|

市场调查报告书

商品编码

1797826

羊毛加工机械市场机会、成长动力、产业趋势分析及2025-2034年预测Wool Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

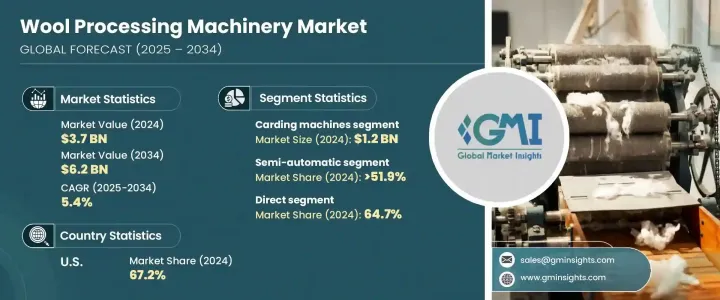

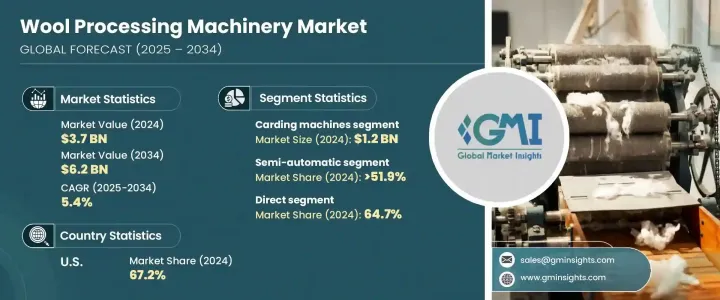

2024年,全球羊毛加工机械市场规模达37亿美元,预计到2034年将以5.4%的复合年增长率成长,达到62亿美元。这一稳定成长主要得益于羊毛製品需求的成长、纺织技术的进步以及製造业自动化程度的提高。纺织业的復苏,尤其是在南亚和东南亚地区,促使企业用现代、高效、环保的机械设备取代老旧过时的系统。对永续加工实践的需求正在成长,尤其是在註重绿色营运的企业中。采用减少用水量和能耗的设备日益受到青睐。

此外,技术纺织品在服装以外的应用领域不断扩展,例如在隔热材料和毡製品领域的应用,也推动了设备需求的成长。自动化和智慧製造的趋势正在推动对人工智慧、物联网和机器学习的投资,这些领域正在帮助工厂监控即时效能,透过预测性维护提高正常运行时间,并最大限度地提高产量。纺织公司也在投资用于羊毛回收的机械设备,这凸显了向永续性和循环生产的更广泛转变。对精准、高效和环保营运的关注正在持续重塑全球羊毛机械格局。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 62亿美元 |

| 复合年增长率 | 5.4% |

2024年,半自动机械市场占据51.9%的市场份额,预计到2034年将以5.3%的复合年增长率成长。这些机器在成本效益和性能之间取得了平衡,因此对发展中市场的工厂尤其具有吸引力。它们之所以越来越受欢迎,是因为它们能够超越手动设置,同时避免了全自动化的高成本。在劳动力短缺或预算有限的地区,半自动系统是理想的解决方案,能够以具有竞争力的价格提供稳定的产量和可靠性。

2024年,北美羊毛加工机械市场占有29.3%的市场份额,并将以5.6%的复合年增长率稳定成长,直至2034年。美国和加拿大都在推动本土纺织品製造,减少对进口的依赖,这鼓励了对尖端羊毛加工技术的投资。对支持再生羊毛和低影响纺织品生产的机械的需求日益增长。此外,以安全为重点的法规和永续发展目标正在激励北美纺织品生产商升级到现代化的自动化系统。精密製造工艺,尤其是在技术纺织和服装业,也促进了这项需求的激增。

积极影响全球羊毛加工机械市场的关键参与者包括 Savio Macchine Tessili SpA、Tritschler 集团、Rieter Holding AG、Lakshmi Machine Works Ltd. 和 Marzoli - Camozzi 集团。领先的羊毛加工机械製造商正专注于永续创新、数位整合和区域市场渗透,以提升其市场份额。许多公司正在使用支援人工智慧和物联网的设备升级其产品组合,这些设备可实现即时效能监控、自动调整和预测性维护。产品多元化,包括羊毛回收、节能营运和低用水量工艺,也在满足永续发展客户需求方面发挥核心作用。企业越来越多地与纺织品製造商合作,提供根据当地生产需求量身定制的机械解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球羊毛需求不断成长

- 服装和纺织业的产品和成长

- 机械技术进步

- 产业陷阱与挑战

- 初期投资成本高

- 原毛价格波动

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机械类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 编码 - 84451950)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依机械类型,2021 - 2034 年

