|

市场调查报告书

商品编码

1801866

井下零件和机械加工市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Downhole Component and Machining Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

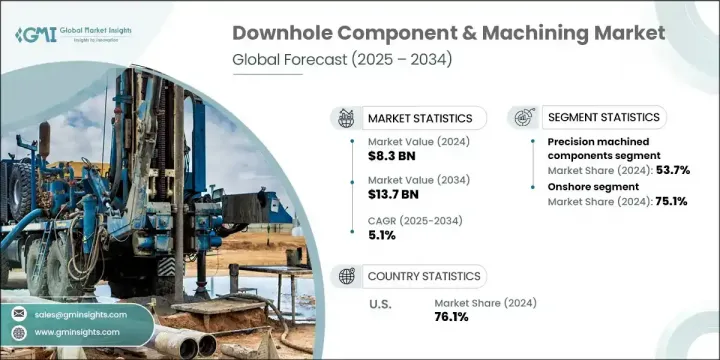

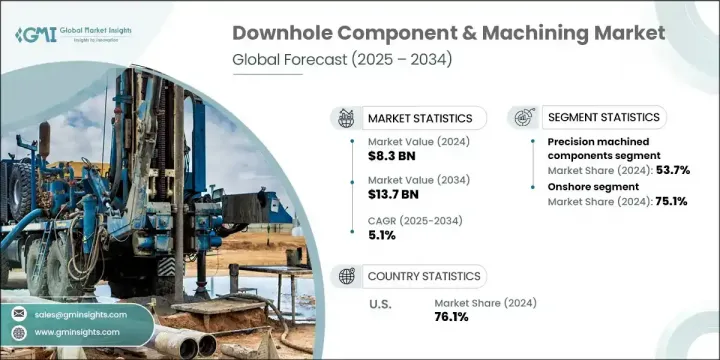

2024年,全球井下零件及机械加工市场规模达83亿美元,预计到2034年将以5.1%的复合年增长率成长,达到137亿美元。随着油气公司向更深、更严苛的油藏环境扩张,对高耐用性材料的需求持续激增。由高温合金、高性能陶瓷和复合材料製成的零件因其强度高、耐腐蚀以及在极端温度下的稳定性而日益重要。同时,该行业对提高采收率和非常规钻井的关注,也推动了对具有极高精度功能(例如先进的流量控制和整合感测)的精密加工零件的需求。

随着智慧技术的普及,井下设备正在快速发展。如今,精密加工技术能够生产出满足当今极端钻井工况要求的复杂几何形状和更严格公差的产品。现代油田正透过在阀门、马达和完井系统等组件中嵌入智慧感测器,实现主动作业。这些感测器能够即时追踪压力、温度、振动和流体成分等重要指标,提供预测性洞察,帮助避免设备故障并优化钻井性能。这种数位转型正在重塑企业管理资产和维持营运连续性的方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 83亿美元 |

| 预测值 | 137亿美元 |

| 复合年增长率 | 5.1% |

精密加工领域在2024年占了53.7%的市场份额,预计到2034年将以4.5%的复合年增长率成长。感测器和监测仪器的使用日益增长,这与行业对极端作业条件下持续性能资料日益增长的需求息息相关。流量、压力和油藏动态等关键效能指标可指导生产效率、设备安全和资源最佳化方面的决策。营运商需要高精度、耐用的感测器整合零件,以便在较长的钻井週期内提供稳定的性能。

2024年,陆上油气产业产值达到62亿美元,这主要得益于长週期油井设计、多级压裂需求以及腐蚀性流体——所有这些都需要坚固耐用、精密製造的零件。这些环境也正透过智慧感测器和整合分析平台迅速实现数位化。对流量、压力和温度的即时洞察支援远端资产管理、预测性维护和流程最佳化,从而提高营运效率并减少计划外停机时间。

2024年,欧洲井下组件和机械加工市场规模达14亿美元。该地区对能源转型和自动化的关注在其油气设备格局的演变中发挥关键作用。随着成熟的海上油田对效率最大化的需求,以及陆上作业对现代化的追求,长寿命、带有感测器组件的应用持续成长。干预效率、自动化监控和数位化整合的创新正在塑造区域前景,并激发长期成长潜力。

塑造全球井下零件和机械加工市场竞争格局的领先公司包括威德福 (Weatherford)、SLB、哈里伯顿 (Halliburton)、Saipem 和贝克休斯 (Baker Hughes)。井下零件和机械加工市场的主要参与者正专注于创新、自动化和材料改进,以增强其竞争地位。领先的公司正在大力投资研发,以开发适用于恶劣环境、具有更高耐热性和耐腐蚀性的下一代材料。

此外,各公司正在采用CNC工具机和多轴系统等精密加工技术来製造公差极小的零件。与油田服务提供商和数位解决方案提供商的策略合作,使物联网和感测器技术能够更广泛地整合到井下工具中。许多公司也正在扩展其区域製造基地和服务网络,以支援快速交付和客製化。这些策略旨在提供高性能、耐用且智慧的零件,同时降低营运风险并提升整个钻井作业的客户价值。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 中断

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 重要伙伴关係与合作

- 重大併购活动

- 关键创新与发布

- 市场扩张策略

- 竞争性基准描述

- 策略仪表板

- 创新与技术格局

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 井下感测器和测量工具

- 井下马达和涡轮机

- 井下控制系统

- 精密加工部件

第六章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 陆上

- 海上

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 德国

- 义大利

- 英国

- 俄罗斯

- 荷兰

- 亚太地区

- 中国

- 印度

- 澳洲

- 印尼

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 阿曼

- 科威特

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第八章:公司简介

- AMETEK

- Baker Hughes

- BICO Drilling Tools, Inc.

