|

市场调查报告书

商品编码

1797752

智慧电池感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Intelligent Battery Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

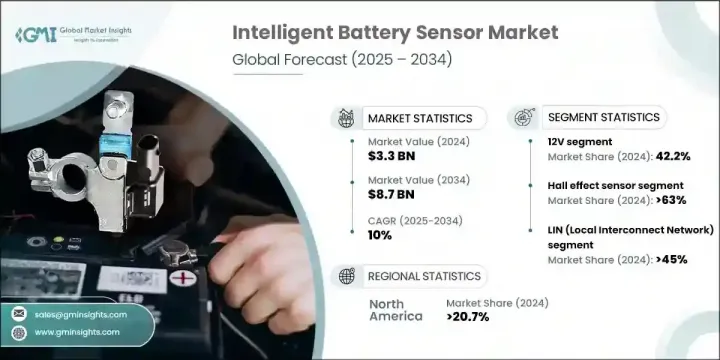

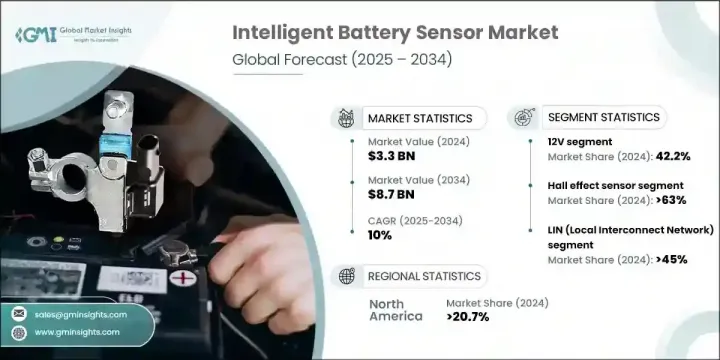

2024年,全球智慧电池感测器市场规模达33亿美元,预计2034年将以10%的复合年增长率成长,达到87亿美元。该市场的快速成长主要得益于电动和混合动力汽车的日益普及,以及需要先进电源管理解决方案的连网和自动驾驶汽车系统的兴起。严格的排放法规和全球对燃油效率提升的追求进一步加速了市场需求。此外,航太业向电气化的转变也推动了对更先进的电池管理系统的需求,这些系统旨在提高安全性、即时监控和系统性能。

业界也正经历着向多参数感测器的重大转变,这些感测器将电压、电流和温度监测整合在一个紧凑的设备中。这种整合不仅简化了感测器架构,还透过从单一来源提供即时、全面的资料,提升了整体系统性能。这些先进的感测器提高了能源管理的准确性,降低了布线复杂性,并降低了安装成本,同时提升了电池管理系统的可靠性和响应速度。透过将多种测量功能整合到一个精简的单元中,製造商可以提供更智慧、更有效率的解决方案,以满足现代电动和混合动力汽车以及航太应用日益增长的需求,在这些领域,节省空间和减轻重量至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 10% |

2024年,霍尔效应感测器市场占据63%的市场份额,预计到2034年将维持9.7%的复合年增长率。霍尔效应感测器的非接触式电流测量能力、高精度以及在恶劣环境下的可靠性使其成为优于传统分流式感测器的首选。这些感测器为汽车製造商和电池管理系统供应商提供了必要的工具,以满足电动传动系统不断变化的需求。

2024年,12V市场占据42.2%的市场份额,这得益于使用12V电气系统的内燃机汽车和轻度混合动力汽车的普及。专注于提高12V架构中感测器精度和耐用性的製造商将在推进高压技术发展的同时,占据有利地位,并保持市场份额。

2024年,北美智慧电池感测器市场占有20.7%的份额,其中美国占75%。受消费者对永续出行方式的追求推动,美国电动车的普及率不断上升,这是推动先进电池管理解决方案发展的关键因素。为了巩固市场地位,製造商应优先进行以人工智慧诊断、紧凑型感测器设计和增强型热管理为中心的研发工作。促进电池製造商与电动车生产商合作的扶持政策,以及鼓励关键零件本地化的激励措施,对于该地区的持续成长至关重要。

