|

市场调查报告书

商品编码

1797805

矿物土壤改良剂碳封存市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mineral Soil Amendments for Carbon Sequestration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

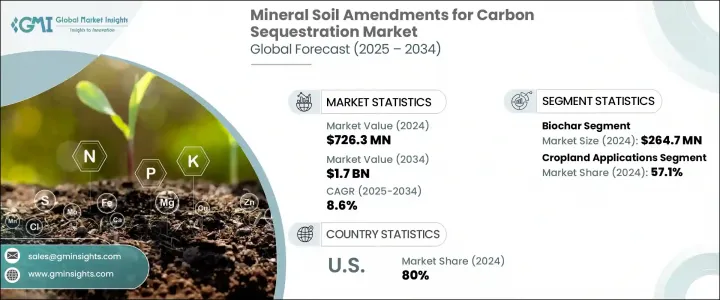

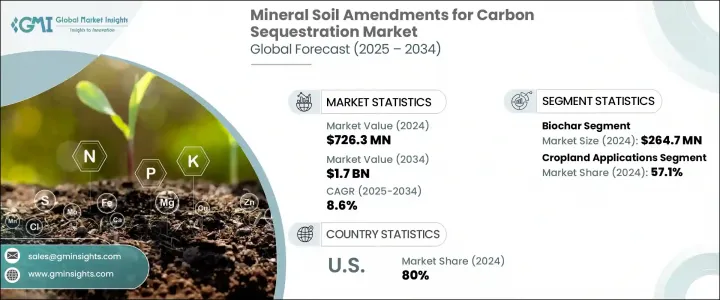

2024 年全球碳封存矿物土壤改良剂市值为 7.263 亿美元,预计到 2034 年将以 8.6% 的复合年增长率增长至 17 亿美元。人们对减缓气候变迁的日益关注极大地推动了对基于自然的解决方案的需求,而矿物土壤改良剂正成为这一转变的有力工具。这些材料——从生物炭到增强风化的矿物和石灰——不仅有助于锁住土壤中的碳,还能改善土壤结构和肥力。世界各国政府都在透过提供政策诱因、研究支持和碳信用机制来支持这项运动。同时,工业界和农业社区也正在采用这些做法,以符合永续发展目标并提高土地生产力。随着人们对再生农业和减排兴趣的日益浓厚,矿物改良剂在各种景观中都越来越受到关注。对土地退化日益增长的担忧以及对长期环境復原力的需求继续推动着这个市场的发展。

随着人们对环境和经济效益的认知不断加深,矿物土壤改良剂不仅被视为气候解决方案,也被视为提升农业系统生产力的利器。农民和土地所有者开始意识到,这些改良剂带来的长期价值远远超过碳封存。生物炭、玄武岩、石灰和橄榄石等矿物质投入能够改善土壤结构、增强养分保留和促进有益微生物活性,直接有助于提高作物产量和土壤恢復力。这不仅能提高用水效率,减少对化学肥料的依赖,也能增强土壤对侵蚀和极端天气条件的抵抗力。因此,将其纳入土壤管理计画正成为永续农业的策略性倡议。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.263亿美元 |

| 预测值 | 17亿美元 |

| 复合年增长率 | 8.6% |

到2024年,生物炭市场产值将达到2.647亿美元,2034年全年复合年增长率将达到8.7%。生物炭凭藉其在碳封存和土壤改善方面的可靠性,成为该市场的主要贡献者。这种多孔材料透过热解生成,可以提高保水性,增加微生物寿命,并促进土壤生态系统的养分循环。诸如更移动的热解装置和原料优化技术等技术创新,使得生物炭的生产更加便利、成本更低。这正在扩大其在大型农场和永续发展驱动型企业的应用。然而,为了确保更广泛的市场可靠性和信任度,仍需应对诸如原料投入品质不稳定以及缺乏标准化认证架构等挑战。

2024年,农地应用领域占57.1%的份额,预计2025年至2034年的复合年增长率为8.5%。农田仍是矿物土壤改良剂的主要应用领域,石灰、玄武岩和生物炭等材料的使用量不断增加,以提高生产力和碳封存。农民正在利用这些投入来保持水分、稳定养分并提高产量,同时实现气候目标。这些土壤处理方法不仅改善了土地的性能,还透过将碳封存在地下来帮助抵消排放。随着对永续农业的需求不断增长,农地应用在向再生和低碳农业体系转变的过程中发挥着至关重要的作用。

2024年,北美碳封存矿物土壤改良剂市场产值达2.209亿美元。美国以80%的份额(相当于1.492亿美元)保持主导地位。美国凭藉其先进的耕作方式和对永续农业计画的大力资金支持,已成为领跑者。研究机构、私人企业和政府机构正在合作,加强土壤改良剂的使用,以捕获碳并提高土壤活力。这项方法得到了一系列政策、补贴和州级计画的支持,这些计画旨在支持相关实施,使美国成为推动该地区创新和应用的关键力量。

