|

市场调查报告书

商品编码

1801851

电阻点焊机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Resistance Spot Welding Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

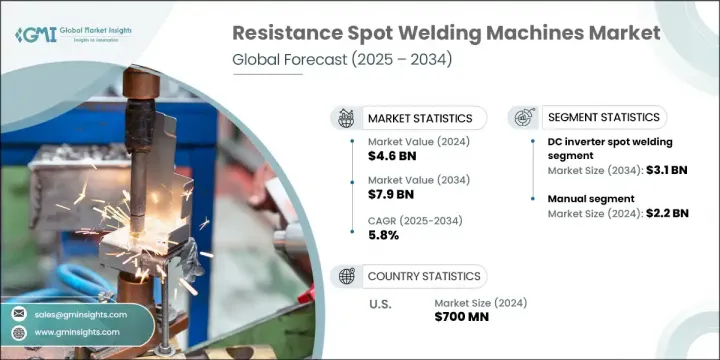

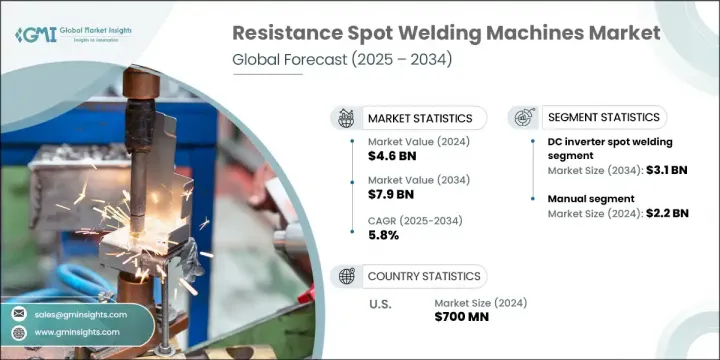

2024年,全球电阻点焊机市场规模达46亿美元,预计2034年将以5.8%的复合年增长率成长,达到79亿美元。製造业自动化的持续进步,尤其是在汽车、航太和家电生产等高产出产业,推动了这一成长。製造商正在整合数位控制和机器人焊接系统,以优化品质、效率和产量。优惠的产业政策和亚太地区製造业的扩张,进一步将电阻点焊定位为大批量生产环境中的关键製程。

随着电动车普及率的上升,电阻点焊因其在轻量化、多金属结构和电池组件组装中的应用价值而日益凸显。此製程的高速运作、可靠性和成本效益使其成为结构连接应用中不可或缺的技术。电阻焊也支持工程领域向高强度钢和铝等轻量化材料的转变,提供低热变形和高强度的焊点——这些特性对现代设计至关重要。因此,全球的原始设备製造商 (OEM) 和一级供应商持续投资于传统和先进的电阻点焊 (RSW) 设备,以满足生产和材料灵活性的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 79亿美元 |

| 复合年增长率 | 5.8% |

直流逆变焊机市场在2024年创造了18亿美元的市场规模,预计2034年将达到31亿美元。与交流电设备相比,这类设备精度更高、电流响应更快、焊接週期更短。逆变技术提高了焊接一致性,降低了营运成本,并将能耗降低高达30%,因此对于追求永续性和效率的製造商来说,逆变焊机的吸引力越来越大。

2024年,手排点焊市场规模达22亿美元,占49.1%。其中很大一部分需求来自拉丁美洲、亚洲和东欧等地区的中小企业。这些企业通常依赖手动机器,因为手动机器价格实惠、操作简单且维护需求低。手动点焊机广泛应用于小批量生产、零件尺寸多样以及需要频繁更换设定的行业。暖通空调製造、客製化金属製品和家俱生产等行业仍然青睐手动系统,因为它们在小批量或专业任务中具有良好的适应性且营运成本低。