全球智慧电池感测器市场的主要参与者包括 ADI 公司、大陆集团、电装株式会社、ams OSRAM、埃贝赫、古河电工株式会社、海拉有限公司、罗伯特·博世有限公司、通用汽车(德尔福科技)和 AVX 公司。为了巩固其在智慧电池感测器市场的立足点,各公司正专注于创新,将多个感测参数整合到单一紧凑单元中,以降低复杂性和成本。他们正在大力投资研究,以提高感测器的精度、耐用性和热管理,这对于电动车和航太应用的严苛环境至关重要。与汽车原始设备製造商和电池製造商的合作有助于根据特定的车辆架构和新兴技术客製化解决方案。策略性区域扩张,尤其是在电动车普及率不断增长的关键市场,也是优先事项。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电动和混合动力车的普及率不断上升

- 自动驾驶和网联汽车的扩张

- 微控制器和感测器技术的进步

- 全球航太航太业的扩张

- 产业陷阱与挑战

- IBS技术初始成本高

- 与现有车辆系统整合的复杂性

- 市场机会

- 对轻量级、智慧电池组件的需求不断增长

- 扩大电动车基础设施和充电网络

- 与物联网和车联网技术的集成

- 增加政府对清洁能源和电动车应用的奖励措施

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 市场集中度分析

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按感测器类型,2021 - 2034 年

- 主要趋势

- 霍尔效应感测器

- 分流感测器

第六章:市场估计与预测:按感测器功能,2021-2034 年

- 主要趋势

- 电流监测感测器

- 电压监测感测器

- 温度监测感测器

- 多参数感测器(SOC/SOH)

第七章:市场估计与预测:依电压范围,2021-2034

- 主要趋势

- 12伏

- 24伏

- 36V以上

第八章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- LIN(本地互连网路)

- CAN(控制器区域网路)

- 其他的

第九章:市场估计与预测:依电池类型,2021-2034

- 主要趋势

- 铅酸电池

- 锂离子电池

- 镍氢电池

- 其他电池类型

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 充电状态测量

- 健康状况监测

- 电池管理系统

- 能量回收

- 启停功能

- 其他的

第 11 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车

- 海洋

- 航太

- 工业的

- 其他的

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十三章:公司简介

- Global Key Players

- Regional Key Players

The Global Intelligent Battery Sensor Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 8.7 billion by 2034. The market's rapid growth is primarily fueled by the increasing adoption of electric and hybrid vehicles, as well as the rise of connected and autonomous automotive systems that require advanced power management solutions. Stringent emission regulations and a global push for enhanced fuel efficiency further accelerate demand. Additionally, the aerospace industry's shift towards electrification is driving the need for more sophisticated battery management systems that improve safety, real-time monitoring, and system performance.

The industry is also experiencing significant move toward multi-parameter sensors that integrate voltage, current, and temperature monitoring within a single compact device. This consolidation not only simplifies the sensor architecture but also enhances overall system performance by providing real-time, comprehensive data from one source. These advanced sensors improve energy management accuracy, reduce wiring complexity, and lower installation costs, all while boosting reliability and responsiveness in battery management systems. By combining multiple measurement capabilities into one streamlined unit, manufacturers can deliver smarter, more efficient solutions that meet the increasing demands of modern electric and hybrid vehicles, as well as aerospace applications where space and weight savings are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 10% |

In 2024, the hall-effect sensors segment held a 63% share and is expected to maintain growth at a CAGR of 9.7% through 2034. Their non-contact current measurement capability, high accuracy, and reliability in tough environments make them a preferred choice over traditional shunt-based sensors. These sensors provide automotive manufacturers and battery management system suppliers with the tools necessary to meet the evolving demands of electrified drivetrains.

The 12V segment held a 42.2% share in 2024, driven by the prevalence of internal combustion engine vehicles and mild hybrids operating on 12V electrical systems. Manufacturers focusing on improving sensor accuracy and durability within the 12V architecture will be positioned well to maintain market share while advancing high-voltage technology development.

North America Intelligent Battery Sensor Market held 20.7% share in 2024, with the United States capturing 75% share. The increasing adoption of electric vehicles in the U.S., propelled by consumers seeking sustainable mobility, is a key driver for advanced battery management solutions. To strengthen their positions, manufacturers are urged to prioritize R&D efforts centered on AI-powered diagnostics, compact sensor designs, and enhanced thermal management. Supportive policies that ease collaboration between battery manufacturers and electric vehicle producers, along with incentives to localize key component production, are crucial for sustaining growth in this region.

