|

市场调查报告书

商品编码

1797833

雷射印表机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Laser Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

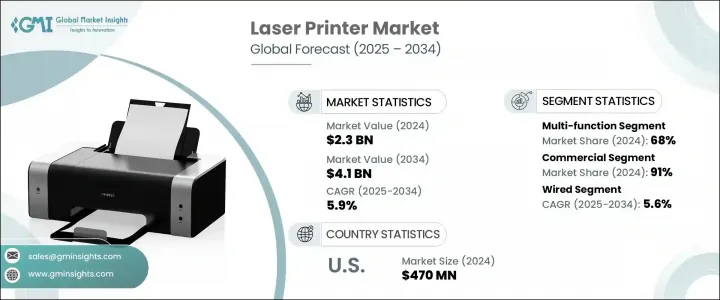

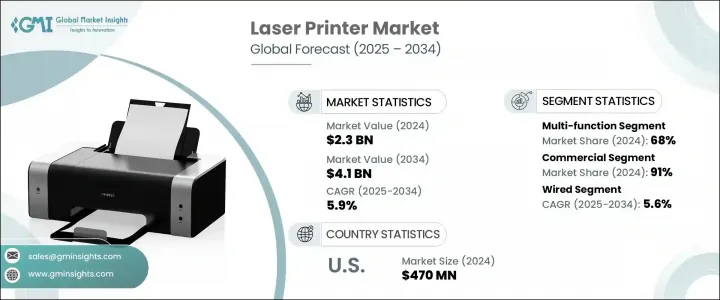

2024年,全球雷射印表机市场规模达23亿美元,预计2034年将以5.9%的复合年增长率成长,达到41亿美元。随着企业和机构持续在数位转型与高品质、可靠列印解决方案的需求之间取得平衡,该市场正稳步成长。儘管许多行业正在迅速采用数位化工作流程,但教育、医疗保健、法律和金融等行业仍然严重依赖纸本文件。对耐用、快速、高效能列印设备的持续需求推动了市场需求。各组织机构纷纷选择能够提供卓越输出和效率的先进雷射印表机。

此外,远距办公和混合办公环境的广泛应用加速了对无线和云端印表机的需求。这种转变正在重新定义工作场所生态系统,使团队能够从多个地点列印和管理文件。包括学校、政府机构和企业在内的机构买家越来越多地投资于满足其高列印量需求的雷射印表机。云端平台和行动连接与新型雷射印表机的无缝整合正在推动产业发展,使列印更加灵活,更加以用户为中心。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.9% |

多功能雷射印表机 (MFP) 市场在 2024 年占据了 68% 的最大市场份额,预计到 2034 年将以 6.1% 的复合年增长率成长。这些设备能够将列印、影印、扫描和传真功能集于一身,从而降低管理成本并简化工作流程,因此在该领域占据主导地位。 MFP 的高效性使其成为寻求降低营运支出和简化设备管理的组织的理想选择。由于耗材使用量和能耗的减少,以及集中维护的优势,大型企业和小型企业对 MFP 的需求都在增加。

商业领域在2024年占据了91%的市场份额,预计到2034年将以6%的复合年增长率成长。政府机构、企业办公室、学校和医疗保健机构等商业用户需要能够每天处理大量列印的高速、高品质印表机。事实证明,多功能雷射印表机对于满足这些期望至关重要,它能够提供专业级的输出,并将停机时间降至最低。其在持续使用下的耐用性和可靠性使其成为商业环境中的首选,因为在商业环境中,不间断的性能至关重要。

美国雷射印表机市场占了79%的市场份额,2024年市场规模达4.7亿美元。美国市场的成长得益于列印技术的持续创新,例如更高的解析度、更快的处理速度、与物联网系统的整合以及增强的无线功能。这些进步不仅提高了营运效率,也降低了长期成本。此外,美国机构正在投资升级其列印基础设施,以配合持续的数位转型目标,尤其是在医疗保健和教育领域。

全球雷射印表机市场的知名企业包括爱普生、罗兰、柯尼卡美能达、奔图国际、惠普开发、戴尔、佐藤美国、利盟国际、兄弟工业、施乐、东芝、衝电气工业、佳能、京瓷和理光。为了保持并扩大市场份额,雷射印表机行业的公司正优先考虑创新和技术升级。他们专注于开发多功能、相容云端技术且节能的机型,以满足不断变化的商业和消费者需求。研发方面的策略性投资仍然至关重要,这有助于推出输出速度更快、影像品质更高、环境影响更小的产品。领先的製造商也在与软体开发商结盟,以增强云端整合和行动可访问性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 单一功能

- 多功能的

第六章:市场估计与预测:依输出类型,2021 - 2034

- 主要趋势

- 彩色雷射

- 黑白雷射

第七章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 有线

- 无线的

第八章:市场估计与预测:按列印速度,2021 - 2034 年

- 主要趋势

- 钢弹 30ppm

- 30至50 ppm

- 高于 50 ppm

第九章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第十章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人

