|

市场调查报告书

商品编码

1801875

水下无人机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Underwater Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

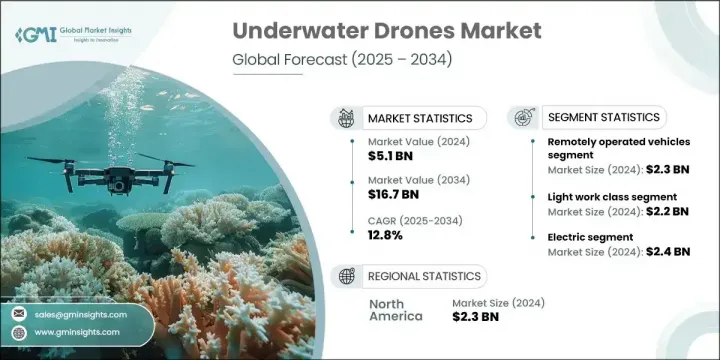

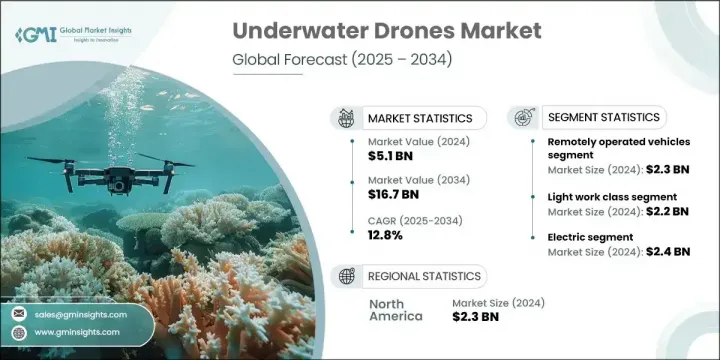

2024年,全球水下无人机市场规模达51亿美元,预估年复合成长率达12.8%,2034年将达167亿美元。这一增长主要得益于海底勘探需求的不断增长、海上油气项目投资的不断增加、海上安全形势的改善以及可再生能源项目的整合。此外,自主性、推进系统和成像技术的不断改进,也推动了水下无人机在商业和国防领域的更广泛应用。

重塑这一领域的关键趋势是人们对电力推进系统的日益青睐。这些升级增强了任务范围,减少了噪音,并提高了能源效率,使电动水下无人机成为一系列应用的理想选择。透过整合锂离子电池、无刷直流马达和超级电容器,现代电动无人机在某些任务中可以运行超过72小时。这种转变在中层水域和近岸作业中尤其重要,因为低噪音和高效率的表现至关重要。同时,人们对自主水下航行器(AUV)的兴趣也日益浓厚,它们利用机载导航、感测器和任务软体独立运行,无需操作员即时输入即可实现精确定位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 167亿美元 |

| 复合年增长率 | 12.8% |

2024年,遥控潜水器 (ROV) 市场价值达23亿美元。由于石油天然气、国防和基础设施检查领域对即时水下作业的需求日益增长,该市场正在快速成长。 ROV 配备多功能工具系统,具有强大的有效载荷能力,并为操作员提供全手动控制,使其成为深水检查、维护工作和水下打捞任务的理想选择。

2024年,轻型工作级无人机市场规模达22亿美元。这类无人机因其操作灵活性、经济实惠以及在执行巡检和轻型干预任务方面的高效性而被广泛采用。它们与感测器和机械臂的良好相容性,加上较低的部署复杂性和极低的地面支撑需求,使其非常适合在狭窄和恶劣的环境中作业。为了满足不断变化的营运需求,製造商正专注于即插即用设计、边缘AI整合和改进的繫绳控制系统,以服务港口管理、基础设施监控和海上承包等行业。

到2034年,加拿大水下无人机市场规模将达到7.751亿美元。这一成长主要得益于加拿大不断扩张的海上能源业务、不断加强的海域监测以及不断深化的海洋科学投资。无人机在冰下导航、远端海底监测和栖息地测绘的应用持续成长。建议设备开发人员优先考虑坚固耐用、能够在冷水下作业的无人机系统,并配备模组化感测器配置,以满足科学探索和国防应用的需求。

全球水下无人机市场的主要参与者包括PowerRay、Gavia AUV、SRV-8 ROV、Neptune ROV、Phantom ROV系列、FIFISH V6、Flying Nodes AUV、Marlin AUV、HUGIN AUV、Seaeye Falcon ROV、Sibiu Pro、SeaDrone ROV、SeaCat AUV、Seunye Falcon ROV、Sibiu Pro、SeaDrone ROV、SeaCat AUV1 ROV、Eelume 海底机器人和 Absolute Ocean AUV。