Key players in the Global Intelligent Battery Sensor Market include Analog Devices, Inc., Continental AG, DENSO Corporation, ams OSRAM, Eberspacher, Furukawa Electric Co., Ltd., HELLA GmbH & Co. KGaA, Robert Bosch GmbH, General Motors (Delphi Technologies), and AVX Corporation. To strengthen their foothold in the intelligent battery sensor market, companies are focusing on innovation by integrating multiple sensing parameters into single compact units that reduce complexity and cost. They are investing heavily in research to enhance sensor accuracy, durability, and thermal management, which are critical for the demanding environments of electric vehicles and aerospace applications. Collaborations with automotive OEMs and battery manufacturers help tailor solutions to specific vehicle architectures and emerging technologies. Strategic regional expansions, especially in key markets with growing EV adoption, are also prioritized.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Sensor type

- 2.2.2 Sensor functionality

- 2.2.3 Voltage range

- 2.2.4 Technology

- 2.2.5 Battery type

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles

- 3.2.1.2 Expansion of autonomous and connected vehicles

- 3.2.1.3 Advancements in microcontrollers and sensor technology

- 3.2.1.4 Expansion of global aerospace industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs of IBS technology

- 3.2.2.2 Complexity in integration with existing vehicle systems

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for lightweight, smart battery components

- 3.2.3.2 Expansion of electric vehicle infrastructure and charging networks

- 3.2.3.3 Integration with IoT and connected vehicle technologies

- 3.2.3.4 Increasing government incentives for clean energy and EV adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Mn & Units)

- 5.1 Key trends

- 5.2 Hall effect sensor

- 5.3 Shunt sensor

Chapter 6 Market Estimates & Forecast, By Sensor Functionality, 2021-2034 (USD Mn & Units)

- 6.1 Key trends

- 6.2 Current monitoring sensors

- 6.3 Voltage monitoring sensors

- 6.4 Temperature monitoring sensors

- 6.5 Multi-parameter sensors (SOC/SOH)

Chapter 7 Market Estimates & Forecast, By Voltage Range, 2021-2034 (USD Mn & Units)

- 7.1 Key trends

- 7.2 12V

- 7.3 24V

- 7.4 36V and above

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Mn & Units)

- 8.1 Key trends

- 8.2 LIN (Local Interconnect Network)

- 8.3 CAN (Controller Area Network)

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Battery Type, 2021-2034 (USD Mn & Units)

- 9.1 Key trends

- 9.2 Lead-acid batteries

- 9.3 Lithium-ion batteries

- 9.4 Nickel-metal hydride batteries

- 9.5 Other battery types

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Mn & Units)

- 10.1 Key trends

- 10.2 State of charge measurement

- 10.3 State of health monitoring

- 10.4 Battery management systems

- 10.5 Energy recovery

- 10.6 Start-stop functions

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2021-2034 (USD Mn & Units)

- 11.1 Key trends

- 11.2 Automotive

- 11.3 Marine

- 11.4 Aerospace

- 11.5 Industrial

- 11.6 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Mn & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Netherlands

- 12.3.5 Spain

- 12.3.6 Italy

- 12.3.7 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 ams OSRAM

- 13.1.2 Analog Devices, Inc.

- 13.1.3 AVX Corporation

- 13.1.4 Bosch (Robert Bosch GmbH)

- 13.1.5 Continental AG

- 13.1.6 DENSO Corporation

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 General Motors

- 13.2.1.2 Littelfuse, Inc.

- 13.2.1.3 SENSATA Technologies

- 13.2.1.4 Johnson Controls International plc

- 13.2.2 Europe

- 13.2.2.1 HELLA GmbH & Co. KGaA

- 13.2.2.2 MTA S.p.A.

- 13.2.2.3 Valeo SA

- 13.2.3 Asia-Pacific

- 13.2.3.1 Hitachi Astemo, Ltd.

- 13.2.3.2 Hyundai Mobis

- 13.2.3.3 LG Innotek

- 13.2.3.4 Furukawa Electric Co., Ltd.

- 13.2.3.5 Murata Manufacturing Co., Ltd.

- 13.2.3.6 Panasonic Corporation

- 13.2.4 Niche Players/ Disruptors

- 13.2.4.1 Bascom Hunter

- 13.2.4.2 Eberspacher

- 13.2.4.3 Renesas Electronics Corporation

- 13.2.4.4 Lear Corporation

- 13.2.4.5 Infineon Technologies AG

- 13.2.4.6 STMicroelectronics

- 13.2.1 North America