|

市场调查报告书

商品编码

1797744

尿液收集设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Urine Collection Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

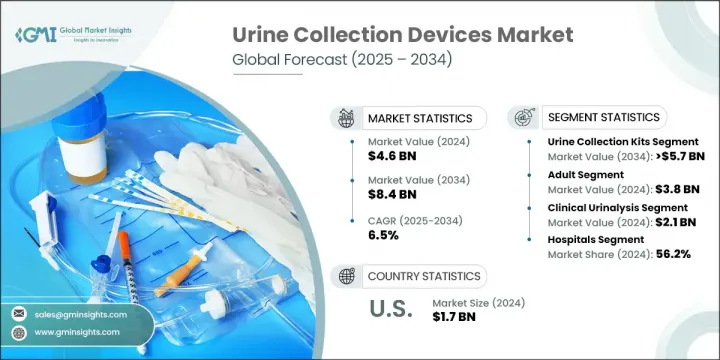

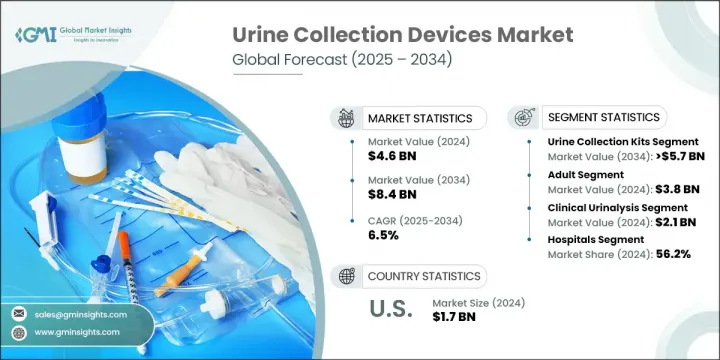

2024年,全球尿液采集设备市场规模达46亿美元,预计2034年将以6.5%的复合年增长率成长至84亿美元。慢性肾臟病、泌尿道感染以及老龄化人口失禁等日益加重的负担,有力地推动了市场扩张。居家医疗保健的兴起,加上即时诊断技术的蓬勃发展以及设备功能和设计的持续创新,共同塑造着市场趋势。尿液采集设备在诊断中发挥至关重要的作用,能够安全、无菌、准确地采集、运输和储存尿液样本。这些工具——从尿杯、样本袋到采集试剂盒和运输容器——广泛应用于医院、诊所、实验室和家庭。疾病筛检频率的提高,尤其是在慢性病照护和代谢诊断领域,正在推动对这些服务的持续需求。随着分散式医疗保健日益普及,以及以患者为中心的照护模式不断发展,人们对使用者友善、卫生可靠的尿液采集系统的需求日益增长。这些市场动态正在帮助企业扩大生产规模,同时投资能够提升样本处理和诊断精确度的技术。

肾臟病学、肿瘤学和内分泌学等领域的临床研究日益增多,推动了对兼容基因组学、蛋白质组学和生物标记检测的先进尿液采集解决方案的需求。研究人员越来越需要无菌、化学稳定的容器,以便在运输和分析过程中保持样本的完整性。因此,供应商正在开发更专业的试剂盒,以满足实验室研究的需求,从而支持更广泛的临床研究生态系统。此外,针对行动不便或慢性病患者的居家照护的扩展,也促进了尿液采集产品在传统临床环境之外的更广泛应用。这种转变促进了产品设计格局的演变,更重视便携性、安全性和易用性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 84亿美元 |

| 复合年增长率 | 6.5% |

2024年,尿液采集试剂盒市场占有69.4%的份额。这一强劲地位主要源于对家用诊断试剂盒的日益依赖、分散式临床试验的增长以及无菌安全标本处理日益重要。这些试剂盒为临床机构以外的使用者提供了便利性和可近性,有助于提高诊断依从性和照护的连续性。尿液采集试剂盒在慢性疾病监测、生殖健康和药物检测等领域的应用非常广泛。