全球碳封存矿物土壤改良剂市场的主要实体包括 Indigo Agriculture、Mati Carbon、Lithos Carbon、Biochar Supreme、Nori、Pacific Biochar、Regen Network、Cool Planet、Soil Capital、UNDO Carbon Ltd.、InPlanet、Dagan、Carbonfuture、Silicate 和 Carbofex。这些公司在扩大气候智慧型土壤解决方案和提高产品可用性方面发挥着至关重要的作用。许多公司正在投资研发,以开发适合各种土壤类型和气候的高性能矿物混合物和生物炭产品。与农业合作社和碳补偿平台的策略合作伙伴关係有助于建立强大的供应链并接触新的客户群。一些公司正专注于建造行动处理单元和在地化生产中心,以降低物流成本并提高采用率。此外,一些参与者正在努力建立认证和验证框架,以增强市场信任并将其产品整合到碳信用系统中。这种多管齐下的方法使他们能够在快速发展的市场中保持竞争力并扩大影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 衝击力

- 成长动力

- 气候政策与净零承诺

- 碳信用市场发展与定价

- 农业永续性和土壤健康倡议

- 技术进步和成本降低

- 产业陷阱与挑战

- 实施成本高,经济障碍多

- 测量、报告和验证的复杂性

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依修订类型,2021-2034 年

- 主要趋势

- 生物炭

- 增强耐候材料

- 玄武岩和橄榄石

- 其他硅酸盐矿物(如硅灰石、蛇纹石)

- 石灰和石灰石的应用

- 沸石和粘土矿物

- 有机矿物混合改良剂

- 新兴的改良技术

- 奈米强化矿物改良剂

- 功能化碳材料

- 微生物-矿物质组合

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 农地应用

- 一年生作物系统

- 多年生作物系统

- 土壤健康和生产力提高

- 草原和牧场管理

- 牲畜放牧系统

- 提高牧草产量

- 草原碳封存

- 林业和农林业

- 森林土壤管理

- 农林业系统

- 植树造林管理

- 土地恢復与復垦

- 退化土地恢復

- 矿场修復

- 湿地和河岸修復

第七章:市场估计与预测:依最终用途领域,2021-2034

- 主要趋势

- 商业性农业

- 大规模农业经营

- 精准农业整合

- 永续农业认证

- 小农和家庭农业

- 小规模生产者应用

- 扩展服务集成

- 金融包容性和支持

- 碳农业和补偿项目

- 专用碳封存项目

- 自愿性碳市场整合

- 合规碳市场应用

- 研究与开发

- 学术研究机构

- 私部门研发

- 试点示范项目

- 政府和公共部门

- 国家气候计划

- 农业政策实施

- 土地管理机构

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- UNDO Carbon Ltd.

- InPlanet

- Silicate

- Lithos Carbon

- Mati Carbon

- Carbonfuture

- Pacific Biochar

- Biochar Supreme

- Carbofex

- Cool Planet

- Nori

- Indigo Agriculture

- Regen Network

- Soil Capital

- Dagan

The Global Mineral Soil Amendments for Carbon Sequestration Market was valued at USD 726.3 million in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 1.7 billion by 2034. Growing attention toward climate change mitigation is significantly driving demand for nature-based solutions, with mineral soil amendments emerging as a powerful tool in this transformation. These materials-ranging from biochar to enhanced weathering minerals and lime-not only help lock carbon in the soil but also improve soil structure and fertility. Governments across the globe are backing this movement by offering policy incentives, research support, and carbon credit mechanisms. In parallel, industries and farming communities are adopting these practices to align with sustainability goals and improve land productivity. With heightened interest in regenerative agriculture and emissions reduction, mineral amendments are gaining traction across varied landscapes. Rising concerns about land degradation and the need for long-term environmental resilience continue to push this market forward.

As awareness of the environmental and economic benefits grows, mineral soil amendments are increasingly seen not just as a climate solution but also as a productivity enhancer for agricultural systems. Farmers and landowners are beginning to recognize that these amendments provide long-term value far beyond carbon sequestration. By improving soil structure, enhancing nutrient retention, and promoting beneficial microbial activity, mineral inputs such as biochar, basalt, lime, and olivine contribute directly to increased crop yields and soil resilience. This leads to better water efficiency, reduced reliance on chemical fertilizers, and greater resistance to erosion and extreme weather conditions. As a result, their integration into soil management plans is becoming a strategic move for sustainable agriculture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $726.3 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 8.6% |

The biochar segment generated USD 264.7 million by 2024, with a consistent CAGR of 8.7% throughout 2034. Biochar is a leading contributor within this market, thanks to its reliability in both carbon sequestration and enhancing soil quality. Created through pyrolysis, this porous material improves water retention, increases microbial life, and supports nutrient cycling in soil ecosystems. Innovations in technology, such as more mobile pyrolysis units and feedstock optimization techniques, are making biochar easier and more affordable to produce. This is expanding its adoption among large-scale farms and sustainability-driven enterprises. However, challenges such as inconsistent quality of feedstock inputs and the lack of standardized certification frameworks still need to be addressed to ensure broader market reliability and trust.

