|

市场调查报告书

商品编码

1797865

对乙酰氨基酚市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Acetaminophen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

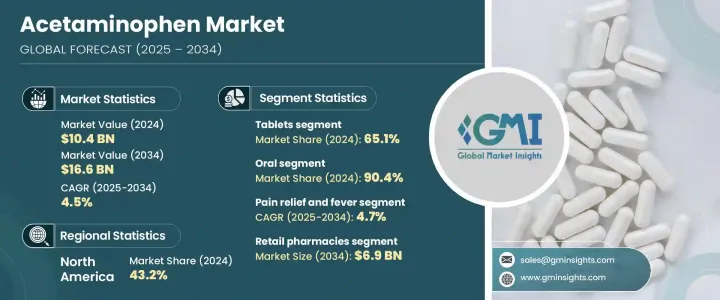

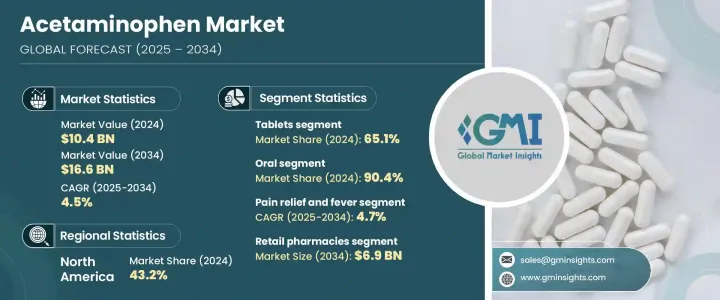

2024 年全球对乙酰氨基酚市场规模为 104 亿美元,预计到 2034 年将以 4.5% 的复合年增长率增长至 166 亿美元。不同年龄层慢性疼痛和反覆发烧的盛行率不断上升,持续推动全球对乙酰氨基酚的需求。对乙酰氨基酚是一种广泛获取且值得信赖的非处方药,常用于缓解轻度至中度疼痛和发烧。全球传染病和头痛相关疾病病例的上升进一步刺激了对乙酰氨基酚的需求。作为非鸦片类镇痛解热药,对乙酰氨基酚仍然是一线治疗选择,尤其适用于因胃肠道或心血管问题而对非类固醇抗发炎药物不耐受的患者。许多地区对自我照顾和非处方药的依赖日益增加,也促进了市场的成长。

太阳製药、雅培、梯瓦製药、赛诺菲和奥罗宾多製药等领导企业凭藉其丰富的製剂品种、广泛的供应链以及在已开发经济体和新兴经济体中保持的强大品牌认知度,发挥着至关重要的作用。这些公司持续投资于生产可扩展性,确保对乙酰氨基酚在各个治疗领域持续供应。他们深厚的监管专业知识使产品审批更加顺畅,而遍布全球的生产布局则有助于缓解供应中断。除了专注于仿製药之外,他们还透过推出缓释剂型、儿科友善製剂以及提高患者依从性的联合疗法,脱颖而出。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 166亿美元 |

| 复合年增长率 | 4.5% |

2024年,片剂製剂市场占65.1%的市占率。这项优势归功于其成本效益高、易于生产以及消费者对一致剂型的偏好。片剂因其更长的保质期、便携性以及与大规模生产(尤其是非处方药)的兼容性而广受青睐。由于口服片剂在零售药局和超市的广泛普及,它仍然是大多数成人和儿童使用者的首选剂型。城乡医疗保健机构的强劲需求,加上强大的製药生产能力,继续巩固了该市场的领先地位。

2024年,口服给药占了90.4%的市场。口服剂型(包括胶囊、糖浆和片剂)由于其易于服用、体内快速吸收以及适合居家治疗,仍然是首选。这些剂型顺应了自我用药的趋势,尤其适用于治疗轻度至中度疼痛或发烧,且无需专业监督。此外,咀嚼锭、缓释剂型和儿童友善糖浆等增强型口服剂型正在改善患者体验,并确保各年龄层患者更好地坚持用药。

