|

市场调查报告书

商品编码

1797780

电动堆高机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Forklift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

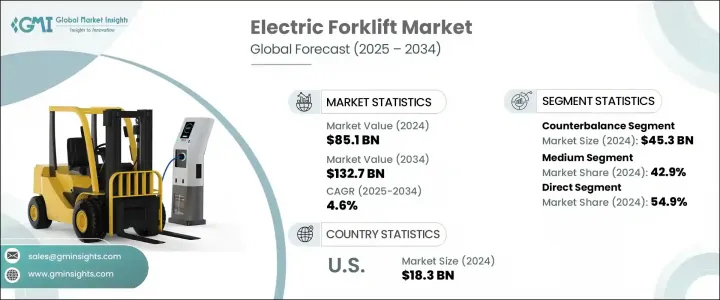

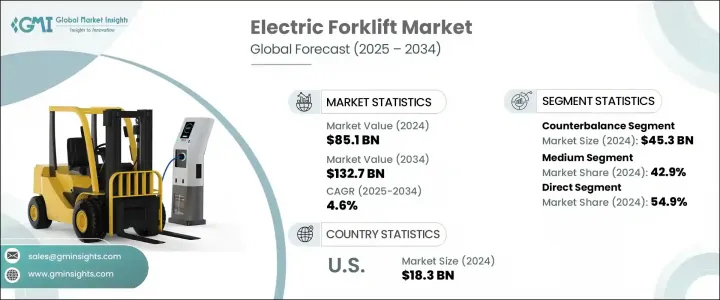

2024年,全球电动堆高机市场规模达851亿美元,预计2034年将以4.6%的复合年增长率成长,达到1327亿美元。这项稳定成长的动力源自于内燃机向更永续的电池驱动型替代能源的持续转变。随着各行各业寻求更清洁、更具成本效益的物料搬运解决方案,电动堆高机在物流、仓储、製造和零售领域正获得显着发展。对环保营运和更低总拥有成本的日益增长的需求,促使企业采用排放更低、噪音更小、效率更高的电动堆高机。随着各国政府和监管机构持续推行更严格的排放标准,电动堆高机正成为许多已开发经济体和发展中经济体的首选。

推动成长的关键因素是电池技术的快速发展。虽然铅酸电池历来为大多数电动堆高机提供动力,但它们的充电週期长且维护成本高。相较之下,锂离子电池凭藉着更快的充电速度、更高的能量密度和极低的维护要求,正在重塑市场。它们还支援“随机充电”,允许操作员在短暂的操作中断期间补充电池电量,而不会缩短电池寿命。此功能有助于提高生产率,使机器能够在整个工作日内更长时间地运作。氢燃料电池技术的兴起也日益受到关注,尤其是在要求严格的工业应用中。这些系统提供超快速的加氢能力(通常不到三分钟),并延长了运行时间,从而实现一致、不间断的工作流程。在需要最大程度减少停机时间且长班次较为常见的领域,燃料电池正成为实用的替代方案。一些製造商正在利用氢燃料电池系统,与电池供电设备相比,将停机时间减少了两位数的百分比。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 851亿美元 |

| 预测值 | 1327亿美元 |

| 复合年增长率 | 4.6% |

在所有产品类型中,平衡重型动力堆高机市场在2024年创造了453亿美元的市场规模,预计在2025年至2034年期间的复合年增长率将达到3.5%。这类车款占全球堆高机总销量的近60%,凭藉着多功能性和便利的操作,仍是市场上的主力车款。这类堆高机的结构包括后部配重,可在提升前端重型负载时提供稳定性,使其成为高容量、高频率起重环境的理想选择。

2024年,中型电动堆高机市场占42.9%的市场份额,预计2025年至2034年的复合年增长率为5.1%。这类车型在需要兼顾起重能力和机动性的作业中备受青睐,例如汽车、製造、港口和配送中心。随着锂离子电池技术的进步,其能量密度已高达200瓦时/公斤(比几年前的水平高出一倍多),这些叉车现在可以延长班次运行时间,并且只需1到2个小时即可充满电,进一步提升了其实用性。

