|

市场调查报告书

商品编码

1801831

温控包装材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Temperature-Controlled Packaging Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

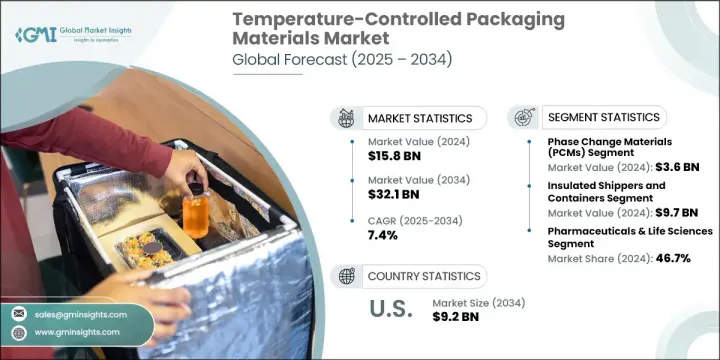

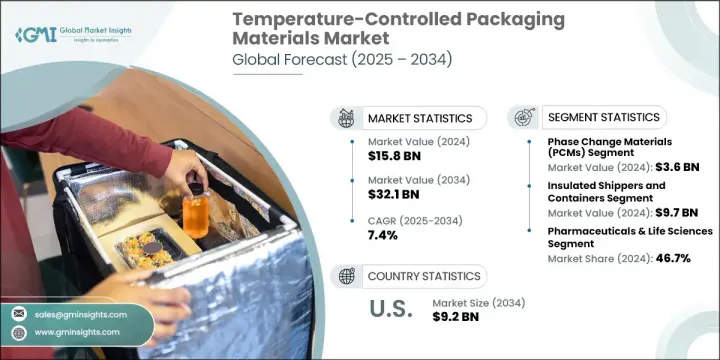

2024年,全球温控包装材料市场规模达158亿美元,预计2034年将以7.4%的复合年增长率成长,达到321亿美元。这一成长主要源于製药、生物技术、临床研究和易腐食品物流等关键产业的需求激增。随着确保温敏产品安全运输的压力日益增大,製造商正转向能够在整个运输过程中提供稳定性、无菌性和持续热控制的高性能材料。产品处理日益复杂,使得先进包装材料成为必需品而非可有可无。这一上升趋势反映出,在产品对温度日益敏感的环境下,全球市场对更先进的供应链解决方案的需求日益增长。

在製药和生物製药行业,高效的热包装尤其重要,因为即使是轻微的温度偏差也可能损害产品的完整性。随着生物製剂、基因疗法和其他复杂疗法日益成为主流,包装解决方案必须适应更严格的温度控制和更长的运输时间。企业正在投资能够满足这些需求的隔热包装形式,而基于物联网 (IoT) 的监控系统的整合也变得越来越普遍,以确保整个冷链的透明度和可追溯性。此外,对可持续且经济高效的包装方案的日益追求,也影响着可重复使用且符合国际法规的新型材料的设计和部署。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 158亿美元 |

| 预测值 | 321亿美元 |

| 复合年增长率 | 7.4% |

就材料类型而言,相变材料正逐渐成为一个重要的细分市场,其估值在2024年将达到36亿美元。预计到2034年,这些材料的复合年增长率将达到8.4%,因其能够在运输过程中保持精确的温度范围而备受青睐。水基和凝胶配方因其能够有效地保持所需的热条件,并可在被动式冷链解决方案中重复使用而日益受到青睐。这些材料不仅因其技术性能而备受青睐,还因其与传统冷媒相比对环境的影响较小。市场日益倾向选择可靠且节能的方案,加速了相变技术的创新,而相变技术如今已成为医药和食品级物流的核心。

从产品角度来看,保温运输箱和保温容器占据主导地位,其市值在2024年将达到97亿美元,预计到2034年的复合年增长率将达到7%。这些解决方案旨在适应各种运输方式,例如小包裹、托盘和散装货物。药品、生物製剂和温敏食品的物流需求推动了这项需求。包装设计客製化程度的提高有助于满足临床试验和个人化治疗等新兴应用的需求,这些应用必须严格控制温度。保温纸箱、板条箱、盒子和保温袋等产品因其在「最后一英里」配送和区域配送网路中的高效性而继续广泛应用。

