|

市场调查报告书

商品编码

1797823

住宅建筑自动化系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Building Automation Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

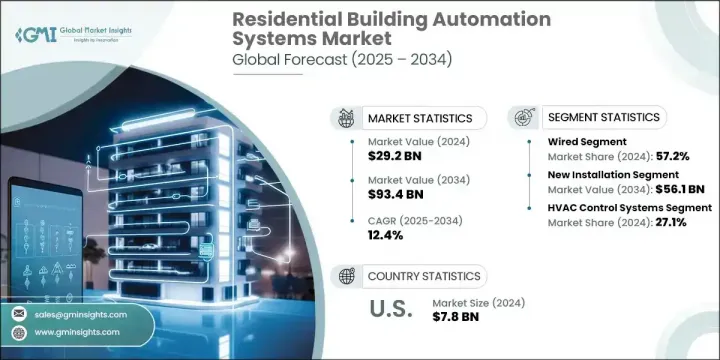

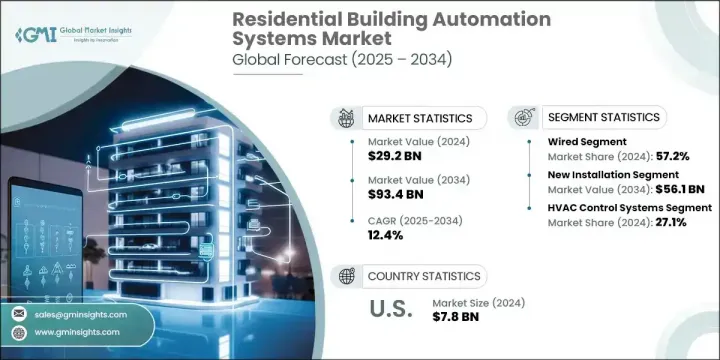

2024年,全球住宅建筑自动化系统市场规模达292亿美元,预计到2034年将以12.4%的复合年增长率成长,达到934亿美元。推动这一成长的因素包括:能源效率需求的不断增长、智慧家居设备的普及、物联网的快速发展以及更严格的环境和建筑法规。消费者越来越重视直觉、整合的系统,这些系统能够简化住宅内照明、暖通空调和安防的控制。物联网协定和无线连接的进步提高了设备的可靠性和相容性,加速了其在新建和翻新专案中的普及。

此外,自动化改造和永续解决方案的趋势也日益增长,尤其是在智慧生活日益成为常态的已开发经济体。随着节能意识的增强,开发商和製造商正将重点转向可持续的智慧系统,以支持环保的居住环境。各国政府正透过监管支持推动绿色生活,进一步鼓励智慧家庭的普及。这些因素都加速了这一市场的成长动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 292亿美元 |

| 预测值 | 934亿美元 |

| 复合年增长率 | 12.4% |

由于物联网技术的使用日益普及,且无需结构改造即可轻鬆安装,预计无线领域在2025年至2034年间的复合年增长率将达到15.6%。随着城市化进程的推进,人们对灵活、易于扩展且适用于公寓和紧凑型住宅布局的系统的兴趣日益浓厚。安全、低能耗的无线通讯协定的升级,使得在不同生活环境中整合空调、照明和家庭安防系统变得更加容易,从而为小型和大型智慧家庭系统增添了价值。

预计到2034年,新安装市场规模将达到561亿美元,这得益于对配备全整合自动化系统的智慧住宅建筑的需求激增。随着智慧技术成为标准住宅设计的一部分,自动化系统越来越多地融入建筑过程中。自动化供应商与建筑公司之间的合作对于满足此需求至关重要,尤其是在专案初期就设计交钥匙解决方案以满足现代住宅的特定需求时。