水下无人机领域的公司正透过多管齐下的策略来巩固其竞争地位。他们高度重视研发,以提升自主性、感测器整合、电池寿命和推进技术。製造商优先考虑模组化设计,以便针对特定任务(例如勘探、国防、检查或科学研究)进行快速客製化。与政府机构、能源公司和海洋研究所建立的策略合作伙伴关係有助于公司获得长期合约。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 海洋探索需求不断成长

- 扩大海上石油和天然气活动

- 海上安全和监视需求

- 再生能源项目投资不断成长

- 自主性和成像技术的进步

- 陷阱与挑战

- 有限的电池寿命和电源管理

- 先进水下无人机成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 遥控车辆

- 自主水下航行器

- 混合动力水下航行器

第六章:市场估计与预测:依产品类别,2021 - 2034 年

- 主要趋势

- 微课

- 中小型班

- 轻工班

- 重工班

第七章:市场估计与预测:按推进系统,2021 - 2034 年

- 主要趋势

- 电的

- 机械的

- 杂交种

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 国防和安全

- 海军监视

- 地雷对策

- 反潜战

- 水下情报与侦察

- 搜救任务

- 其他的

- 科学研究与探索

- 海洋学研究

- 海洋生物多样性监测

- 海底测绘

- 气候与环境研究

- 基础设施检查和维护

- 管道和钻机检查

- 水下电缆监测

- 大坝和桥樑检查

- 港口和港湾维护

- 核设施检查

- 其他的

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 全球关键参与者

- General Dynamics Mission Systems

- Deep Ocean Engineering, Inc.

- Nido Robotics

- Oceanbotics

- Neptune Robotics

- Terradepth

- SeaDrone Inc.

- Edgerov (Notilo Plus)

- Autonomous Robotics Ltd.

- 区域关键参与者

- 北美洲

- Oceaneering International, Inc.

- Lockheed Martin Corporation

- Teledyne Marine

- 欧洲

- Kongsberg Maritime

- Saab Group

- Atlas Elektronik

- Asia-Pacific

- QYSEA Technology

- PowerVision Inc.

- Youcan Robotics(Shanghai) Co., Ltd.

- 北美洲

- 颠覆者/利基市场参与者

- Blueye Robotics

- Eelume AS

The Global Underwater Drones Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 16.7 billion by 2034. The expansion is largely supported by increasing demand for subsea exploration, rising investments in offshore oil and gas projects, maritime security enhancements, and the integration of renewable energy ventures. Additionally, constant improvements in autonomy, propulsion systems, and imaging technologies are driving broader market adoption across both commercial and defense sectors.

A key trend reshaping this space is the growing preference for electric propulsion systems. These upgrades enhance mission range, reduce acoustic footprint, and improve energy efficiency, making electric-powered underwater drones ideal for a range of applications. With the integration of lithium-ion batteries, brushless DC motors, and supercapacitors, modern electric drones now operate over 72 hours in certain missions. This transformation is especially valuable in mid-water and nearshore operations where low-noise and high-efficiency performance is essential. At the same time, there's a surge in interest for autonomous underwater vehicles (AUVs), which operate independently using onboard navigation, sensors, and mission software, enabling precision without real-time operator input.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 billion |

| Forecast Value | $16.7 billion |

| CAGR | 12.8% |

In 2024, the remotely operated vehicle (ROV) segment was valued at USD 2.3 billion. This segment is growing rapidly due to the rising need for real-time underwater operations in oil and gas, defense, and infrastructure inspections. ROVs are equipped with versatile tool systems, have strong payload capacities, and provide operators with full manual control, making them ideal for deepwater inspections, maintenance work, and underwater recovery tasks.

The light work-class drone segment generated USD 2.2 billion in 2024. These drones are widely adopted due to their operational flexibility, affordability, and effectiveness in performing inspection and light intervention missions. Their adaptability with sensors and manipulators, along with low deployment complexity and minimal surface support needs, makes them suitable for confined and harsh environments. To support evolving operational needs, manufacturers are focusing on plug-and-play designs, edge AI integration, and improved tether control systems to serve industries such as port management, infrastructure surveillance, and offshore contracting.

