|

市场调查报告书

商品编码

1801823

脊椎机器人手术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Spine Robotic Surgery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

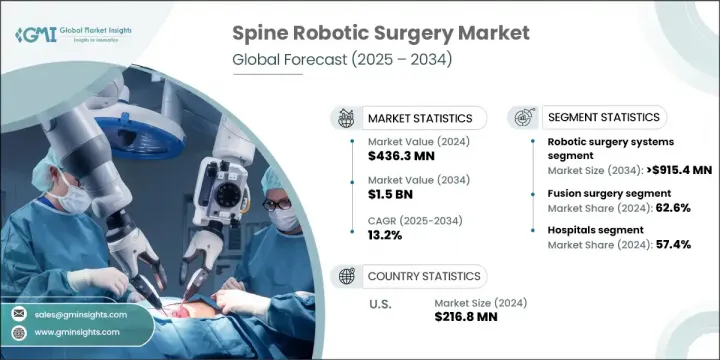

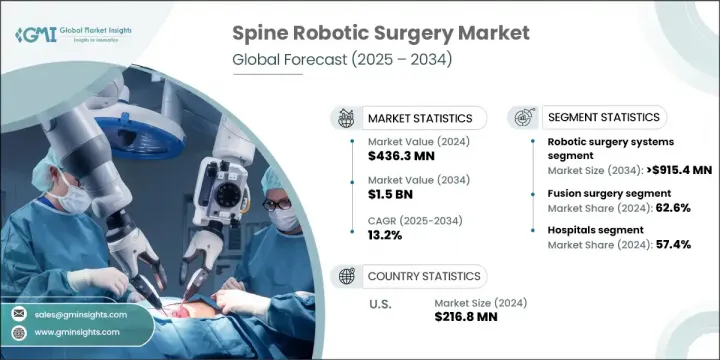

2024年,全球脊椎机器人手术市场规模达4.363亿美元,预计2034年将以13.2%的复合年增长率成长,达到15亿美元。这一大幅增长主要源于脊椎疾病发病率的上升、医疗保健投资的增加以及全球向微创手术的转变。随着患者和医疗机构都寻求更安全、更精准、更短恢復时间的手术方案,对先进手术方案的需求持续成长。随着人口老化加剧和医疗保健体系的不断发展,各地区对机器人辅助脊椎手术的需求正在不断增长。

手术机器人技术的创新,加上人工智慧、导航和即时影像技术的发展,正在使这些系统更加可靠,并得到更广泛的应用。这些技术正在提高复杂脊椎手术的精准度,并实现传统手术方法难以达到的效果。在不断发展的医疗格局中,机器人系统正成为脊椎手术的重要组成部分,提升手术安全性和效率。它们在医院和外科中心的日益普及,预示着未来十年市场将呈现强劲成长动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.363亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 13.2% |

脊椎机器人手术提供了高水准的控制力和精准度,显着改善了脊椎手术的实施方式。其微创特性有助于加快癒合速度并降低併发症风险,这对外科医生和患者都极具吸引力。透过使用机器人系统,临床医生可以进行更小、更精确的切口,从而最大限度地减少对周围组织的损伤。这些系统能够实现手动难以复製的精细操作,从而降低手术失误的可能性并取得更好的效果。医院受益于患者復原时间的缩短和住院时间的缩短,这进而降低了整体医疗成本并提高了手术流程的效率。

2024年,机器人手术系统细分市场占据58.3%的市场。专家指出,技术进步和卓越的临床疗效是推动这项绩效的关键因素。现代手术机器人配备了增强型成像、人工智慧驱动的手术计划和即时导航功能,可帮助外科医生轻鬆完成高度复杂的手术。这意味着手术更加精准,修復风险更低,使机器人平台成为许多医疗机构的首选。此外,机器人系统旨在支援微创技术,提供先进的工具来协助完成精细复杂的手术。这种精准度不仅提高了手术质量,也增强了外科医生的信心。

