|

市场调查报告书

商品编码

1801855

珠宝製造及贵金属加工设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Jewelry Making and Precious Metals Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

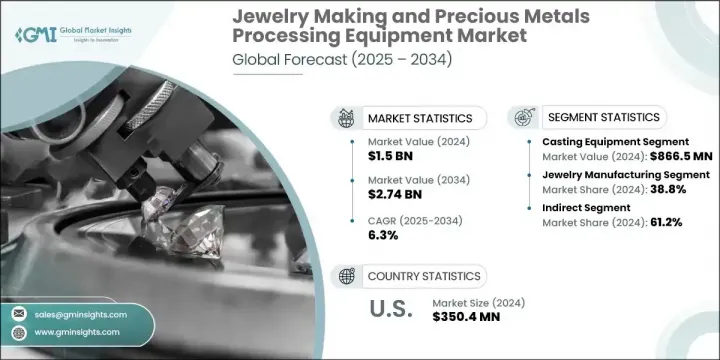

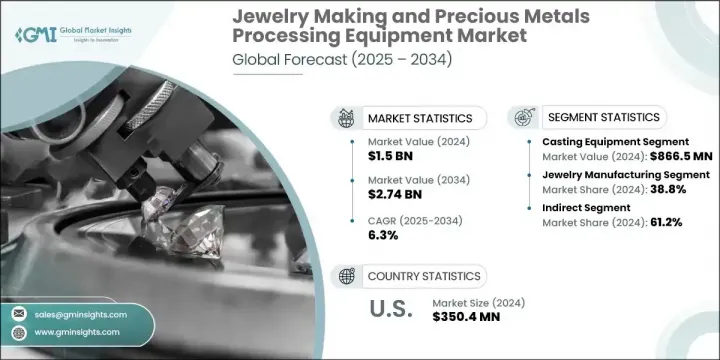

2024年,全球珠宝製造和贵金属加工设备市场规模达15亿美元,预计到2034年将以6.3%的复合年增长率成长,达到27.4亿美元。该市场正经历强劲且持续的成长,主要得益于消费者对高品质订製珠宝日益增长的兴趣。无论是在成熟经济体或新兴经济体,年轻一代和富裕消费者对能够展现自身生活方式和个性的珠宝的需求尤其强烈。随着精密製造需求的不断增长,产业参与者正在积极拥抱能够确保精准度和可扩展性的先进生产技术。

电脑辅助设计软体、3D列印工具和自动化系统正在帮助製造商提供详细、一致且可扩展的设计,同时最大限度地减少材料浪费和生产时间。这些进步也有助于显着降低劳动成本。由于完善的基础设施、熟练的劳动力以及不断增长的国内外需求,亚太地区仍然是该行业的主导中心。该地区各国受益于低成本劳动力、优惠的监管框架以及促进珠宝购买的文化偏好,这些因素共同增强了亚太地区对全球市场格局的影响力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 27.4亿美元 |

| 复合年增长率 | 6.3% |

铸造设备领域在2024年创造了8.665亿美元的产值,预计2025年至2034年间的复合年增长率将达到6.7%。该设备因其适合大规模生产、客製化灵活性和成本效益,在珠宝和贵金属应用领域备受青睐。虽然基于雷射的系统(例如雕刻和焊接工具)越来越多地用于精密精加工,但铸造技术仍然是实现可扩展生产的首选,尤其是在新兴市场和中小型製造商中。其适应性强和经济价值将继续推动其在整个产业的广泛应用。

珠宝製造业在2024年占据38.8%的市场份额,预计到2034年复合年增长率将达到6.8%。作为贵金属加工和珠宝设备行业的领先应用,该领域正因消费者需求的不断增长、数位化製造工艺的进步以及珠宝生产网络的国际化而不断扩张。与工业精炼或回收等其他应用相比,珠宝生产需要更多种类的工具和设备,这使得其在产业的持续发展和创新中发挥核心作用。

