Corporation

- 10.2.3.3 Renesas Electronics

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Identiv

- 10.3.2 MagTek

- 10.3.3 Tageos

- 10.3.4 Pragmatic Semiconductor