|

市场调查报告书

商品编码

1797850

地暖致动器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Underfloor Heating Actuator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

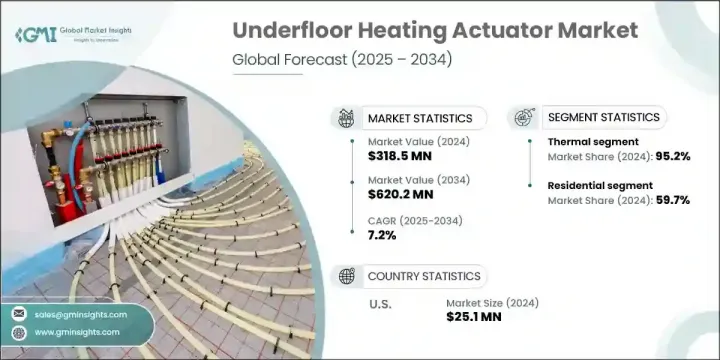

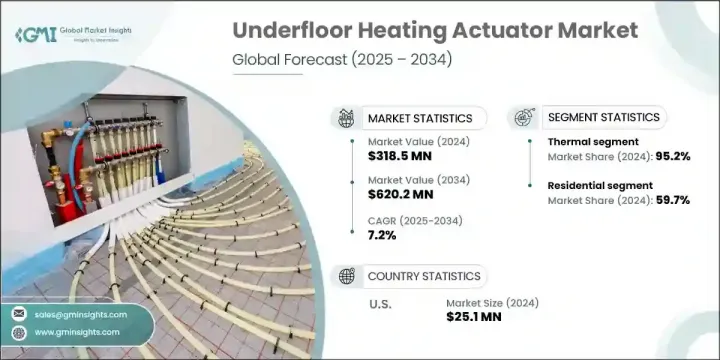

2024年,全球地暖致动器市场规模达3.185亿美元,预计复合年增长率为7.2%,到2034年将达到6.202亿美元。初始设置和安装成本的显着下降,使地暖从高端设施转变为普及的技术。无论是浴室、厨房等紧凑区域,还是更大规模的安装,创新技术都在加速产业发展。执行器是地暖系统的重要组成部分,能够确保分集水器高效运行,并提升系统性能。

工业设施和製造园区对可靠、节能供暖的需求日益增长,推动了先进执行器系统的采用。智慧控制的突破、更长的产品寿命和更高的精度显着提升了人们对这些系统的兴趣。快速发展地区的消费者越来越重视可持续且经济高效的解决方案,这进一步支持了市场的成长。随着住宅和商业环境(尤其是医疗保健设施)对安全、均匀分布供暖的需求不断增长,地暖执行器产业持续受到关注。消费者意识的提升和更具竞争力的价格点可能会在整个预测期内维持这一成长轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.185亿美元 |

| 预测值 | 6.202亿美元 |

| 复合年增长率 | 7.2% |

2024年,住宅应用领域占据了59.7%的市场份额,预计到2034年将以7%的复合年增长率成长。由于地暖分布均匀,且能够在适度温度下高效运行,房主们正在逐渐转向地暖。与在较高温度范围内运作的传统散热器相比,地暖系统使用恆温器和感测器实现更智慧的加热。 Wi-Fi连接和分区控制系统的加入,使家庭节能高达15%,同时由于没有暴露元素或空气中的过敏原,空气品质也得到了改善。这使得地暖系统对于多户住宅和追求安全和便利的家庭尤其具有吸引力。

电动执行器市场在2024年占据4.8%的市场份额,预计到2034年将以7%的复合年增长率成长。这些执行器因其高效的性能、成本效益和精准的控製而需求旺盛。製造商对传统液压和热力执行器的日益青睐,促使其加强对电动执行器生产的投入。马达设计、系统相容性和通讯标准的持续进步,正在推动产品的普及。此外,针对能源效率和室内舒适度的严格建筑规范,也推动电动执行器进一步融入现代暖气系统。

