|

市场调查报告书

商品编码

1797843

液压缸市场机会、成长动力、产业趋势分析及2025-2034年预测Hydraulic Cylinder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

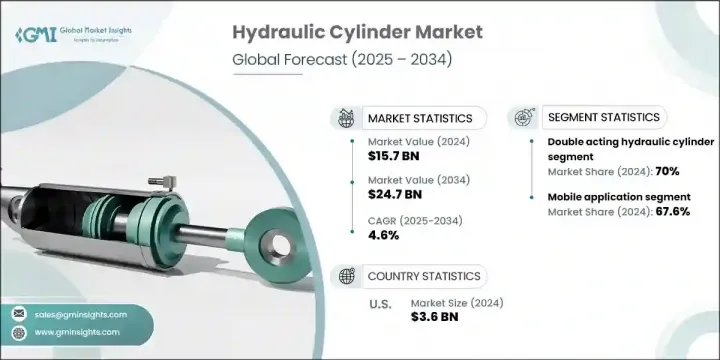

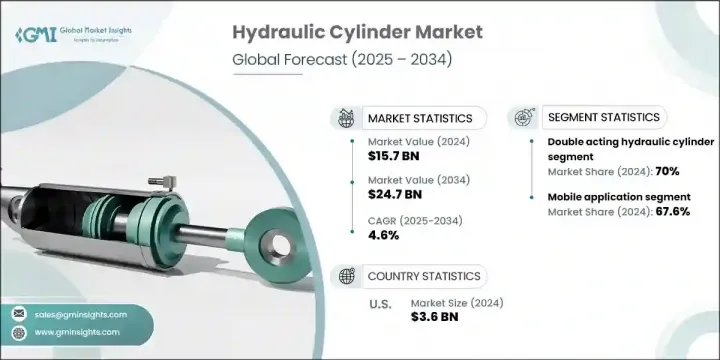

2024 年全球液压缸市场价值为 157 亿美元,预计到 2034 年将以 4.6% 的复合年增长率增长至 247 亿美元。农业、采矿业、製造业和建筑业等多个终端使用领域工业自动化的日益整合显着增加了对液压缸的需求。随着各行各业不断追求更高的生产力和营运效率,对可靠的运动控制系统的依赖也日益加深。液压设计和技术的不断进步进一步推动了这种需求。製造商正在采用智慧感测器和基于物联网的控制系统来提高能源效率、系统精度和使用寿命,从而拓宽该技术的市场范围。随着生产商采用自动化设备来满足日益增长的粮食需求,全球农业机械化正在获得发展动力。精准农业和数位控制的田间作业正在成为主流,这促使现代农业机械需要先进的液压系统。

全球农业实践的不断发展预计将增强对这些部件的长期需求。随着农业持续向自动化和精准化作业转型,收割机、喷雾器和拖拉机等现代设备越来越依赖先进的液压缸来实现高效可控的运动。向数据驱动农业、GPS导航系统和变速技术的转变需要高响应度的液压机构,能够在各种田间条件下提供稳定的性能。此外,各国政府推动智慧农业的倡议,加上全球持续提高粮食产量的努力,正推动配备智慧液压系统的机械的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 157亿美元 |

| 预测值 | 247亿美元 |

| 复合年增长率 | 4.6% |

2024年,双作用液压缸市场占据70%的市场份额,预计到2034年将以4%的复合年增长率成长。这类液压缸在机器人、大规模製造和高负荷建筑机械等自动化程度较高的应用中至关重要。它们能够支援双向运动并具有更好的控制能力,使其成为智慧系统的理想选择。随着各行各业对预测性维护和即时资料分析的重视,配备嵌入式感测器和反馈机制的液压缸的需求日益增长,从而实现响应式力管理和更高的负载精度。

2024年,行动装置领域占据67.6%的市场份额,预计到2034年将以4.2%的复合年增长率成长。该领域包括用于农业设备、非公路车辆和采矿机械的液压系统。随着设备不断发展以满足更严格的效率和排放标准,行动液压缸正在重新设计,以整合混合动力驱动技术和智慧控制平台。即时遥测、远端诊断和地形响应调整的采用,进一步提升了它们在现代设备性能中的作用。

美国液压缸市场占30%的市场份额,2024年产值达36亿美元。该地区的成长得益于基础设施投资的增加,包括交通和公用事业发展。农业和建筑机械领域的持续扩张正在增强产品需求。该地区重新关注製造业回流,尤其是在航太和汽车领域,这正在推动节能液压技术的部署。此外,数位化和互联液压系统的广泛应用正在推动创新,并推动各行各业的设备升级。

液压缸市场的主要参与者包括 Norrhydro Oy、卡特彼勒、博世力士乐、派克汉尼汾集团和伊顿公司。液压缸市场的主要参与者正在利用产品创新和数位整合相结合的策略来确保竞争优势。各公司正积极开发融合远端资讯处理、状态监测和预测性维护的智慧液压解决方案,以提供更卓越的系统效能。为了确保更快的交付週期并满足区域监管标准,生产本地化正在得到大力推动。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 科技趋势

- 智慧感测器与物联网连接的集成

- 数位液压驱动系统

- 电液一体化

- 价格趋势分析(美元/单位)

- 按产品

- 按地区

- 监管格局

- 产业衝击力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率按区域分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依功能划分,2021 - 2034 年

- 主要趋势

- 单作用汽缸

- 双作用气压缸

第六章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 拉桿汽缸

- 焊接圆筒

- 其他的

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 移动的

- 工业的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 西班牙

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Aggressive, Inc.