美国珠宝製造和贵金属加工设备市场占76.5%的市场份额,2024年产值达3.504亿美元。这一强劲地位得益于美国先进的製造能力和稳固的奢侈珠宝品牌。美国製造商广泛利用CAD软体、3D列印系统和雷射工具等数位技术来简化工作流程并提高产品产量。这项技术优势支撑了美国在高端珠宝製造领域的持续主导地位,使其成为整个市场中至关重要的参与者。

塑造全球珠宝製造和贵金属加工设备市场的关键公司包括 Durston Tools、UIHM、Orotig、Supermelt、Indutherm、LaserStar Technologies、CDOCAST Machinery、Gesswein、Rio Grande、EnvisionTEC、Gravotech、Schultheiss、Contenti 和 Pepetools。为了巩固市场地位,该领域的公司专注于产品创新、扩展数位化设计能力并升级製造技术。许多公司正在整合自动化和人工智慧驱动的工具,以提高设计准确性并简化生产流程。投资使用者友善的介面和模组化机器,使企业能够满足从小型手工作坊到大型製造商的广泛客户需求。企业还透过与区域分销商建立合作伙伴关係并提供响应迅速的售后支援来提升其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 订製和奢侈珠宝的需求不断增长

- 加工设备的技术进步

- 自动化和数位设计工具的使用日益增多

- 产业陷阱与挑战

- 先进设备成本高

- 贵金属价格波动

- 机会

- 3D列印在珠宝製造领域的兴起

- 对永续和道德珠宝的需求不断增加

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 监管环境

- 价值链分析

- 原料供应商和零件製造商

- 设备製造商和原始设备製造商

- 分销通路和销售网络

- 最终用途领域和应用

- 售后服务供应商

- 价格趋势

- 按地区

- 依设备类型

- 监管格局

- 标准和合规要求

- 区域监理框架

- 认证标准 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依设备类型,2021 - 2034 年

- 主要趋势

- 铸造设备

- 熔炼和精炼设备

- 冲压成型设备

- 雷射设备

- 抛光和精加工设备

- 电镀设备

- 其他设备

第六章:市场估计与预测:依金属类型,2021 - 2034 年

- 主要趋势

- 黄金加工设备

- 银加工设备

- 铂族金属设备

- 其他贵金属设备

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 珠宝製造

- 贵金属精炼

- 钟錶製造

- 其他行业

第八章:市场估计与预测:按配销通路2021 - 2034

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- CDOCAST Machinery

- Contenti

- Durston Tools

- EnvisionTEC

- Gesswein

- Gravotech

- Indutherm

- LaserStar Technologies

- Orotig

- Pepetools

- Rio Grande

- Schultheiss

- Superbmelt

- UIHM

The Global Jewelry Making and Precious Metals Processing Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.74 billion by 2034. This market is witnessing strong and sustained growth, primarily driven by increasing consumer interest in high-quality, custom-designed jewelry. The demand is especially strong among younger demographics and affluent consumers in both established and emerging economies who seek pieces that express their lifestyle and individuality. As the need for precision manufacturing rises, industry players are embracing advanced production technologies that ensure accuracy and scalability.

Computer-aided design software, 3D printing tools, and automated systems are helping manufacturers deliver detailed, consistent, and scalable designs while minimizing material waste and production time. These advancements are also contributing to significant reductions in labor costs. The Asia-Pacific region remains the dominant hub for this industry, thanks to its established infrastructure, skilled labor force, and growing domestic and global demand. Countries across the region benefit from low-cost labor, favorable regulatory frameworks, and cultural preferences that promote jewelry purchases, which collectively strengthen APAC's influence on the global market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.74 Billion |

| CAGR | 6.3% |

The casting equipment segment generated USD 866.5 million in 2024 and is forecasted to grow at a CAGR of 6.7% between 2025 and 2034. This equipment is highly favored in jewelry and precious metal applications due to its suitability for mass production, flexibility in customization, and cost efficiency. While laser-based systems like engraving and welding tools are increasingly used for precision finishing, casting technology remains the go-to for scalable production, particularly in emerging markets and among small to mid-sized manufacturers. Its adaptability and economic value continue to drive its widespread adoption across the sector.