临床尿液分析应用领域在2024年创造了21亿美元的市场规模,预计在2025-2034年期间的复合年增长率将达到6.1%。这个领域引领市场,因为尿液检测仍然是识别各种疾病(从泌尿道感染、糖尿病到肾臟疾病和代谢疾病)的第一线诊断工具。医院和诊断中心是主要的终端用户,他们依靠化学稳定、耐污染的设备来确保实验室结果的准确性。定期健康筛检和慢性病诊断数量的不断增长,巩固了尿液分析作为预防和急性护理基石的地位。

2024年,欧洲尿液采集设备市场规模达13亿美元。该地区拥有高度发展的医疗基础设施,且广泛采用非侵入性检测方法。高昂的人均医疗支出和广泛的公共筛检项目,正在加速医院和家庭尿液检测的需求。西欧和斯堪的纳维亚半岛国家由于更加重视老年族群慢性泌尿系统疾病的管理,尿液采集设备使用率尤其高。

全球尿液采集设备市场的主要参与者包括 BioTouch、QIAGEN、Ardo Medical、赛默飞世尔科技、罗氏、雅培、POLYMED、Aspen Surgical、Cardinal Health、HENSO、Convatec、Becton、Dickinson and Company、Labcorp (Litholink)、MEDLINE 和 ANGIPLAST。参与尿液采集设备市场竞争的公司正在利用产品创新、策略合作伙伴关係和全球扩张来巩固其立足点。核心重点在于开发以使用者为中心、无菌和一次性的套件,以符合现代临床和家庭护理工作流程。许多公司正在投资具有防篡改和样品保存功能的智慧包装解决方案,以满足不断发展的诊断标准。与医疗保健提供者和实验室的合作使得能够共同开发针对特定测试应用的专用产品。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性肾臟病(CKD)盛行率不断上升

- 老年人口不断增加

- 非侵入性诊断工具的需求不断增长

- 尿液收集装置的技术进步

- 产业陷阱与挑战

- 污染和样品处理错误的风险

- 市场机会

- 尿液液体活检和基因组检测的使用日益增多

- 儿科友善智慧尿液采集装置的开发

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 新兴技术

- 2024年定价分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品类型发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 尿液收集套件

- 尿液检体袋

- 尿杯和容器

第六章:市场估计与预测:按患者,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 临床尿液分析

- 泌尿道感染(UTI)

- 肾臟疾病

- 其他临床尿液分析

- 药物筛选

- 妊娠测试

- 临床研究和调查

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 居家照护环境

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- ANGIPLAST

- Ardo Medical

- Aspen Surgical

- Becton, Dickinson and Company

- BioTouch

- Cardinal Health

- convatec

- HENSO

- Labcorp (Litholink)

- MEDLINE

- POLYMED

- QIAGEN

- Roche

- Thermo Fisher Scientific

The Global Urine Collection Devices Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 8.4 billion by 2034. Market expansion is strongly supported by the rising burden of chronic kidney diseases, urinary tract infections, and an aging population dealing with incontinence. The shift toward home-based healthcare, together with the growth in point-of-care diagnostics and ongoing innovation in device functionality and design, continues to shape market trends. Urine collection devices play a crucial role in diagnostics by enabling safe, sterile, and accurate sample gathering, transportation, and storage. These tools-ranging from cups and specimen bags to collection kits and transport containers-are extensively used across hospitals, clinics, laboratories, and at-home settings. The increased frequency of disease screening, particularly in chronic care and metabolic diagnostics, is driving sustained demand for these services. As decentralized healthcare becomes more prominent and patient-centric care models evolve, there is significant interest in user-friendly, hygienic, and reliable urine collection systems. These market dynamics are helping companies scale production while investing in technology that enhances sample handling and diagnostic precision.

