|

市场调查报告书

商品编码

1801874

液膜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Liquid Membrane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

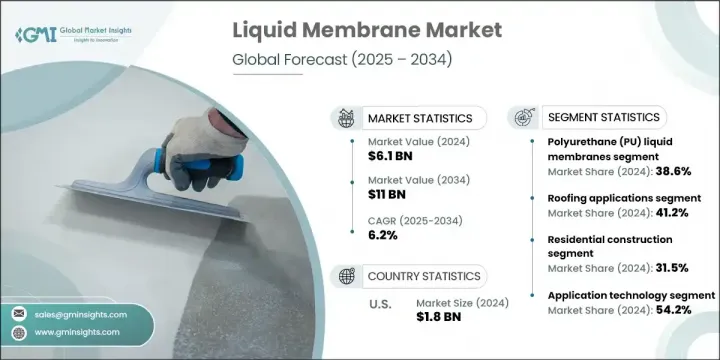

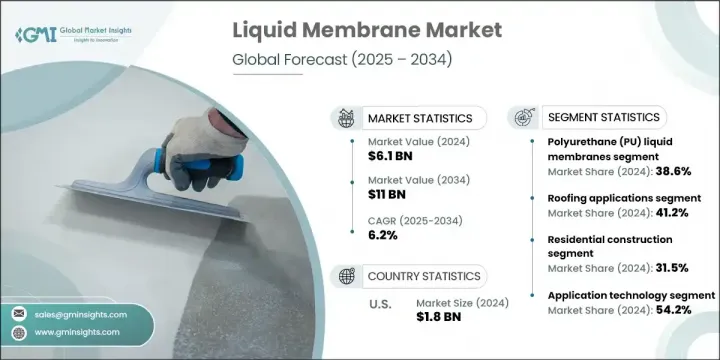

2024年,全球液态膜市场规模达61亿美元,预计2034年将以6.2%的复合年增长率成长,达到110亿美元。市场成长主要源自于基础设施投资的增加、建筑需求的不断变化以及公私合作项目的增加。由于液态膜符合商业、住宅和工业建筑的节能要求和防潮规范,其在翻新和新建项目中受到广泛青睐。与片状膜相比,液态膜材料固化速度快、施工简单、使用寿命更长,因此在新兴市场的应用日益广泛。快速的城市化进程、垂直建筑趋势以及永续建筑认证的推动,也加速了该领域对聚氨酯、丙烯酸和水泥基配方的需求。

先进的液膜具有长期防水性能和强大的耐化学性,在气候多变地区的裙楼平台、地下室和露天屋顶等高要求应用的应用日益广泛。改性聚氨酯配方因其优异的延展性、抗紫外线性能和透气性,同时保持了牢固的黏合性能,正日益受到关注。低VOC含量的环保丙烯酸基膜因其价格实惠且符合环保要求,被广泛应用于低坡屋顶、阳台和金属结构。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 61亿美元 |

| 预测值 | 110亿美元 |

| 复合年增长率 | 6.2% |

聚氨酯 (PU) 液膜市场在 2024 年占据最大份额,贡献了总收入的 38.6%,预计到 2034 年复合年增长率将超过 6.8%。聚氨酯液膜的弹性、紫外线照射下的耐久性以及与复杂建筑设计的兼容性使其非常适合商业屋顶和基础设施项目。在密集的城市建筑区,聚氨酯液膜在需要高性能防水以延长使用寿命的翻新工程中越来越受欢迎。

屋顶应用领域在2024年占据41.2%的市场份额,预计到2034年将以5.6%的复合年增长率成长。该领域的成长主要得益于商业和住宅建筑升级的投资,尤其是在欧洲和北美的城市地区。液体薄膜因其易于施工、抗紫外线和卓越的裂缝桥接能力,继续受到屋顶材料的青睐。节能屋顶和太阳能相容设计的安装量不断增加,也支撑了整个屋顶领域的需求。

美国液膜市场占据82%的市场份额,2024年贡献了18亿美元的市场规模。美国占据主导地位的原因在于其成熟的建筑格局以及对防水和节能建筑围护结构日益增长的投资。联邦政府在环境和水基础设施方面的强劲支出(超过1,220亿美元)进一步凸显了液膜在全国公共基础建设和建筑恢復工作中所扮演的角色。

塑造全球液体膜市场的顶尖公司包括巴斯夫欧洲公司、西卡股份公司、索普瑞玛集团、Tremco Incorporated 和卡莱尔公司。为了巩固其在液体膜市场的地位,领先公司正在部署多项策略性措施。这些措施包括扩大产品线以满足特定的气候和应用需求,大力投资研发具有更高弹性、防紫外线和环保合规性的先进配方。与基础设施开发商、承包商和建筑师的合作正在为大型专案提供客製化解决方案。许多参与者也注重永续性,开发低挥发性有机化合物 (VOC) 和可回收产品,以符合绿色建筑标准。区域扩张(尤其是在高成长的新兴市场)以及智慧应用技术的整合,有助于推动更广泛的市场渗透和长期的客户忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 建筑业需求不断增长