从应用角度来看,製药和生命科学占据最大的市场份额,到2024年将占全球市场份额的46.7%。预计到2034年,该产业的复合年增长率将达到7.9%,这得益于生物製剂、疫苗和个人化医疗产品线的不断扩张。製药公司要求包装系统能够确保无菌、精准、符合监管框架,同时也要具备可扩展性以实现大规模部署。一次性包装形式和先进冷却解决方案的重要性日益提升,加上数位监控容器的普及,正在重塑该行业的物流运作。随着全球卫生情势的演变,包装技术在确保这些高价值产品完好无损地到达目的地方面发挥着至关重要的作用。

在美国,2024年温控包装材料市场规模为48亿美元,预计2034年将攀升至92亿美元,复合年增长率为6.7%。美国生物技术和製药行业的持续扩张推动了这一成长。市场正在越来越多地采用先进的热包装系统,例如真空隔热板和下一代相变材料。此外,直接面向患者的配送模式的成长也对包装提出了新的需求,这些包装需要确保在各种运输条件下保持一致的温度。美国利害关係人也在推动智慧追踪解决方案和包装创新,以满足特殊疗法对严格热容差的要求。

市场领导地位集中在少数几家主要参与者手中,排名前五的公司在2024年合计占据全球约40%的市场份额。这些公司透过提供符合良好分销规范 (GDP) 和其他全球标准的可重复使用和一次性解决方案,建立了稳固的市场地位。随着法规日益严格,以及客户对卓越可靠性、成本效益和永续性的需求,竞争日益激烈。企业正在透过整合智慧追踪技术、扩展全球基础设施以及投资于降低环境影响的材料来应对这项挑战。为了保持竞争力,企业正在优先进行策略合作,包括併购以及与物流和技术供应商的合作。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 绝缘材料

- 相变材料(PCM)

- 冷媒和冷却剂

- 智慧感测器和监控设备

第六章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 绝缘托运箱和货柜

- 客製化和专业解决方案

- 冷藏冷冻包装

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 製药和生命科学

- 食品和饮料

- 化学品和工业品

- 其他应用

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- AmerisourceBergen

- Avery Dennison

- Cold Chain Technologies

- Cryopak

- Envirotainer

- Intelsius

- Nordic Cold Chain Solutions

- Pelican BioThermal

- Sealed Air

- Sofrigam

- Softbox Systems

- Sonoco Products Company

- TemperPack

- Tower Cold Chain

- Va-Q-Tec

The Global Temperature-Controlled Packaging Materials Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 32.1 billion by 2034. The growth is driven by demand surges across critical industries such as pharmaceuticals, biotechnology, clinical research, and perishable food logistics. With increasing pressure to ensure the safe transportation of temperature-sensitive products, manufacturers are shifting toward high-performance materials that can provide stability, sterility, and consistent thermal control throughout transit. This growing complexity in product handling has made advanced packaging materials a necessity rather than an option. This upward trend reflects the global push for more sophisticated supply chain solutions amid an increasingly temperature-sensitive product landscape.

The need for efficient thermal packaging is especially critical in the pharmaceutical and biopharma sectors, where even slight temperature deviations can compromise product integrity. As biologics, gene therapies, and other complex treatments become more mainstream, packaging solutions must adapt to support stricter temperature controls and longer shipping durations. Companies are investing in insulated packaging formats that can meet these demands, and the integration of Internet of Things (IoT)-based monitoring systems has become more common to ensure transparency and traceability across the cold chain. Moreover, the growing push for sustainable and cost-efficient packaging options is influencing the design and deployment of newer materials that are both reusable and compliant with international regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $32.1 Billion |

| CAGR | 7.4% |

In terms of material type, phase change materials are emerging as a major segment, reaching a valuation of USD 3.6 billion in 2024. Expected to grow at a CAGR of 8.4% through 2034, these materials are preferred for their ability to maintain precise temperature ranges during shipping. Water-based and gel formulations are gaining traction due to their efficiency in preserving required thermal conditions and their potential for reuse in passive cold chain solutions. These materials are being favored not only for their technical performance but also for their lower environmental impact compared to traditional refrigerants. The market's growing inclination toward reliable and energy-efficient options is accelerating innovation in phase change technologies, which are now central to both pharmaceutical and food-grade logistics.

