|

市场调查报告书

商品编码

1801863

细胞凋亡检测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

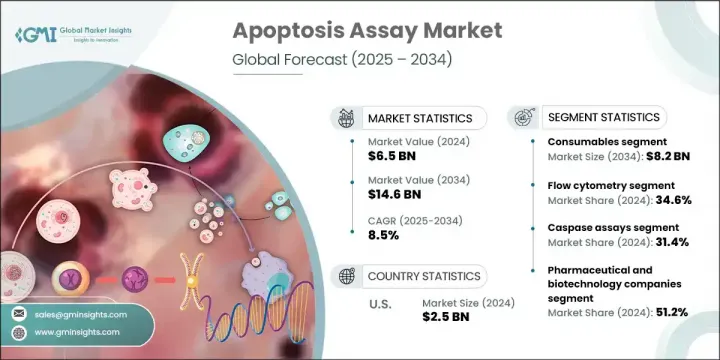

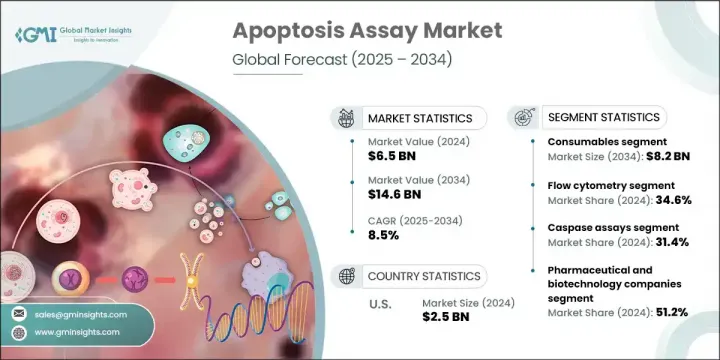

2024 年全球细胞凋亡检测市场规模为 65 亿美元,预计到 2034 年将以 8.5% 的复合年增长率成长至 146 亿美元。慢性病发病率上升和个人化治疗方案需求不断增长推动着该市场稳步扩张。细胞分析工具的创新,包括先进的影像检测和高通量流式细胞仪,显着提高了研究过程的准确性和效率。此外,生命科学领域的资金投入增加以及细胞凋亡检测在药物研发中的更广泛应用,正在推动该检测在全球已开发地区和发展中地区的应用。细胞凋亡检测对于识别和测量程序性细胞死亡至关重要,在推动疾病研究和药物创新方面发挥关键作用。随着医疗保健系统优先考虑标靶治疗和早期诊断,细胞凋亡检测在多个医疗领域的相关性持续成长。

个人化医疗日益受到关注,这成为细胞凋亡检测市场强劲的成长引擎。根据个别基因组成和特定疾病特征量身订做医疗方案需要能够进行精确细胞层级分析的先进工具。细胞凋亡检测使研究人员能够评估细胞对治疗的反应,尤其是在神经退化性疾病、癌症和自体免疫疾病等领域。这种细胞反应追踪对于确定治疗效果、优化给药策略和最大程度减少不良反应至关重要。透过让临床医生监测治疗诱导的细胞凋亡,这些检测有助于改进治疗方案,以获得更好的疗效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 146亿美元 |

| 复合年增长率 | 8.5% |

2024年,流式细胞仪市占率为34.6%。流式细胞仪因其速度快、准确性高以及在单细胞层级进行多参数分析的能力而备受青睐。它具有高通量功能,并擅长同时识别各种凋亡指标。其先进的雷射检测、自动门控机制和即时资料监控等功能使其能够与现代实验室集成,使其成为大规模临床和研究的理想选择。

2024年,胱天蛋白酶(caspase)检测细分市场占31.4%的市占率。这类检测透过测量胱天蛋白酶(caspase)的活性来追踪程序性细胞死亡,而胱天蛋白酶在细胞凋亡中起着核心作用。它们广泛应用于免疫学、肿瘤学和药物筛选等领域,以评估治疗药物如何影响细胞活力。胱天蛋白酶检测专为高通量筛选环境而设计,相容于自动化系统,并支援发光和萤光检测,从而实现灵活、灵敏的性能。

美国细胞凋亡检测市场规模预计在2024年达到25亿美元。这一增长反映了美国在研发方面的强劲投入、良好的监管框架以及对先进诊断工具的高度认知。美国市场受益于生物医学研究领域对可扩展自动化解决方案日益增长的需求,尤其是在免疫疗法和肿瘤学等领域。持续的公共卫生努力和私人创新持续增强了市场的发展势头,确保了细胞凋亡检测技术的长期应用。

全球细胞凋亡检测市场的关键公司包括赛默飞世尔科技、普洛麦格、珀金埃尔默、碧迪、迪金森公司、GeneCopoeia、Takara Bio、安捷伦科技、丹纳赫、赛多利斯、艾博抗姆、G Biosciences、默克、Biotium、Bio-Rad Laboratories 和 Bio-Techne。这些公司正积极塑造全球市场格局。为了巩固市场地位,细胞凋亡检测产业的领导者正强调检测灵敏度、速度和多参数能力的创新。各公司正在利用自动化平台增强产品组合,并整合人工智慧驱动的分析以获得更精确的结果。与製药公司和学术机构的策略合作支持个人化医疗和药物发现的新应用。同时,各公司正在透过区域合作伙伴关係、在地化生产和针对新兴市场客製化产品来扩大其地理覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 个人化医疗需求日益增长

