|

市场调查报告书

商品编码

1801843

裂缝修復化学品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Crack Repair Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

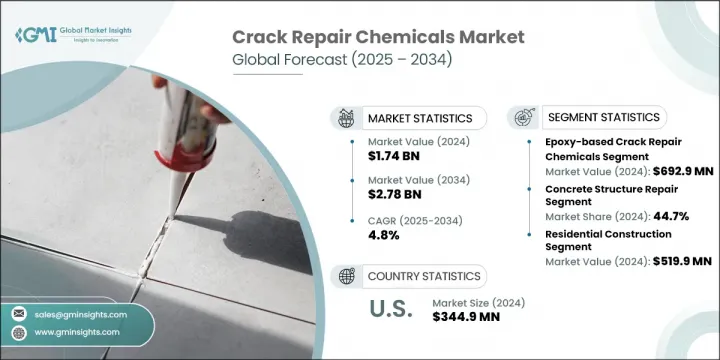

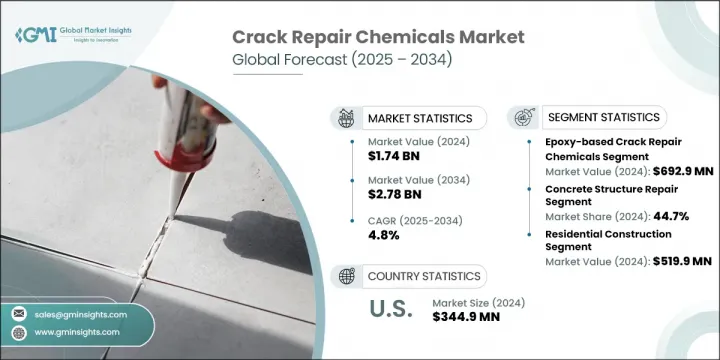

2024年,全球裂缝修復化学品市场规模达17.4亿美元,预计2034年将以4.8%的复合年增长率成长,达到27.8亿美元。这一成长主要源于住宅、商业、基础设施和工业项目等各行各业对耐用、快速、高效的修復解决方案日益增长的需求。这些化学物质不仅对新建筑至关重要,对老旧建筑的修復也至关重要,尤其是在道路、桥樑和公共建筑面临磨损和老化的发达地区。此外,对关键资产寿命、安全性和效能的提升也推动了这项需求的成长。

随着材料科学的创新,裂缝修復解决方案正被设计得更具柔韧性、耐化学性和附着力,使其能够承受地震、潮湿和极端温度等恶劣环境条件。正在进行的基础设施现代化项目以及可持续建筑实践的优先考虑,持续扩大了全球裂缝修復化学品的使用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17.4亿美元 |

| 预测值 | 27.8亿美元 |

| 复合年增长率 | 4.8% |

2024年,环氧基裂缝修补材料凭藉其高强度和耐久性创造了6.929亿美元的市场规模。聚氨酯基化学物质因其优异的弹性以及适应运动和温度波动的能力而发展迅速,使其成为隧道、桥樑和高流量区域等动态环境的理想选择。其快速固化的特性还可最大程度地缩短结构修復期间的停机时间。丙烯酸基产品在性能和经济性之间实现了切实的平衡,尤其适用于预算优先的非关键应用。每种类型都能满足不同的效能要求和环境需求。

2024年,混凝土修復领域占据了44.7%的市场。这主要归因于混凝土在关键基础设施(包括高速公路、建筑和工业设施)中的广泛应用。随着这些结构的老化,保持完整性变得至关重要,这增加了对裂缝修復化学物质的依赖。这些产品具有强大的附着力、长期耐环境应力以及在各种条件下的耐久性,可确保结构稳定性并延长使用寿命。

2024年,美国裂缝修復化学品市场规模达3.449亿美元。其领先地位源于对基础设施修復的大量投资以及成熟的建筑业。美国重视高性能修復材料,尤其是环氧树脂和聚氨酯基体系,以支援大型基础设施项目。主要参与者的加入、强劲的研发活动以及预防性维护意识的提升,进一步刺激了美国对先进化学修復解决方案的需求。