预计2034年,北美地暖致动器市场规模将达到6,420万美元。人们对再生能源技术的兴趣日益浓厚,以及对绿色能源政策的遵守,正在塑造该地区的成长。商业基础设施建设活动的增加,以及住宅装修中地暖系统(尤其是在加拿大和美国的多单元住宅中)的广泛应用,正在提振市场需求。消费者在房屋升级方面的支出增加以及对现代设计的偏好,也是该产业发展的关键因素。

活跃于全球地暖执行器市场的主要公司包括 Mohlenhoff、西门子、施耐德电气、Intatec、江森自控、霍尼韦尔国际、SMLGHVAC、丹佛斯、Belimo、Uponor、Schluter-Systems、Warmup、Pentair、Heatmiser、艾默生电气、Hunt Hepun、Hunt、Ele领先的製造商正在优先考虑产品创新,透过提高执行器性能、整合智慧控制功能以及提高与先进楼宇管理系统的兼容性。他们还透过合作伙伴关係、分销协议以及与区域公司的合併来扩大其地理覆盖范围。对研发的策略性投资正在帮助企业创造出更紧凑、更节能、更耐用的执行器。为了满足不断变化的客户需求,许多公司正在实现产品线多元化,并为住宅和商业市场提供客製化解决方案。此外,遵守能源效率法规和永续发展目标仍然是确保在竞争激烈的市场中实现长期成长的关键关注领域。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 零件供应商

- 技术提供者

- 产品整合商

- 开发商和 EPC 承包商

- 最终用途

- 价格趋势分析(美元/单位)

- 按产品

- 按地区

- 监管格局

- 产业衝击力

- 成长动力

- 引入能源效率标准并增强空间供暖需求

- 极端气候条件

- 生活水准提高

- 产业陷阱与挑战

- 现有建筑改造成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依产品,2021-2034

- 主要趋势

- 热的

- 运动性

第六章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 住宅

- 商业的

- 工业的

第七章:市场规模及预测:依地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 西班牙

- 奥地利

- 比利时

- 丹麦

- 芬兰

- 挪威

- 瑞典

- 英国

- 义大利

- 俄罗斯

- 捷克共和国

- 瑞士

- 荷兰

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第八章:公司简介

- Belimo

- Danfoss

- Uponor

- Eberle Controls

- Emerson Electric

- Honeywell International

- Hunt Heating

- Heatmiser

- Intatec

- Johnson Controls

- Mohlenhoff

- Oventrop

- Pentair

- Polypipe

- SMLGHVAC

- Sauter

- Siemens

- Schluter-Systems

- Schneider Electric

- Warmup

The Global Underfloor Heating Actuator Market was valued at USD 318.5 million in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 620.2 million by 2034. A notable drop in initial setup and installation costs has transformed underfloor heating from a high-end amenity to a widely accessible technology. Innovations supporting both compact areas like bathrooms and kitchens and larger-scale installations are accelerating industry momentum. Actuators are essential components in underfloor heating systems, enabling efficient operation of the manifold and contributing to system performance.

The growing need for reliable, energy-efficient heating in industrial facilities and manufacturing zones is driving the adoption of advanced actuator systems. Breakthroughs in smart controls, longer product lifespans, and increased accuracy have significantly boosted interest in these systems. Consumers in fast-developing regions are increasingly prioritizing sustainable and cost-efficient solutions, further supporting market growth. With rising demand for safe, evenly distributed heating in residential and commercial environments-particularly in healthcare facilities-the underfloor heating actuator sector continues to gain traction. Increased consumer awareness and more competitive price points are likely to sustain this growth trajectory throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $318.5 Million |

| Forecast Value | $620.2 Million |

| CAGR | 7.2% |

In 2024, the residential applications segment held a 59.7% share and is expected to grow at a CAGR of 7% through 2034. Homeowners are turning to underfloor heating due to its uniform heat distribution and ability to run efficiently at moderate temperatures. Compared to traditional radiators that function at higher heat ranges, underfloor systems use thermostats and sensors for smarter heating. The addition of Wi-Fi connectivity and zoned control systems allows households to achieve energy savings of up to 15%, all while enjoying improved air quality due to the lack of exposed elements or airborne allergens. This makes the system especially appealing for multi-family units and households seeking safety and convenience.