Canada Underwater Drones Market will reach USD 775.1 million by 2034. This growth is driven by the nation's expanding offshore energy operations, increased maritime territorial monitoring, and deepening investments in marine science. The use of drones for under-ice navigation, remote subsea monitoring, and habitat mapping continues to rise. Equipment developers are advised to prioritize ruggedized, cold-water-capable drone systems with modular sensor configurations suitable for both scientific exploration and defense applications.

Key players in the Global Underwater Drones Market include PowerRay, Gavia AUV, SRV-8 ROV, Neptune ROV, Phantom ROV Series, FIFISH V6, Flying Nodes AUV, Marlin AUV, HUGIN AUV, Seaeye Falcon ROV, Sibiu Pro, SeaDrone ROV, SeaCat AUV, Seasam ROV, BW Space Pro, Blueye X3, Bluefin-21 AUV, Oceaneering ROVs, Eelume Subsea Robot, and Absolute Ocean AUV.

Companies in the underwater drones space are reinforcing their competitive position through multi-faceted strategies. A strong emphasis is placed on R&D to advance autonomy, sensor integration, battery longevity, and propulsion technology. Manufacturers are prioritizing modular designs to enable rapid customization for specific missions, such as exploration, defense, inspection, or scientific research. Strategic partnerships with government bodies, energy firms, and marine institutes are helping companies secure long-term contracts.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Product class trends

- 2.2.3 Propulsion system trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising Demand for Ocean Exploration

- 3.3.1.2 Expansion of Offshore Oil & Gas Activities

- 3.3.1.3 Maritime Security and Surveillance Needs

- 3.3.1.4 Growing Investment in Renewable Energy Projects

- 3.3.1.5 Technological Advancements in Autonomy & Imaging

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Limited Battery Life and Power Management

- 3.3.2.2 High Cost of Advanced Underwater Drones

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Defense budget analysis

- 3.14 Global defense spending trends

- 3.15 Regional defense budget allocation

- 3.15.1 North america

- 3.15.2 Europe

- 3.15.3 Asia Pacific

- 3.15.4 Middle East and Africa

- 3.15.5 Latin america

- 3.16 Key defense modernization programs

- 3.17 Budget forecast (2025-2034)

- 3.17.1 Impact on industry growth

- 3.17.2 Defense budgets by country

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, by Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Remotely operated vehicles

- 5.3 Autonomous underwater vehicles

- 5.4 Hybrid underwater vehicles

Chapter 6 Market estimates and forecast, by Product Class, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Micro class

- 6.3 Small and medium class

- 6.4 Light work class

- 6.5 Heavy work class

Chapter 7 Market estimates and forecast, by Propulsion System, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Mechanical

- 7.4 Hybrid

Chapter 8 Market estimates and forecast, by Application, 2021 - 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Defense and security

- 8.2.1 Naval surveillance

- 8.2.2 Mine countermeasures

- 8.2.3 Anti-submarine warfare

- 8.2.4 Underwater intelligence and reconnaissance

- 8.2.5 Search and rescue missions

- 8.2.6 Others

- 8.3 Scientific research and exploration

- 8.3.1 Oceanographic studies

- 8.3.2 Marine biodiversity monitoring

- 8.3.3 Seabed mapping

- 8.3.4 Climate and environmental studies

- 8.4 Infrastructure inspection and maintenance

- 8.4.1 Pipeline and rig inspection

- 8.4.2 Underwater cable monitoring

- 8.4.3 Dam and bridge inspection

- 8.4.4 Port and harbour maintenance

- 8.4.5 Nuclear facility inspection

- 8.4.6 Others

- 8.5 Others

Chapter 9 Market estimates and forecast, by Region, 2021 - 2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 General Dynamics Mission Systems

- 10.1.2 Deep Ocean Engineering, Inc.

- 10.1.3 Nido Robotics

- 10.1.4 Oceanbotics

- 10.1.5 Neptune Robotics

- 10.1.6 Terradepth

- 10.1.7 SeaDrone Inc.

- 10.1.8 Edgerov (Notilo Plus)

- 10.1.9 Autonomous Robotics Ltd.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Oceaneering International, Inc.

- 10.2.1.2 Lockheed Martin Corporation

- 10.2.1.3 Teledyne Marine

- 10.2.2 Europe

- 10.2.2.1 Kongsberg Maritime

- 10.2.2.2 Saab Group

- 10.2.2.3 Atlas Elektronik

- 10.2.3 Asia-Pacific

- 10.2.3.1 QYSEA Technology

- 10.2.3.2 PowerVision Inc.

- 10.2.3.3 Youcan Robotics(Shanghai) Co., Ltd.

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 Blueye Robotics

- 10.3.2 Eelume AS