|

市场调查报告书

商品编码

1797883

冻干注射药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lyophilized Injectable Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球冷冻干燥注射剂市场规模为 3,569 亿美元,预计到 2034 年将以 14.1% 的复合年增长率成长,达到 1.31 兆美元。癌症和传染病等慢性疾病发生率的上升,持续推高了对稳定长效治疗药物的需求。对延长保存期限和提高药效的需求,使得冷冻干燥注射剂成为医药产品线的重要组成部分。此外,全球监管部门批准的增加以及冻干製程技术的进步,显着提高了市场渗透率。随着住院和门诊治疗逐渐转向生物製剂和注射疗法,冷冻干燥注射剂产业的製造能力、物流基础设施和临床应用正在快速发展。

随着对耐用且高度稳定的药物製剂的需求日益增长,製药公司正将冷冻干燥技术应用于越来越多的注射药物。诸如强化冷链配送、单剂量包装以及復溶效率提升等创新技术,正在增强全球医疗体系的产品可靠性。冷冻干燥製剂在稳定性和无菌性至关重要的疾病治疗中正日益受到青睐。这些药物通常与稀释剂混合后给药,这使得医疗保健提供者能够控制剂量的准确性并延长产品的可用性。由于可靠的製剂具有更长的保质期,冷冻干燥药物成为首选,尤其是在基础设施有限且先进医疗服务日益普及的地区。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3569亿美元 |

| 预测值 | 1.31兆美元 |

| 复合年增长率 | 14.1% |

2024年,抗肿瘤药物市场规模达1,395亿美元,反映出市场对肿瘤生物製剂和细胞毒性化合物的需求激增。冷冻干燥注射剂尤其适合此类治疗,它具有更高的稳定性和更长的保质期,同时最大限度地降低了污染和操作相关的风险。这些特性在癌症治疗中至关重要,因为精准剂量、无菌和长期储存至关重要。随着监管机构越来越多地批准冷冻干燥製剂用于肿瘤治疗,製药公司正优先考虑抗肿瘤注射剂的研发,尤其是那些高价值製剂且效力或纯度偏差空间有限的药物。

2024年,肿瘤治疗领域占据领先地位,市占率达28.7%。该领域占据主导地位的原因是全球癌症发病率的不断上升,以及对稳定注射疗法的需求,这些疗法需要透过长期储存和运输来维持疗效。全球医疗保健系统正在投资更强大的药物输送解决方案,而冷冻干燥注射剂则提供了一种经济高效、长期有效的解决方案。为了满足日益增长的癌症治疗需求,药物开发商正致力于改善输送方法、减少药物浪费并延长产品寿命。

2024年,北美冷冻干燥注射剂市场占据47%的市场份额,这得益于该地区先进的医药产业格局和高度集中的慢性病病例。该地区的主导地位也源于其强大的研发能力、FDA频繁批准的冷冻干燥注射剂,以及成熟的医疗保健体系,支持其在医院和门诊的广泛应用。对肿瘤学、自体免疫疾病治疗和生物製剂的持续投入,加上人们对保质期较长的注射剂的日益接受,将继续巩固该地区在全球冻干注射剂市场的地位。

为产业成长做出贡献的杰出市场参与者包括西普拉、诺和诺德、Akums Drugs and Pharmaceuticals、默克、Aurobindo Pharma、辉瑞、吉利德科学、赛诺菲、强生、武田製药、Vetter Pharma、Zydus、明治集团、Gufic Group、Fareva、百时美林施贵宝、费森斯、施贵罗氏和 Boraticals Pharmauticals。为了巩固市场领导地位,冷冻干燥注射药物行业的公司正在增加对高容量冻干设备和符合严格的全球监管标准的最先进生产线的投资。许多公司正在扩大其合约製造服务,改善冷链物流,并整合自动化以减少停机时间和生产成本。策略合作和授权协议通常用于获取创新生物化合物和扩大产品组合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病和传染病的盛行率不断上升

- 药物输送系统的技术进步

- 对生物製剂和复杂分子的需求不断增长

- 产业陷阱与挑战

- 生产和设备成本高

- 监管和品质合规挑战

- 市场机会

- 个人化精准医疗

- 扩大合约研究与製造服务(CRAMS)

