|

市场调查报告书

商品编码

1801842

摩托车碳陶瓷煞车转子市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motorcycle Carbon Ceramic Brake Rotors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

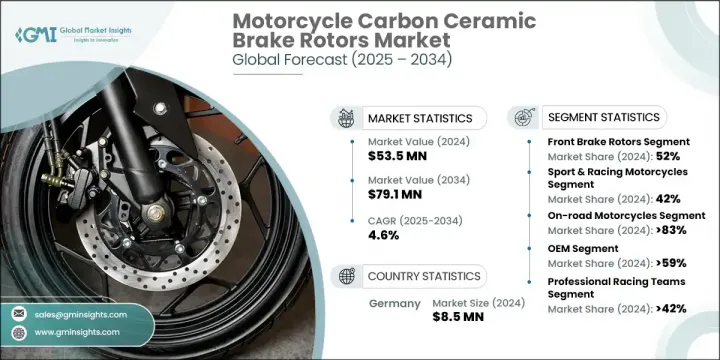

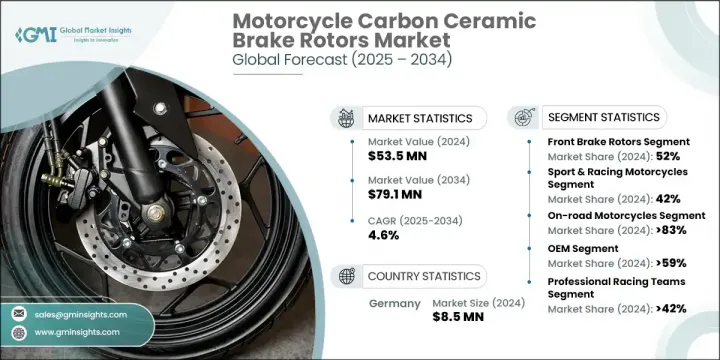

2024年,全球摩托车碳陶瓷煞车碟盘市场规模达5,350万美元,预计2034年将以4.6%的复合年增长率成长,达到7,910万美元。高性能和豪华摩托车(尤其是在运动和赛车领域)日益普及,推动了该市场的成长。这些煞车碟盘因其轻量化结构、卓越的耐热性和更高的煞车精度而备受青睐,使其成为激烈驾驶和高速操控的理想选择。对于注重安全性、耐用性和减少维护的骑乘者来说,这些系统尤其具有吸引力。复合材料的创新正在提高这些煞车碟盘的使用寿命和热管理,即使在极端驾驶条件下也是如此。

随着欧洲和北美等赛车运动重镇的需求不断增长,领先的製造商正在利用先进的冷却技术和模组化转子架构,为符合道路法规的摩托车带来赛道级的性能。供应商正在客製化设计,以满足原始设备製造OEM) 的规格和消费者对安全性、效率和性能的期望。高端市场的蓬勃发展促使 EBC Brakes、Sunstar 和 Braketech 等製造商在售后市场和原厂配件通路拓展产品线。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5350万美元 |

| 预测值 | 7910万美元 |

| 复合年增长率 | 4.6% |

2024年,前煞车碟盘市场占52%的市场份额,预计到2034年将以5%的复合年增长率成长。由于大部分制动力由前煞车碟盘处理,因此性能升级和创新都围绕着这些部件。随着运动旅行车和超级摩托车销售的持续成长,通风式和开槽式转子设计等技术正日益受到青睐。 Galfer Brakes和Brembo等製造商正在积极推出高效能转子系统,以满足这一需求。

2024年,运动和赛车摩托车市场占据了50%的市场。这些摩托车需要在高速行驶时实现无与伦比的煞车控制和热平衡。该领域正在持续进行产品开发,其转子能够减少热变形并增强通风性能,以应对长时间的高性能使用。骑士们更青睐碳陶瓷,因为它即使在恶劣条件下也能保持稳定的煞车力,这也促使其在赛道车型中的应用日益广泛。

德国摩托车碳陶瓷煞车碟盘市场占50%的市场份额,2024年市场规模达850万美元。该国的领先地位源自于其强大的赛车运动文化和OEM供应商网络。对更轻、更耐热材料的需求,尤其是电动摩托车的需求,正在加速陶瓷复合材料的创新。先进的研发中心不断涌现,不断突破煞车碟盘技术的极限,注重效率和安全性,使德国成为全球产品革新的重要贡献者。