- 流式细胞仪的技术进步

- 毒理学和药物安全评估中的应用日益增多

- 产业陷阱与挑战

- 先进技术成本高昂

- 监管和道德挑战

- 市场机会

- 癌症和神经退化性疾病研究日益受到关注

- 成长动力

- 成长潜力分析

- 监管格局

- 技术进步

- 当前的技术趋势

- 新兴技术

- 供应链分析

- 2024年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 仪器

- 耗材

- 试剂盒和试剂

- 微孔板

- 其他耗材

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 流式细胞仪

- 细胞成像与分析系统

- 分光光度法

- 其他检测技术

第七章:市场估计与预测:按检测类型,2021 - 2034 年

- 主要趋势

- 胱天蛋白酶检测

- DNA碎片化分析

- 粒线体检测

- 膜联蛋白V

- 细胞通透性测定

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药和生物技术公司

- 医院和诊断实验室

- 学术和研究机构

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abcam

- Agilent Technologies

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Bio-Techne

- Biotium

- Danaher

- G Biosciences

- GeneCopoeia

- Merck

- PerkinElmer

- Promega

- Sartorius

- Takara Bio

- Thermo Fisher Scientific

The Global Apoptosis Assay Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 14.6 billion by 2034. The steady expansion of this market is being driven by the rising prevalence of chronic conditions and the growing demand for personalized therapeutic solutions. Innovations in cell analysis tools, including advanced imaging-based assays and high-throughput flow cytometry, are significantly enhancing the accuracy and efficiency of research processes. Additionally, increased funding for life sciences and broader use of apoptosis assays in drug development are fueling global adoption across both developed and developing regions. Apoptosis assays are essential for identifying and measuring programmed cell death and play a key role in advancing disease research and pharmaceutical innovations. As healthcare systems prioritize targeted treatment and early diagnostics, the relevance of apoptosis assays continues to grow across multiple medical fields.

The increasing focus on personalized medicine is acting as a powerful growth engine for the apoptosis assay market. Tailoring medical treatments to an individual's genetic makeup and specific disease characteristics demands advanced tools capable of precise cellular-level analysis. Apoptosis assays enable researchers to evaluate how cells respond to therapies, particularly in fields like neurodegenerative disease, cancer, and autoimmune disorders. This type of cellular response tracking is essential for determining the effectiveness of treatments, optimizing dosing strategies, and minimizing adverse effects. By allowing clinicians to monitor therapy-induced apoptosis, these assays help refine treatment protocols for better outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 8.5% |

In 2024, the flow cytometry segment held a 34.6% share. Flow cytometry is favored for its speed, accuracy, and capacity to perform multi-parameter analysis at the single-cell level. It offers high-throughput functionality and excels in identifying various apoptotic indicators simultaneously. Its integration into modern laboratories is supported by cutting-edge features such as laser-based detection, automated gating mechanisms, and live data monitoring, making it ideal for large-scale clinical and research settings.

The caspase assays segment held a 31.4% share in 2024. These assays are instrumental in tracking programmed cell death by measuring the activity of caspase enzymes, which play a central role in apoptosis. They are extensively used in areas like immunology, oncology, and drug screening to assess how therapeutic agents affect cell viability. Designed for use in high-volume screening environments, caspase assays feature compatibility with automated systems and support luminescent and fluorescent detection for flexible, sensitive performance.

United States Apoptosis Assay Market USD 2.5 billion in 2024. This growth reflects the country's strong investment in R&D, favorable regulatory framework, and high level of awareness around advanced diagnostic tools. The U.S. market benefits from increasing demand for scalable, automated solutions in biomedical research, especially in fields like immunotherapy and oncology. Ongoing public health efforts and private innovation continue to strengthen the market's momentum, ensuring long-term adoption of apoptosis assay technologies.

Key companies in the Global Apoptosis Assay Market include Thermo Fisher Scientific, Promega, PerkinElmer, Becton, Dickinson and Company, GeneCopoeia, Takara Bio, Agilent Technologies, Danaher, Sartorius, Abcam, G Biosciences, Merck, Biotium, Bio-Rad Laboratories, and Bio-Techne. These firms are actively shaping the global market landscape. To reinforce their market position, leading players in the apoptosis assay industry are emphasizing innovation in assay sensitivity, speed, and multi-parameter capabilities. Companies are enhancing product portfolios with automation-ready platforms and integrating AI-driven analytics for more precise results. Strategic collaborations with pharmaceutical firms and academic institutions support new applications in personalized medicine and drug discovery. In parallel, firms are expanding their geographic reach through regional partnerships, localized manufacturing, and tailored product offerings for emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Assay type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Bio-Rad Laboratories

- 10.5 Bio-Techne

- 10.6 Biotium

- 10.7 Danaher

- 10.8 G Biosciences

- 10.9 GeneCopoeia

- 10.10 Merck

- 10.11 PerkinElmer

- 10.12 Promega

- 10.13 Sartorius

- 10.14 Takara Bio

- 10.15 Thermo Fisher Scientific