|

市场调查报告书

商品编码

1801798

支气管内超音波切片设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Endobronchial Ultrasound Biopsy Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

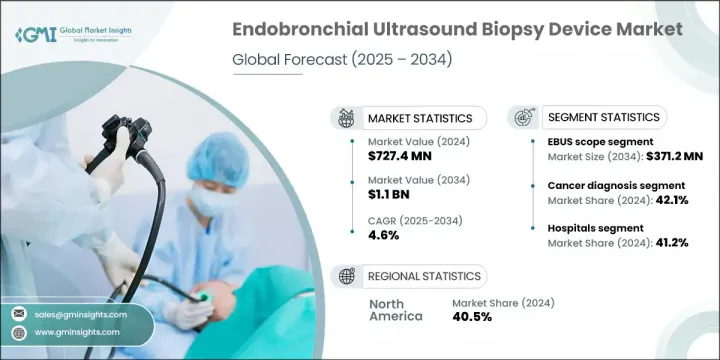

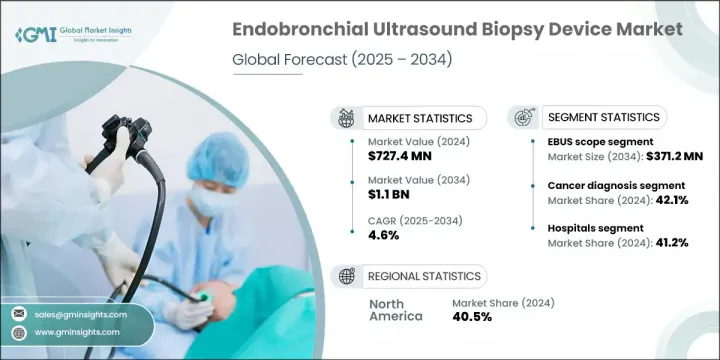

2024 年全球支气管内超音波活检设备市场价值为 7.274 亿美元,预计到 2034 年将以 4.6% 的复合年增长率增长至 11 亿美元。人口老化加剧、呼吸系统疾病发病率上升、对微创诊断技术的需求不断增长以及活检设备的技术进步,推动了该市场的成长。这些设备旨在帮助临床医生以高精度和最小患者不适的方式从肺部和周围淋巴结采集组织样本。随着向微创诊断的转变,医院、诊断实验室和癌症护理中心越来越多地采用这些超音波导引解决方案来诊断和分期肺癌和其他胸部疾病等疾病。对早期疾病检测和高效临床程序的不断增长的需求也促使 EBUS 工具在常规医疗实践中的使用日益增多。

活检平台的技术突破正在改变诊断程序的模式。现代解决方案如今包含弹性成像、人工智慧导航和混合成像等功能,这些功能可提高准确性和手术效率。这些创新有助于降低併发症风险、简化工作流程并改善患者体验。此外,随着医疗保健系统强调早期和准确的诊断,人们越来越依赖这些系统来减少对侵入性手术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.274亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 4.6% |

EBUS 针头市场在 2024 年的市场规模为 2.043 亿美元,预计到 2034 年将达到 3.365 亿美元,复合年增长率为 5.2%。该市场的成长得益于多样化的针头规格选择和迴声针尖技术,这些技术提高了手术过程中的可视性。 EBUS 内视镜将超音波探头与支气管镜结合,能够即时成像气道附近的组织和淋巴结。这些内视镜对于实施经支气管针吸活检 (TBNA) 至关重要,TBNA 是一种使临床医生无需进行开放性手术即可获取诊断样本的检查方法。此技术不仅可以最大限度地减少不适,还能确保患者更快康復,并降低接受肺部或胸部评估的风险。

2024年,癌症诊断应用领域占42.1%的市占率。胸部癌症发生率的上升大幅提升了对精准即时诊断工具的需求。 EBUS内视镜、TBNA设备和配备弹性成像的探头对于癌症分期和早期检测至关重要,它们能够为临床医生提供设计个人化治疗方案所需的资料。随着癌症病例的持续增长,医疗保健机构正在加速采用先进的超音波导引活检设备,以满足日益增长的诊断需求。

2024年,美国支气管内超音波切片设备市场规模达2.694亿美元。这一增长趋势归因于慢性阻塞性肺病(COPD)、结核病和癌症等肺部疾病的高发生率。此外,完善的监管框架、民众日益增强的认知度以及强大的研发投入,推动了先进的EBUS技术在全美各地临床实践中的广泛应用。

全球支气管内超音波活检设备市场的知名公司包括西门子医疗、贝朗、库克医疗、Argon Medical Devices、富士胶片控股、Praxis Medical、Hobbs Medical、奥林匹克医疗、Argon Medical Devices、富士胶片控股、Praxis Medical、Hobbs Medical、奥林匹克医疗、Argon Medical Devices、富士胶片控股、通用电气医疗、荷兰皇家飞利浦、Clinodevice、Medi-Globe 和美敦力。支气管内超音波活检设备市场的主要参与者正在部署一系列策略,以增强其市场影响力。

许多公司正在大力投资研发,以开发人工智慧辅助导航系统、增强型视觉化工具以及更符合人体工学的活检仪器。一些公司正在透过推出诊断准确性更高、患者安全功能更强的设备来扩展其产品组合。与医院和诊断中心的策略合作也有助于公司加速技术应用。临床试验和医生培训计画的合作支持真实世界验证,并拓展使用者能力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 老年人口不断增加