- Best Metal Products

- Bosch Rexroth

- Caterpillar

- Eaton Corporation

- ENERPAC

- Hydrosila

- Hydac

- JARP Industries Inc.

- KYB Corporation

- Liebherr

- Ligon Industries, LLC

- Montanhydraulik GmbH

- Norrhydro Oy

- Pacoma GmbH

- PARKER HANNIFIN CORP

- Prince Manufacturing Corporation

- Texas Inc

- Weber-Hydraulik Group

- Wipro Infrastructure Engineering.

The Global Hydraulic Cylinder Market was valued at USD 15.7 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 24.7 billion by 2034. Rising integration of industrial automation across multiple end-use sectors-such as agriculture, mining, manufacturing, and construction-is significantly increasing the demand for hydraulic cylinders. As industries continue to push for higher productivity and operational efficiency, there's a growing reliance on reliable motion control systems. This demand is further fueled by ongoing advancements in hydraulic design and technology. Manufacturers are incorporating smart sensors and IoT-based control systems to enhance energy efficiency, system precision, and longevity, thus broadening the technology's market scope. Global agricultural mechanization is gaining traction as producers adopt automated equipment to meet rising food requirements. Precision farming and digitally controlled field operations are becoming mainstream, prompting the need for advanced hydraulic systems across modern agricultural machinery.

The evolving nature of global farming practices is expected to reinforce long-term demand for these components. As agriculture continues transitioning toward automation and precision-based operations, modern equipment such as harvesters, sprayers, and tractors increasingly relies on advanced hydraulic cylinders for efficient and controlled movement. The shift toward data-driven farming, GPS-guided systems, and variable rate technology demands highly responsive hydraulic mechanisms capable of delivering consistent performance under diverse field conditions. Additionally, government initiatives promoting smart agriculture, coupled with the global push to boost food production sustainably, are encouraging the adoption of machinery equipped with intelligent hydraulic systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $24.7 Billion |

| CAGR | 4.6% |

In 2024, the double-acting hydraulic cylinders segment held a 70% share and will grow at a CAGR of 4% through 2034. These cylinders are critical in automation-heavy applications such as robotics, large-scale manufacturing, and high-load construction machinery. Their ability to support bidirectional motion with improved control makes them ideal for smart systems. With industries prioritizing predictive maintenance and real-time data analytics, demand is rising for cylinders equipped with embedded sensors and feedback mechanisms, enabling responsive force management and enhanced load precision.

The mobile equipment segment held a 67.6% share in 2024 and is projected to grow at a CAGR of 4.2% by 2034. This segment includes hydraulic systems used in agricultural equipment, off-highway vehicles, and mining machinery. As equipment evolves to meet stricter efficiency and emissions standards, mobile hydraulic cylinders are being reengineered to integrate hybrid drive technology and intelligent control platforms. The adoption of real-time telemetry, remote diagnostics, and terrain-responsive adjustments is further elevating their role in modern equipment performance.

United States Hydraulic Cylinder Market held a 30% share and generated USD 3.6 billion in 2024. Growth in the region is being supported by increased investments in infrastructure, including transportation and utility development. Ongoing expansion in the agriculture and construction machinery segments is reinforcing product demand. The region's renewed focus on reshoring manufacturing, particularly within the aerospace and automotive sectors, is encouraging the deployment of energy-efficient hydraulic technologies. Additionally, widespread implementation of digital and connected hydraulic systems is advancing innovation and driving equipment upgrades across industries.

The leading Hydraulic Cylinder Market players include Norrhydro Oy, Caterpillar, Bosch Rexroth, Parker Hannifin Group, and Eaton Corporation. Major players in the hydraulic cylinder market are leveraging a mix of product innovation and digital integration to secure a competitive advantage. Companies are actively developing smart hydraulic solutions that incorporate telematics, condition monitoring, and predictive maintenance to deliver better system performance. There is a strong push toward localization of production to ensure faster lead times and meet regional regulatory standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Function trends

- 2.1.3 Product trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Technology trend

- 3.2.1 Integration of smart sensors & IoT connectivity

- 3.2.2 Digital hydraulic actuation systems

- 3.2.3 Electro-hydraulic integration

- 3.3 Price trend analysis (USD/unit)

- 3.3.1 By product

- 3.3.2 By region

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Environmental factors

- 3.8.6 Legal factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Function, 2021 - 2034 (USD Billion, Million Units)

- 5.1 Key trends

- 5.2 Single acting cylinders

- 5.3 Double acting cylinders

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion, Million Units)

- 6.1 Key trends

- 6.2 Tie-rod cylinder

- 6.3 Welded cylinder

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Million Units)

- 7.1 Key trends

- 7.2 Mobile

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion, Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 Spain

- 8.3.5 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Aggressive, Inc.

- 9.2 Best Metal Products

- 9.3 Bosch Rexroth

- 9.4 Caterpillar

- 9.5 Eaton Corporation

- 9.6 ENERPAC

- 9.7 Hydrosila

- 9.8 Hydac

- 9.9 JARP Industries Inc.

- 9.10 KYB Corporation

- 9.11 Liebherr

- 9.12 Ligon Industries, LLC

- 9.13 Montanhydraulik GmbH

- 9.14 Norrhydro Oy

- 9.15 Pacoma GmbH

- 9.16 PARKER HANNIFIN CORP

- 9.17 Prince Manufacturing Corporation

- 9.18 Texas Inc

- 9.19 Weber-Hydraulik Group

- 9.20 Wipro Infrastructure Engineering.