塑造摩托车碳陶瓷煞车转子市场的关键参与者包括 AP Racing、Braketech、SICOM Brakes、Galfer Brakes、Sunstar、Brembo SpA 和 EBC Brakes。该市场的製造商正在利用先进的转子技术来扩展其产品组合,这些技术专注于热稳定性、轻量化结构和改进的气流。与原始设备製造商 (OEM) 的策略合作帮助品牌商获得长期供应协议,同时与不断发展的摩托车设计保持一致。一些参与者正在投资研发,以开发具有更长使用寿命和更高高温性能的转子材料。各公司也在加强其全球分销网络,尤其是在赛车运动占主导地位的地区,以提高售后市场的可及性。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 高性能摩托车需求不断成长

- 卓越的耐热性并减少煞车衰退

- 赛车运动和场地赛日益流行

- 转子製造的技术进步

- 重量轻且操控性更好

- 产业陷阱与挑战

- 碳陶瓷转子成本高

- 与标准摩托车的兼容性有限

- 市场机会

- 进军中檔摩托车

- 电动摩托车(EV)的成长

- 材料科学的技术进步

- 新兴市场的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 统计概览

- 全球高级摩托车产量统计

- 碳陶瓷采用率(按领域)

- 与传统转子的性能比较

- 成本分析和溢价评估

- 全球高级摩托车产量统计

- 技术与材料分析

- 材料成分和结构

- 碳纤维增强系统

- 陶瓷基质组合物

- 黏合剂和添加剂

- 组织与绩效关係

- 製造流程

- 预製件准备和铺层

- 化学气相渗透(CVI)

- 液态硅渗透(LSI)

- 机械加工和精加工操作

- 性能特征

- 热性能和散热

- 机械强度和耐久性

- 摩擦係数和耐磨性

- 减重和密度分析

- 材料成分和结构

- 价格趋势

- 按地区

- 按产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 品牌分析与市场认知

- 品牌实力与认知度

- 客户忠诚度和满意度

- 赛车传统和性能可信度

- 技术领导认知

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品,2021 - 2034 年

- 主要趋势

- 前煞车转子

- 后煞车转子

- 全套(前后)

第六章:市场估计与预测:按摩托车,2021 - 2034 年

- 主要趋势

- 运动和赛车摩托车

- 巡洋舰和旅行摩托车

- 泥地和越野摩托车

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 公路

- 越野

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 专业赛车队

- 个人摩托车主

- 摩托车製造商

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Alth Brakes

- AP Racing

- Braketech

- BRAKING

- Brembo

- Carbon Lorraine

- EBC Brakes

- Ferodo

- Galfer Brakes

- Galfer USA

- Moto-Master

- NG Brakes

- Nissin Kogyo

- SBS Friction

- SICOM Brakes

- Sunstar Engineering

- TRW Automotive

- Yutaka Giken

The Global Motorcycle Carbon Ceramic Brake Rotors Market was valued at USD 53.5 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 79.1 million by 2034. Growth in this market is driven by the rising popularity of high-performance and luxury motorcycles, particularly in the sport and racing categories. These brake rotors are favored for their lightweight structure, superior heat resistance, and increased braking precision, making them ideal for aggressive riding and high-speed control. The appeal of these systems is especially strong among riders who prioritize safety, durability, and reduced maintenance. Innovations in composite materials are enhancing the lifespan and thermal management of these rotors, even under extreme riding conditions.

With expanding demand across motorsports-heavy regions like Europe and North America, leading manufacturers are leveraging advanced cooling technologies and modular rotor architecture to bring track-level performance to road-legal motorcycles. Suppliers are tailoring designs to match OEM specifications and consumer expectations around safety, efficiency, and performance. Premium segment growth has encouraged manufacturers like EBC Brakes, Sunstar, and Braketech to expand their offerings across both aftermarket and factory-fit channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.5 Million |

| Forecast Value | $79.1 Million |

| CAGR | 4.6% |

In 2024, the front brake rotor segment held a 52% share and is projected to grow at a CAGR of 5% through 2034. Since most braking power is handled by front rotors, performance upgrades and innovations are centered around these components. Technologies like ventilated and slotted rotor designs are gaining traction as sport touring and superbike sales continue to rise. Manufacturers such as Galfer Brakes and Brembo are actively releasing high-efficiency rotor systems to meet this demand.

The sport and racing motorcycles segment held a 50% share in 2024. These motorcycles require unmatched braking control and thermal balance at high speeds. The segment is seeing ongoing product development with rotors offering reduced thermal distortion and enhanced ventilation to manage prolonged high-performance use. Riders prefer carbon ceramic for its consistent stopping power, even under aggressive conditions, contributing to its rising adoption across track-inspired models.