- 成长动力

- 成长潜力分析

- 技术格局

- 当前的技术趋势

- 新兴技术

- 定价分析

- 研发管线及研发投资分析

- 专利态势分析

- 母市场分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按药物类型,2021 - 2034 年

- 主要趋势

- 抗感染

- 抗肿瘤

- 抗凝血剂

- 荷尔蒙

- 抗心律不整药

- 质子帮浦抑制剂

- 麻醉药

- 其他药物类型

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 自体免疫疾病

- 呼吸系统疾病

- 胃肠道疾病

- 肿瘤学

- 心血管疾病

- 传染病

- 荷尔蒙失调

- 代谢紊乱

- 生殖健康

- 其他适应症

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 预充式稀释剂注射器

- 多步骤设备

第八章:市场估计与预测:按包装,2021 - 2034 年

- 主要趋势

- 小瓶

- 墨水匣

- 预充式装置

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 专科诊所

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Akums Drugs and Pharmaceuticals

- Aurobindo Pharma

- Bora Pharmaceuticals

- Bristol Myers Squibb

- Cipla

- F. Hoffmann-La Roche

- Fareva

- Fresenius

- Gilead Sciences

- Gufic Group

- Johnson & Johnson

- Meiji Group

- Merck

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda Pharmaceuticals

- Vetter Pharma

- Zydus

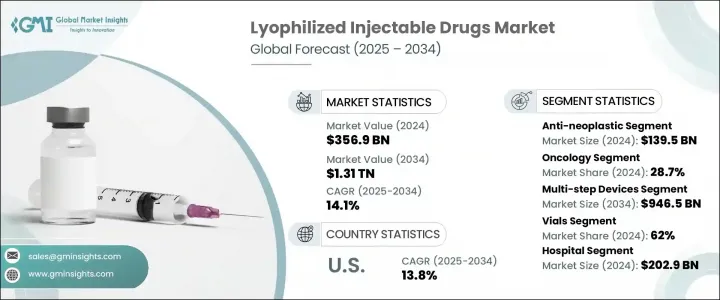

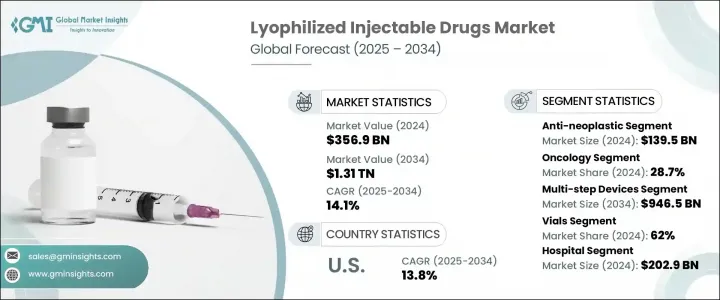

The Global Lyophilized Injectable Drugs Market was valued at USD 356.9 billion in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 1.31 trillion by 2034. Rising incidences of chronic health conditions, including cancer and infectious diseases, continue to escalate demand for stable and long-acting therapeutics. The need for extended shelf life and improved drug efficacy has made freeze-dried injectable formulations an essential part of the pharmaceutical pipeline. Additionally, the increase in global regulatory approvals and technological advancements in lyophilization processes is significantly enhancing market penetration. With a shift toward biologics and injectable therapies in both inpatient and outpatient care, the lyophilized injectables sector is seeing rapid development in manufacturing capabilities, logistics infrastructure, and clinical applications.

The rising need for durable and highly stable drug formulations is pushing pharmaceutical companies to adopt lyophilization for an expanding range of injectable drugs. Innovations such as enhanced cold-chain distribution, single-dose packaging, and improvements in reconstitution efficiency are strengthening product reliability across global healthcare systems. Lyophilized formulations are gaining momentum in the treatment of diseases where stability and sterility are critical. These drugs are typically administered after mixing with a diluent, allowing healthcare providers to manage dosing accuracy and extend product usability. The availability of reliable formulations with longer shelf lives makes lyophilized drugs a preferred choice, particularly in regions with limited infrastructure and growing access to advanced medical care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $356.9 Billion |

| Forecast Value | $1.31 Trillion |

| CAGR | 14.1% |

In 2024, the anti-neoplastic agents segment captured a USD 139.5 billion share, reflecting the surging demand for oncology-focused biologics and cytotoxic compounds. Lyophilized injectable drugs are particularly well-suited for these treatments, offering improved stability and longer shelf life while minimizing the risks associated with contamination and handling. These properties are critical in cancer care, where precise dosage, sterility, and long-term storage are vital. With regulatory bodies increasingly approving freeze-dried formulations in oncology, pharmaceutical firms are prioritizing development pipelines around anti-neoplastic injectables, particularly those with high-value formulations and limited room for deviation in potency or purity.