From a product perspective, insulated shippers and containers dominate the landscape, with a market value of USD 9.7 billion in 2024 and a forecasted CAGR of 7% through 2034. These solutions are designed to accommodate various shipping formats such as small parcels, pallets, and bulk shipments. Demand is being driven by the logistics needs of pharmaceuticals, biologics, and temperature-sensitive food products. Increasing customization in packaging design is helping cater to emerging applications like clinical trials and personalized therapies, where strict temperature control is mandatory. Products such as insulated cartons, crates, boxes, and pouches continue to see wide usage due to their effectiveness in last-mile delivery and regional distribution networks.

On the basis of application, pharmaceuticals and life sciences represent the largest segment, accounting for 46.7% of the global market share in 2024. This sector is anticipated to grow at a CAGR of 7.9% through 2034, fueled by the expanding pipeline of biologics, vaccines, and personalized medicine. Pharmaceutical companies are demanding packaging systems that ensure sterility, precision, and compliance with regulatory frameworks while also offering scalability for mass deployment. The increasing importance of single-use packaging formats and advanced cooling solutions, along with the adoption of digitally monitored containers, is reshaping logistics operations in this sector. As the global health landscape evolves, packaging technologies are playing an essential role in ensuring that these high-value products reach their destinations intact.

In the United States, the temperature-controlled packaging materials market was worth USD 4.8 billion in 2024 and is expected to climb to USD 9.2 billion by 2034, reflecting a CAGR of 6.7%. The continued expansion of the U.S. biotechnology and pharmaceutical industries is driving this growth. The market is experiencing increased adoption of advanced thermal packaging systems, such as vacuum insulation panels and next-generation phase change materials. Furthermore, the growth of direct-to-patient delivery models is creating new demands for packaging that ensures consistent temperature maintenance across varied transport conditions. U.S. stakeholders are also pushing for intelligent tracking solutions and packaging innovations that meet the narrow thermal tolerances required by specialized therapies.

Market leadership is concentrated among a few major players, with the top five companies collectively holding approximately 40% of the global market share in 2024. These companies have established a stronghold by offering a mix of reusable and single-use solutions that comply with Good Distribution Practices (GDP) and other global standards. Competitive intensity is growing as regulations become more stringent and customers demand superior reliability, cost-efficiency, and sustainability. Companies are responding by integrating smart tracking technologies, expanding global infrastructure, and investing in materials that lower environmental impact. Strategic collaborations, including M&A and partnerships with logistics and tech providers, are being prioritized to stay competitive.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Insulation Materials

- 5.3 Phase Change Materials (PCMs)

- 5.4 Refrigerants and Cooling Agents

- 5.5 Smart Sensors and Monitoring Devices

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Insulated Shippers and Containers

- 6.3 Custom and Specialty Solutions

- 6.4 Refrigerated and Frozen Packaging

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals and Life Sciences

- 7.3 Food and Beverage

- 7.4 Chemicals and Industrial Goods

- 7.5 Other Applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AmerisourceBergen

- 9.2 Avery Dennison

- 9.3 Cold Chain Technologies

- 9.4 Cryopak

- 9.5 Envirotainer

- 9.6 Intelsius

- 9.7 Nordic Cold Chain Solutions

- 9.8 Pelican BioThermal

- 9.9 Sealed Air

- 9.10 Sofrigam

- 9.11 Softbox Systems

- 9.12 Sonoco Products Company

- 9.13 TemperPack

- 9.14 Tower Cold Chain

- 9.15 Va-Q-Tec