- 基础建设发展与都市化

- 更加重视建筑耐久性

- 产业陷阱与挑战

- 原物料价格波动

- 技术应用挑战

- 市场机会

- 永续和生物基解决方案

- 智慧膜技术

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 聚氨酯(PU)液膜

- 单组分聚氨酯体系

- 双组分聚氨酯体系

- 芳香族PU膜

- 脂肪族PU膜

- 生物基聚氨酯膜

- 丙烯酸液膜

- 水性丙烯酸体系

- 溶剂型丙烯酸体系

- 纯丙烯酸膜

- 改性丙烯酸膜

- 水泥基液体膜

- 柔性水泥基体系

- 刚性水泥基体系

- 聚合物改质水泥基

- 结晶防水系统

- 混合膜和特种膜

- 聚脲体系

- 硅基膜

- 沥青改质体系

- 其他特殊配方

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 屋顶应用

- 平屋顶防水

- 坡屋顶应用

- 绿色屋顶系统

- 屋顶翻新和维修

- 地下防水

- 地下室防水

- 地基防水

- 地下结构

- 隧道防水

- 高于等级的应用

- 阳台、露台防水

- 浴室及潮湿区域防水

- 外墙和墙壁保护

- 泳池防水

- 基础设施应用

- 桥面防水

- 停车场应用

- 水处理设施

- 工业地板涂料

- 专业应用

- 海洋和近海结构

- 交通基础设施

- 农业应用

- 采矿业和重工业

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 住宅建筑

- 新住宅建设

- 住宅装潢与维修

- 多户住宅

- 单户住宅

- 商业建筑

- 办公大楼

- 零售和购物中心

- 饭店和娱乐

- 医疗保健设施

- 工业建筑

- 生产设施

- 仓库和配送中心

- 化学和加工工业

- 餐饮设施

- 基础设施和公共工程

- 交通基础设施

- 水和废水处理

- 能源与发电

- 政府及公共建筑

第八章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 应用科技

- 冷应用系统

- 热应用系统

- 喷涂系统

- 刷涂/滚涂系统

- 固化技术

- 湿气固化系统

- 热固化系统

- 紫外线固化系统

- 化学固化体系

- 性能技术

- 标准绩效系统

- 高效能係统

- 专业性能係统

- 智慧且反应迅速的系统

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Sika AG

- BASF SE

- Tremco Incorporated

- Carlisle Companies Inc.

- Soprema Group

- GAF Materials Corporation

- Johns Manville Corporation

- Firestone Building Products

- Dow Chemical Company

- Huntsman Corporation

- Pidilite Industries Limited (India)

- Fosroc International Limited (UK)

- MAPEI SpA (Italy)

The Global Liquid Membrane Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 11 billion by 2034. Growth in the market is largely driven by rising infrastructure investments, evolving architectural requirements, and an increase in public-private partnership projects. Renovation and new construction projects are embracing liquid membranes due to their compliance with energy efficiency mandates and moisture protection codes across commercial, residential, and industrial structures. Emerging markets are seeing increased adoption because of the fast-curing nature, easy application, and extended lifespan of these materials compared to sheet membranes. Rapid urbanization, vertical construction trends, and a push for sustainable building certifications are also accelerating demand for polyurethane, acrylic, and cementitious formulations in this space.

Advanced liquid membranes offering long-term waterproofing performance and strong chemical resistance are seeing increased usage in challenging applications like podium decks, basements, and exposed roofs in regions with volatile climates. Modified polyurethane formulations are gaining attention for their superior elongation, UV resistance, and breathability while maintaining solid adhesion properties. Eco-friendly acrylic-based membranes with low VOC content are being widely adopted for use on low-slope roofs, balconies, and metal structures, due to their affordability and environmental compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $11 Billion |

| CAGR | 6.2% |

The polyurethane (PU) liquid membranes segment held the largest share in 2024, contributing 38.6% of total revenue and are expected to grow at over 6.8% CAGR through 2034. Their elasticity, durability under UV exposure, and compatibility with complex architectural designs have made them highly suitable for both commercial roofing and infrastructure projects. Their popularity is expanding across retrofitting works where high-performance waterproofing is required for extended lifespans in dense urban construction zones.

The roofing applications segment held 41.2% share in 2024 and is forecasted to grow at a CAGR of 5.6% through 2034. Growth in this segment is fueled by investments in commercial and residential building upgrades, particularly across urban regions in Europe and North America. Liquid membranes continue to be favored for roofing due to their ease of application, resistance to UV rays, and superior crack-bridging capabilities. Rising installations of energy-saving roofs and solar-compatible designs are also supporting demand across the roofing segment.

United States Liquid Membrane Market held 82% share contributing USD 1.8 billion in 2024. The country's dominance stems from its well-established construction landscape and growing investments in waterproofing and energy-efficient building envelopes. Robust federal spending on environmental and water infrastructure, which topped USD 122 billion, further underscores the role of liquid membranes in public infrastructure development and building recovery efforts across the nation.