美国电动堆高机市场在2024年创下了183亿美元的产值,预计到2034年将以5.3%的复合年增长率成长。美国领先的地位归功于其完善的製造业基础设施、自动化驱动的营运模式以及强有力的永续发展监管。蓬勃发展的电子商务和仓储行业推动了堆高机需求的飙升,而电动堆高机的营运成本和排放更低。美国也受益于强大的製造商和分销商基础、广泛的服务网络以及熟练的劳动力,使其成为电动堆高机创新和部署领域的全球领导者。

引领全球电动堆高机市场的关键参与者包括海斯特-耶鲁物料搬运公司、丰田物料搬运、三菱 Logisnext 有限公司、凯傲集团和永恆力股份公司。在竞争策略方面,主要电动堆高机製造商正在积极投资研发,以增强电池技术、系统整合和智慧车队管理平台。许多製造商专注于模组化电池组和可扩展能源系统,以适应不同的应用需求。与能源公司和基础设施供应商的合作有助于简化电池充电和加氢站。製造商也在努力提高远端资讯处理和远端诊断能力,使车队营运商能够监控性能、安排维护并优化车队利用率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业影响力量

- 成长动力

- 电池技术的进步

- 环境法规与永续发展目标

- 电子商务和仓储的成长

- 产业陷阱与挑战

- 初期投资成本高

- 重型能力有限

- 机会

- 向新兴市场扩张

- 与智慧仓储集成

- 快速充电和可更换电池解决方案的开发

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 抗衡

- 仓库堆高机

- 堆高机和堆高机

- 前移式堆高机

- 其他的

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 小型(3吨以下)

- 中型(3-10吨)

- 重型(10吨以上)

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 工厂

- 仓库

- 零售店

- 食品和製药

- 建筑工地

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- Crown Equipment Corporation

- Doosan Industrial Vehicle Co., Ltd.

- EP Equipment Co., Ltd.

- Hangcha Group Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- Hyundai Material Handling

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Lonking Holdings Limited

- Mitsubishi Logisnext Co., Ltd.

- Noblelift Intelligent Equipment Co., Ltd.

- Toyota Material Handling

The Global Electric Forklift Market was valued at USD 85.1 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 132.7 billion by 2034. This steady growth is being driven by the ongoing transition from internal combustion engines to more sustainable, battery-powered alternatives. As industries seek cleaner and more cost-efficient material handling solutions, electric forklifts are gaining significant traction across logistics, warehousing, manufacturing, and retail sectors. The growing demand for environmentally friendly operations and lower total cost of ownership is pushing businesses to adopt electric forklift models that offer reduced emissions, less noise, and improved efficiency. With governments and regulatory bodies continuing to push stricter emissions standards, electric forklifts are becoming a preferred choice in many developed and developing economies.

A key factor driving growth is the rapid evolution in battery technologies. While lead-acid batteries have historically powered most electric forklifts, they suffer from lengthy charge cycles and ongoing maintenance. In contrast, lithium-ion batteries are reshaping the market by offering faster charging, higher energy density, and minimal maintenance requirements. They also support "opportunity charging," which allows operators to top up battery power during brief operational breaks without diminishing battery life. This feature helps improve productivity by keeping machines operational longer throughout the workday. The emergence of hydrogen fuel cell technology is also gaining attention, especially for demanding industrial applications. These systems offer ultra-fast refueling-often under three minutes-and extended operation times that allow for consistent, uninterrupted workflow. Fuel cells are becoming a practical alternative where downtime needs to be minimized and long shifts are common. Several manufacturers are leveraging hydrogen-based systems to reduce downtime by double-digit percentages compared to battery-powered units.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $85.1 Billion |

| Forecast Value | $132.7 Billion |

| CAGR | 4.6% |

Among the product types, the counterbalance electric forklifts segment generated USD 45.3 billion in 2024 and is expected to grow at a CAGR of 3.5% between 2025 and 2034. These models represent nearly 60% of the total forklift units sold globally and remain the workhorse of the market due to their versatility and straightforward operation. Their construction includes rear counterweights that provide stability when lifting heavy front-end loads, making them ideal for high-capacity, high-frequency lifting environments.