推动裂缝修补化学品市场发展的关键参与者包括西卡股份公司、马贝集团、福斯罗克国际有限公司、陶氏公司、RPM国际公司、巴斯夫股份公司、阿科玛股份公司、Master Builders Solutions(MBCC集团)、汉高股份公司和3M公司。为了加强市场占有率,裂缝修补化学品产业的公司正专注于研发具有更高弹性、耐化学性和速凝性的配方。与基础设施开发商和政府建立长期供应合约的合作伙伴关係也是关键策略。企业正在透过本地化生产和分销向新兴市场扩张,并强调环保和低VOC配方以满足环境法规。根据区域气候挑战和建筑标准客製化解决方案是另一种保持竞争力和提高全球品牌忠诚度的策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依材料类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 环氧基裂缝修补化学品

- 低黏度环氧树脂

- 高模量环氧体系

- 耐湿环氧树脂溶液

- 快速固化环氧配方

- 聚氨酯基解决方案

- 疏水性聚氨酯灌浆料

- 柔性聚氨酯密封胶

- 膨胀聚氨酯体系

- 丙烯酸基修復材料

- 水性丙烯酸体系

- 溶剂型丙烯酸溶液

- 改质丙烯酸聚合物

- 水泥基修补剂

- 聚合物改质水泥体系

- 速凝水泥砂浆

- 补偿收缩水泥

- 硅烷/硅氧烷基产品

- 其他(混合系统、生物基材料)

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 混凝土结构修復

- 建筑和施工

- 桥樑和基础设施

- 工业设施

- 地基修復

- 住宅地基

- 商业基金会

- 工业基础

- 路面和道路维修

- 高速公路和主干道

- 机场跑道和滑行道

- 停车场

- 海洋和沿海结构

- 地下和隧道应用

- 其他(游泳池、水处理设施)

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅建筑

- 新建筑

- 翻新和维修

- 维护服务

- 商业建筑

- 办公大楼

- 零售和购物中心

- 饭店和娱乐

- 工业建筑

- 生产设施

- 仓库和配送中心

- 发电设施

- 基础设施和公共工程

- 交通基础设施

- 水和废水处理

- 政府及市政建筑

第八章:市场估计与预测:按技术,2021-2034 年

- 主要趋势

- 常规修復技术

- 基于注射的系统

- 表面应用方法

- 结构加固系统

- 先进的修復技术

- 自我修復系统

- 奈米科技增强产品

- 智慧且反应迅速的材料

- 新兴技术

- 生物基治疗系统

- 人工智慧辅助应用系统

- 支援物联网的监控解决方案

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Sika AG

- MAPEI SpA

- RPM International Inc.

- Master Builders Solutions (MBCC Group)

- BASF SE

- Arkema SA

- Dow Inc.

- 3M Company

- Henkel AG & Co. KGaA

- FOSROC International Limited

The Global Crack Repair Chemicals Market was valued at USD 1.74 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 2.78 billion by 2034. This growth is fueled by rising demand for durable, quick, and efficient repair solutions across various sectors, including residential, commercial, infrastructure, and industrial projects. These chemicals are vital not only for new construction but also for restoring aged structures, especially in developed regions where roads, bridges, and public buildings face wear and deterioration. The demand is also supported by a focus on enhancing the longevity, safety, and performance of critical assets.

With innovation in material science, crack repair solutions are being engineered to offer better flexibility, chemical resistance, and adhesion, enabling them to withstand harsh environmental conditions such as earthquakes, moisture, and extreme temperatures. Ongoing infrastructure modernization projects and the prioritization of sustainable construction practices continue to amplify the use of crack repair chemicals globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.74 Billion |

| Forecast Value | $2.78 Billion |

| CAGR | 4.8% |

In 2024, the epoxy-based crack repair materials generated USD 692.9 million, driven by their high strength and durability. Polyurethane-based chemicals are gaining rapid momentum due to their elasticity and ability to adjust to movement and temperature fluctuations, making them ideal for dynamic environments such as tunnels, bridges, and high-traffic zones. Their quick curing time also ensures minimal downtime during structural repairs. Acrylic-based options offer a practical balance between performance and affordability, especially in non-critical applications where budget remains a priority. Each type caters to distinct performance requirements and environmental demands.

The concrete repair segment generated 44.7% share in 2024. This is largely attributed to the wide use of concrete in key infrastructure, including highways, buildings, and industrial units. As these structures age, maintaining integrity becomes critical, increasing reliance on crack repair chemicals. These products offer strong adhesion, long-term resistance to environmental stress, and endurance under varying conditions, ensuring structural stability and extended service life.