美国电阻点焊机市场在2024年创收7亿美元,预计2034年将以4.9%的复合年增长率成长。美国仍然是汽车和国防应用领域的全球製造中心,而结构焊接在这些领域至关重要。电动车产量的加速成长也增强了国内需求,主要汽车製造商纷纷部署点焊机,用于生产电池模组和白车身结构等关键零件。此外,联邦政府对国防的投资以及产能回流,也支撑了本地原始设备製造商和供应商对电阻点焊系统的需求稳定成长。

电阻点焊机市场的主要参与者包括 Miyachi Unitek (AMADA WELD TECH)、CenterLine (Windsor) Ltd.、Panasonic Welding Systems Co., Ltd.、Nimak GmbH 和 Automation International, Inc.,它们均继续在该领域保持领先地位。电阻点焊机市场的领先公司正在透过投资自动化、能源效率和先进控制系统来增强其竞争优势。与汽车 OEM 和工业製造商建立策略合作伙伴关係,可以共同开发满足不断变化的材料和设计需求的客製化焊接解决方案。一些製造商正在扩大研发活动,以推出具有智慧监控、预测性维护和人工智慧驱动焊接精度的下一代基于逆变器的系统。此外,扩大服务网络和在高成长地区实现生产在地化可以提供更快的支援并降低分销成本。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区和焊接材料

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 交流电阻点焊

- 直流逆变点焊接机

- 电容放电点焊

- 伺服枪点焊

第六章:市场估计与预测:依焊接材料,2021 - 2034 年

- 主要趋势

- 低碳钢

- 不銹钢

- 铝

- 镀锌钢

- 铜及合金

- 其他(高强度低合金(HSLA)钢、异种金属组合等)

第七章:市场估计与预测:依焊接厚度,2021 - 2034 年

- 主要趋势

- 最多 2 毫米

- 2 - 5 毫米

- 5毫米以上

第八章:市场估计与预测:按电源,2021 - 2034 年

- 主要趋势

- 单相电源

- 三相电源

- 直流电源

第九章:市场估计与预测:依自动化水平,2021 - 2034 年

- 主要趋势

- 手动的

- 半自动

- 自动的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 汽车

- 製造业

- 航太和国防

- 电子和半导体

- 建造

- 农业设备

- 其他的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- ARO Welding Technologies SAS

- Automation International, Inc.

- CenterLine (Windsor) Ltd.

- Dengensha Manufacturing Co., Ltd.

- Guangzhou CEA Welding Equipment Co., Ltd.

- Heron Intelligent Equipment Co., Ltd.

- Janda Company, Inc.

- Miyachi Unitek (AMADA WELD TECH)

- Nimak GmbH

- Panasonic Welding Systems Co., Ltd.

- TJ Snow Company, Inc.

- TECNA SpA

The Global Resistance Spot Welding Machines Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 7.9 billion by 2034. This growth is being fueled by continued advancements in manufacturing automation, especially in high-output industries such as automotive, aerospace, and appliance production. Manufacturers are integrating digital controls and robotic welding systems to optimize quality, efficiency, and throughput. Favorable industrial policies and the expansion of manufacturing in the Asia-Pacific region have further positioned resistance spot welding as a key process in high-volume production environments.

As electric vehicle adoption rises, demand for resistance spot welding intensifies due to its relevance in assembling lightweight, multi-metal structures and battery components. The method's high-speed operation, reliability, and cost-effectiveness continue to make it indispensable in structural joining applications. Resistance welding also supports engineering shifts toward lightweight materials like high-strength steel and aluminum, offering low thermal distortion and strong weld joints-attributes crucial to modern design requirements. As a result, OEMs and Tier-1 suppliers globally continue to invest in both traditional and advanced RSW machines to meet production and material flexibility demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.8% |

The DC inverter segment generated USD 1.8 billion during 2024 and is projected to reach USD 3.1 billion by 2034. These machines provide enhanced precision, faster current response, and shorter weld cycles compared to AC-based equipment. Inverter technology improves consistency, lowers operational costs, and consumes up to 30% less energy, making it increasingly attractive for manufacturers pursuing sustainability and efficiency.