- 呼吸系统疾病盛行率不断上升

- 微创手术需求不断成长

- 切片设备的技术进步

- 产业陷阱与挑战

- 设备成本高

- 发展中国家缺乏报销政策

- 市场机会

- 专科诊所越来越多地采用标靶活检

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- EBUS示波器

- EBUS针头

- 超音波处理器和成像系统

- 配件

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 癌症诊断

- 感染诊断

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 专科诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Argon Medical Devices

- ACE Medical Devices

- B. Braun

- Boston Scientific

- Cook Medical

- Clinodevice

- Fujifilm Holdings

- GE Healthcare

- Hobbs Medical

- Koninklijke Philips

- Medtronic

- Medi-Globe

- Olympus Corporation

- Praxis Medical

- Siemens Healthineers

The Global Endobronchial Ultrasound Biopsy Device Market was valued at USD 727.4 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 1.1 billion by 2034. Growth in this market is driven by the increasing aging population, a growing incidence of respiratory diseases, rising demand for minimally invasive diagnostic techniques, and ongoing technological advancements in biopsy equipment. These devices are designed to assist clinicians in collecting tissue samples from the lungs and surrounding lymph nodes with high accuracy and minimal patient discomfort. With a shift toward less invasive diagnostics, hospitals, diagnostic labs, and cancer care centers are increasingly adopting these ultrasound-guided solutions to diagnose and stage diseases such as lung cancer and other thoracic conditions. The rising demand for early disease detection and efficient clinical procedures is also contributing to the growing utilization of EBUS tools in routine medical practice.

Technological breakthroughs in biopsy platforms are transforming the landscape of diagnostic procedures. Modern solutions now include features like elastography, AI-enabled navigation, and hybrid imaging, which offer enhanced accuracy and procedural efficiency. These innovations help reduce complication risks, streamline workflow, and contribute to improved patient experiences. Additionally, as healthcare systems emphasize early and accurate diagnosis, there's a higher reliance on these systems for their ability to reduce the need for more invasive surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $727.4 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.6% |

The EBUS needle segment generated USD 204.3 million in 2024 and is forecast to reach USD 336.5 million by 2034, growing at a CAGR of 5.2%. The growth of this segment is supported by diverse needle gauge options and echogenic tip technology, which improve visibility during procedures. EBUS scopes, which incorporate ultrasound probes with bronchoscopy, enable real-time imaging of tissues and lymph nodes near the airways. These scopes are essential for performing transbronchial needle aspiration (TBNA), a method that allows clinicians to obtain diagnostic samples without resorting to open procedures. This technique not only minimizes discomfort but also ensures faster recovery and lower risks for patients undergoing lung or thoracic evaluations.

In 2024, the cancer diagnosis application segment held 42.1% share. The increasing incidence of thoracic cancers has sharply raised the need for precise, real-time diagnostic tools. EBUS scopes, TBNA devices, and elastography-equipped probes are vital for staging and early detection, offering clinicians the data necessary to design personalized treatment plans. As cases of cancer continue to rise, healthcare providers are accelerating the adoption of advanced ultrasound-guided biopsy equipment to meet growing diagnostic demands.

United States Endobronchial Ultrasound Biopsy Device Market was valued at USD 269.4 million in 2024. This upward trajectory is attributed to the high prevalence of lung conditions like COPD, tuberculosis, and cancer. Additionally, a well-structured regulatory framework, growing awareness among the population, and strong investments in R&D have supported the widespread integration of advanced EBUS technology in clinical practices across the country.

Notable companies involved in the Global Endobronchial Ultrasound Biopsy Device Market include Siemens Healthineers, B. Braun, Cook Medical, Argon Medical Devices, Fujifilm Holdings, Praxis Medical, Hobbs Medical, Olympus Corporation, Boston Scientific, ACE Medical Devices, GE Healthcare, Koninklijke Philips, Clinodevice, Medi-Globe, and Medtronic. Key players in the endobronchial ultrasound biopsy device market are deploying a range of strategies to strengthen their market presence.

Many are heavily investing in R&D to develop AI-assisted navigation systems, enhanced visualization tools, and more ergonomic biopsy instruments. Several companies are expanding their product portfolios through the launch of devices with improved diagnostic accuracy and patient safety features. Strategic collaborations with hospitals and diagnostic centers are also helping firms to accelerate technology adoption. Partnerships for clinical trials and physician training programs support real-world validation and broaden user competence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising geriatric population

- 3.2.1.2 Increasing prevalence of respiratory disorders

- 3.2.1.3 Rising demand for minimally invasive procedures

- 3.2.1.4 Technological advancements in biopsy devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Lack reimbursement policies in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in specialty clinics for targeted biopsies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 EBUS scopes

- 5.3 EBUS needles

- 5.4 Ultrasound processors and imaging systems

- 5.5 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer diagnosis

- 6.3 Infection diagnosis

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Argon Medical Devices

- 9.2 ACE Medical Devices

- 9.3 B. Braun

- 9.4 Boston Scientific

- 9.5 Cook Medical

- 9.6 Clinodevice

- 9.7 Fujifilm Holdings

- 9.8 GE Healthcare

- 9.9 Hobbs Medical

- 9.10 Koninklijke Philips

- 9.11 Medtronic

- 9.12 Medi-Globe

- 9.13 Olympus Corporation

- 9.14 Praxis Medical

- 9.15 Siemens Healthineers