U.S. Crack Repair Chemicals Market generated USD 344.9 million in 2024. Its leadership stems from substantial investment in infrastructure rehabilitation and a mature construction industry. The country places emphasis on high-performance repair materials-especially epoxy and polyurethane-based systems-to support large-scale infrastructure projects. The presence of major players, strong research and development activity, and increased awareness around preventive maintenance further boost demand for advanced chemical repair solutions across the country.

Key players driving Crack Repair Chemicals Market include Sika AG, MAPEI S.p.A, Fosroc International Limited, Dow Inc., RPM International Inc., BASF SE, Arkema S.A., Master Builders Solutions (MBCC Group), Henkel AG & Co. KGaA, and 3M Company. To strengthen their market footprint, companies in the crack repair chemicals sector are focusing on R&D to develop formulations with higher elasticity, chemical resistance, and quick-setting properties. Partnerships with infrastructure developers and governments for long-term supply contracts are also key strategies. Firms are expanding into emerging markets through localized production and distribution and emphasizing eco-friendly and low-VOC formulations to meet environmental regulations. Customization of solutions based on regional climatic challenges and construction standards is another tactic being used to stay competitive and boost brand loyalty globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 End user trends

- 2.2.4 Technology trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo tons)

- 5.1 Key trends

- 5.2 Epoxy-based crack repair chemicals

- 5.2.1 Low-viscosity epoxy resins

- 5.2.2 High-modulus epoxy systems

- 5.2.3 Moisture-tolerant epoxy solutions

- 5.2.4 Rapid-curing epoxy formulations

- 5.3 Polyurethane-based solutions

- 5.3.1 Hydrophobic polyurethane grouts

- 5.3.2 Flexible polyurethane sealants

- 5.3.3 Expanding polyurethane systems

- 5.4 Acrylic-based repair materials

- 5.4.1 Water-based acrylic systems

- 5.4.2 Solvent-based acrylic solutions

- 5.4.3 Modified acrylic polymers

- 5.5 Cement-based repair compounds

- 5.5.1 Polymer-modified cement systems

- 5.5.2 Rapid-setting cement mortars

- 5.5.3 Shrinkage-compensating cement

- 5.6 Silane/siloxane-based products

- 5.7 Others (hybrid systems, bio-based materials)

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo tons)

- 6.1 Key trends

- 6.2 Concrete structure repair

- 6.2.1 Building and construction

- 6.2.2 Bridge and infrastructure

- 6.2.3 Industrial facilities

- 6.3 Foundation repair

- 6.3.1 Residential foundations

- 6.3.2 Commercial foundations

- 6.3.3 Industrial foundations

- 6.4 Pavement and road repair

- 6.4.1 Highway and arterial roads

- 6.4.2 Airport runways and taxiways

- 6.4.3 Parking structures

- 6.5 Marine and coastal structures

- 6.6 Underground and tunnel applications

- 6.7 Others (swimming pools, water treatment facilities)

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Kilo tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 New construction

- 7.2.2 Renovation and repair

- 7.2.3 Maintenance services

- 7.3 Commercial construction

- 7.3.1 Office buildings

- 7.3.2 Retail and shopping centers

- 7.3.3 Hospitality and entertainment

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities

- 7.4.2 Warehouses and distribution centers

- 7.4.3 Power generation facilities

- 7.5 Infrastructure and public works

- 7.5.1 Transportation infrastructure

- 7.5.2 Water and wastewater treatment

- 7.5.3 Government and municipal buildings

Chapter 8 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo tons)

- 8.1 Key trends

- 8.2 Conventional repair technologies

- 8.2.1 Injection-based systems

- 8.2.2 Surface application methods

- 8.2.3 Structural strengthening systems

- 8.3 Advanced repair technologies

- 8.3.1 Self-healing systems

- 8.3.2 Nanotechnology-enhanced products

- 8.3.3 Smart and responsive materials

- 8.4 Emerging technologies

- 8.4.1 Bio-based healing systems

- 8.4.2 Ai-assisted application systems

- 8.4.3 IoT-enabled monitoring solutions

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Sika AG

- 10.2 MAPEI S.p.A.

- 10.3 RPM International Inc.

- 10.4 Master Builders Solutions (MBCC Group)

- 10.5 BASF SE

- 10.6 Arkema S.A.

- 10.7 Dow Inc.

- 10.8 3M Company

- 10.9 Henkel AG & Co. KGaA

- 10.10 FOSROC International Limited