The manual spot-welding segment accounted for USD 2.2 billion in 2024, securing a 49.1% share. A significant portion of this demand stems from small and medium enterprises in regions such as Latin America, Asia, and Eastern Europe. These operations often rely on manual machines for their affordability, ease of operation, and minimal maintenance needs. Manual spot welders are widely used in small-batch production, varied part sizes, and industries require frequent setup changes. Sectors such as HVAC fabrication, custom metalwork, and furniture production continue to favor manual systems for their adaptability and low operating cost in low-volume or specialized tasks.

United States Resistance Spot Welding Machines Market generated USD 700 million in 2024 and is expected to grow at a CAGR of 4.9% through 2034. The US remains a global manufacturing hub for automotive and defense applications, where structural welding is critical. The accelerated growth of electric vehicle production has also strengthened domestic demand, with major automotive manufacturers deploying spot welding machines for key components like battery modules and BIW structures. Additionally, federal investments in defense and reshoring production capacity have supported a steady increase in demand for RSW systems from local OEMs and suppliers.

Major Resistance Spot Welding Machines Market players include Miyachi Unitek (AMADA WELD TECH), CenterLine (Windsor) Ltd., Panasonic Welding Systems Co., Ltd., Nimak GmbH, and Automation International, Inc., all of which continue to hold leading positions in this space. Leading companies in the resistance spot welding machines market are enhancing their competitive edge through investments in automation, energy efficiency, and advanced control systems. Strategic partnerships with automotive OEMs and industrial manufacturers allow for collaborative development of tailored welding solutions that meet evolving material and design needs. Several manufacturers are scaling up their R&D activities to introduce next-generation inverter-based systems with smart monitoring, predictive maintenance, and AI-driven welding precision. Additionally, expanding service networks and localization of production in high-growth regions enable faster support and lower distribution costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Material Welded

- 2.2.4 Welding Thickness

- 2.2.5 Power Supply

- 2.2.6 Automation Level

- 2.2.7 End Use Industry

- 2.2.8 Distribution Channel

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and materials welded

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 AC Resistance Spot Welding

- 5.3 DC Inverter Spot Welding

- 5.4 Capacitor Discharge Spot Welding

- 5.5 Servo-Gun Spot Welding

Chapter 6 Market Estimates & Forecast, By Material Welded, 2021 - 2034, (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Mild Steel

- 6.3 Stainless Steel

- 6.4 Aluminum

- 6.5 Galvanized Steel

- 6.6 Copper & Alloys

- 6.7 Others (High Strength Low Alloy (HSLA) Steel, Dissimilar Metal Combination, etc.)

Chapter 7 Market Estimates & Forecast, By Welding Thickness, 2021 - 2034, (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Up to 2 mm

- 7.3 2 - 5 mm

- 7.4 Above 5 mm

Chapter 8 Market Estimates & Forecast, By Power Supply, 2021 - 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Single-phase Power Supply

- 8.3 Three-phase Power Supply

- 8.4 Direct Current Power Supply

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 Manual

- 9.3 Semi-automatic

- 9.4 Automatic

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Manufacturing

- 10.4 Aerospace and Defense

- 10.5 Electronics and Semiconductors

- 10.6 Construction

- 10.7 Agricultural Equipment

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 ARO Welding Technologies SAS

- 13.2 Automation International, Inc.

- 13.3 CenterLine (Windsor) Ltd.

- 13.4 Dengensha Manufacturing Co., Ltd.

- 13.5 Guangzhou CEA Welding Equipment Co., Ltd.

- 13.6 Heron Intelligent Equipment Co., Ltd.

- 13.7 Janda Company, Inc.

- 13.8 Miyachi Unitek (AMADA WELD TECH)

- 13.9 Nimak GmbH

- 13.10 Panasonic Welding Systems Co., Ltd.

- 13.11 T. J. Snow Company, Inc.

- 13.12 TECNA S.p.A.