In 2024, the cropland applications segment held 57.1% share and is expected to grow at a CAGR of 8.5% from 2025 through 2034. Cropland remains the dominant application area for mineral soil amendments, with increased use of materials like lime, basalt, and biochar to boost productivity and carbon sequestration. Farmers are turning to these inputs to retain moisture, stabilize nutrients, and boost yields, all while meeting climate goals. These soil treatments are not just improving the land's performance-they're also helping to offset emissions by storing carbon underground. As demand for sustainable agriculture increases, cropland applications are proving critical in the shift toward regenerative and carbon-conscious farming systems.

North America Mineral Soil Amendments for Carbon Sequestration Market generated USD 220.9 million in 2024. United States maintained its dominant position with an 80% share, translating to USD 149.2 million. The U.S. has emerged as a frontrunner due to its progressive farming practices and significant financial support for sustainable agriculture initiatives. Research institutions, private companies, and government agencies are collaborating to enhance the use of soil amendments that trap carbon and improve soil vitality. This approach is backed by a framework of policies, subsidies, and state-level programs that support implementation, making the U.S. a key force in driving innovation and adoption across the region.

Leading entities operating in the Global Mineral Soil Amendments for Carbon Sequestration Market include Indigo Agriculture, Mati Carbon, Lithos Carbon, Biochar Supreme, Nori, Pacific Biochar, Regen Network, Cool Planet, Soil Capital, UNDO Carbon Ltd., InPlanet, Dagan, Carbonfuture, Silicate, and Carbofex. These companies play a crucial role in scaling up climate-smart soil solutions and advancing product availability. Many are investing in R&D to develop high-performance mineral blends and biochar products tailored for various soil types and climates. Strategic partnerships with agricultural cooperatives and carbon offset platforms are helping to build robust supply chains and access new customer segments. Some firms are focusing on building mobile processing units and localized production hubs to reduce logistics costs and increase adoption rates. Additionally, several players are working toward certification and verification frameworks to enhance market trust and integrate their products into carbon credit systems. This multifaceted approach enables them to remain competitive and expand their reach in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Climate policy and net-zero commitments

- 3.2.1.2 Carbon credit market development and pricing

- 3.2.1.3 Agricultural sustainability and soil health initiatives

- 3.2.1.4 Technology advancement and cost reduction

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation costs and economic barriers

- 3.2.2.2 Measurement, reporting, and verification complexity

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Amendment Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Biochar

- 5.3 Enhanced weathering materials

- 5.3.1 Basalt and olivine

- 5.3.2 Other silicate minerals (e.g., wollastonite, serpentine)

- 5.4 Lime and limestone applications

- 5.5 Zeolites and clay minerals

- 5.6 Organic-mineral hybrid amendments

- 5.7 Emerging amendment technologies

- 5.8 Nano-enhanced mineral amendments

- 5.9 Functionalized carbon materials

- 5.10 Microbial-mineral combinations

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cropland applications

- 6.2.1 Annual crop systems

- 6.2.2 Perennial crop systems

- 6.2.3 Soil health and productivity enhancement

- 6.3 Grassland and pasture management

- 6.3.1 Livestock grazing systems

- 6.3.2 Forage production enhancement

- 6.3.3 Carbon sequestration in grasslands

- 6.4 Forestry and agroforestry

- 6.4.1 Forest soil management

- 6.4.2 Agroforestry systems

- 6.4.3 Tree plantation management

- 6.5 Land restoration and rehabilitation

- 6.5.1 Degraded land recovery

- 6.5.2 Mine site rehabilitation

- 6.5.3 Wetland and riparian restoration

Chapter 7 Market Estimates & Forecast, By End Use Sector, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial agriculture

- 7.2.1 Large-scale farming operations

- 7.2.2 Precision agriculture integration

- 7.2.3 Sustainable agriculture certification

- 7.3 Smallholder and family farming

- 7.3.1 Small-scale producer applications

- 7.3.2 Extension service integration

- 7.3.3 Financial inclusion and support

- 7.4 Carbon farming and offset projects

- 7.4.1 Dedicated carbon sequestration projects

- 7.4.2 Voluntary carbon market integration

- 7.4.3 Compliance carbon market applications

- 7.5 Research and development

- 7.5.1 Academic research institutions

- 7.5.2 Private sector R&D

- 7.5.3 Pilot and demonstration projects

- 7.6 Government and public sector

- 7.6.1 National climate programs

- 7.6.2 Agricultural policy implementation

- 7.6.3 Land management agencies

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 UNDO Carbon Ltd.

- 9.2 InPlanet

- 9.3 Silicate

- 9.4 Lithos Carbon

- 9.5 Mati Carbon

- 9.6 Carbonfuture

- 9.7 Pacific Biochar

- 9.8 Biochar Supreme

- 9.9 Carbofex

- 9.10 Cool Planet

- 9.11 Nori

- 9.12 Indigo Agriculture

- 9.13 Regen Network

- 9.14 Soil Capital

- 9.15 Dagan