The motoric actuator segment held a 4.8% share in 2024 and is projected to grow at a CAGR of 7% through 2034. These actuators are in high demand because they deliver efficient performance, cost benefits, and precision control. Their increasing preference for traditional hydraulic and thermal variants is prompting manufacturers to invest more heavily in motoric actuator production. Continued advancements in motor design, system compatibility, and communication standards are pushing product adoption forward. In addition, stringent building codes targeting energy efficiency and indoor comfort are fueling further integration of motoric actuators into modern heating systems.

North American Underfloor Heating Actuator Market is expected to reach USD 64.2 million by 2034. Increased interest in renewable technologies and compliance with green energy policies are shaping regional growth. Rising construction activity in commercial infrastructure and the broader adoption of these systems in residential renovations, particularly in multi-unit properties across Canada and the U.S., are bolstering market demand. Higher consumer spending on home upgrades and modern design preferences are also key contributors to the sector's progress.

Key companies active in the Global Underfloor Heating Actuator Market include Mohlenhoff, Siemens, Schneider Electric, Intatec, Johnson Controls, Honeywell International, SMLGHVAC, Danfoss, Belimo, Uponor, Schluter-Systems, Warmup, Pentair, Heatmiser, Emerson Electric, Hunt Heating, Eberle Controls, Oventrop, Sauter, and Polypipe. Leading manufacturers are prioritizing product innovation by enhancing actuator performance, integrating smart control features, and improving compatibility with advanced building management systems. They are also expanding their geographic footprint through partnerships, distribution agreements, and mergers with regional firms. Strategic investments in R&D are helping companies create more compact, energy-efficient, and durable actuators. To cater to shifting customer needs, many firms are diversifying product lines and offering customized solutions for both residential and commercial markets. Additionally, compliance with energy efficiency regulations and sustainability goals remains a critical focus area to secure long-term growth in competitive markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Product integrators

- 3.1.4 Developers & EPC contractors

- 3.1.5 End use

- 3.2 Price trend analysis (USD/Unit)

- 3.2.1 By product

- 3.2.2 By region

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Introduction of energy efficiency standards and enhanced demand for space heating

- 3.4.1.2 Extreme climatic conditions

- 3.4.1.3 Increased standard of living

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High cost of retrofitting in existing buildings

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Environmental factors

- 3.7.6 Legal factors

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size & Forecast, By Product, 2021-2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Thermal

- 5.3 Motoric

Chapter 6 Market Size & Forecast, By Application, 2021-2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size & Forecast, By Region, 2021-2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 Austria

- 7.3.5 Belgium

- 7.3.6 Denmark

- 7.3.7 Finland

- 7.3.8 Norway

- 7.3.9 Sweden

- 7.3.10 UK

- 7.3.11 Italy

- 7.3.12 Russia

- 7.3.13 Czech Republic

- 7.3.14 Switzerland

- 7.3.15 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Australia

- 7.4.4 India

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

Chapter 8 Company Profiles

- 8.1 Belimo

- 8.2 Danfoss

- 8.3 Uponor

- 8.4 Eberle Controls

- 8.5 Emerson Electric

- 8.6 Honeywell International

- 8.7 Hunt Heating

- 8.8 Heatmiser

- 8.9 Intatec

- 8.10 Johnson Controls

- 8.11 Mohlenhoff

- 8.12 Oventrop

- 8.13 Pentair

- 8.14 Polypipe

- 8.15 SMLGHVAC

- 8.16 Sauter

- 8.17 Siemens

- 8.18 Schluter-Systems

- 8.19 Schneider Electric

- 8.20 Warmup