- 主要趋势

- 煮练机

- 梳理机

- 联合机

- 纺纱机

- 染色机

- 混合机

- 整理机

- 剪切机和打包机

第六章:市场估计与预测:依自动化类型,2021 - 2034 年

- 主要趋势

- 手动/传统机械

- 半自动机械

- 全自动机械

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 服饰和服饰

- 家用纺织品(毛毯、室内装饰用品)

- 工业用布

- 地毯和地垫

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 毛纺厂

- 纺织品製造商

- 地毯编织单元

- 出口型单位

第九章:市场估计与预测:按配销通路2021 - 2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Camozzi

- Fangzheng

- Fong's

- Jingwei

- Lakshmi

- NSC

- Rieter

- Saurer

- Savio

- Shanghai Texmac

- Tatham

- Texpro

- Trutzschler

The Global Wool Processing Machinery Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.2 billion by 2034. This steady growth is largely fueled by increased demand for wool-based products, advancements in textile technologies, and rising automation across the manufacturing sector. The resurgence of the textile industry, particularly across South and Southeast Asia, has encouraged companies to replace older, outdated systems with modern, efficient, and eco-friendly machinery. Demand is rising for sustainable processing practices, especially in companies focusing on green operations. The adoption of equipment that reduces water consumption and energy usage continues to gain traction.

Additionally, the expanding use of technical textiles beyond clothing, such as in insulation and felting applications, is boosting equipment demand. The trend toward automation and smart manufacturing is driving investments in AI, IoT, and machine learning, which are helping mills monitor real-time performance, improve uptime through predictive maintenance, and maximize production output. Textile companies are also investing in machinery designed for wool recycling, highlighting a broader shift toward sustainability and circular production. The focus on precision, efficiency, and eco-conscious operations continues to reshape the global wool machinery landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

In 2024, the semi-automatic machinery segment held a 51.9% share 2024 and is projected to grow at a CAGR of 5.3% through 2034. These machines strike a balance between cost-efficiency and performance, making them especially appealing to mills in developing markets. Their rising adoption is driven by their ability to outperform manual setups while avoiding the high cost of full automation. In regions with labor shortages or budget limitations, semi-automatic systems offer an ideal solution, delivering solid output and reliability at a competitive price.

North America Wool Processing Machinery Market held 29.3% share in 2024 and is growing steadily at a CAGR of 5.6% through 2034. Both the US and Canada are pushing for onshore textile manufacturing and reducing dependence on imports, which is encouraging investments in cutting-edge wool processing technologies. There's increasing demand for machinery that supports the production of recycled wool and low-impact textiles. Additionally, safety-focused regulations and sustainability goals are motivating textile producers in North America to upgrade to modern, automated systems. Precision-based manufacturing processes, particularly in the technical textile and garment industries, are also contributing to this demand surge.

Key players actively shaping the Global Wool Processing Machinery Market include Savio Macchine Tessili S.p.A., Tritschler Group, Rieter Holding AG, Lakshmi Machine Works Ltd., and Marzoli - Camozzi Group. Leading wool processing machinery manufacturers are focusing on sustainable innovation, digital integration, and regional market penetration to enhance their market presence. Many companies are upgrading their portfolios with AI-powered and IoT-enabled equipment that allows real-time performance monitoring, automated adjustments, and predictive maintenance. Product diversification toward wool recycling, energy-saving operations, and low-water-use processes also plays a central role in capturing demand from sustainability-driven customers. Firms are increasingly collaborating with textile manufacturers to offer customized machinery solutions tailored to local production needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machinery type

- 2.2.3 Automation type

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.4 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global demand for wool

- 3.2.1.2 Products, growth of the apparel and textile industry

- 3.2.1.3 Technological advancements in machinery

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Fluctuating raw wool prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machinery type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84451950)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machinery Type, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Scouring machines

- 5.3 Carding machines

- 5.4 Combining machines

- 5.5 Spinning machines

- 5.6 Dying machines

- 5.7 Blending machines

- 5.8 Finishing machines

- 5.9 Shearing and baling machines

Chapter 6 Market Estimates & Forecast, By Automation Type, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Manual/traditional machinery

- 6.3 Semi-automatic machinery

- 6.4 Fully automatic machinery

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Apparel & garments

- 7.3 Home textiles (blankets, upholstery)

- 7.4 Industrial fabrics

- 7.5 Carpets and rugs

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Woolen mills

- 8.3 Textile manufacturers

- 8.4 Carpet weaving units

- 8.5 Export-oriented units

Chapter 9 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Camozzi

- 11.2 Fangzheng

- 11.3 Fong's

- 11.4 Jingwei

- 11.5 Lakshmi

- 11.6 NSC

- 11.7 Rieter

- 11.8 Saurer

- 11.9 Savio

- 11.10 Shanghai Texmac

- 11.11 Tatham

- 11.12 Texpro

- 11.13 Trutzschler