|

市场调查报告书

商品编码

1797882

母线槽系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Busbar Trunking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

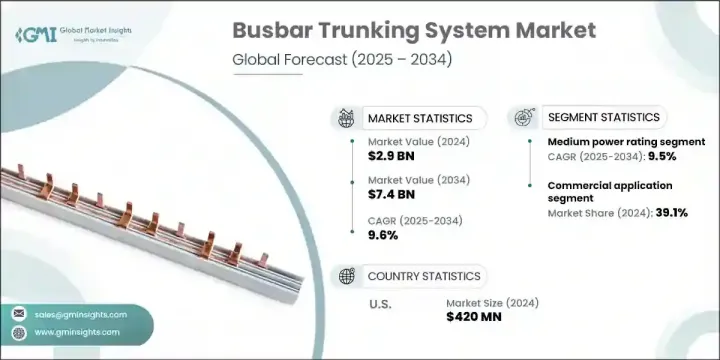

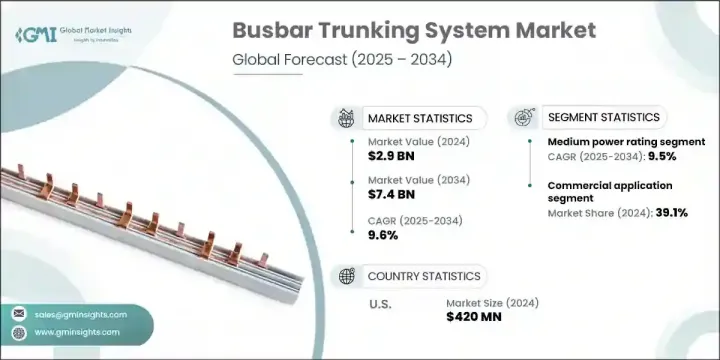

2024年,全球母线槽系统市场规模达29亿美元,预计到2034年将以9.6%的复合年增长率成长,达到74亿美元。随着工业和商业设施寻求优化空间和最大限度降低能源损耗的方法,对高效配电解决方案的需求正在快速增长。母线槽系统相较于传统布线具有显着优势,其模组化设计、易于安装和可扩展性使其成为现代基础设施专案的理想解决方案。智慧城市和智慧建筑的兴起,强调即时监控、自动化和能源最佳化,进一步推动了这些配电系统的需求。

此外,日益增长的永续发展趋势和材料创新正在塑造配电的未来。为了满足全球环保标准,製造商正在转向更环保的材料和生产工艺,例如引入了TECHNYL 4EARTH(基于再生尼龙的成分)。随着永续性越来越受到关注,采用更环保解决方案的公司正在获得竞争优势,吸引投资,并推动母线槽系统的市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 9.6% |

中等功率母线槽系统市场在2024年占据29%的市场份额,预计到2034年将以9.5%的复合年增长率成长。这些系统的额定电流通常在800A至2500A之间,因其能够确保安全高效的配电,在工业和基础设施领域越来越受欢迎。随着全球数位基础设施的发展,具有夹层绝缘和即时监控等先进功能的母线槽系统正变得越来越普遍。

预计到2034年,工业应用领域的复合年增长率将达到9.5%。这一成长主要源自于製造工厂、汽车工厂和物流中心等关键工业环境对可靠、大容量配电系统日益增长的需求。这些设施严重依赖不间断电源来维持平稳运行,尤其是在处理重型机械、复杂的自动化系统和高能耗需求时。随着产业的不断扩展和发展,迫切需要更有效率、可扩展的电力解决方案,而母线槽系统正是满足这项需求的独特优势。

美国母线槽系统市场占71%的市场份额,2024年市场规模达4.2亿美元。美国市场的稳定成长得益于老旧电力基础设施的现代化改造以及智慧建筑技术的日益普及。该地区对能源效率、消防安全和模组化建筑的重视,正在加速从传统布线系统转向更先进的母线槽解决方案的转变。

母线槽系统市场的顶级参与者包括施耐德电机、西门子、ABB、伊顿公司和罗格朗。为了巩固市场地位,母线槽系统产业的公司专注于推进产品创新,尤其是在能源效率、可扩展性和与智慧基础设施的整合方面。他们也将永续性放在首位,许多公司为了应对监管压力和消费者需求,转向环保材料和工艺。策略合作伙伴关係、併购是扩大市场范围和能力的关键策略,尤其是在对智慧和永续解决方案的需求持续增长的背景下。此外,各公司正在投资研发,以提高母线槽系统的性能并改善整体客户体验,确保其产品符合不断变化的行业需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 科技趋势

- 智慧电网整合与数位化

- 再生能源整合

- 监管格局

- 产业衝击力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依绝缘材料,2021 - 2034

- 主要趋势

- 三明治

- 空气绝缘

第六章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- 灯光

- 低的

- 中等的

- 高的

第七章:市场规模及预测:依指挥,2021 - 2034

- 主要趋势

- 铜

- 铝

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 工业的

- 力量

- 石油和天然气

- 流程

- 运输

- 製造业

- 商业的

- 公用事业

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 义大利

- 西班牙

- 法国

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第十章:公司简介

- ABB

- Anord Mardix

- Bticino

- C&S Electric Limited

- DBTS Industries Sdn Bhd

- EAE

- Eaton

- Effibar

- Entraco Bks Busducts Pvt. Ltd.