The medium-capacity electric forklifts segment held 42.9% share in 2024 and is forecast to grow at a CAGR of 5.1% from 2025 to 2034. These models are favored in operations that demand a balance between lifting capacity and maneuverability-such as in automotive, manufacturing, ports, and distribution hubs. With lithium-ion battery advancements pushing energy densities as high as 200 Wh/kg-more than double what was available just a few years ago-these forklifts can now operate for extended shifts and recharge in just 1 to 2 hours, further enhancing their practicality.

United States Electric Forklift Market generated USD 18.3 billion in 2024 and is projected to grow at a CAGR of 5.3% through 2034. The country's leadership is attributed to its well-established manufacturing infrastructure, automation-driven operations, and a strong regulatory push for sustainability. The booming e-commerce and warehousing segments are contributing to soaring forklift demand, with electric models offering lower operating costs and emissions. The U.S. also benefits from a strong base of manufacturers and distributors, extensive service networks, and a skilled labor force, positioning it as a global leader in electric forklift innovation and deployment.

Key players leading the Global Electric Forklift Market include Hyster-Yale Materials Handling, Inc., Toyota Material Handling, Mitsubishi Logisnext Co., Ltd., KION Group AG, and Jungheinrich AG. In terms of competitive strategies, major electric forklift manufacturers are aggressively investing in research and development to enhance battery technologies, system integration, and intelligent fleet management platforms. Many are focusing on modular battery packs and scalable energy systems that adapt to diverse application needs. Collaborations with energy companies and infrastructure providers help streamline battery charging and hydrogen refueling stations. Manufacturers are also working to improve telematics and remote diagnostics capabilities, allowing fleet operators to monitor performance, schedule maintenance, and optimize fleet utilization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Regional trends

- 2.2.3 Type trends

- 2.2.4 Capacity trends

- 2.2.5 End use trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in battery technology

- 3.2.1.2 Environmental regulations & sustainability goals

- 3.2.1.3 Growth of e-commerce and warehousing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Limited heavy-duty capabilities

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration with smart warehousing

- 3.2.3.3 Development of fast-charging and swappable battery solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Counterbalance

- 5.3 Warehouse Forklifts

- 5.3.1 Pallet jacks and stackers

- 5.3.2 Reach trucks

- 5.3.3 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small (under 3 tons)

- 6.3 Medium (3-10 tons)

- 6.4 Heavy (over 10 tons)

Chapter 7 Market Estimates & Forecast, By End use, 2021-2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Factories

- 7.3 Warehouses

- 7.4 Retail stores

- 7.5 Food and pharma

- 7.6 Construction sites

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Anhui Heli Co., Ltd.

- 10.2 Clark Material Handling Company

- 10.3 Crown Equipment Corporation

- 10.4 Doosan Industrial Vehicle Co., Ltd.

- 10.5 EP Equipment Co., Ltd.

- 10.6 Hangcha Group Co., Ltd.

- 10.7 Hyster-Yale Materials Handling, Inc.

- 10.8 Hyundai Material Handling

- 10.9 Jungheinrich AG

- 10.10 KION Group AG

- 10.11 Komatsu Ltd.

- 10.12 Lonking Holdings Limited

- 10.13 Mitsubishi Logisnext Co., Ltd.

- 10.14 Noblelift Intelligent Equipment Co., Ltd.

- 10.15 Toyota Material Handling