2024年,美国住宅楼宇自动化系统市场规模达78亿美元,这得益于智慧科技的高普及率以及消费者对节能生活的日益重视。该地区许多获得认证的节能住宅都体现了这一发展势头。强有力的监管措施对永续性的重视以及优惠政策持续鼓励智慧楼宇系统的使用。这使得美国成为企业投资开发以互通性、合规性和降低能耗为重点的解决方案的最具前景的市场之一。与建筑商和合规专家的合作,使企业能够快速整合,并在这个竞争激烈的领域拓展业务。

住宅建筑自动化系统市场的主要参与者包括施耐德电气、ABB、江森自控、西门子股份公司和霍尼韦尔国际。为了巩固市场地位,住宅楼宇自动化系统领域的领导者正致力于创建整合生态系统,将暖通空调、照明、安全和能源管理整合到统一的平台中。企业正在投资人工智慧自动化和语音技术,以提升使用者体验和适应性。与房地产开发商和建筑商的策略合作伙伴关係使建筑专案的早期整合成为可能,而云端连接和行动应用程式则确保了远端存取和控制。企业也正在扩展针对改造和新建专案的产品线,提供适用于各种房屋类型的可扩展解决方案。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 能源效率需求不断成长

- 智慧家庭设备和物联网应用的快速成长

- 政府政策与绿建筑规范

- 人工智慧和机器学习的进步

- 与语音助理和人工智慧平台集成

- 产业陷阱与挑战

- 初始安装成本高且投资报酬率担忧

- 网路安全和隐私风险

- 市场机会

- 既有住宅建筑改造市场

- 与再生能源和储能的整合

- 对辅助生活和居家养老解决方案的需求不断增长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按系统类型,2021 - 2034 年

- 主要趋势

- 能源管理系统(EMS)

- 照明控制系统

- HVAC控制系统

- 安全和门禁系统

- 消防和安全系统

- 智慧家电

- 其他的

第六章:市场估计与预测:按通讯技术,2021 - 2034 年

- 主要趋势

- 有线

- 无线的

- ZigBee

- Z-Wave

- 无线上网

- 蓝牙

- 其他的

第七章:市场估计与预测:按自动化水平,2021 - 2034 年

- 主要趋势

- 半自动化系统

- 全自动系统

第八章:市场估计与预测:按安装量,2021 - 2034 年

- 主要趋势

- 新安装

- 改造/升级

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Global Key Players

- Regional Key Players

- 利基市场参与者/颠覆者

- 德尔塔控制公司

- 迪斯特克控制公司

The Global Residential Building Automation Systems Market was valued at USD 29.2 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 93.4 billion by 2034. This growth is being driven by rising demand for energy efficiency, the expansion of smart home devices, the rapid evolution of the Internet of Things, and stricter environmental and building regulations. Consumers are placing higher priority on intuitive, integrated systems that simplify the control of lighting, HVAC, and security within their homes. Advancements in IoT protocols and wireless connectivity have improved the reliability and compatibility of devices, accelerating adoption in both new construction and renovations.

There is also a growing trend in retrofit automation and sustainable solutions, particularly in developed economies where smart living is becoming the norm. With increasing awareness about energy conservation, developers and manufacturers are shifting their focus to sustainable, intelligent systems that support eco-friendly residential environments. Governments are pushing for green living through regulatory backing, further encouraging smart home adoption. These factors contribute to the accelerated momentum of this expanding market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.2 Billion |

| Forecast Value | $93.4 Billion |

| CAGR | 12.4% |

The wireless segment is forecasted to grow at a CAGR of 15.6% from 2025 to 2034, due to the increased use of IoT-enabled technologies and the convenience of installation without structural changes. As urbanization continues, there is growing interest in flexible, easily scalable systems suitable for apartments and compact residential layouts. Upgrades in secure, low-energy wireless communication protocols have made it easier to integrate air conditioning, lighting, and home security systems across diverse living environments, adding value to both small and large-scale smart home setups.

The new installation segment is projected to reach USD 56.1 billion by 2034, driven by the surge in demand for smart residential buildings equipped with fully integrated automation from the ground up. As smart technologies become part of standard home design, automation systems are increasingly being built into the construction process. Partnerships between automation providers and construction firms are essential to meet this demand, especially when turnkey solutions are designed to meet the specific needs of modern homes from the beginning of a project.