- Gersan Elektrik AS

- Godrej

- Lauritz Knudsen Electrical & Automation

- Legrand

- 美加巴雷欧洲有限公司

- Naxso Srl

- NOVA Electrical Co.

- Power Plug Busduct Sdn. Bhd.

- Schneider Electric

- Siemens

- Terasaki Electric Co., Ltd.

The Global Busbar Trunking System Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 7.4 billion by 2034. The demand for efficient power distribution solutions is rapidly increasing, as industries and commercial facilities seek ways to optimize space and minimize energy losses. Busbar trunking systems offer a significant advantage over traditional cabling, with their modular design, ease of installation, and scalability making them an ideal solution for modern infrastructure projects. The rise of smart cities and intelligent buildings, which emphasize real-time monitoring, automation, and energy optimization, is further driving the need for these electrical distribution systems.

Furthermore, growing sustainability trends and innovations in materials are shaping the future of electrical distribution. Manufacturers are shifting towards more eco-friendly materials and production processes to meet global environmental standards, with the introduction of materials like TECHNYL 4EARTH, a recycled nylon-based component. As sustainability becomes a greater focus, companies adopting greener solutions are gaining competitive advantage, attracting investment, and boosting market demand for busbar trunking systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 9.6% |

The medium power rating busbar trunking systems segment held a 29% share in 2024 and is expected to grow at a CAGR of 9.5% through 2034. These systems, typically rated between 800A and 2500A, are increasingly sought after in industrial and infrastructure sectors, as they ensure safe and efficient power distribution. Busbar trunking systems with advanced features, such as sandwich insulation and real-time monitoring capabilities, are becoming more prevalent as digital infrastructure grows globally.

The industrial application segment is projected to grow at a CAGR of 9.5% through 2034. This surge is primarily driven by the increasing demand for reliable, high-capacity power distribution systems in critical industrial environments like manufacturing plants, automotive factories, and logistics hubs. These facilities rely heavily on uninterrupted power to maintain smooth operations, especially when dealing with heavy machinery, complex automation systems, and high-energy requirements. As industries continue to expand and evolve, there is a pressing need for more efficient and scalable power solutions, which busbar trunking systems are uniquely positioned to offer.

U.S. Busbar Trunking System Market held 71% share, generating USD 420 million in 2024. The steady growth of the market in the U.S. is driven by the modernization of aging electrical infrastructure and the increased adoption of smart building technologies. The region's emphasis on energy efficiency, fire safety, and modular construction is accelerating the shift from traditional cabling systems to more advanced busbar trunking solutions.

The top players in the Busbar Trunking System Market include Schneider Electric, Siemens, ABB, Eaton Corporation, and Legrand. To strengthen their market position, companies in the busbar trunking system industry focus on advancing product innovation, particularly in terms of energy efficiency, scalability, and integration with smart infrastructure. They also prioritize sustainability, with many shifting toward eco-friendly materials and processes in response to both regulatory pressures and consumer demand. Strategic partnerships, mergers, and acquisitions are key tactics used to expand market reach and capabilities, especially as demand for smart and sustainable solutions continues to rise. Additionally, companies are investing in research and development to enhance the performance of busbar systems and improve the overall customer experience, ensuring that their products align with evolving industry needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Insulation trends

- 2.1.3 Power rating trends

- 2.1.4 Conductor trends

- 2.1.5 Application trends

- 2.1.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Technology trend

- 3.2.1 Smart grid integration and digitalization

- 3.2.2 Renewable energy integration

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Environmental factors

- 3.7.6 Legal factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Insulation, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Sandwich

- 5.3 Air insulated

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Lighting

- 6.3 Low

- 6.4 Medium

- 6.5 High

Chapter 7 Market Size and Forecast, By Conductor, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Copper

- 7.3 Aluminum

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Power

- 8.2.2 Oil & gas

- 8.2.3 Process

- 8.2.4 Transportation

- 8.2.5 Manufacturing

- 8.3 Commercial

- 8.4 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 France

- 9.3.6 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Anord Mardix

- 10.3 Bticino

- 10.4 C&S Electric Limited

- 10.5 DBTS Industries Sdn Bhd

- 10.6 EAE

- 10.7 Eaton

- 10.8 Effibar

- 10.9 Entraco Bks Busducts Pvt. Ltd.

- 10.10 Gersan Elektrik A.S

- 10.11 Godrej

- 10.12 Lauritz Knudsen Electrical & Automation

- 10.13 Legrand

- 10.14 MEGABARRE EUROPE SRL

- 10.15 Naxso S.r.l.

- 10.16 NOVA Electrical Co.

- 10.17 Power Plug Busduct Sdn. Bhd.

- 10.18 Schneider Electric

- 10.19 Siemens

- 10.20 Terasaki Electric Co., Ltd.