2024年,融合手术市占率达到62.6%,反映出其在脊椎治疗领域持续受到欢迎。脊椎融合手术仍然是最常见的手术之一,尤其是在人口老化和生活方式因素导致脊椎相关问题日益普遍的背景下。机器人辅助融合手术具有更高的精准度、更少的併发症和更低的翻修率,所有这些都使其在该领域占据主导地位。机器人技术的整合有助于改善这些手术,使其对于治疗慢性脊椎疾病的患者更安全、更可预测。

2024年,美国脊椎机器人手术市场规模达2.168亿美元。该地区的主导地位得益于先进的医院系统、创新技术的快速应用以及不断增加的研发投入。美国凭藉其完善的基础设施和报销体系,以及庞大的脊椎疾病患者群体,实现了强劲成长。这些因素使北美成为机器人脊椎手术的创新中心和商业领导者,吸引了许多致力于拓展全球业务的公司的注意。

影响全球脊椎机器人手术市场的主要参与者包括强生、Zimmer Biomet、西门子医疗、美敦力、直觉外科、史赛克、Brainlab、CUREXO、Orthofix Medical、R2 Surgical、B Braun、Globus Medical 等。他们持续的研发投入和对产品创新的关注正在塑造脊椎外科技术的未来。为了建立强大的市场影响力,脊椎机器人手术领域的领先公司正专注于持续创新和策略合作伙伴关係。他们正在大力投资人工智慧整合、下一代导航工具和先进的成像功能,以提供精确增强的系统。许多公司正在扩大其临床试验管道,以在全球市场更快获得监管部门的批准。与医院和学术机构的合作透过提供培训和演示设施,有助于加速机器人平台的采用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 脊椎疾病盛行率不断上升

- 技术进步

- 微创外科手术激增

- 医疗支出增加

- 产业陷阱与挑战

- 机器人设备的复杂性

- 严格的监管要求

- 市场机会

- 发展中经济体的成长潜力

- 持续投入研发,促进产品开发

- 成长动力

- 成长潜力

- 成长潜力分析

- 报销场景

- 监管格局

- 我们

- 欧洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 新产品开发格局

- 启动场景

- 2024年定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 机器人手术系统

- 全机器人系统

- 机械手臂辅助系统

- 手术导航系统

- 电磁导航系统

- 光学导航系统

- 混合导航系统

- 软体解决方案

- 配件和耗材

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 融合手术

- 非融合手术

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- B Braun

- Brainlab

- CUREXO

- Globus Medical

- Intuitive Surgical Operations

- Johnson & Johnson

- Medtronic

- Orthofix Medical

- R2 Surgical

- Siemens Healthineers

- Stryker

- Zimmer Biomet

The Global Spine Robotic Surgery Market was valued at USD 436.3 million in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 1.5 billion by 2034. This substantial growth is largely driven by the rising incidence of spinal disorders, increased healthcare investment, and a global shift toward minimally invasive surgical procedures. The need for advanced surgical options continues to grow as patients and providers alike seek safer, more accurate procedures that also reduce recovery time. As the aging population increases and healthcare systems evolve, the demand for robot-assisted spinal procedures is expanding across various regions.

Innovations in surgical robotics-combined with developments in artificial intelligence, navigation, and real-time imaging-are making these systems more reliable and widely adopted. These technologies are improving precision during complex spine procedures and enabling outcomes that traditional surgical methods struggle to achieve. In this evolving medical landscape, robotic systems are becoming an essential component of spinal surgery, enhancing both safety and efficiency. Their growing presence in hospitals and surgical centers signals a strong market trajectory through the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $436.3 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 13.2% |

Spine robotic surgery offers a level of control and accuracy that dramatically improves the way spinal procedures are performed. Its minimally invasive nature supports faster healing and lowers complication risks, which appeals to both surgeons and patients. By using robotic systems, clinicians can make smaller, more precise incisions, which helps minimize trauma to surrounding tissue. These systems enable fine-tuned maneuvers that are difficult to replicate manually, reducing the potential for surgical error and delivering better results. Hospitals benefit from reduced recovery times and shorter patient stays, which in turn lowers overall healthcare costs and increases efficiency in surgical workflows.

