|

市场调查报告书

商品编码

1801833

ATP 检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测ATP Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

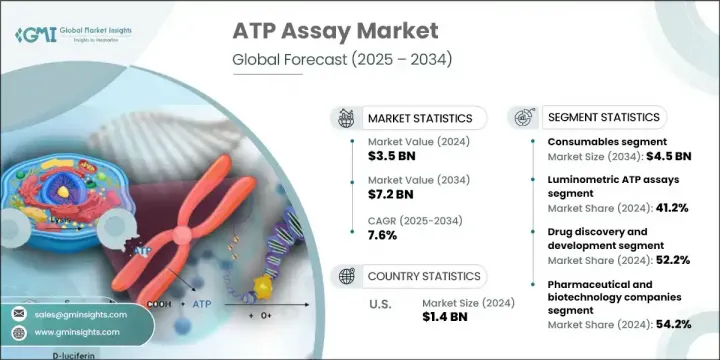

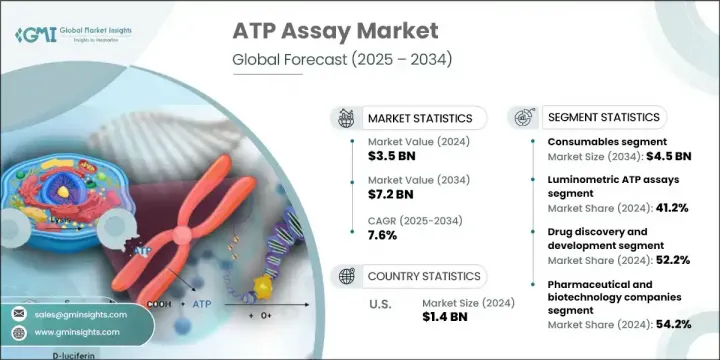

2024年,全球ATP检测市场规模达35亿美元,预计2034年将以7.6%的复合年增长率成长,达到72亿美元。慢性病负担的加重、个人化治疗需求的不断增长以及检测技术的持续创新,加速了市场的成长。光度法和酶促检测平台的演进显着提高了通量、精确度和灵敏度,从而扩大了其在研究、诊断和药物开发领域的应用。诸如分光光度计和高通量光度计等增强型实验室仪器,有助于简化工作流程并提高检测效率。

ATP 检测对于检测三磷酸腺苷水平至关重要,而三磷酸腺苷水平是细胞活力、能量代谢和细胞毒性反应的指标。随着精准医疗和生物相关检测的兴起,对即时细胞检测的需求日益增长。这些检测使研究人员能够在早期药物开发、环境监测和毒性筛选过程中评估细胞行为、活力和压力反应。生物技术和製药实验室对标靶药物发现和高通量筛选的日益重视,进一步提升了 ATP 检测在提供可靠且可扩展的生物资料方面的作用,而这些数据对于下一代疗法至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 72亿美元 |

| 复合年增长率 | 7.6% |

2024年,耗材市场规模达21亿美元,预估到2034年将达45亿美元,复合年增长率为7.7%。由于对常规操作所必需的检测试剂盒、试剂和专用实验室材料的持续需求,该市场仍将占据主导地位。这些产品构成了大多数ATP检测工作流程的支柱,并且在多个平台上都至关重要,尤其是在药物筛检和污染检测领域。随着实验室规模的扩大,这些材料在研究和诊断应用中的持续使用将支持该市场的稳定成长。

2024年,光度测定法占据41.2%的市占率。其广泛应用源自于其高精度、快速结果和自动化相容性。这些检测方法能够提供高灵敏度和低背景杂讯的定量资料,使其成为大规模筛选和实验室工作流程的首选。由于其易于与自动化系统整合、即时监控和多路復用功能,它们被广泛应用于高容量研究环境。它们能够有效率地处理大量资料集,最大限度地减少手动操作,从而显着提高吞吐量,同时保持资料一致性。

2024年,北美ATP检测市场占据42.5%的市占率。该地区先进的科研基础设施、强大的製药和生物技术公司以及对新型诊断技术的快速应用,持续推动市场需求。美国和加拿大实验室对细胞检测、药物开发和污染检测的需求日益增长,巩固了该地区的领先地位。慢性病病例的激增以及临床试验投资的不断增加,也促进了ATP检测在学术和工业领域的应用不断增长。

推动全球 ATP 检测市场的顶级公司包括丹纳赫、3M 公司、普罗麦格公司、默克和赛默飞世尔科技,共占全球市场份额的 55%。 ATP 检测市场的主要参与者正致力于透过在检测灵敏度、可扩展性和自动化相容性方面的持续研发来实现创新驱动的成长。公司正在透过整合先进的发光技术和支援高通量应用的微孔板系统来增强其产品线。与生技公司和研究机构的策略合作有助于扩大最终用户群,同时增强品牌知名度。併购也被用来进入新的地理市场并提高生产能力。该公司正在增加对数位实验室解决方案和基于云端的分析的投资,以提供更好的检测监控和资料可追溯性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病负担加重