北美对乙酰氨基酚市场预计在2024年将占据43.2%的市场。该地区的高消费量与关节炎和慢性背痛等肌肉骨骼疾病的普遍流行有关,此外,该地区居民对非处方药的依赖程度也日益加深。此外,推广阿片类药物替代品的宣传活动和医疗保健政策进一步巩固了对乙酰氨基酚作为首选药物的地位。凭藉强大的公共卫生基础设施、高度的消费者认知度以及强大的製药业影响力,北美将继续推动该领域的收入大幅成长和创新。

对乙酰氨基酚市场的一些顶级公司包括 Hyloris Pharmaceuticals、Granules India Limited、B. Braun Melsungen、拜耳股份公司、Dr. Reddy's Laboratories、Mallinckrodt Pharmaceuticals、诺华、葛兰素史克製药、Lupin、Alkem Laboratories 和 Kenvue(强生),以及其他公司,如同菲诺菲诺菲诺.,为了巩固其在对乙酰氨基酚市场的地位,领先企业正在采取几种关键策略。许多公司专注于产品组合多样化,推出针对特定患者需求的各种配方,例如儿科滴剂、泡腾片和组合产品。他们非常重视製造可扩展性和成本优化,以提高发展中地区的可近性。对供应链效率的投资以及与零售分销商的策略合作伙伴关係进一步确保了产品的可用性。此外,该公司继续参与行销活动,以提高品牌召回率并使其对乙酰氨基酚产品差异化。遵守不断发展的监管框架以及对产品品质、安全性和临床疗效的投资仍然是其长期市场策略的重要组成部分。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 普通感冒、发烧和流感病例增加

- 慢性病和疼痛管理问题数量不断增加

- 静脉注射扑热息痛与非类固醇抗发炎药和麻醉药的合併使用日益增多

- 产业陷阱与挑战

- 对乙酰氨基酚的副作用,例如血压升高和肝毒性

- 更有效的止痛药的可用性

- 市场机会

- 向新兴市场扩张

- 开发创新且更安全的配方

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 未来市场趋势

- 差距分析

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按剂型,2021 - 2034 年

- 主要趋势

- 药片

- 液体悬浮液

- 点滴溶液

- 其他剂型

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 肠外

- 其他给药途径

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 缓解疼痛和发烧

- 普通感冒

- 头痛

- 腹部绞痛

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- Alkem Laboratories

- Aurobindo Pharma

- B. Braun Melsungen

- Bayer AG

- Dr. Reddy's Laboratories

- GlaxoSmithKline Pharmaceuticals

- Granules India Limited

- Hyloris Pharmaceuticals

- Kenvue (Johnson & Johnson)

- Lupin

- Mallinckrodt Pharmaceuticals

- Novartis

- Sanofi

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

The Global Acetaminophen Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 16.6 billion by 2034. The rising prevalence of chronic pain conditions and recurring fever across various age groups continues to propel the demand for acetaminophen worldwide. As a widely accessible and trusted over-the-counter drug, acetaminophen is commonly used for mild to moderate pain and fever management. The global uptick in cases of infectious illnesses and headache-related disorders is further accelerating demand. As a non-opioid analgesic and antipyretic, acetaminophen remains a first-line treatment option, especially for patients intolerant to NSAIDs due to gastrointestinal or cardiovascular issues. The market growth is also reinforced by an increasing reliance on self-care and non-prescription medications across many regions.