Germany Motorcycle Carbon Ceramic Brake Rotors Market held a 50% share and generated USD 8.5 million in 2024. The country's leadership is anchored in its robust motorsports culture and strong OEM-supplier networks. Innovation in ceramic composites is being accelerated by the demand for lighter and more heat-tolerant materials, especially for electric motorcycles. Advanced R&D centers are emerging, pushing the limits of rotor technology, with an emphasis on efficiency and safety, making Germany a major contributor to global product evolution.

Key players shaping the Motorcycle Carbon Ceramic Brake Rotors Market include AP Racing, Braketech, SICOM Brakes, Galfer Brakes, Sunstar, Brembo S.p.A., and EBC Brakes. Manufacturers in this market are expanding their product portfolios with advanced rotor technologies that focus on thermal stability, lightweight construction, and improved airflow. Strategic collaborations with OEMs have helped brands secure long-term supply deals while aligning with evolving motorcycle designs. Several players are investing in R&D to develop rotor materials with extended life cycles and enhanced performance at high operating temperatures. Companies are also enhancing their global distribution networks, particularly in motorsport-dominant regions, to improve aftermarket accessibility.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Motorcycle

- 2.2.4 Application

- 2.2.5 Sales Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance motorcycles

- 3.2.1.2 Superior heat resistance & reduced brake fade

- 3.2.1.3 Rising popularity of motorsport & track racing

- 3.2.1.4 Technological advancements in rotor manufacturing

- 3.2.1.5 Lightweight and improved handling

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of carbon ceramic rotors

- 3.2.2.2 Limited compatibility with standard motorcycles

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into mid-range motorcycles

- 3.2.3.2 Growth in electric motorcycles (EVs)

- 3.2.3.3 Technological advancements in material science

- 3.2.3.4 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.8 Statistical overview

- 3.8.1 Global premium motorcycle production statistics

- 3.8.1.1 Carbon ceramic adoption rates by segment

- 3.8.1.2 Performance comparison vs traditional rotors

- 3.8.1.3 Cost analysis and price premium assessment

- 3.8.1 Global premium motorcycle production statistics

- 3.9 Technology and material analysis

- 3.9.1 Material composition and structure

- 3.9.1.1 Carbon fiber reinforcement systems

- 3.9.1.2 Ceramic matrix compositions

- 3.9.1.3 Binding agents and additives

- 3.9.1.4 Microstructure and performance relationship

- 3.9.2 Manufacturing processes

- 3.9.2.1 Preform preparation and layup

- 3.9.2.2 Chemical vapor infiltration (CVI)

- 3.9.2.3 Liquid silicon infiltration (LSI)

- 3.9.2.4 Machining and finishing operations

- 3.9.3 Performance characteristics

- 3.9.3.1 Thermal properties and heat dissipation

- 3.9.3.2 Mechanical strength and durability

- 3.9.3.3 Friction coefficient and wear resistance

- 3.9.3.4 Weight reduction and density analysis

- 3.9.1 Material composition and structure

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Brand analysis and market perception

- 4.4.1 Brand strength and recognition

- 4.4.2 Customer loyalty and satisfaction

- 4.4.3 Racing heritage and performance credibility

- 4.4.4 Technology leadership perception

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front brake rotors

- 5.3 Rear brake rotors

- 5.4 Full set (Front & Rear)

Chapter 6 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Sport & racing motorcycles

- 6.3 Cruisers & touring motorcycles

- 6.4 Dirt & off-road motorcycles

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 On-road

- 7.3 Off-road

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Professional racing teams

- 9.3 Individual motorcycle owners

- 9.4 Motorcycle manufacturers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 ANZ

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 UAE

- 10.5.2 Saudi Arabia

- 10.5.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alth Brakes

- 11.2 AP Racing

- 11.3 Braketech

- 11.4 BRAKING

- 11.5 Brembo

- 11.6 Carbon Lorraine

- 11.7 EBC Brakes

- 11.8 Ferodo

- 11.9 Galfer Brakes

- 11.10 Galfer USA

- 11.11 Moto-Master

- 11.12 NG Brakes

- 11.13 Nissin Kogyo

- 11.14 SBS Friction

- 11.15 SICOM Brakes

- 11.16 Sunstar Engineering

- 11.17 TRW Automotive

- 11.18 Yutaka Giken