The oncology segment held the leading share of 28.7% in 2024. Its dominance is driven by the growing global incidence of cancer and the necessity for stable injectable therapies that maintain therapeutic effectiveness through extended storage and transport. Healthcare systems worldwide are investing in more robust drug delivery solutions, and lyophilized injectables provide a cost-effective, long-term answer. Pharmaceutical developers are focusing heavily on refining delivery methods, reducing drug wastage, and enhancing product lifespan through lyophilization to meet the growing demand for cancer treatments.

North America Lyophilized Injectable Drugs Market held 47% in 2024, underpinned by the region's advanced pharmaceutical landscape and high concentration of chronic disease cases. The region's dominance also stems from strong R&D capabilities, frequent FDA approvals for freeze-dried injectables, and a mature healthcare delivery system that supports wide adoption across hospital and ambulatory settings. Continued investment in oncology, autoimmune disease therapies, and biologics, combined with growing acceptance of injectable drugs with extended shelf lives, continues to support the region's stronghold in the global lyophilized injectable drugs market.

Prominent market participants contributing to industry growth include Cipla, Novo Nordisk, Akums Drugs and Pharmaceuticals, Merck, Aurobindo Pharma, Pfizer, Gilead Sciences, Sanofi, Johnson & Johnson, Takeda Pharmaceuticals, Vetter Pharma, Zydus, Meiji Group, Gufic Group, Fareva, Bristol Myers Squibb, Fresenius, F. Hoffmann-La Roche, and Bora Pharmaceuticals. To secure their market leadership, companies in the lyophilized injectable drugs industry are increasingly investing in high-capacity freeze-drying equipment and state-of-the-art manufacturing lines that meet stringent global regulatory standards. Many firms are expanding their contract manufacturing services, improving cold chain logistics, and integrating automation to reduce downtime and production costs. Strategic collaborations and licensing agreements are commonly used to gain access to innovative biologic compounds and expand product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Indication

- 2.2.4 Application

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic and infectious diseases

- 3.2.1.2 Technological advancements in drug delivery systems

- 3.2.1.3 Rising demand for biologics and complex molecules

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and equipment costs

- 3.2.2.2 Regulatory and quality compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Personalized and precision medicine

- 3.2.3.2 Expansion of contract research and manufacturing services (CRAMS)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Pricing analysis

- 3.6 Pipeline and R&D investment analysis

- 3.7 Patent landscape analysis

- 3.8 Parent market analysis

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia Pacific

- 3.9.4 Latin America

- 3.9.5 Middle East and Africa

- 3.10 Future market trends

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Anti-infective

- 5.3 Anti-neoplastic

- 5.4 Anticoagulant

- 5.5 Hormones

- 5.6 Antiarrhythmic

- 5.7 Proton pump inhibitors

- 5.8 Anesthetics

- 5.9 Other drug types

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Autoimmune diseases

- 6.3 Respiratory diseases

- 6.4 Gastrointestinal disorders

- 6.5 Oncology

- 6.6 Cardiovascular diseases

- 6.7 Infectious diseases

- 6.8 Hormonal disorders

- 6.9 Metabolic disorders

- 6.10 Reproductive health

- 6.11 Other indications

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prefilled diluent syringes

- 7.3 Multi-step devices

Chapter 8 Market Estimates and Forecast, By Packaging, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Vials

- 8.3 Cartridges

- 8.4 Prefilled devices

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Akums Drugs and Pharmaceuticals

- 11.2 Aurobindo Pharma

- 11.3 Bora Pharmaceuticals

- 11.4 Bristol Myers Squibb

- 11.5 Cipla

- 11.6 F. Hoffmann-La Roche

- 11.7 Fareva

- 11.8 Fresenius

- 11.9 Gilead Sciences

- 11.10 Gufic Group

- 11.11 Johnson & Johnson

- 11.12 Meiji Group

- 11.13 Merck

- 11.14 Novo Nordisk

- 11.15 Pfizer

- 11.16 Sanofi

- 11.17 Takeda Pharmaceuticals

- 11.18 Vetter Pharma

- 11.19 Zydus