U.S. Residential Building Automation Systems Market was valued at USD 7.8 billion in 2024, supported by a high rate of smart technology adoption and growing consumer awareness about energy-efficient living. Many certified energy-efficient homes in the region reflect this momentum. Strong regulatory focus on sustainability and favorable policies continue to encourage the use of intelligent building systems. This makes the U.S. one of the most promising markets for companies to invest in developing solutions that prioritize interoperability, regulatory compliance, and reduced energy consumption. Collaborations with builders and compliance experts allow companies to fast-track integration and broaden their footprint in this competitive space.

Key Residential Building Automation Systems Market participants include Schneider Electric, ABB, Johnson Controls, Siemens AG, and Honeywell International. To strengthen their market presence, leading players in the residential building automation systems space are focusing on creating integrated ecosystems that combine HVAC, lighting, security, and energy management into unified platforms. Investments are being made in AI-powered automation and voice-enabled technologies to enhance user experience and adaptability. Strategic partnerships with property developers and builders enable early-stage integration in construction projects, while cloud connectivity and mobile applications ensure remote access and control. Companies are also expanding product lines tailored for both retrofitting and new builds, offering scalable solutions across housing types.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 -2034

- 2.2 Key market trends

- 2.2.1 System type trends

- 2.2.2 Communication technology trends

- 2.2.3 Automation level trends

- 2.2.4 Installation trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy efficiency

- 3.2.1.2 Rapid growth of smart home devices and IoT adoption

- 3.2.1.3 Government policies and green building codes

- 3.2.1.4 Advancements in AI and machine learning

- 3.2.1.5 Integration with voice assistants and AI platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial installation cost and ROI concerns

- 3.2.2.2 Cybersecurity and privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Retrofit market in existing residential buildings

- 3.2.3.2 Integration with renewable energy and storage

- 3.2.3.3 Rising demand for assisted living and aging-in-place solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By System Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Energy management systems (EMS)

- 5.3 Lighting control systems

- 5.4 HVAC control systems

- 5.5 Security & access control systems

- 5.6 Fire & safety systems

- 5.7 Smart appliances

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Communication Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

- 6.3.1 ZigBee

- 6.3.2 Z-Wave

- 6.3.3 Wi-Fi

- 6.3.4 Bluetooth

- 6.3.5 Others

Chapter 7 Market Estimates and Forecast, By Automation Level, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Semi-automation system

- 7.3 Fully-automation system

Chapter 8 Market Estimates and Forecast, By Installation, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 New installation

- 8.3 Retrofit/upgrade

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Honeywell International Inc.

- 10.1.2 Siemens AG

- 10.1.3 Schneider Electric

- 10.1.4 Johnson Controls International Plc

- 10.1.5 ABB Ltd.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Carrier

- 10.2.1.2 Crestron Electronics, Inc.

- 10.2.1.3 Lutron Electronics Co., Inc

- 10.2.1.4 Trane Technologies

- 10.2.1.5 Rockwell Automation

- 10.2.1.6 Eaton Corporation

- 10.2.1.7 Cisco Systems, Inc.

- 10.2.1.8 Emerson Electric Co.

- 10.2.2 Europe

- 10.2.2.1 Legrand SA

- 10.2.2.2 Bosch Sicherheitssysteme GmbH

- 10.2.2.3 Beckhoff Automation

- 10.2.3 Asia Pacific

- 10.2.3.1 Mitsubishi Electric Corporation

- 10.2.3.2 Hitachi, Ltd.

- 10.2.3.3 Azbil Corporation

- 10.2.3.4 Hangzhou Hikvision Digital Technology Co., Ltd.

- 10.2.3.5 SAMSUNG

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Delta Controls Inc.

- 10.3.2 Distech Controls