- 商业的

- 公司的

- 教育机构

- 媒体和出版机构

- 印刷中心和文具

- 其他(医疗保健、零售等)

- 政府机构

- 工业的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 专业零售店

- 其他(独立零售商等)

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Brother Industries

- Canon

- Dell

- Epson

- HP Development

- Konica Minolta

- Kyocera

- Lexmark International

- Oki Electric Industry

- Pantum International

- Ricoh

- Roland DG

- SATO America

- Toshiba

- Xerox

The Global Laser Printer Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 4.1 billion by 2034. The market is witnessing steady growth as businesses and institutions continue to balance digital transformation with the need for high-quality, reliable print solutions. While many sectors are rapidly adopting digital workflows, industries such as education, healthcare, legal, and finance still heavily rely on physical documentation. This persistent need for durable, fast, and high-performance printing devices is propelling demand. Organizations are opting for advanced laser printers that deliver superior output and efficiency.

Additionally, widespread adoption of remote and hybrid work environments has accelerated the demand for wireless and cloud-enabled printers. This shift is redefining the workplace ecosystem, enabling teams to print and manage documents from multiple locations. Institutional buyers, including schools, government agencies, and corporations, are increasingly investing in laser printers that meet their high-volume requirements. The seamless integration of cloud platforms and mobile connectivity into newer laser printer models is pushing the industry forward, making printing more flexible and user-centric.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.9% |

The multifunction laser printers (MFPs) segment held the largest market share of 68% in 2024 and is forecast to grow at a CAGR of 6.1% through 2034. These devices are dominating the segment due to their ability to combine printing, copying, scanning, and faxing in one unit, allowing for reduced overhead costs and streamlined workflows. The efficiency offered by MFPs makes them ideal for organizations seeking to lower operational expenditures and simplify device management. The demand for MFPs is rising across both large enterprises and small businesses, thanks to the reduction in consumable usage and energy consumption, along with the benefits of consolidated maintenance.

The commercial segment held a 91% share in 2024 and is anticipated to grow at a CAGR of 6% through 2034. Commercial users such as government bodies, corporate offices, schools, and healthcare providers require high-speed, high-quality printers that can manage large volumes daily. Multifunction laser printers have proven to be essential in meeting these expectations, offering professional-grade output along with minimal downtime. Their durability and reliability under constant use make them the preferred choice in commercial settings, where uninterrupted performance is critical.

United States Laser Printer Market accounted for a 79% share and reached USD 470 million in 2024. The market's growth in the U.S. is being driven by continuous innovations in printing technology, such as enhanced resolution, quicker processing speeds, integration with IoT systems, and increased wireless functionality. These advancements are enabling more efficient operations while reducing long-term expenses. Additionally, U.S. institutions are investing in upgrading their print infrastructure to align with ongoing digital transformation goals, particularly within the healthcare and education sectors.

Prominent players in the Global Laser Printer Market include Epson, Roland DG, Konica Minolta, Pantum International, HP Development, Dell, SATO America, Lexmark International, Brother Industries, Xerox, Toshiba, Oki Electric Industry, Canon, Kyocera, and Ricoh. To maintain and expand their market presence, companies in the laser printer sector are prioritizing innovation and technology upgrades. They are focusing on developing multifunctional, cloud-compatible, and energy-efficient models that align with evolving business and consumer needs. Strategic investment in R&D remains crucial, enabling the introduction of products with faster output, improved image quality, and lower environmental impact. Leading manufacturers are also forming alliances with software developers to enhance cloud integration and mobile accessibility.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By output type

- 2.2.4 By connectivity

- 2.2.5 By print speed

- 2.2.6 By price

- 2.2.7 By end use

- 2.2.8 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Single function

- 5.3 Multi-function

Chapter 6 Market Estimates & Forecast, By Output Type, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Color laser

- 6.3 Black & white laser

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Print speed, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Up to 30ppm

- 8.3 30 to 50 ppm

- 8.4 Above 50 ppm

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key Trends

- 10.2 Individual

- 10.3 Commercial

- 10.2.1 Corporate

- 10.2.2 Education institutes

- 10.2.3 Media & publication houses

- 10.2.4 Printing centres & stationary

- 10.2.5 Others (healthcare, retail, etc.)

- 10.4 Government Agencies

- 10.5 Industrial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarket

- 11.3.2 Specialty retail stores

- 11.3.3 Others (independent retailer etc.)

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Brother Industries

- 13.2 Canon

- 13.3 Dell

- 13.4 Epson

- 13.5 HP Development

- 13.6 Konica Minolta

- 13.7 Kyocera

- 13.8 Lexmark International

- 13.9 Oki Electric Industry

- 13.10 Pantum International

- 13.11 Ricoh

- 13.12 Roland DG

- 13.13 SATO America

- 13.14 Toshiba

- 13.15 Xerox