|

市场调查报告书

商品编码

1797802

家禽药品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Poultry Pharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

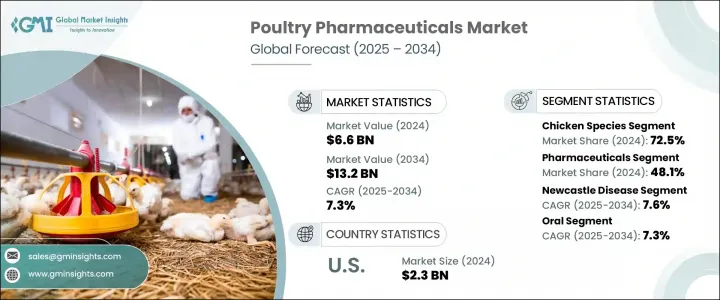

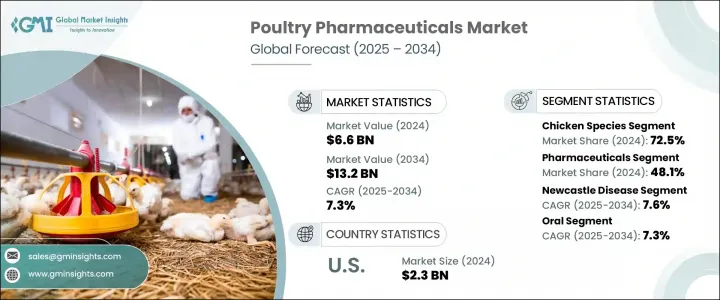

2024年,全球家禽药品市场规模达66亿美元,预计到2034年将以7.3%的复合年增长率成长,达到132亿美元。受鸡肉和鸡蛋等产品价格实惠且蛋白质含量高的影响,全球家禽消费量不断增长,这持续推动市场需求。同时,商业家禽养殖场对动物健康、预防保健和疾病管理的日益重视,也加速了对有效药物解决方案的需求。随着对抗生素抗药性担忧的加剧,监管机构正在对抗生素的使用施加更严格的限制,从而导致疫苗、益生菌和其他替代品的广泛采用。

家禽养殖户正在转向可持续的健康策略,以满足消费者对无抗生素和有机家禽产品的需求。这一趋势促进了生物製剂、先进疫苗和益生菌药物的普及。该领域涵盖了针对鸡、鸭、火鸡和其他禽类的各种健康解决方案,重点是减少疾病爆发并维持稳定的生产品质。整体市场的成长得益于对家禽保健创新的持续投资,以及在大规模生产中采用天然、非抗生素方法维护生物安全和生产力的转变。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 66亿美元 |

| 预测值 | 132亿美元 |

| 复合年增长率 | 7.3% |

2024年,鸡肉市场占72.5%,到2034年将达到94亿美元,复合年增长率为7.2%。鸡肉在家禽生产中占主导地位,尤其容易感染马立克氏症、发炎性肠道疾病、新城疫和球虫病等疾病。因此,药物介入主要着重于提高鸡群免疫力,并透过预防性治疗和结构化的疫苗接种计画来支持大规模肉鸡和蛋鸡养殖。

2024年,药品市场占48.1%的份额。该领域的成长得益于抗感染药、驱虫药和止痛药等产品的广泛使用,这些产品因其安全性、便利性和预防性而备受青睐。减少抗生素依赖的广泛趋势已将人们的注意力转向益生菌和益生元解决方案,这些解决方案可以改善肠道健康并最大程度地降低感染风险。监管机构对抗菌药物使用的压力日益加大,进一步鼓励了这些替代品的采用。

2024年,美国家禽药品市场价值达23亿美元。由于美国强劲的家禽消费率和对大规模商业化养殖的依赖,美国将继续引领该地区的成长。集约化养殖体系中疾病风险的增加,以及严格的生物安全规定,促使美国和加拿大各地的农民优先考虑早期疫苗接种,并透过药品进行持续的健康监测。

全球家禽药品市场的主要参与者包括硕腾 (Zoetis)、诗华动物保健 (Ceva Sante Animale)、菲布罗动物保健 (Phibro Animal Health)、勃林格殷格翰 (Boehringer Ingelheim) 和礼来 (Elanco)。家禽药品市场的主要公司正专注于研发,以提供下一代生物製剂、疫苗和传统抗生素的可持续替代品。礼来和诗华动物保健 (Ceva Sante Animale) 等企业正在扩大其生物製剂产品组合,以满足市场对无抗生素产品日益增长的需求。策略性收购、与家禽生产商的合作以及区域扩张仍然是关键途径。各公司也正在投资数位工具,监测鸡群健康状况,提高治疗精准度和遵从性。针对特定物种疾病客製化产品、扩大新兴市场的产品註册以及确保法规合规性,这些倡议正在加强其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 家禽产品需求不断成长

- 家禽疾病发生率不断上升

- 更重视食品安全和抗菌药物管理

- 兽医保健和疫苗接种的进步

- 产业陷阱与挑战

- 新药研发成本高

- 抗菌素抗药性问题

- 市场机会

- 家禽预防性医疗保健需求不断增长

- 新兴经济体需求不断成长

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按物种,2021 - 2034 年

- 主要趋势

- 鸡

- 土耳其

- 鸭子

- 其他物种

第六章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 生物製剂

- 疫苗

- 改良/减毒活疫苗

- 灭活(杀死)