The jewelry manufacturing segment accounted for a 38.8% share in 2024 and is expected to register a CAGR of 6.8% through 2034. As the leading application within the precious metals processing and jewelry equipment industry, this segment is expanding due to rising consumer demand, advancements in digital manufacturing processes, and the internationalization of jewelry production networks. Compared to other applications like industrial refining or recycling, jewelry production requires a greater variety of tools and equipment, giving it a central role in the industry's continued development and innovation.

U.S. Jewelry Making and Precious Metals Processing Equipment Market held a 76.5% share and generated USD 350.4 million in 2024. This strong position can be attributed to the country's advanced manufacturing capabilities and well-established presence of luxury jewelry brands. American manufacturers widely utilize digital technologies such as CAD software, 3D printing systems, and laser-based tools to streamline workflows and enhance product output. This technological edge supports the country's continued dominance in the high-end jewelry manufacturing space, making it a critical player in the overall market.

Key companies shaping the Global Jewelry Making and Precious Metals Processing Equipment Market include Durston Tools, UIHM, Orotig, Supermelt, Indutherm, LaserStar Technologies, CDOCAST Machinery, Gesswein, Rio Grande, EnvisionTEC, Gravotech, Schultheiss, Contenti, and Pepetools. To reinforce their market position, companies in this sector are focusing on product innovation, expanding digital design capabilities, and upgrading manufacturing technologies. Many are integrating automation and AI-driven tools to enhance design accuracy and streamline production timelines. Investing in user-friendly interfaces and modular machines allows businesses to serve a wide range of customer needs-from small artisan workshops to large-scale manufacturers. Firms are also increasing their global presence by establishing partnerships with regional distributors and offering responsive after-sales support.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Metal type

- 2.2.4 End use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom and luxury jewelry

- 3.2.1.2 Technological advancements in processing equipment

- 3.2.1.3 Growing use of automation and digital design tools

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced equipment

- 3.2.2.2 Volatility in precious metal prices

- 3.2.3 Opportunities

- 3.2.3.1 Emergence of 3d printing in jewelry manufacturing

- 3.2.3.2 Increasing demand for sustainable and ethical jewelry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Regulatory environment

- 3.7 Value Chain Analysis

- 3.7.1 Raw material suppliers and component manufacturers

- 3.7.2 Equipment manufacturers and OEMs

- 3.7.3 Distribution channels and sales networks

- 3.7.4 End use segments and applications

- 3.7.5 After-sales service providers

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By equipment type

- 3.9 Regulatory landscape

- 3.9.1 standards and compliance requirements

- 3.9.2 Regional regulatory frameworks

- 3.10 Certification standards Trade statistics

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Casting equipment

- 5.2.1 Melting and refining equipment

- 5.2.2 Stamping and forming equipment

- 5.3 Laser equipment

- 5.3.1 Polishing and finishing equipment

- 5.3.2 Electroplating equipment

- 5.3.3 Other equipment

Chapter 6 Market Estimates & Forecast, By Metal Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gold processing equipment

- 6.3 Silver processing equipment

- 6.4 Platinum group metals equipment

- 6.5 Other precious metals equipment

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Jewelry manufacturing

- 7.3 Precious metals refining

- 7.4 Watch manufacturing

- 7.5 Other industries

Chapter 8 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 CDOCAST Machinery

- 10.2 Contenti

- 10.3 Durston Tools

- 10.4 EnvisionTEC

- 10.5 Gesswein

- 10.6 Gravotech

- 10.7 Indutherm

- 10.8 LaserStar Technologies

- 10.9 Orotig

- 10.10 Pepetools

- 10.11 Rio Grande

- 10.12 Schultheiss

- 10.13 Superbmelt

- 10.14 UIHM