The robotic surgery systems segment held a 58.3% share in 2024. Experts pointed to technological advancement and strong clinical outcomes as key drivers for this performance. Modern surgical robotics are equipped with enhanced imaging, AI-driven planning, and real-time navigation, helping surgeons perform highly complex procedures with ease. This translates into more precise surgeries and less risk of revision, making robotic platforms a preferred choice in many facilities. Additionally, robotic systems are built to support minimally invasive techniques, offering advanced tools that assist with delicate and intricate tasks. This precision not only improves surgical quality but also boosts surgeon confidence.

The fusion surgery segment accounted for a 62.6% share in 2024, reflecting its continued popularity in spinal treatment. Spinal fusion remains one of the most frequently performed procedures, particularly as spine-related issues become more common with aging populations and lifestyle factors. Robotic-assisted fusion surgeries offer heightened precision, fewer complications, and lower revision rates, all of which contribute to their dominance in this space. The integration of robotics has helped refine these procedures, making them safer and more predictable for patients dealing with chronic spine conditions.

United States Spine Robotic Surgery Market generated USD 216.8 million in 2024. The region's dominance is fueled by advanced hospital systems, quick adoption of innovative technologies, and increasing investments in research and development. The US shows strong growth due to its established infrastructure and reimbursement landscape, alongside a large patient population affected by spine disorders. These factors make North America an innovation hub and commercial leader in robotic spine surgery, drawing interest from companies aiming to expand their global footprint.

Major players influencing the Global Spine Robotic Surgery Market include Johnson & Johnson, Zimmer Biomet, Siemens Healthineers, Medtronic, Intuitive Surgical Operations, Stryker, Brainlab, CUREXO, Orthofix Medical, R2 Surgical, B Braun, Globus Medical, and others. Their continued R&D investments and focus on product innovation are shaping the future of spinal surgery technologies. To build a strong market presence, leading companies in the spine robotic surgery space are focusing on continual innovation and strategic partnerships. They're investing heavily in AI integration, next-gen navigation tools, and advanced imaging capabilities to offer precision-enhanced systems. Many are expanding their clinical trial pipelines to gain regulatory approvals faster across global markets. Collaborations with hospitals and academic institutions are helping accelerate the adoption of robotic platforms by providing training and demonstration facilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of spinal disorders

- 3.2.1.2 Technological advancements

- 3.2.1.3 Surge in minimally invasive surgical procedures

- 3.2.1.4 Increased healthcare spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity of robotic devices

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Growth potential in developing economies

- 3.2.3.2 Continued investment in research and development for product development

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Growth potential analysis

- 3.5 Reimbursement scenario

- 3.6 Regulatory landscape

- 3.6.1 U.S.

- 3.6.2 Europe

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Future market trends

- 3.9 New product development landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Gap analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Robotic surgery systems

- 5.2.1 Fully robotic systems

- 5.2.2 Robotic arm-assisted systems

- 5.3 Surgical navigation systems

- 5.3.1 Electromagnetic navigation systems

- 5.3.2 Optical navigation systems

- 5.3.3 Hybrid navigation systems

- 5.4 Software solutions

- 5.5 Accessories and consumables

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fusion surgery

- 6.3 Non-fusion surgery

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Brainlab

- 9.3 CUREXO

- 9.4 Globus Medical

- 9.5 Intuitive Surgical Operations

- 9.6 Johnson & Johnson

- 9.7 Medtronic

- 9.8 Orthofix Medical

- 9.9 R2 Surgical

- 9.10 Siemens Healthineers

- 9.11 Stryker

- 9.12 Zimmer Biomet