- 其他疫苗

- 其他生物製剂

- 疫苗

- 製药

- 杀寄生虫剂

- 抗感染药物

- 抗发炎镇痛药

- 其他药品

- 药物饲料添加剂

第七章:市场估计与预测:依疾病类型,2021 - 2034 年

- 主要趋势

- 新城疫

- 传染性支气管炎

- 传染性法氏囊病

- 球虫病

- 沙门氏菌

- 马立克氏症

- 其他疾病类型

第八章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

- 外用

- 其他给药途径

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医医院和诊所

- 家禽养殖场

- 零售兽药局

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Avimex

- Boehringer Ingelheim International

- Calier

- Ceva Sante Animale

- Elanco

- Hester Biosciences

- Indovax

- Kemin Industries

- Merck

- Phibro Animal Health

- Vaxxinova (EW Group)

- Vetanco

- Virbac

- Zoetis

The Global Poultry Pharmaceuticals Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 13.2 billion by 2034. Rising poultry consumption worldwide, driven by the affordability and high protein content of products like chicken and eggs, continues to fuel market demand. At the same time, the growing focus on animal health, preventive care, and disease management in commercial poultry operations is accelerating the need for effective pharmaceutical solutions. As concerns about antibiotic resistance increase, regulatory agencies are placing stricter limitations on antibiotic use, leading to greater adoption of vaccines, probiotics, and other alternatives.

Poultry farmers are shifting to sustainable health strategies to meet consumer demand for antibiotic-free and organic poultry products. This trend has boosted the uptake of biologics, advanced vaccines, and probiotic-based medications. The sector includes a wide range of health solutions for chickens, ducks, turkeys, and other birds, focusing on reducing disease outbreaks and maintaining consistent production quality. The overall market growth is supported by ongoing investments in poultry healthcare innovation and a shift toward natural, non-antibiotic approaches for maintaining biosecurity and productivity in large-scale operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 7.3% |

In 2024, the chicken segment held 72.5% and will reach USD 9.4 billion by 2034 at a CAGR of 7.2%. Chicken dominate poultry production and are especially prone to diseases such as Marek's disease, IBD, Newcastle disease, and coccidiosis. As a result, pharmaceutical interventions are primarily focused on improving flock immunity and supporting large-scale broiler and layer farming operations with preventive treatments and structured vaccination schedules.

The pharmaceuticals segment held a 48.1% share in 2024. This segment's growth is driven by widespread use of products like anti-infectives, parasiticides, and analgesics, which are favored for their safety, convenience, and preventive capabilities. A broader movement toward reducing antibiotic dependency has shifted attention to probiotic and prebiotic-based solutions that improve gut health and minimize infection risks. Increasing pressure from regulatory bodies regarding antimicrobial usage has further encouraged the adoption of these alternatives.

U.S. Poultry Pharmaceuticals Market was valued at USD 2.3 billion in 2024. The U.S. continues to lead regional growth due to its strong poultry consumption rates and reliance on large-scale commercial farming. Enhanced disease risks within intensive farming systems, along with strict biosecurity mandates, have prompted farmers across the U.S. and Canada to prioritize early vaccination and consistent health monitoring through pharmaceutical products.

Key industry players operating in the Global Poultry Pharmaceuticals Market include Zoetis, Ceva Sante Animale, Phibro Animal Health, Boehringer Ingelheim, and Elanco. Major companies in the poultry pharmaceuticals market are focusing on R&D to deliver next-generation biologics, vaccines, and sustainable alternatives to conventional antibiotics. Businesses like Elanco and Ceva Sante Animale are expanding their biologics portfolios to meet growing demand for antibiotic-free products. Strategic acquisitions, partnerships with poultry producers, and regional expansion remain critical approaches. Companies are also investing in digital tools to monitor flock health, improving treatment precision and compliance. Tailoring products for species-specific diseases, expanding product registrations across emerging markets, and ensuring regulatory compliance are strengthening global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Species trends

- 2.2.3 Product trends

- 2.2.4 Disease type trends

- 2.2.5 Route of administration trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for poultry products

- 3.2.1.2 Growing incidence of poultry disease

- 3.2.1.3 Increasing focus on food safety and antimicrobial stewardship

- 3.2.1.4 Advancement in veterinary healthcare and vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of new drug development

- 3.2.2.2 Antimicrobial resistance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for preventive healthcare in poultry animals

- 3.2.3.2 Rising demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Species, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chicken

- 5.3 Turkey

- 5.4 Ducks

- 5.5 Other species

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biologics

- 6.2.1 Vaccines

- 6.2.1.1 Modified/ attenuated live

- 6.2.1.2 Inactivated (killed)

- 6.2.1.3 Other vaccines

- 6.2.2 Other biologics

- 6.2.1 Vaccines

- 6.3 Pharmaceuticals

- 6.3.1 Parasiticides

- 6.3.2 Anti-infectives

- 6.3.3 Anti-inflammatory and analgesics

- 6.3.4 Other pharmaceuticals

- 6.4 Medicated feed additives

Chapter 7 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Newcastle disease

- 7.3 Infectious bronchitis

- 7.4 Infectious bursal disease

- 7.5 Coccidiosis

- 7.6 Salmonella

- 7.7 Marek's disease

- 7.8 Other disease types

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Poultry farms

- 9.4 Retail veterinary pharmacies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avimex

- 11.2 Boehringer Ingelheim International

- 11.3 Calier

- 11.4 Ceva Sante Animale

- 11.5 Elanco

- 11.6 Hester Biosciences

- 11.7 Indovax

- 11.8 Kemin Industries

- 11.9 Merck

- 11.10 Phibro Animal Health

- 11.11 Vaxxinova (EW Group)

- 11.12 Vetanco

- 11.13 Virbac

- 11.14 Zoetis