The rising number of clinical investigations in fields such as nephrology, oncology, and endocrinology is pushing demand for advanced urine collection solutions that are compatible with genomic, proteomic, and biomarker testing. Researchers increasingly require sterile, chemically stable containers that preserve sample integrity during transport and analysis. As a result, suppliers are developing more specialized kits tailored to lab research, supporting the wider clinical research ecosystem. Additionally, the expansion of home-based care for patients with limited mobility or chronic illness is promoting broader use of urine collection products outside traditional clinical settings. This transition is contributing to an evolving product design landscape focused on portability, safety, and ease of use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 6.5% |

The urine collection kits segment held a 69.4% share in 2024. This strong position is primarily due to the increasing reliance on at-home diagnostic kits, growth in decentralized clinical trials, and the rising importance of sterile and secure specimen handling. These kits offer convenience and accessibility to users outside of clinical facilities, helping improve diagnostic compliance and continuity of care. High adoption of urine collection kits is seen in applications like chronic disease monitoring, reproductive health, and drug testing.

The clinical urinalysis application segment generated USD 2.1 billion in 2024 and is projected to grow at a CAGR of 6.1% during 2025-2034. This segment leads the market because urine testing remains a frontline diagnostic tool in identifying a wide range of disorders, from UTIs and diabetes to kidney and metabolic conditions. Hospitals and diagnostic centers are the main end users, relying on chemically stable, contamination-resistant devices to maintain accurate laboratory results. The growing volume of regular health screenings and chronic condition diagnostics has solidified urinalysis as a cornerstone in preventative and acute care.

Europe Urine Collection Devices Market reached USD 1.3 billion in 2024. The region benefits from a highly developed healthcare infrastructure and widespread adoption of non-invasive testing methods. High per capita health expenditure and broad public screening programs are helping accelerate demand for urine testing in both hospitals and home-based settings. Countries in Western Europe and Scandinavia show particularly high usage due to increased focus on managing chronic urological conditions in elderly populations.

Major players operating in the Global Urine Collection Devices Market include BioTouch, QIAGEN, Ardo Medical, Thermo Fisher Scientific, Roche, Abbott, POLYMED, Aspen Surgical, Cardinal Health, HENSO, Convatec, Becton, Dickinson and Company, Labcorp (Litholink), MEDLINE, and ANGIPLAST. Companies competing in the urine collection devices market are leveraging product innovation, strategic partnerships, and global expansion to strengthen their foothold. A core focus lies in developing user-centric, sterile, and disposable kits that align with modern clinical and home care workflows. Many firms are investing in smart packaging solutions with tamper-evidence and sample-preservation features to meet evolving diagnostic standards. Collaborations with healthcare providers and laboratories are enabling co-development of purpose-driven products tailored to specific testing applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Patient trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic kidney diseases (CKD)

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Rising demand for non-invasive diagnostic tools

- 3.2.1.4 Technological advancements in urine collection devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of contamination and sample handling errors

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing use of urine-based liquid biopsy and genomic testing

- 3.2.3.2 Development of pediatric-friendly and smart urine collection devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Urine collection kits

- 5.3 Urine specimen bags

- 5.4 Urine cups and containers

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical urinalysis

- 7.2.1 Urinary tract infections (UTI)

- 7.2.2 Kidney disorders

- 7.2.3 Other clinical urinalysis

- 7.3 Drug screening

- 7.4 Pregnancy testing

- 7.5 Clinical research and studies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Home care settings

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 ANGIPLAST

- 10.3 Ardo Medical

- 10.4 Aspen Surgical

- 10.5 Becton, Dickinson and Company

- 10.6 BioTouch

- 10.7 Cardinal Health

- 10.8 convatec

- 10.9 HENSO

- 10.10 Labcorp (Litholink)

- 10.11 MEDLINE

- 10.12 POLYMED

- 10.13 QIAGEN

- 10.14 Roche

- 10.15 Thermo Fisher Scientific