Leading players such as Sun Pharmaceutical Industries, Abbott, Teva Pharmaceuticals, Sanofi, and Aurobindo Pharma play a critical role by offering a diverse range of formulations, leveraging extensive supply chains, and maintaining strong brand recognition in both developed and emerging economies. These companies continuously invest in production scalability, ensuring consistent availability of acetaminophen across various therapeutic segments. Their deep regulatory expertise allows for smoother product approvals, while global manufacturing footprints help mitigate supply disruptions. In addition to focusing on generics, they also differentiate themselves by introducing extended-release versions, pediatric-friendly formats, and combination therapies that improve patient compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.6 Billion |

| CAGR | 4.5% |

In 2024, the tablet-based formulations segment held a 65.1% share. This dominance is attributed to their cost-effectiveness, ease of manufacturing, and consumer preference for consistent dosage formats. Tablets are widely preferred for their longer shelf life, portability, and compatibility with large-scale production, especially for over-the-counter products. With broad accessibility in retail pharmacies and supermarkets, the oral tablet remains the go-to form for most users across adult and pediatric populations. Strong demand from both urban and rural healthcare settings, combined with robust pharmaceutical manufacturing capacities, continues to sustain the segment's leadership.

The oral route segment held a 90.4% share in 2024. Oral formulations-including capsules, syrups, and tablets-remain the preferred choice due to their ease of administration, rapid availability in the body, and suitability for at-home treatment. These formats support self-medication trends and are especially effective for treating low to moderate pain or fever without the need for professional supervision. Additionally, enhanced oral formulations such as chewables, extended-release variants, and child-friendly syrups are improving patient experience and ensuring better adherence across age groups.

North America Acetaminophen Market with a 43.2% share in 2024. The region's high consumption is linked to the widespread prevalence of musculoskeletal conditions such as arthritis and chronic back pain, coupled with an increased reliance on non-prescription medications for everyday ailments. Moreover, awareness campaigns and healthcare policies promoting alternatives to opioids have further established acetaminophen as a preferred option. With robust public health infrastructure, high consumer awareness, and strong pharmaceutical presence, North America continues to drive significant revenue growth and innovation in the sector.

Some of the top companies operating in the Acetaminophen Market include Hyloris Pharmaceuticals, Granules India Limited, B. Braun Melsungen, Bayer AG, Dr. Reddy's Laboratories, Mallinckrodt Pharmaceuticals, Novartis, GlaxoSmithKline Pharmaceuticals, Lupin, Alkem Laboratories, and Kenvue (Johnson & Johnson), alongside others like Sanofi and Convergent Technologies. To strengthen their position in the acetaminophen market, leading players are adopting several key strategies. Many companies focus on portfolio diversification by introducing a broad range of formulations tailored to specific patient needs, such as pediatric drops, effervescent tablets, and combination products. Strong emphasis is placed on manufacturing scalability and cost optimization to improve accessibility in developing regions. Investments in supply chain efficiency and strategic partnerships with retail distributors further ensure product availability. In addition, companies continue to engage in marketing initiatives to enhance brand recall and differentiate their acetaminophen products. Compliance with evolving regulatory frameworks and investment in product quality, safety, and clinical efficacy remain essential elements of their long-term market strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Dosage form trends

- 2.2.3 Route of administration trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cases of common cold, fever, and influenza

- 3.2.1.2 Rising number of chronic diseases and pain management conditions

- 3.2.1.3 Increasing use of intravenous paracetamol in combination with NSAIDs and narcotics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of paracetamol, such as a rise in blood pressure and hepatotoxicity

- 3.2.2.2 Availability of more effective painkillers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Development of innovative and safer formulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Reimbursement scenario

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tablet

- 5.3 Liquid suspension

- 5.4 Infusion solution

- 5.5 Other dosage forms

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pain relief and fever

- 7.3 Common cold

- 7.4 Headache

- 7.5 Abdominal cramps

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Alkem Laboratories

- 10.3 Aurobindo Pharma

- 10.4 B. Braun Melsungen

- 10.5 Bayer AG

- 10.6 Dr. Reddy's Laboratories

- 10.7 GlaxoSmithKline Pharmaceuticals

- 10.8 Granules India Limited

- 10.9 Hyloris Pharmaceuticals

- 10.10 Kenvue (Johnson & Johnson)

- 10.11 Lupin

- 10.12 Mallinckrodt Pharmaceuticals

- 10.13 Novartis

- 10.14 Sanofi

- 10.15 Sun Pharmaceutical Industries

- 10.16 Teva Pharmaceuticals