- 对细胞检测的需求不断增长

- 生物製药研发的成长

- 检测形式的技术进步

- 产业陷阱与挑战

- 高级套件成本高昂

- 严格的监管准则

- 市场机会

- 卫生和环境监测的爆炸性增长

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 报销场景

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 仪器

- 光度计

- 分光光度计

- 耗材

- 试剂和试剂盒

- 微孔板

- 其他耗材

第六章:市场估计与预测:按检测类型,2021 - 2034 年

- 主要趋势

- 光度法 ATP 测定

- 酶促 ATP 测定

- 生物发光共振能量转移(BRET)ATP测定

- 基于细胞的ATP测定

- 其他检测类型

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 药物发现与开发

- 污染测试

- 疾病检测

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药和生物技术公司

- 医院和诊断实验室

- 学术和研究机构

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 3M Company

- AAT Bioquest

- Abcam

- Agilent Technologies

- Berthold Technologies

- Biotium

- BioVision

- Cayman Chemical

- Cell Signaling Technology

- Charm Sciences

- Danaher Corporation

- Lonza

- Merck

- PCE Instruments

- Promega

- Reddot Biotech

- Revvity

- Thermo Fisher Scientific

The Global ATP Assay Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 7.2 billion by 2034. Market growth is being accelerated by the rising burden of chronic diseases, the growing demand for personalized therapies, and continuous innovation in assay technology. The evolution of luminometric and enzymatic detection platforms is significantly improving throughput, precision, and sensitivity, resulting in expanded use across research, diagnostics, and pharmaceutical development. Enhanced lab instrumentation, like spectrophotometers and high-throughput luminometers, is helping streamline workflows while increasing assay efficiency.

ATP assays are essential for detecting adenosine triphosphate levels, which act as indicators of cellular viability, energy metabolism, and cytotoxic response. With the shift toward precision medicine and biologically relevant testing, demand for real-time, cell-based assays is rising. These tests enable researchers to assess cellular behavior, viability, and stress responses during early drug development, environmental monitoring, and toxicity screening. The growing emphasis on targeted drug discovery and high-throughput screening in biotechnology and pharmaceutical labs continues to elevate the role of ATP assays in delivering reliable and scalable biological data essential for next-generation therapeutics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 7.6% |

In 2024, the consumables segment generated USD 2.1 billion and will reach USD 4.5 billion by 2034 at a CAGR of 7.7%. This segment remains dominant due to the recurring need for assay kits, reagents, and specialized lab materials essential for routine procedures. These items form the backbone of most ATP testing workflows and are vital across multiple platforms, particularly in drug screening and contamination detection. As laboratories scale their operations, the continued use of these materials in research and diagnostic applications supports steady segmental growth.

The luminometric assays segment held 41.2% share in 2024. Their widespread adoption stems from high accuracy, fast results, and automation compatibility. The ability of these assays to deliver quantitative data with high sensitivity and low background noise makes them the preferred choice for large-scale screening and laboratory workflows. They are widely used in high-volume research settings for their easy integration with automated systems, real-time monitoring, and multiplexing capabilities. Their efficiency in handling large datasets with minimal manual processing significantly improves throughput while maintaining data consistency.

North America ATP Assay Market held 42.5% share in 2024. The region's advanced infrastructure for research, strong presence of pharmaceutical and biotech firms, and rapid uptake of novel diagnostic technologies continue to drive demand. A growing need for cell-based testing, drug development, and contamination detection across labs in the U.S. and Canada has strengthened the region's leadership. The surge in chronic illness cases and expanding investments in clinical trials also contribute to the rising use of ATP assays across academic and industrial sectors.

Top companies driving the Global ATP Assay Market include Danaher, 3M Company, Promega Corporation, Merck, and Thermo Fisher Scientific-together accounting for 55% of global market share. Key players in the ATP assay market are focusing on innovation-driven growth through continuous R&D in assay sensitivity, scalability, and automation compatibility. Companies are enhancing their product lines by integrating advanced luminometric technologies and microplate-based systems that support high-throughput applications. Strategic collaborations with biotech firms and research institutes help expand their End user base while strengthening brand recognition. Mergers and acquisitions are also being used to enter new geographic markets and enhance production capacity. Firms are increasingly investing in digital lab solutions and cloud-based analytics to offer better assay monitoring and data traceability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Assay type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of chronic diseases

- 3.2.1.2 Growing demand for cell-based assays

- 3.2.1.3 Growth in biopharmaceutical R&D

- 3.2.1.4 Technological advancements in assay formats

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced kits

- 3.2.2.2 Stringent regulatory guidelines

- 3.2.3 Market opportunities

- 3.2.3.1 Explosive growth in hygiene and environmental monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Reimbursement scenario

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.2.1 Luminometers

- 5.2.2 Spectrophotometers

- 5.3 Consumables

- 5.3.1 Reagents and kits

- 5.3.2 Microplates

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Luminometric ATP assays

- 6.3 Enzymatic ATP assays

- 6.4 Bioluminescence resonance energy transfer (BRET) ATP assays

- 6.5 Cell-based ATP assays

- 6.6 Other assay types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Drug discovery and development

- 7.3 Contamination testing

- 7.4 Disease detection

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M Company

- 10.2 AAT Bioquest

- 10.3 Abcam

- 10.4 Agilent Technologies

- 10.5 Berthold Technologies

- 10.6 Biotium

- 10.7 BioVision

- 10.8 Cayman Chemical

- 10.9 Cell Signaling Technology

- 10.10 Charm Sciences

- 10.11 Danaher Corporation

- 10.12 Lonza

- 10.13 Merck

- 10.14 PCE Instruments

- 10.15 Promega

- 10.16 Reddot Biotech

- 10.17 Revvity

- 10.18 Thermo Fisher Scientific