- China Oilfield Services Limited

- Halliburton

- Helmerich & Payne

- Nabors Industries Ltd

- National Oilwell Varco

- NOV

- Oberg Industries

- Penguin Petroleum Services

- Saipem

- Sanmina Corporation

- SLB

- TechnipFMC plc

- Tenaris

- Transocean

- Weatherford

- Wenze

The Global Downhole Component & Machining Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 13.7 billion by 2034. As oil & gas companies expand into deeper and harsher reservoir environments, the demand for highly durable materials continues to surge. Components made from superalloys, high-performance ceramics, and composite materials are increasingly essential due to their strength, resistance to corrosion, and stability under extreme temperatures. At the same time, the industry's focus on enhanced oil recovery and unconventional drilling is driving the need for intricately machined parts with extreme precision-enabling functions such as advanced flow control and integrated sensing.

Downhole equipment is evolving rapidly with the adoption of smart technologies. Precision machining techniques now enable the production of complex geometries with tighter tolerances needed in today's extreme drilling scenarios. Modern oilfields are shifting toward proactive operations by embedding intelligent sensors in components like valves, motors, and completion systems. These sensors enable real-time tracking of vital metrics, including pressure, temperature, vibration, and fluid makeup, providing predictive insights that help avoid equipment failures and optimize drilling performance. This digital shift is reshaping how companies manage assets and maintain operational continuity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 5.1% |

The precision-machined segment held a 53.7% share in 2024 and is expected to grow at a CAGR of 4.5% through 2034. The rising use of sensors and monitoring instruments is tied to the industry's increasing need for continuous performance data under extreme operational conditions. Key performance indicators such as flow rates, pressure, and reservoir behavior guide decisions around production efficiency, equipment safety, and resource optimization. Operators require highly accurate and durable sensor-integrated parts that deliver consistent performance over long drilling cycles.

The onshore segment generated USD 6.2 billion in 2024, driven by long-cycle well designs, multi-stage fracturing demands, and corrosive fluids-all of which require ruggedized, precision-manufactured components. These environments are also rapidly embracing digitalization through smart sensors and integrated analytics platforms. Real-time insights into flow, pressure, and temperature support remote asset management, predictive maintenance, and process optimization, enhancing operational efficiency while reducing unplanned downtime.

Europe Downhole Component & Machining Market was valued at USD 1.4 billion in 2024. The region's focus on energy transition and automation is playing a pivotal role in the evolution of its oil and gas equipment landscape. As mature offshore fields demand maximum efficiency and onshore operations push for modernization, the adoption of long-life, sensor-enabled components continues to rise. Innovations in intervention efficiency, automated monitoring, and digital integration are shaping the regional outlook and fueling long-term growth potential.

The leading companies shaping the competitive landscape in the Global Downhole Component & Machining Market include Weatherford, SLB, Halliburton, Saipem, and Baker Hughes. Major players in the Downhole Component & Machining Market are focusing on innovation, automation, and material advancement to strengthen their competitive position. Leading firms are investing heavily in R&D to develop next-generation materials with improved thermal and corrosion resistance for hostile environments.

In addition, companies are adopting precision machining technologies such as CNC and multi-axis systems to manufacture components with ultra-tight tolerances. Strategic collaborations with oilfield service providers and digital solution providers are enabling broader integration of IoT and sensor technologies into downhole tools. Many firms are also expanding their regional manufacturing bases and service networks to support rapid delivery and customization. These strategies aim to deliver high-performance, durable, and intelligent components while reducing operational risks and increasing client value across drilling operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter’s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Key innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Downhole sensors and measurement tools

- 5.3 Downhole motors and turbines

- 5.4 Downhole control systems

- 5.5 Precision machined components

Chapter 6 Market Estimates & Forecast, By Location, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 Italy

- 7.3.4 UK

- 7.3.5 Russia

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 Indonesia

- 7.4.5 Vietnam

- 7.5 Middle East and Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Oman

- 7.5.4 Kuwait

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 AMETEK

- 8.2 Baker Hughes

- 8.3 BICO Drilling Tools, Inc.

- 8.4 China Oilfield Services Limited

- 8.5 Halliburton

- 8.6 Helmerich & Payne

- 8.7 Nabors Industries Ltd

- 8.8 National Oilwell Varco

- 8.9 NOV

- 8.10 Oberg Industries

- 8.11 Penguin Petroleum Services

- 8.12 Saipem

- 8.13 Sanmina Corporation

- 8.14 SLB

- 8.15 TechnipFMC plc

- 8.16 Tenaris

- 8.17 Transocean

- 8.18 Weatherford

- 8.19 Wenze