Top companies shaping the Global Liquid Membrane Market include BASF SE, Sika AG, Soprema Group, Tremco Incorporated, and Carlisle Companies Inc. To strengthen their presence in the liquid membrane market, leading companies are deploying several strategic initiatives. These include expanding product lines to meet specific climate and application needs, investing heavily in R&D for advanced formulations with higher elasticity, UV protection, and eco-compliance. Partnerships with infrastructure developers, contractors, and architects are enabling customized solutions for large-scale projects. Many players are also focusing on sustainability, developing low-VOC and recyclable products to align with green building standards. Regional expansion, especially in high-growth emerging markets, and the integration of smart application technologies are helping to drive broader market penetration and long-term customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing construction industry demand

- 3.2.1.2 Infrastructure development and urbanization

- 3.2.1.3 Increasing focus on building durability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 Technical application challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Sustainable and bio-based solutions

- 3.2.3.2 Smart membrane technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyurethane (PU) liquid membranes

- 5.2.1 Single component PU systems

- 5.2.2 Two-component PU systems

- 5.2.3 Aromatic PU membranes

- 5.2.4 Aliphatic PU membranes

- 5.2.5 Bio-based PU membranes

- 5.3 Acrylic liquid membranes

- 5.3.1 Water-based acrylic systems

- 5.3.2 Solvent-based acrylic systems

- 5.3.3 Pure acrylic membranes

- 5.3.4 Modified acrylic membranes

- 5.4 Cementitious liquid membranes

- 5.4.1 Flexible cementitious systems

- 5.4.2 Rigid cementitious systems

- 5.4.3 Polymer-modified cementitious

- 5.4.4 Crystalline waterproofing systems

- 5.5 Hybrid and specialty membranes

- 5.5.1 Polyurea systems

- 5.5.2 Silicone-based membranes

- 5.5.3 Bitumen-modified systems

- 5.5.4 Other specialty formulations

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Roofing applications

- 6.2.1 Flat roof waterproofing

- 6.2.2 Pitched roof applications

- 6.2.3 Green roof systems

- 6.2.4 Roof renovation and repair

- 6.3 Below-grade waterproofing

- 6.3.1 Basement waterproofing

- 6.3.2 Foundation waterproofing

- 6.3.3 Underground structures

- 6.3.4 Tunnel waterproofing

- 6.4 Above-grade applications

- 6.4.1 Balcony and terrace waterproofing

- 6.4.2 Bathroom and wet area waterproofing

- 6.4.3 Facade and wall protection

- 6.4.4 Swimming pool waterproofing

- 6.5 Infrastructure applications

- 6.5.1 Bridge deck waterproofing

- 6.5.2 Parking deck applications

- 6.5.3 Water treatment facilities

- 6.5.4 Industrial floor coatings

- 6.6 Specialty applications

- 6.6.1 Marine and offshore structures

- 6.6.2 Transportation infrastructure

- 6.6.3 Agricultural applications

- 6.6.4 Mining and heavy industry

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential Construction

- 7.2.1 New Residential Construction

- 7.2.2 Residential Renovation and Repair

- 7.2.3 Multi-family Housing

- 7.2.4 Single-family Housing

- 7.3 Commercial Construction

- 7.3.1 Office Buildings

- 7.3.2 Retail and Shopping Centers

- 7.3.3 Hospitality and Entertainment

- 7.3.4 Healthcare Facilities

- 7.4 Industrial Construction

- 7.4.1 Manufacturing Facilities

- 7.4.2 Warehouses and Distribution Centers

- 7.4.3 Chemical and Process Industries

- 7.4.4 Food and Beverage Facilities

- 7.5 Infrastructure and Public Works

- 7.5.1 Transportation Infrastructure

- 7.5.2 Water and Wastewater Treatment

- 7.5.3 Energy and Power Generation

- 7.5.4 Government and Public Buildings

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Application Technology

- 8.2.1 Cold Applied Systems

- 8.2.2 Hot Applied Systems

- 8.2.3 Spray Applied Systems

- 8.2.4 Brush/Roller Applied Systems

- 8.3 Curing Technology

- 8.3.1 Moisture Curing Systems

- 8.3.2 Heat Curing Systems

- 8.3.3 UV Curing Systems

- 8.3.4 Chemical Curing Systems

- 8.4 Performance Technology

- 8.4.1 Standard Performance Systems

- 8.4.2 High-Performance Systems

- 8.4.3 Specialty Performance Systems

- 8.4.4 Smart and Responsive Systems

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Sika AG

- 10.2 BASF SE

- 10.3 Tremco Incorporated

- 10.4 Carlisle Companies Inc.

- 10.5 Soprema Group

- 10.6 GAF Materials Corporation

- 10.7 Johns Manville Corporation

- 10.8 Firestone Building Products

- 10.9 Dow Chemical Company

- 10.10 Huntsman Corporation

- 10.11 Pidilite Industries Limited (India)

- 10.12 Fosroc International Limited (UK)

- 10.13 MAPEI S.p.A. (Italy)